Cheap Ford F-350 Super Duty Insurance in 2025 [Cash Savings With These 10 Companies]

Allstate, Liberty Mutual, and Progressive offer cheap Ford F-350 Super Duty insurance. Allstate is the cheapest option with comprehensive coverage, starting at $45 per month. Liberty Mutual excels with customizable policies, and Progressive provides competitive usage-based Ford F-350 insurance rates.

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Scott W. Johnson

Licensed Insurance Agent

Scott W Johnson is an independent insurance agent in California. Principal Broker and founder of Marindependent Insurance Services, Scott brings over 25 years of experience to his clients. His Five President’s Council awards prove he uses all he learned at Avocet, Sprint Nextel, and Farmers Insurance to the benefit of his clients. Scott quickly grasped the unique insurance requirements of his...

Licensed Insurance Agent

UPDATED: Apr 1, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident car insurance decisions. Comparison shopping should be easy. We are not affiliated with any one car insurance company and cannot guarantee quotes from any single provider.

Our insurance industry partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about car insurance. Our goal is to be an objective, third-party resource for everything car insurance related. We update our site regularly, and all content is reviewed by car insurance experts.

UPDATED: Apr 1, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident car insurance decisions. Comparison shopping should be easy. We are not affiliated with any one car insurance company and cannot guarantee quotes from any single provider.

Our insurance industry partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

3,792 reviews

3,792 reviewsCompany Facts

Min. Coverage

A.M. Best Rating

Complaint Level

Pros & Cons

3,792 reviews

3,792 reviews 13,283 reviews

13,283 reviewsCompany Facts

Min. Coverage

A.M. Best Rating

Complaint Level

Pros & Cons

13,283 reviews

13,283 reviewsAllstate, Liberty Mutual, and Progressive have cheap Ford F-350 Super Duty insurance starting at $45 per month. Allstate’s comprehensive policy protects against theft, weather damage, collisions, liability, and provides roadside assistance, making it the cheapest option for full protection.

Our Top 10 Company Picks: Cheap Ford F-350 Super Duty Insurance

| Company | Rank | Monthly Rates | A.M. Best | Best For | Jump to Pros/Cons |

|---|---|---|---|---|---|

| #1 | $45 | A+ | Comprehensive Coverage | Allstate | |

| #2 | $50 | A | Customizable Policies | Liberty Mutual |

| #3 | $58 | A+ | Usage-Based Insurance | Progressive | |

| #4 | $60 | A++ | Accident-Free | Geico | |

| #5 | $62 | A++ | Customer Satisfaction | Auto-Owners | |

| #6 | $64 | A+ | Bundling Discounts | Nationwide |

| #7 | $65 | A+ | Personalized Service | Erie |

| #8 | $67 | A | Extensive Coverage | Farmers | |

| #9 | $69 | A | Loyalty Rewards | American Family | |

| #10 | $71 | A++ | Reliable Reputation | State Farm |

Liberty Mutual stands out with customizable policies, allowing drivers to add gap insurance, accident forgiveness, and new car replacement.

Progressive provides cheap Ford auto insurance with competitive usage-based discounts through Snapshot.

- Find cheap Ford F-350 Super Duty insurance at $45 a month

- Allstate is the cheapest for comprehensive coverage and roadside assistance

- Liberty Mutual offers flexible policies, while Progressive has competitive rates

Comparing these top insurers ensures drivers find the best coverage at the lowest price. Enter your ZIP code into our free comparison tool to see how much car insurance costs in your area.

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#1 – Allstate: Top Overall Pick

Pros

- Comprehensive Coverage: Allstate offers collision, liability, roadside assistance, and rental reimbursement for Ford F-350 Super Duty owners.

- Lowest Monthly Rates: Allstate provides Ford F-350 drivers with minimum coverage starting at $45 per month, making it the cheapest option.

- Accident Forgiveness: Allstate’s Accident Forgiveness ensures Ford F-350 owners won’t see a rate increase after their first accident. Learn more in our Allstate car insurance review.

Cons

- Higher Full Coverage Costs: While Allstate offers cheap minimum coverage for the Ford F-350, its full coverage rates are higher than some competitors.

- Claims Satisfaction: Allstate has lower claims satisfaction ratings from J.D. Power than other Ford F-350 Super Duty insurance companies

#2 – Liberty Mutual: Best for Customizable Policies

Pros

- Customizable Policies: Liberty Mutual offers gap insurance, accident forgiveness, and new car replacement for Ford F-350 drivers. See full policy options in our Liberty Mutual review.

- Competitive Monthly Rates: At $50 per month, Liberty Mutual provides affordable minimum coverage for Ford F-350 Super Duty drivers.

- Usage-Based Discount: Ford F-350 owners who enroll in Liberty Mutual’s RightTrack program can save up to 30% for safe driving habits.

Cons

- Higher Costs for High-Risk Drivers: Liberty Mutual tends to charge higher rates for Ford F-350 drivers with prior accidents or traffic violations.

- Limited Availability of Discounts: Some Ford F-350 Super Duty drivers may find Liberty Mutual’s discounts less competitive than other insurers.

#3 – Progressive: Best for Usage-Based Insurance

Pros

- Snapshot Program Savings: Ford F-350 drivers who use Progressive Snapshot UBI can save based on real-time driving data.

- Competitive Rates: Our Progressive review compares Ford F-350 Super Duty minimum insurance coverage starting at $58 per month, making it a budget-friendly choice.

- Strong Multi-Policy Discounts: Ford F-350 owners can bundle their auto, home, or renters insurance with Progressive for additional savings.

Cons

- Rate Increases After Accidents: Ford F-350 owners may experience steeper premium hikes after an accident than with other companies.

- Fewer Physical Locations: Progressive primarily operates online, making in-person agent support difficult for some Ford F-350 Super Duty drivers.

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#4 – Geico: Best for Accident-Free

Pros

- Accident-Free Discounts: Ford F-350 owners with a clean driving record for five years can receive up to a 22% discount on premiums.

- Affordable Premiums: As mentioned in our Geico review, it offers Ford F-350 Super Duty insurance at $60 per month, making it one of the most budget-friendly choices.

- Strong Military Discounts: Active and retired military members driving a Ford F-350 can save with Geico’s military discount program.

Cons

- Limited Customization Options: Geico lacks add-ons like gap insurance, which could be useful for new Ford F-350 Super Duty drivers financing their truck.

- Higher Full Coverage Costs: While minimum coverage is cheap for the Ford F-350, full coverage can be more expensive than competitors.

#5 – Auto-Owners: Best for Customer Satisfaction

Pros

- Highly Rated Customer Service: As per Auto-Owners car insurance review, it consistently ranks high in claims satisfaction for Ford F-350 Super Duty owners.

- Affordable Minimum Coverage: Ford F-350 drivers can get minimum coverage for $62 per month, making it an affordable mid-range option.

- Deductible Perks: Safe Ford F-350 Super Duty drivers can lower their deductible over time through Auto-Owners diminishing deductible program.

Cons

- Limited Online Services: Ford F-350 drivers may find Auto-Owners’ lack of an online quote system inconvenient.

- Availability Issues: Auto-Owners is not available in all states, limiting options for Ford F-350 Super Duty drivers in certain areas.

#6 – Nationwide: Best for Bundling Discounts

Pros

- Strong Bundling Discounts: Ford F-350 owners who combine auto and home insurance can save significantly with Nationwide.

- Affordable Minimum Coverage: In our Nationwide car insurance review, we compare affordable minimum coverage at $64 a month for Ford F-350 Super Duty drivers.

- Usage-Based Savings: Ford F-350 owners who enroll in Nationwide’s SmartRide program can earn discounts based on safe driving habits.

Cons

- Limited High-Risk Coverage: Ford F-350 owners who have had accidents or violations may receive higher quotes from Nationwide.

- Slow Claims Process: Some customers report that claims for Ford F-350 Super Duty repairs take longer than expected.

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#7 – Erie: Best for Personalized Service

Pros

- Personalized Local Support: Based on our Erie insurance review, it provides Ford F-350 Super Duty owners with dedicated local agents for tailored policy options.

- Inexpensive Minimum Coverage: At $65 per month, Erie’s minimum coverage is competitive for Ford F-350 drivers.

- Rate Lock Feature: Drivers can lock in cheap Ford F-350 insurance rates with Erie’s Rate Lock, preventing unexpected premium hikes.

Cons

- Limited Availability: Erie is only available in 12 states, restricting access for Ford F-350 drivers elsewhere.

- Fewer Digital Tools: Erie lacks a fully developed online claims process, which may be inconvenient for Ford F-350 Super Duty owners.

#8 – Farmers: Best for Extensive Coverage

Pros

- Extensive Coverage Options: Farmers offers Ford F-350 Super Duty drivers add-ons like rental car reimbursement and loss of use coverage.

- Cost-Effective Minimum Rates: Farmers provides affordable basic insurance at $67 a month for Ford F-350 owners.

- Safe Driver Discounts: Farmers rewards safe drivers with accident-free F-350 insurance discounts and telematics savings. Find more discounts in our Farmers Insurance review.

Cons

- Higher Rates for Young Drivers: Farmers tends to charge higher premiums for young Ford F-350 drivers.

- Fewer Online Policy Management Tools: Some Ford F-350 Super Duty owners may find Farmers’ online tools outdated.

#9 – American Family: Best for Loyalty Rewards

Pros

- Loyalty and Renewal Discounts: AmFam offers Ford F-350 Super Duty owners exclusive savings for long-term customers. Learn how to qualify in our American Family review.

- Wallet-Friendly Rates: Ford F-350 Super Duty insurance costs are reasonable at $69 a month for basic insurance coverage.

- Teen Safe Driving Program: American Family provides discounts for young Ford F-350 Super Duty drivers through its safe-driving program.

Cons

- Not Available in All States: American Family has limited coverage availability for Ford F-350 owners in some regions.

- Fewer High-Risk Driver Discounts: Ford F-350 Super Duty drivers with accidents may not qualify for as many savings.

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#10 – State Farm: Best for Reliable Reputation

Pros

- Strong Industry Reputation: According to our State Farm review, it has the highest customer service ratings for Ford F-350 auto insurance.

- Economic Rates: State Farm provides Ford F-350 drivers with comprehensive insurance options at $71 per month.

- Drive Safe & Save Program: Drivers can use State Farm usage-based car insurance to lower Ford F-350 Super Duty insurance costs.

Cons

- Higher Full Coverage Rates: State Farm’s full coverage for Ford F-350 is more expensive than competitors.

- Limited Availability: State Farm is not writing new Ford F-350 Super Duty insurance policies in Rhode Island and Massachusetts.

Ford F-350 Super Duty Insurance Rates

Comparing the monthly rates for Ford F-350 Super Duty insurance helps drivers find the best balance between cost and coverage. Allstate offers the lowest minimum coverage at $45 per month, while Progressive has the cheapest full coverage at $95 per month.

Ford F-350 Super Duty Insurance Monthly Rates

| Insurance Company | Minimum Coverage | Full Coverage |

|---|---|---|

| $45 | $100 | |

| $69 | $108 | |

| $62 | $103 | |

| $65 | $105 |

| $67 | $106 | |

| $60 | $98 | |

| $50 | $110 |

| $64 | $107 |

| $58 | $95 | |

| $71 | $112 |

While some insurers have slightly higher prices, coverage quality and available discounts also play a big role in choosing the right policy. Allstate, Liberty Mutual, and Progressive stand out as the best options because they offer affordable rates with strong benefits. Allstate is the top pick for comprehensive coverage with roadside assistance.

Liberty Mutual’s $50 rate is worth it for drivers who want customizable policies, including new car replacement for F-350s under three years old. Progressive keeps costs low with usage-based discounts for safe drivers through its Snapshot car insurance with telematics.

Coverage Options for Ford F-350 Super Duty Insurance

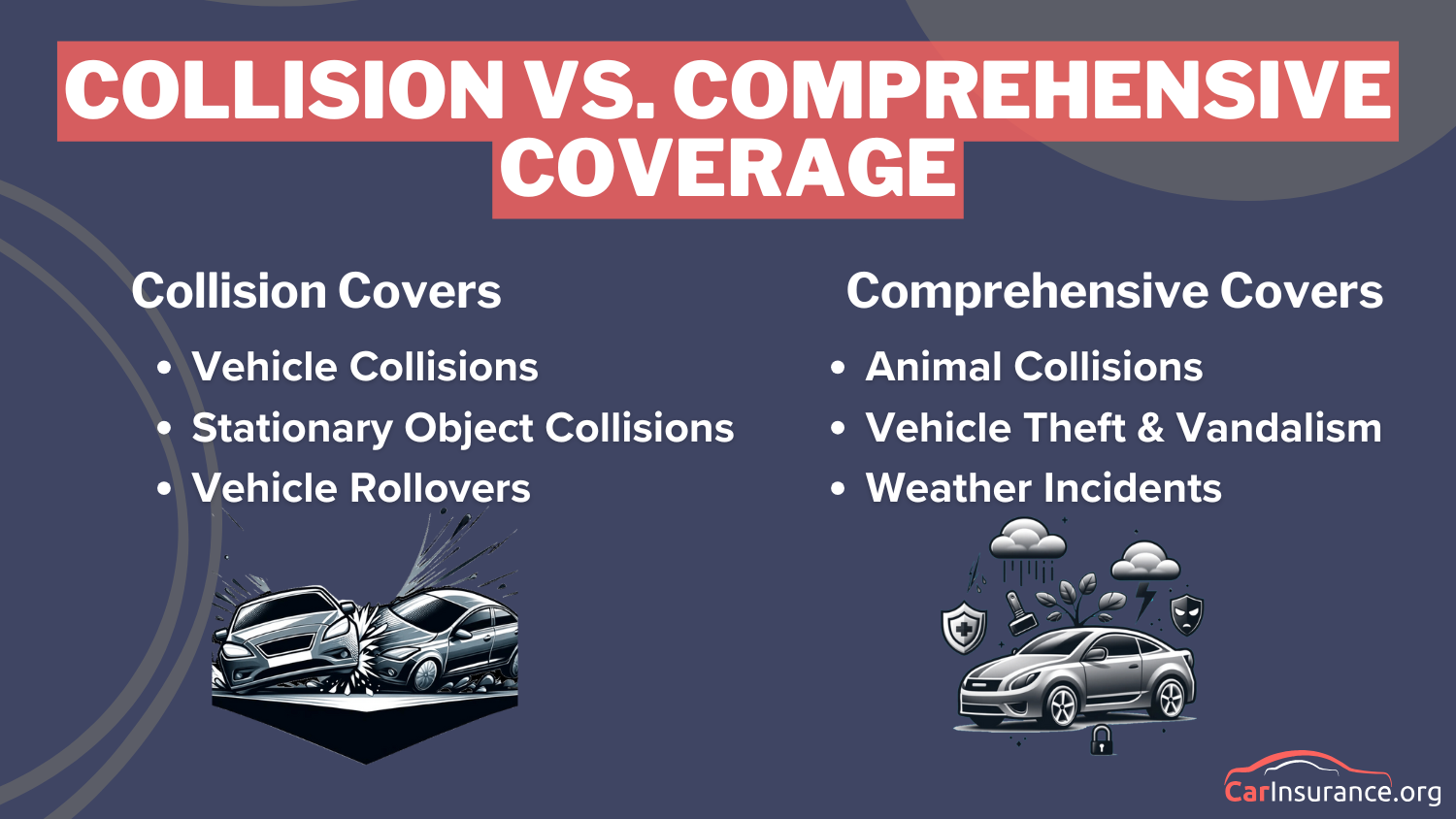

Comprehensive and collision coverage are essential for Ford F-350 Super Duty owners who want full protection against unpredictable risks and costly repairs.

These coverages help safeguard against different risks and expenses related to accidents, liabilities, and damages:

- Liability Insurance: Covers bodily injury and property damage if you cause an accident.

- Collision vs. Comprehensive Insurance: Pays for repairs if your Ford F-350 Super Duty is damaged in a crash, natural disaster, or stolen.

- Uninsured/Underinsured Motorist Coverage: Protects you if another driver lacks enough insurance to cover damages.

- Gap Insurance: Covers the difference between your truck’s value and remaining loan balance if totaled.

- Roadside Assistance: Provides towing, jump-starts, and emergency services if your truck breaks down.

Additional coverages like medical payments (MedPay), personal injury protection (PIP), rental reimbursement, and custom parts coverage can also be added based on state requirements and your personal needs.

Standard collision and comprehensive insurance may not fully cover custom parts, aftermarket upgrades, or towing hitches on a Super Duty pickup truck. Many insurers offer custom equipment coverage, which provides extra protection for modifications like lift kits, smart hitches, or specialized toolboxes.

Read More: Best Car Insurance For Ford Raptors

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Top Ways to Save on Ford F-350 Super Duty Insurance

Getting cheap Ford F-350 Super Duty insurance isn’t just about finding the lowest price — it’s also about using discounts to save more. Allstate, Liberty Mutual, and Progressive offer some of the best deals to lower costs.

Car Insurance Discounts From Top Providers

| Company | Accident-Free | Bundling | UBI | Auto-Pay |

|---|---|---|---|---|

| 25% | 25% | 30% | 10% | |

| 25% | 25% | 30% | 10% | |

| 16% | 16% | 30% | 5% | |

| 25% | 25% | 30% | 10% |

| 20% | 20% | 30% | 10% | |

| 22% | 25% | 25% | 5% | |

| 20% | 25% | 30% | 10% |

| 20% | 20% | 40% | 10% |

| 10% | 10% | $231/yr | 5% | |

| 17% | 17% | 30% | 10% |

Allstate gives discounts for early sign-ups, bundling policies, and paying on time, making it a top choice for drivers who want strong coverage at a low price.

Taking advantage of safe driver, multi-policy, and vehicle safety discounts can significantly reduce Ford F-350 Super Duty insurance costs.Daniel Walker Licensed Insurance Agent

Liberty Mutual has the RightTrack program, which rewards safe driving with lower rates, while Progressive’s Snapshot program helps drivers save up to 30% by tracking their driving habits. These discounts reward safe drivers with better Ford F-350 Super Duty insurance rates.

The #KeysToProgress giveaway is coming up! We can’t wait for all the smiles and joy that come from providing vehicles to these amazing veterans, their families, and more 🚙🎉 Learn more at https://t.co/hxXXn54HwJ #GivingBack #Veterans #Keystoprogress2024 pic.twitter.com/DneX3dt3Kl

— Progressive (@progressive) October 8, 2024

Even though Geico and Auto-Owners have good rates, discounts from the best cheap Ford F-350 Super Duty insurance companies make a big difference. Nationwide, Farmers, and Erie offer savings for bundling auto, home, or business insurance, which helps Ford F-350 Super Duty owners lower their overall costs.

Comparing these discounts along with base rates helps Ford F-350 Super Duty owners get the best coverage at the lowest price. See if you’re getting the best deal on car insurance by entering your ZIP code here.

Frequently Asked Questions

How much does Ford F-350 Super Duty insurance cost per month?

The cost of Ford F-350 Super Duty insurance depends on the level of coverage, location, driving history, and the insurance provider. Minimum coverage starts as low as $45 per month with Allstate, while full coverage can range from $95 to $112 per month, depending on the insurer.

Read More: Do I need full coverage on a financed car?

Why is Ford F-350 Super Duty insurance more expensive than standard car insurance?

The Ford F-350 Super Duty is a large, heavy-duty truck, which makes repairs and replacement parts more expensive than those for smaller vehicles. The high towing capacity and commercial usage potential increase risk, and the F-350’s size means that accidents involving this truck can cause more damage, leading to higher liability costs for insurers.

Does Ford F-350 Super Duty insurance cost more for commercial use?

Yes, insuring a Ford F-350 Super Duty for business use is generally more expensive than personal auto insurance. If you use your Ford F-350 Super Duty for work purposes, it’s important to get a commercial policy to ensure you’re properly covered. Ready to find cheaper car insurance coverage? Enter your ZIP code to begin.

What coverage do I need for my Ford F-350 Super Duty?

At the very least, you need liability insurance, which covers damages and injuries you cause in an accident. However, full coverage with comprehensive and collision insurance is highly recommended, especially if your truck is financed or leased.

Learn More: The Different Types of Car Insurance Coverage

Which companies offer the cheapest Ford F-350 Super Duty insurance?

Allstate offers the cheapest minimum coverage at $45 per month, making it the most affordable option for basic protection. Progressive provides the lowest full coverage rate at $95 per month, making it a good choice for drivers who want extensive coverage at a reasonable price.

What discounts are available for Ford F-350 Super Duty insurance?

Many insurance companies offer discounts to help lower the cost of car insurance for Ford F-350 Super Duty trucks. Some of the most common discounts include multi-policy savings (bundling auto and home insurance), safe driver discounts for accident-free records, and telematics-based discounts like Liberty Mutual’s RightTrack or Progressive’s Snapshot.

How can I lower my Ford F-350 Super Duty insurance rates?

There are several ways to reduce the cost of Ford F-350 Super Duty insurance. Comparing multiple quotes from different insurers is one of the best ways to find a lower rate. Increasing your deductible can also lower monthly premiums, though you’ll pay more out of pocket if you file a claim.

Does modifying my Ford F-350 Super Duty affect insurance rates?

Yes, modifying your Ford F-350 Super Duty can increase your insurance rates. Changes like lift kits, larger tires, performance tuning, or custom accessories make repairs more expensive and increase the likelihood of theft. Enter your ZIP code into our free comparison tool to see how much modified car insurance costs in your area.

Is full coverage necessary for an older Ford F-350 Super Duty?

If your Ford F-350 Super Duty is older and fully paid off, you might not need full coverage. However, full coverage is still a good idea if your F-350 is worth significantly more than the cost of the insurance premium. Keeping comprehensive and collision coverage can save you from expensive repair bills in case of an accident.

Read More: Why You Need Car Insurance

How do insurers determine Ford F-350 Super Duty insurance rates?

Insurance companies set rates for Ford F-350 Super Duty insurance based on several factors, including your driving record, location, age, credit history, and how the truck is used. Insurers also consider the level of coverage chosen, annual mileage, and safety features installed on the vehicle.

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Scott W. Johnson

Licensed Insurance Agent

Scott W Johnson is an independent insurance agent in California. Principal Broker and founder of Marindependent Insurance Services, Scott brings over 25 years of experience to his clients. His Five President’s Council awards prove he uses all he learned at Avocet, Sprint Nextel, and Farmers Insurance to the benefit of his clients. Scott quickly grasped the unique insurance requirements of his...

Licensed Insurance Agent

Editorial Guidelines: We are a free online resource for anyone interested in learning more about car insurance. Our goal is to be an objective, third-party resource for everything car insurance related. We update our site regularly, and all content is reviewed by car insurance experts.