Cheap Ford F-450 Super Duty Insurance in 2025 [10 Most Affordable Companies]

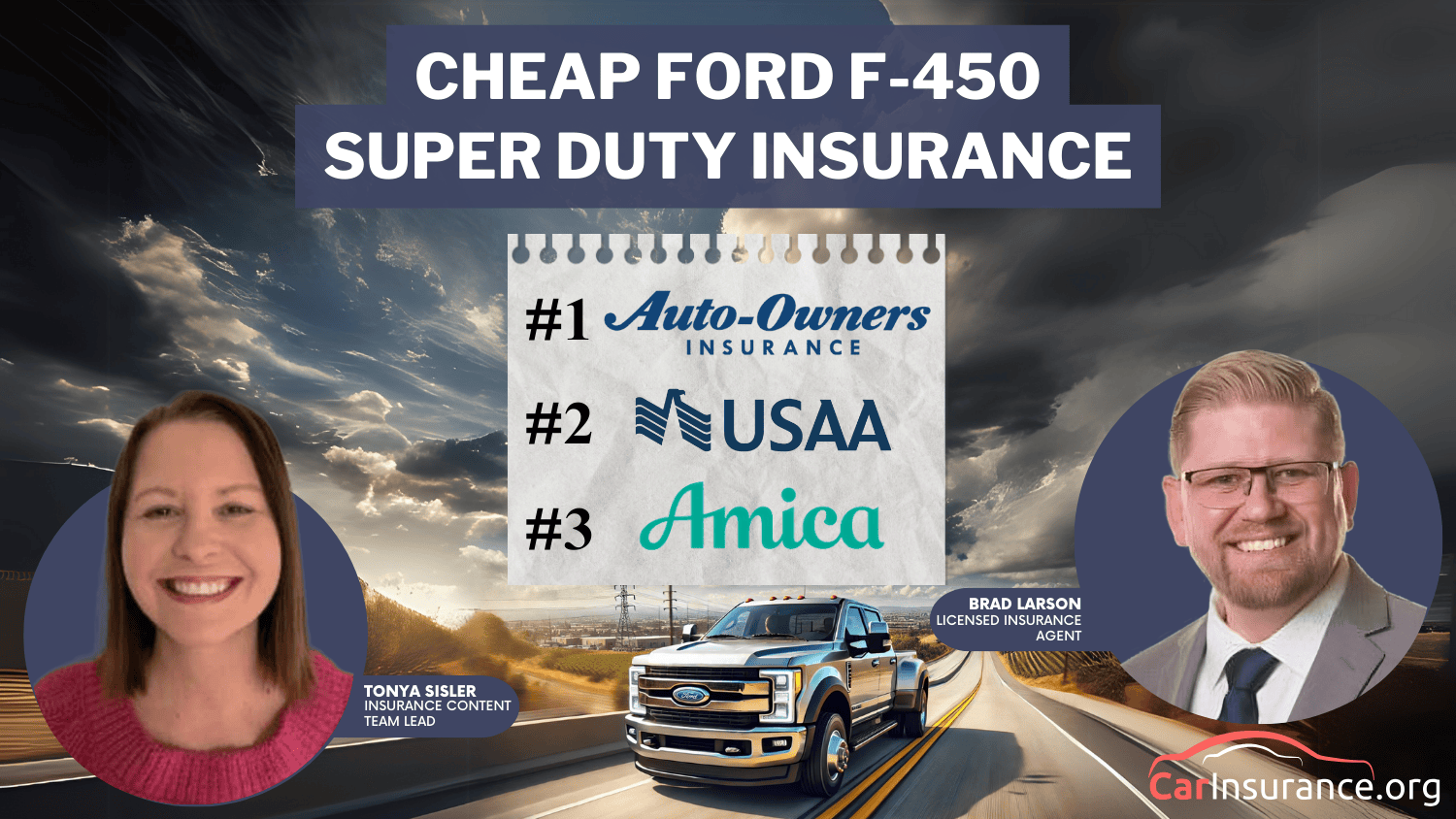

Auto-Owners, USAA, and Amica lead the market for cheap Ford F-450 Super Duty insurance. Auto-Owners guarantees genuine Ford replacement parts with F-450 auto insurance rates starting at $98 per month. USAA delivers savings for military members, while Amica provides lifetime guarantees on Ford F-450 repairs.

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Brad Larson

Licensed Insurance Agent

Brad Larson has been in the insurance industry for over 16 years. He specializes in helping clients navigate the claims process, with a particular emphasis on coverage analysis. He received his bachelor’s degree from the University of Utah in Political Science. He also holds an Associate in Claims (AIC) and Associate in General Insurance (AINS) designations, as well as a Utah Property and Casual...

Licensed Insurance Agent

UPDATED: Apr 17, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident car insurance decisions. Comparison shopping should be easy. We are not affiliated with any one car insurance company and cannot guarantee quotes from any single provider.

Our insurance industry partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about car insurance. Our goal is to be an objective, third-party resource for everything car insurance related. We update our site regularly, and all content is reviewed by car insurance experts.

UPDATED: Apr 17, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident car insurance decisions. Comparison shopping should be easy. We are not affiliated with any one car insurance company and cannot guarantee quotes from any single provider.

Our insurance industry partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

6,589 reviews

6,589 reviewsCompany Facts

Min. Coverage

A.M. Best Rating

Complaint Level

Pros & Cons

6,589 reviews

6,589 reviews 768 reviews

768 reviewsCompany Facts

Min. Coverage

A.M. Best Rating

Complaint Level

Pros & Cons

768 reviews

768 reviewsAuto-Owners, USAA, and Amica provide cheap Ford F-450 Super Duty insurance with basic coverage starting at $98 a month. Auto-Owners stands out for its low-mileage discount for Ford F-450 Super Duty trucks, which is ideal for owners who use their vehicles primarily for occasional towing.

Our Top 10 Company Picks: Cheap Ford F-450 Super Duty Insurance

| Company | Rank | Monthly Rates | A.M. Best | Best For | Jump to Pros/Cons |

|---|---|---|---|---|---|

| #1 | $98 | A++ | Safe Drivers | Auto-Owners | |

| #2 | $105 | A++ | Military Members | USAA | |

| #3 | $112 | A+ | Lifetime Repairs | Amica | |

| #4 | $120 | A+ | Regional Coverage | Erie |

| #5 | $127 | A+ | Roadside Assistance | Nationwide |

| #6 | $134 | A | High-Risk Drivers | Safeco | |

| #7 | $140 | A++ | Young Drivers | State Farm | |

| #8 | $148 | A++ | Gap Coverage | Travelers | |

| #9 | $155 | A | Loyal Customers | American Family | |

| #10 | $165 | A+ | AARP Members | The Hartford |

As one of the most popular cars in the United States, the Ford F-450 usually has higher insurance costs than regular vehicles due to its commercial capabilities and specialized parts.

Drivers need to consider whether they require commercial truck insurance based on how they use the vehicle, especially in places like Texas, where rules differ.

- Auto-Owners Insurance offers the lowest monthly premium at $98

- USAA offers minimum F-450 coverage starting at $105 monthly

- Amica rewards good drivers with a return of premiums

Affordable car insurance rates are just a click away. Enter your ZIP code into our free quote tool to find the best policy for you.

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#1 – Auto-Owners: Top Overall Pick

Pros

- Specialized Policies: Offers custom coverage packages with up to $2 million liability protection for F-450 Super Duty owners who use their trucks for both personal and commercial purposes.

- Claims-Free Rewards: Program significantly reduces Ford F-450 Super Duty insurance costs for safe drivers.

- Parts Replacement Guarantee: It covers 100% of OEM Ford components for F-450 Super Duty repairs. Learn more in our Auto-Owners car insurance review.

Cons

- Limited Digital Tools: Lacks mobile app claim filing for F-450 owners and offers no online policy adjustments, requiring phone calls for all coverage changes.

- Coverage Restrictions: Territory limitations restrict F-450 Super Duty coverage beyond 100 miles from home address, creating gaps for cross-country towers.

#2 – USAA: Best for Military Members

Pros

- Military Discounts: Delivers 15% premium reduction for active service members and 12% for veterans with Ford F-450 Super Duty trucks.

- Accident Forgiveness: As mentioned in our USAA car insurance review, it prevents rate increases after the first Ford F-450 Super Duty car insurance claim.

- Bundling Options: Create exceptional savings opportunities for eligible Ford F-450 owners who have home or renters insurance with USAA.

Cons

- Membership Limitations: Availability is exclusively restricted to military personnel seeking Ford F-450 coverage.

- Equipment Coverage Costs: Additional coverage for F-450 Super Duty modifications costs $45/month compared to competitors’ average of $35/month.

#3 – Amica: Best for Lifetime Repairs

Pros

- Lifetime Repair Guarantee: Covers powertrain, transmission, and all Ford factory components on F-450 Super Duty trucks as long as you own the vehicle.

- Dividend Policies: Returns up to 20% of annual premiums to Ford F-450 Super Duty owners who maintain claim-free records for three consecutive years.

- Superior Claims Handling: Provides exceptional support during Ford F-450 Super Duty repair processes (Read More: Amica Mutual Car Insurance Review).

Cons

- Strict Underwriting: Guidelines reject F-450 Super Duty owners who use their trucks for snowplowing, towing services, or construction with over 15% commercial use.

- Higher Initial Premiums: Demands $175/month average starting cost for full F-450 coverage, compared to $145/month from competitors.

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#4 – Erie: Best for Regional Coverage

Pros

- Rate-Lock Guarantee: Prevents premium increases for Ford F-450 Super Duty owners after minor claims. Learn more about its rate-lock guarantee in our Erie car insurance review.

- Diminishing Deductible: Rewards claim-free Ford F-450 Super Duty drivers by reducing out-of-pocket costs.

- Vehicle Replacement Coverage: Provides full replacement value for new Ford F-450 Super Duty trucks for the first three years without depreciation factored into claims.

Cons

- Limited Availability: Cheap Ford F-450 car insurance through Erie is only available in 11 states.

- Documentation Requirements: Claims process requires original purchase receipts for all F-450 modifications and three separate inspection forms for commercial-grade trucks.

#5 – Nationwide: Best for Roadside Assistance

Pros

- Roadside Assistance: Includes specialized heavy-duty towing up to 100 miles, on-site mechanical support, and fuel delivery services equipped for Ford F-450 Super Duty trucks.

- Multi-Policy Bundling: Creates impressive savings opportunities for Ford F-450 Super Duty owners as highlighted in our Nationwide car insurance review.

- Vanishing Deductible: Reduces collision deductible by $100 annually for claim-free Ford F-450 Super Duty owners, up to $500 total savings after five years of safe driving.

Cons

- Commercial Restrictions: Denies coverage for F-450 Super Duty trucks used more than 20% for towing services, delivery routes, or construction hauling.

- Premium Increase: Full coverage costs 45% more than minimum coverage for Ford F-450 Super Duty owners, compared to industry average increase of 35%.

#6 – Safeco: Best for High-Risk Drivers

Pros

- High-Risk Programs: Provides Low Ford F-450 Super Duty insurance costs for owners with speeding tickets and for those with minor accidents.

- Accident Forgiveness: It prevents rate increases after the first Ford F-450 Super Duty insurance claim. Learn more about this program in our Safeco car insurance review.

- Equipment Coverage: Provides up to $10,000 coverage for aftermarket snowplows, winches, and commercial racks installed on Ford F-450 Super Duty trucks.

Cons

- Customer Service Issues: Scores 2.7/5 stars in J.D. Power satisfaction surveys from Ford F-450 Super Duty owners compared to industry average of 3.8/5 stars.

- Slower Claims Process: Takes 14 days on average for F-450 Super Duty repairs versus 9 days with competing insurers.

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#7 – State Farm: Best for Young Drivers

Pros

- Young Driver Programs: Offers reduced Ford F-450 insurance rates for drivers under 25 with good grades. Learn more about its discounts in our State Farm car insurance review.

- Drive Safe & Save: Usage-based program delivers up to 30% off Ford F-450 Super Duty premiums by tracking acceleration, braking habits, and mileage through the mobile app.

- Local Agents: Access 19,000 local representatives nationwide who specialize in commercial-grade Ford F-450 Super Duty insurance coverage options.

Cons

- Coverage Add-On Costs: Specialized equipment protection for F-450 modifications costs $25-40 more monthly than other insurers.

- Discount Requirements: Requires 5+ years of clean driving history and completion of defensive driving course to qualify for premium discounts

#8 – Travelers: Best for Gap Insurance

Pros

- Gap Coverage: Covers up to 120% of the difference between your F-450 Super Duty’s actual cash value and remaining loan balance with no deductible.

- Bundling Discounts: Delivers premium reduction when combining Ford F-450 Super Duty insurance with home, or business policies. Learn more in our Travelers car insurance review.

- Commercial Expertise: Offers specialized coverage for F-450 Super Duty trucks used in contracting, landscaping, and snowplowing with up to $2 million liability protection.

Cons

- Limited Online Platform: Mobile app lacks claim filing capabilities and policy adjustment tools for F-450 Super Duty owners, forcing phone calls for service changes.

- Documentation Requirements: Claims process requires extensive paperwork for modified Ford F-450 Super Duty trucks.

#9 – American Family: Best for Loyal Customers

Pros

- Loyalty Rewards: Significantly reduces premiums for long-term Ford F-450 Super Duty policyholders, with extra savings for legacy members.

- Diminishing Deductible: As mentioned in our AmFam car insurance review, it rewards claim-free Ford F-450 Super Duty owners with substantial savings.

- Customized Coverage: Ford F-450 Super Duty insurance policy options address the specific needs of drivers using their personal truck for business purposes.

Cons

- Higher Initial Premiums: AmFam’s monthly rates are around $50 higher than the cheapest Ford F-450 Super Duty insurance companies on this list.

- Commercial Coverage Gaps: Specialized options for Ford F-450 Super Duty commercial insurance lack some features that other providers offer.

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#10 – The Hartford: Best for AARP Members

Pros

- AARP Discounts: As highlighted in our The Hartford car insurance review, it provides substantial savings for Ford F-450 Super Duty owners who are AARP members.

- Lifetime Renewability: This guarantees continued Ford F-450 Super Duty car insurance coverage for seniors.

- RecoverCare Program: Covers additional expenses while your Ford F-450 Super Duty is repaired after an accident.

Cons

- Membership Restrictions: Ford F-450 car insurance through The Hartford is only available to AARP members.

- Equipment Coverage Costs: Specialized protection costs more than competitors’ for modified Ford F-450 Super Duty trucks.

Comparing Ford F-450 Super Duty Insurance Rates

Getting cheap Ford F-450 Super Duty insurance involves comparing several providers. The best options tend to be insurers such as Auto-Owners, USAA (for military personnel), and Amica, which routinely provide the most competitive quotes.

Ford F-450 Super Duty Insurance Monthly Rates by Provider & Coverage Level

| Company | Minimum Coverage | Full Coverage |

|---|---|---|

| $155 | $250 | |

| $112 | $190 | |

| $98 | $175 | |

| $120 | $200 |

| $127 | $210 | |

| $134 | $220 | |

| $140 | $230 | |

| $165 | $265 | |

| $148 | $240 | |

| $105 | $180 |

What does car insurance cover? These top car insurance providers cover the Ford F-450’s commercial vehicle types, specialized equipment protection, and the value of essential and modified parts.

Is the Ford F-450 Super Duty expensive to insure? As a commercial-duty pickup with a high towing capacity and high-end components, the F-450 Super Duty usually has higher insurance rates than typical passenger cars. Always shop around and compare car insurance online to find the cheapest companies and best discounts on F-450 car insurance.

As shown in the table below, the F-450 is more expensive and has more capability than the competition, which affects insurance costs.

Ford F-450 Super Duty vs. Competing Heavy-Duty Trucks

| Category | Ford F-450 Super Duty | RAM 3500 | Chevy Silverado 3500HD | GMC Sierra 3500HD |

|---|---|---|---|---|

| Starting Price | $60,000+ | $51,000+ | $50,000+ | $51,500+ |

| Max Towing Capacity | Up to 40,000 lbs (gooseneck) | Up to 37,090 lbs | Up to 36,000 lbs | Up to 36,000 lbs |

| Max Payload | ~6,300 lbs | ~7,680 lbs | ~7,442 lbs | ~7,442 lbs |

| Horsepower | Up to 500 hp (High-Output Diesel) | Up to 420 hp (High-Output) | Up to 445 hp | Up to 445 hp |

| Torque | 1,200 lb-ft (6.7L HO Diesel) | 1,075 lb-ft | 910 lb-ft | 910 lb-ft |

| Transmission | 10-speed automatic | 6-speed/8-speed automatic | 10-speed automatic | 10-speed automatic |

| Cab Configurations | Regular, SuperCab, CrewCab | Regular, Crew, Mega Cab | Regular, Double, Crew Cab | Regular, Double, Crew Cab |

| Ride Quality | Work-focused, firm | Smoother than expected | Balanced for heavy hauling | Slightly more upscale feel |

| Interior Features | Tech-forward, durable materials | Luxe trims (Laramie, Limited) | Practical, durable | Premium Denali trim available |

| Off-Road Option | Tremor Package | Power Wagon (only on 2500) | Z71 Package | AT4 Package |

The F-450 Super Duty outperforms the competition with 40,000 lb towing capacity and 6.7L diesel engine, but that premium performance comes at a rising cost as shown in the price trend over the last 10 years.

Ford F-450 Super Duty Starting MSRP by Model Year (2016–2025)

| Model Year | Starting MSRP |

|---|---|

| 2025 | $67,500 |

| 2024 | $66,500 |

| 2023 | $65,000 |

| 2022 | $63,800 |

| 2021 | $62,500 |

| 2020 | $61,000 |

| 2019 | $59,500 |

| 2018 | $58,000 |

| 2017 | $56,500 |

| 2016 | $55,000 |

The F-450 Super Duty’s premium price point plus its class leading towing capacity and specialized parts means higher replacement costs and repair costs. That’s why insurers charge more to insure an F-450 than a standard passenger vehicle, so you need to compare providers to find the best rates.

Top Ways to Save on Ford F-450 Super Duty Insurance

If you know how to lower the cost of car insurance with various discount programs, you can get significantly cheaper Ford F-450 Super Duty insurance rates. Asking for the right discounts can turn what otherwise would be a costly policy into a budget-friendly protection plan.

Ford F-450 Super Duty Insurance Discount From Top Providers

| Company | Bundling | Good Driver | Good Student | Loyalty | Low Mileage |

|---|---|---|---|---|---|

| 25% | 25% | 20% | 18% | 20% | |

| 30% | 20% | 20% | 13% | 20% | |

| 16% | 25% | 20% | 10% | 30% | |

| 25% | 23% | 15% | 10% | 30% | |

| 20% | 40% | 18% | 8% | 20% | |

| 15% | 20% | 15% | 12% | 25% | |

| 17% | 25% | 35% | 6% | 30% | |

| 5% | 15% | 12% | 7% | 10% | |

| 13% | 10% | 8% | 9% | 20% | |

| 10% | 30% | 10% | 11% | 20% |

Nationwide’s stellar 40% good driver discount and State Farm’s 35% good student discounts are especially worthwhile opportunities for qualified Ford F-450 Super Duty owners.

Auto-Owners offers notable 30% price reductions to those with low mileage, which can benefit drivers who use a Ford F-450 Super Duty primarily for leisure towing or specific job-related tasks rather than everyday travel to work.

You might not know we have life, home, car, and business insurance.

Now you do. pic.twitter.com/kpfAQQurXR— Auto-Owners (@AutoOwnersIns) May 4, 2020

These discounts become especially valuable for heavy-duty truck owners since base premiums are higher due to the vehicle’s commercial-grade capabilities, increased repair costs, and specialized components.

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Factors Impacting Ford F-450 Insurance Costs

When shopping for Ford F-450 Super Duty insurance, you need to know the factors that affect the price of car insurance. As a commercial-grade truck with specialized parts and high towing capacity, several unique factors impact your insurance costs:

- Vehicle Usage: How you use your F-450 matters, with commercial use like towing services, construction hauling or snowplowing requiring specialized coverage at higher rates than personal use only.

- Specialized Parts: The F-450’s heavy-duty parts and specialized equipment cost more to repair or replace than regular vehicle parts, so insurers charge higher rates to offset those costs.

- Driver Profile: Your driving record, age and experience level matter, with companies like State Farm offering up to 35% discounts for young drivers with good grades and Nationwide 40% for clean driving records.

- Location: Insurance costs vary greatly based on where you live and drive, with regional factors like theft rates, accident frequency and repair costs in your area affecting premiums.

- Coverage Limits: Full coverage with low deductibles provides better protection but costs more, with full coverage averaging $175-$265 a month vs $98-$165 for minimum coverage.

Finding cheap Ford F-450 Super Duty insurance means comparing multiple providers and knowing these factors. By using the right discounts and choosing coverage that matches your usage, you can get comprehensive coverage without overpaying for features you don’t need.

Get Cheap Coverage for Your Ford F-450 Super Duty

Auto-Owners, USAA, and Amica are the best options for cheap Ford F-450 Super Duty insurance. Auto-Owners guarantees genuine Ford parts, USAA forgives accidents, and Amica promises lifetime repairs.

Make sure you know how car insurance works since commercial insurance rules can be tricky for those using the F-450 for work and personal life, especially if you drive and work in multiple states.

Standard policies for F-450s often restrict coverage to just 100 miles from your home address.Brad Larson Licensed Insurance Agent

Our free online comparison tool allows you to compare cheap car insurance quotes instantly from all over the country — just enter your ZIP code to get started.

Frequently Asked Questions

Does an F-450 Super Duty require commercial insurance in Texas?

Yes, Texas typically requires commercial insurance for F-450 trucks used for business purposes. Personal auto policies may be sufficient if the trucks are used exclusively for personal transportation without business use.

Read More: Best Car Insurance in Texas

What is the best year for a Ford F-450 Super Duty?

The 2020 Ford F-450 is considered the best model year due to its enhanced towing capacity, improved powertrain reliability, and updated technology features with fewer reported issues.

How much is insurance for a Ford 4-50 Super Duty?

Due to their size, value, and specialized components, F-450 Super Duty models cost more. Auto-Owners has the cheapest rates, starting at $98 a month. Shop for the cheapest liability-only car insurance with our free quote comparison tool.

How much can an F-450 carry?

The Ford F-450 Super Duty offers a maximum payload capacity of 6,210 pounds and can tow up to 37,000 pounds when properly equipped with the gooseneck trailer setup.

What is a Super Duty in Ford?

Ford Super Duty designates heavy-duty pickup trucks (F-250, F-350, F-450) built with stronger frames, more robust components, and enhanced towing capabilities compared to standard F-150 models. Fun fact: The Ford F-150 is considered one of the safest pickup trucks.

How much does a Super Duty Ford F-450 cost?

New Ford Super Duty trucks range from $41,445 for base F-250 models to $92,670 for fully-equipped F-450 Limited trims, with F-450 models starting around $53,475.

Is F-450 gas or diesel?

The Ford F-450 Super Duty has a 7.3L V8 gas engine, but most models are equipped with the optional 6.7L Power Stroke turbo diesel for superior towing capability.

How much does it cost to maintain a Ford F-450 Super Duty?

Annual maintenance costs for a Ford F-450 Super Duty average at $1,295, with diesel models requiring more expensive maintenance than gas versions.

What year Ford F-450 truck is most reliable?

The 2012-2016 Ford F-450 Super Duty trucks with the 6.7L Power Stroke diesel are considered the most reliable. They offer excellent durability with fewer emissions system issues.

Read More: Buying a Car: What You Need to Know

What year did the Ford F-450 come out?

The Ford F-450 Super Duty was first introduced in 1999 as part of Ford’s expanded heavy-duty truck lineup, replacing the previous F-Super Duty commercial trucks.

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Brad Larson

Licensed Insurance Agent

Brad Larson has been in the insurance industry for over 16 years. He specializes in helping clients navigate the claims process, with a particular emphasis on coverage analysis. He received his bachelor’s degree from the University of Utah in Political Science. He also holds an Associate in Claims (AIC) and Associate in General Insurance (AINS) designations, as well as a Utah Property and Casual...

Licensed Insurance Agent

Editorial Guidelines: We are a free online resource for anyone interested in learning more about car insurance. Our goal is to be an objective, third-party resource for everything car insurance related. We update our site regularly, and all content is reviewed by car insurance experts.