Best Car Insurance for Alaska in 2025 [Find the Top 10 Companies Here]

State Farm, Geico, and Progressive have the best car insurance in Alaska, with rates starting at just $22/mo. State Farm stands out due to its telematics program that rewards safe driving, while Geico's affordable rates help drivers save. For high-risk drivers, Progressive has the best Alaska car insurance.

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Eric Stauffer

Licensed Insurance Agent

Eric Stauffer is an insurance agent and banker-turned-consumer advocate. His priority is educating individuals and families about the different types of insurance coverage. He is passionate about helping consumers find the best coverage for their budgets and personal needs. Eric is the CEO of C Street Media, a full-service marketing firm and the co-founder of ProperCents.com, a financial educat...

Licensed Insurance Agent

UPDATED: Mar 13, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident car insurance decisions. Comparison shopping should be easy. We are not affiliated with any one car insurance company and cannot guarantee quotes from any single provider.

Our insurance industry partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about car insurance. Our goal is to be an objective, third-party resource for everything car insurance related. We update our site regularly, and all content is reviewed by car insurance experts.

18,154 reviews

18,154 reviewsCompany Facts

Full Coverage in Alaska

A.M. Best Rating

Complaint Level

Pros & Cons

18,154 reviews

18,154 reviews 19,116 reviews

19,116 reviewsCompany Facts

Full Coverage in Alaska

A.M. Best Rating

Complaint Level

Pros & Cons

19,116 reviews

19,116 reviews 13,283 reviews

13,283 reviewsCompany Facts

Full Coverage in Alaska

A.M. Best Rating

Complaint Level

Pros & Cons

13,283 reviews

13,283 reviewsState Farm, Geico, and Progressive have the best car insurance in Alaska, with rates starting at just $22/mo. State Farm stands out because its telematics program rewards safe driving, while Geico’s affordable rates help drivers save. Progressive has the best Alaska car insurance for high-risk drivers.

Our Top 10 Company Picks: Best Car Insurance for Alaska

| Company | Rank | Bundling Discount | A.M. Best | Best For | Jump to Pros/Cons |

|---|---|---|---|---|---|

| #1 | 17% | B | Safe Drivers | State Farm | |

| #2 | 25% | A++ | Low Rates | Geico | |

| #3 | 10% | A+ | High-Risk Drivers | Progressive | |

| #4 | 25% | A+ | Full Coverage | Allstate | |

| #5 | 10% | A++ | Military Families | USAA | |

| #6 | 25% | A | Custom Plans | Liberty Mutual |

| #7 | 20% | A | Customer Service | Farmers | |

| #8 | 20% | A+ | Safe Drivers | Nationwide |

| #9 | 13% | A++ | Reliable Coverage | Travelers | |

| #10 | 20% | A | Young Drivers | American Family |

You will be well-informed about the minimum coverage requirements, rules of the road, and Alaska’s car insurance laws.

You can also start comparison shopping today by entering your ZIP code using our FREE online tool above!

- Alaska’s unique weather conditions factor into insurance premiums

- Winter protection in Alaska, like roadside assistance, is key

- Seasonal coverage in Alaska is perfect for when your vehicle is not in use

#1 – State Farm: Top Pick Overall

Pros

- Strong Customer Service: State Farm’s excellent customer service reputation is proven by its personalized support for Alaskan drivers who need to make a quick claim.

- Discount Opportunities: State Farm offers multiple discounts, such as safe driving through their Drive Safe & Save program, good student discounts, and multi-policy bundling.

- National Network: State Farm operates and covers drivers in all 50 states, so if you drive across states often, State Farm may be best for you. Learn more in this State Farm car insurance review.

Cons

- Drive Safe & Save Program Challenges: Alaska’s driving conditions may make the telematics-based discount program less effective than in other states.

- Less Specialized for Alaska’s Needs: Some regional insurers may provide better coverage tailored to the specific challenges of driving in Alaska.

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#2 – Geico: Best for Low Rates

Pros

- Low Rates: Geico is known for its affordable rates for all types of drivers, even if the car is in not in your name. It is often one of the cheapest car insurance companies in Alaska.

- Wide Range of Discounts: Geico’s discounts contribute to cheap car insurance in Alaska. Check what discounts are available in this Geico car insurance review.

- Easy Claims Processing: Geico’s claims process is simple and fast. They offer 24/7 customer support anytime you need help in Alaska or other states.

Cons

- Not Alaska-Specific: Policies may not be suitable for Alaska’s extreme weather conditions or wildlife-related incidents.

- Roadside Assistance Limitations: While available, Geico’s roadside assistance program may not be as extensive in remote parts of Alaska.

#3 – Progressive: Best for High-Risk Drivers

Pros

- Cheap Rates for High-Risk Drivers: Progressive offers affordable car insurance quotes in Alaska for high-risk drivers. Progressive’s car insurance review discusses more.

- Customizable Coverage: Progressive offers optional add-ons, such as Gap insurance for vehicles you may not use and roadside assistance if your car breaks down.

- Specialty Insurance: Progressive also offers additional coverage for ATVs, snowmobiles, and other vehicles commonly used in Alaska.

Cons

- Higher Rates for Low-Risk Drivers: Progressive may not be the cheapest car insurance in Alaska for drivers with clean records or those seeking minimum coverage.

- Wildlife Collision Coverage: While included under comprehensive policies, Progressive doesn’t cover Alaska-specific common risks like moose or deer collisions.

#4 – Allstate: Best for Full Coverage

Pros

- Coverage Options: Allstate offers specialized coverage for wildlife collisions in Alaska. Check Allstate’s car insurance review to see what coverage is available.

- Local and Digital Service: Allstate has local agents in Alaskan cities for personalized service and a mobile app for easy policy management.

- Claim Satisfaction Guarantee: Allstate’s car insurance in Alaska offers a money-back guarantee on claim handling.

Cons

- Drivewise® Challenges: The telematics program may not reflect safe driving in Alaska’s challenging roads and weather.

- Limited Remote Coverage: Roadside assistance and claims support may be less accessible in Alaska’s rural and remote areas.

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#5 – USAA: Best for Military Families

Pros

- Tailored for Military Members: Alaska car insurance quotes are cheap, with their policies including unique features like coverage during deployment or overseas travel.

- Exceptional Customer Service: USAA customer satisfaction is highly ranked due to its helpful agents and smooth claims process for accidents in Alaska.

- Local Knowledge: USAA is familiar with Alaska’s unique driving conditions. To learn more about the company, read USAA’s car insurance review.

Cons

- Limited Local Agent Support: The company operates online and by phone, which may not appeal to Alaskans who prefer local service.

- High Rates Without Discounts: Alaska’s minimum coverage premiums may not always be the lowest without discounts.

#6 – Liberty Mutual: Best for Custom Plans

Pros

- Customizable Policies: Liberty Mutual policies offer standard coverage options and Alaska-specific add-ons for wildlife and weather conditions.

- Local Presence: Alaskan drivers can easily get assistance in cities and towns for personalized policy service. Check out the Liberty Mutual car insurance review for more information.

- Better Car Replacement: This coverage is valuable to Alaskans who are concerned about vehicle depreciation after an accident.

Cons

- Higher Premiums: Liberty Mutual’s rates can be higher than the average cost of car insurance in Alaska.

- Mixed Claims Reviews: Some customers report issues with claims processing, which can interfere with quick repairs in Alaska’s harsh winters.

#7 – Farmers: Best for Customer Service

Pros

- Customizable Coverage Options: Farmers’ policies include the standard coverage as well as essential add-ons for Alaska’s road conditions, such as roadside assistance and glass coverage.

- Local Agents: Farmers can provide local assistance and services in Alaska.

- Specialty Coverage Options: Farmers provide options for vehicle modifications for off-road and for Alaska’s severe weather conditions.

Cons

- Higher Premiums: Farmers tend to have higher Alaska auto insurance quotes than competitors. Check out Farmer’s car insurance review to learn more.

- Fewer Discounts: While discounts are available, they may not be as extensive or generous as competitors in Alaska, such as USAA or Geico.

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#8 – Nationwide: Best for Safe Drivers

Pros

- Wide Range of Coverage Options: Nationwide offers standard coverage types and add-ons, such as roadside assistance.

- Discounts: Nationwide offers discounts for safe drivers and or completing a defensive driving course.

- On Your Side® Review: A unique service where agents review your policy to ensure you have the right coverage in Alaska at the best price.

Cons

- Higher Premiums: Nationwide’s car insurance rates in Alaska may be higher, particularly for minimum coverage.

- Not For Alaskan Conditions: Nationwide’s policies do not cover Alaska’s off-road driving and snowy conditions. To learn what’s covered, read our Nationwide car insurance review.

#9 – Travelers: Best for Reliable Coverage

Pros

- Flexible Policy Customization: Travelers’ reliable coverage allows drivers to tailor their policies to meet specific needs for high-risk Alaskan conditions.

- Financial Stability: Travelers is a well-established company with a strong reputation for reliable payouts when handling claims.

- Strong Digital Tools: Their mobile app and website enable easy policy management, claims filing, and payment processing.

Cons

- Limited Local Presence: Fewer local agents in Alaska may result in less personalized in-person service. Read our Travelers car insurance review to find out more.

- Roadside Assistance Limitations: Alaska’s rural or remote areas might be less accessible, which could be a drawback for drivers outside urban centers.

#10 – American Family: Best for Young Drivers

Pros

- Discounts: AmFam offers multi-vehicle discounts and teen driver discounts for families, contributing to cheap car insurance in Alaska.

- Strong Digital Tools: Their mobile app and website offer convenient policy management, claims filing, and access to digital ID cards.

- Customer-Centric Features: These include accident forgiveness and diminishing deductible programs, which are perfect for getting cheap auto insurance in Alaska.

Cons

- Limited Availability: American Family does not operate in all states, and its presence in Alaska is limited. Our American Family car insurance review can help you learn more.

- KnowYourDrive® Challenges: Alaska’s icy roads and severe weather might negatively impact safe driving scores in the telematics program.

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Alaska’s Car Insurance Coverage and Rates

The first and foremost information you need before asking for quotes from insurers is your state’s coverage requirements and rates. Suppose you aren’t aware of the minimum coverage requirements, options for additional coverage, add-ons, different types of discounts, and rates in your ZIP code. In that case, you might end up with a policy that’s unsuitable for you.

Alaska Car Insurance Monthly Rates by Provider & Coverage Level

| Insurance Company | Minimum Coverage | Full Coverage |

|---|---|---|

| $46 | $135 | |

| $36 | $105 | |

| $44 | $127 | |

| $26 | $76 | |

| $56 | $164 |

| $37 | $108 |

| $33 | $97 | |

| $22 | $65 | |

| $32 | $93 | |

| $20 | $60 |

Also, in the event of an unfortunate accident, you must be reasonably covered to pay any personal injury and property damage expenses and know the law to avoid scams. Did you know that there are many remote areas in Alaska wherein vehicle registration and insurance are not required?

Like every other shopping experience, you have to search the internet for the best coverage for you. A good way to do that is to enter your ZIP code in our comparison tool. Without further ado, let’s get you started with details that would help in your car insurance buying process.

Alaska’s Minimum Car Insurance Requirements

Every state has a mandatory minimum liability coverage requirement for the safety of everyone on the road. Now, you might wonder why you need to shell out your hard-earned money for premiums every year when you drive safely.

In Alaska, it's illegal to drive without the minimum coverage. You could face a fine of up to $500 or lose your driving privilege for a year.Daniel Walker Licensed Insurance Agent

The mandatory insurance law came into place because a few people were unable to pay off damages in an accident caused by them. Also, the financial and legal costs from an accident run into millions at times. Hence, car insurance policies were invented to make a collective pool of premiums from which insurers could pay damages from accidents.

The Alaska statutes section 28.22.101 mentions Alaska’s minimum car insurance requirements to cover Bodily Injury/Death for $50,000 per person per accident, with a maximum limit of $100,000 per accident and Property Damage to cover $25,000 per accident in total.

Is it bad to just have minimum coverage car insurance? Wirh this basic coverage, the insurer would pay any medical costs for personal injury to drivers, passengers, and pedestrians and property damage costs as per the coverage limits.

Point to note: The car insurance limits mandated by the state of Alaska wouldn’t be enough to cover the cost of damage if you are involved in an accident with a luxury car or your car gets totaled by a moose attack.

In the next few sections, we will discuss the different types of insurance coverage that you may consider buying for better protection.

The Acceptable Forms of Financial Responsibility in Alaska

Alaska’s financial responsibility law requires motorists to prove that they have the means to settle damages if involved in an accident while driving. Buying a car insurance policy is one way of proving financial responsibility, but there are other ways to prove that you have assets in reserve.

- Surety Bond: A bond assured by a licensed company that covers the minimum state requirement amount also serves as proof of financial responsibility in Alaska.

- Self-Insurance: You can also get a self-insurance certificate from the DMV if you can prove that you would be able to pay the minimum coverage amount in the event of an accident, provided you have a minimum of 25 registered vehicles.

You would be required to show proof of financial responsibility during these situations:

- Registration of car

- Reinstatement of driver’s license after suspension

- At the request of a police officer

- If you happen to be involved in an accident

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

The Average Monthly Car Insurance Rates in AK

How much are premiums when broken down into different coverage types? With just minimum coverage, you can expect to pay the lowest rates available, however is it really all you need?

By law, you’re required to buy only the state minimum liability coverage. Still, it is recommended that you buy additional coverage, such as collision, comprehensive, uninsured insurance, personal injury protection, etc.

The different types of car insurance coverage options offer you a larger cushion to settle damages in the event of an accident. On the other hand, liability insurance only pays for the other party’s expenses from an accident you caused.

Alaska Report Card: Car Insurance Premiums

| Category | Grade | Explanation |

|---|---|---|

| Average Claim Size | A | Claim sizes are comparatively high overall |

| Traffic Density | B | Moderate traffic, manageable congestion levels |

| Weather-Related Risks | B | Harsh weather increases accident risks |

| Vehicle Theft Rate | C | Higher theft rates in urban areas |

| Uninsured Drivers Rate | D | Significant proportion of drivers uninsured |

The premiums listed in the table above indicate how these factors affect Alaska’s rates, which will differ significantly depending on your personal situation.

Additional Auto Insurance Coverage in Alaska

We have discussed whether it’s bad to just have liability coverage in detail multiple times now because you are required to settle damages caused by you in an accident, irrespective of anything else. That’s the law!

But who would pay your personal injury and property damage expenses if you’re the at-fault party? Also, has anyone told you that there are motorists who drive without any insurance coverage?

The answer to all those questions is additional car insurance coverage. Let’s understand the different options in the market.

- Uninsured/Underinsured Motorist: This coverage is a blessing if you get hit by an uninsured or underinsured motorist because an uninsured motorist wouldn’t have the means to pay your damages, but this coverage option would.

- Personal Injury Protection: Irrespective of the fault, PIP pays for your personal injury expenses in an accident.

- Collision Coverage: There’s some chance that you might tread off that path and hit a tree on the Alaskan highway someday. If you collide with a tree or any other object, your collision coverage will pay for the repairs.

- Comprehensive Coverage: Circumstances beyond our control, such as theft, fire, vandalism, and hurricanes, may cause damage to your motor vehicle, and comprehensive coverage would pay for the repair of these damages.

The loss ratio for uninsured motorist coverage hovers around 50 percent in Alaska, as the table above shows for three years.

Loss Ratio in Alaska

| Coverage | 2025 | 2024 | 2023 | 2022 | 2021 | 2020 |

|---|---|---|---|---|---|---|

| Medical Payments | 73% | 73% | 72% | 71% | 70% | 66% |

| Uninsured/Underinsured Motorist | 65% | 64% | 63% | 63% | 63% | 60% |

This means that insurers are paying around $50 in claim settlement for every $100 in premiums earned from this optional coverage. Alaska ranks 11th among all states in the estimated uninsured motorist category, with around 15.4 percent of motorists driving without insurance in the state.

Add-ons, Endorsements, and Riders Available in Alaska

Apart from the basic coverage types that you must buy to protect yourself, insurers also offer few add-ons and optional riders that would be of use under specific circumstances.

- Guaranteed Auto Protection (GAP)

- Personal Umbrella Policy (PUP)

- Rental Reimbursement

- Emergency Roadside Assistance

- Mechanical Breakdown Insurance

- Non-Owner Car Insurance

- Modified Car Insurance Coverage

- Classic Car Insurance

Add-ons like a mechanical breakdown or emergency roadside assistance can be quite useful in Alaska as you drive on unpaved roads without any service station in sight for miles.

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Average Monthly Car Insurance Rates by Age and Gender in AK

Age and gender will affect your car insurance. Younger drivers are often in a high-risk class, especially with the common risks teen drivers face. See if the gender stereotype (males pay more) holds true in AK.

Alaska Car Insurance Monthly Rates by Age, Gender, & Provider

| Age & Gender | |||||

|---|---|---|---|---|---|

| 17-Year-Old Female | $425 | $389 | $542 | $347 | $388 |

| 17-Year-Old Male | $557 | $496 | $604 | $449 | $431 |

| 25-Year-Old Female | $223 | $131 | $190 | $121 | $129 |

| 25-Year-Old Male | $245 | $127 | $192 | $116 | $137 |

| 45-Year-Old Female | $192 | $109 | $157 | $93 | $85 |

| 45-Year-Old Male | $192 | $109 | $138 | $93 | $85 |

| 60-Year-Old Female | $183 | $99 | $125 | $83 | $76 |

| 60-Year-Old Male | $183 | $101 | $131 | $83 | $76 |

As per multiple studies, women are less likely to cause an accident than men, and men are considered riskier drivers. Although auto insurance companies might not accept it, the premium rates for men are higher than for women.

In Alaska, men and women above 30 pay similar premiums; however, the rate gap is evident in the 17-25-year-old category. The rates for single 17-year-old males are significantly higher than the females.

Premium Rates by ZIP code in Alaska

Any typical conversation with an insurance agent for a quote starts with questions specific to your profile, and one of the foremost things they ask is your ZIP code.

You have probably observed that rates in your city vary from ZIP code to ZIP code. Insurance companies can use your ZIP code to fetch data about car thefts, vandalism, accident rates, snow and wet weather conditions, etc., factors that help them determine the final rate.

Alaska Car Insurance Monthly Rates by ZIP Code

| ZIP | Rank | Rates | U.S. Average +/- | City |

|---|---|---|---|---|

| 99504 | #1 | $261 | $379 | Anchorage |

| 99567 | #2 | $260 | $370 | Chugiak |

| 99577 | #3 | $259 | $357 | Eagle River |

| 99508 | #4 | $258 | $347 | Anchorage |

| 99645 | #5 | $258 | $338 | Palmer |

| 99502 | #6 | $257 | $332 | Anchorage |

| 99507 | #7 | $257 | $329 | Anchorage |

| 99518 | #8 | $257 | $326 | Anchorage |

| 99503 | #9 | $256 | $320 | Anchorage |

| 99599 | #9 | $256 | $320 | Anchorage |

| 99501 | #9 | $256 | $320 | Anchorage |

| 99513 | #9 | $256 | $320 | Anchorage |

| 99529 | #9 | $256 | $320 | Anchorage |

| 99652 | #10 | $256 | $319 | Big Lake |

| 99654 | #10 | $256 | $319 | Wasilla |

| 99515 | #11 | $256 | $318 | Anchorage |

| 99517 | #12 | $256 | $315 | Anchorage |

| 99530 | #12 | $256 | $315 | Anchorage |

| 99674 | #13 | $255 | $306 | Sutton |

| 99516 | #14 | $255 | $302 | Anchorage |

| 99540 | #15 | $252 | $273 | Indian |

| 99505 | #16 | $251 | $259 | Jber |

| 99506 | #17 | $249 | $235 | Jber |

| 99688 | #18 | $246 | $203 | Willow |

| 99694 | #18 | $246 | $203 | Houston |

| 99587 | #19 | $241 | $141 | Girdwood |

| 99701 | #20 | $241 | $131 | Fairbanks |

| 99714 | #21 | $240 | $126 | Salcha |

| 99712 | #22 | $240 | $122 | Fairbanks |

| 99790 | #22 | $240 | $122 | Fairbanks |

| 99703 | #22 | $240 | $122 | Fort Wainwright |

| 99519 | #23 | $238 | $100 | Anchorage |

| 99716 | #24 | $237 | $94 | Two Rivers |

| 99775 | #25 | $236 | $83 | Fairbanks |

| 99693 | #26 | $236 | $80 | Whittier |

| 99732 | #27 | $236 | $75 | Chicken |

| 99738 | #27 | $236 | $75 | Eagle |

| 99764 | #27 | $236 | $75 | Northway |

| 99776 | #27 | $236 | $75 | Tanacross |

| 99780 | #27 | $236 | $75 | Tok |

| 99705 | #28 | $236 | $73 | North Pole |

| 99731 | #27 | $235 | $70 | Fort Greely |

| 99737 | #27 | $235 | $70 | Delta Junction |

| 99744 | #28 | $235 | $62 | Anderson |

| 99702 | #29 | $234 | $59 | Eielson Afb |

| 99743 | #30 | $234 | $57 | Healy |

| 99682 | #31 | $234 | $56 | Tyonek |

| 99709 | #32 | $234 | $54 | Fairbanks |

| 99723 | #32 | $234 | $54 | Barrow |

| 99586 | #33 | $234 | $53 | Gakona |

| 99566 | #34 | $234 | $49 | Chitina |

| 99573 | #34 | $234 | $49 | Copper Center |

| 99588 | #34 | $234 | $49 | Glennallen |

| 99623 | #35 | $233 | $46 | Houston |

| 99755 | #36 | $233 | $44 | Denali National Park |

| 99726 | #37 | $233 | $42 | Bettles Field |

| 99740 | #37 | $233 | $42 | Fort Yukon |

| 99788 | #37 | $233 | $42 | Chalkyitsik |

| 99733 | #38 | $233 | $40 | Circle |

| 99777 | #39 | $233 | $39 | Tanana |

| 99729 | #40 | $233 | $37 | Cantwell |

| 99760 | #41 | $232 | $35 | Nenana |

| 99759 | #42 | $232 | $31 | Point Lay |

| 99758 | #42 | $232 | $31 | Minto |

| 99569 | #43 | $232 | $28 | Clarks Point |

| 99559 | #43 | $232 | $28 | Bethel |

| 99609 | #43 | $232 | $28 | Kasigluk |

| 99680 | #43 | $232 | $28 | Tuntutuliak |

| 99690 | #43 | $232 | $28 | Nightmute |

| 99722 | #43 | $232 | $28 | Arctic Village |

| 99781 | #43 | $232 | $28 | Venetie |

| 99641 | #44 | $232 | $27 | Nunapitchuk |

| 99679 | #44 | $232 | $27 | Tuluksak |

| 99789 | #48 | $232 | $26 | Nuiqsut |

| 99765 | #49 | $232 | $25 | Nulato |

| 99580 | #50 | $232 | $24 | Ekwok |

| 99782 | #51 | $231 | $23 | Wainwright |

| 99552 | #51 | $231 | $23 | AkiaK |

| 99557 | #51 | $231 | $23 | Aniak |

| 99575 | #51 | $231 | $23 | Crooked Creek |

| 99637 | #51 | $231 | $23 | Toksook Bay |

| 99681 | #51 | $231 | $23 | Tununak |

| 99757 | #52 | $231 | $22 | Lake Minchumina |

| 99660 | #53 | $231 | $21 | Saint Paul Island |

| 99548 | #54 | $231 | $20 | Chignik Lake |

| 99549 | #54 | $231 | $20 | Port Heiden |

| 99565 | #54 | $231 | $20 | Chignik Lagoon |

| 99579 | #54 | $231 | $20 | Egegik |

| 99648 | #54 | $231 | $20 | Perryville |

| 99768 | #55 | $231 | $19 | Ruby |

| 99791 | #55 | $231 | $19 | Atqasuk |

| 99558 | #55 | $231 | $19 | Anvik |

| 99745 | #55 | $231 | $19 | Hughes |

| 99774 | #55 | $231 | $19 | Stevens Village |

| 99683 | #55 | $231 | $19 | Trapper Creek |

| 99555 | #55 | $231 | $19 | Aleknagik |

| 99670 | #55 | $231 | $19 | South Naknek |

| 99583 | #56 | $231 | $18 | False Pass |

| 99649 | #56 | $231 | $18 | Pilot Point |

| 99546 | #56 | $231 | $18 | Adak |

| 99628 | #56 | $231 | $18 | Manokotak |

| 99636 | #56 | $231 | $18 | New Stuyahok |

| 99590 | #57 | $231 | $17 | Grayling |

| 99665 | #57 | $231 | $17 | Shageluk |

| 99724 | #57 | $231 | $17 | Beaver |

| 99746 | #57 | $231 | $17 | Huslia |

| 99576 | #57 | $231 | $17 | Dillingham |

| 99678 | #57 | $231 | $17 | Togiak |

| 99704 | #58 | $231 | $16 | Clear |

| 99691 | #58 | $231 | $16 | Nikolai |

| 99547 | #58 | $231 | $16 | Atka |

| 99720 | #58 | $231 | $16 | Allakaket |

| 99571 | #58 | $231 | $16 | Cold Bay |

| 99747 | #59 | $231 | $15 | Kaktovik |

| 99553 | #59 | $231 | $14 | Akutan |

| 99638 | #59 | $231 | $14 | Nikolski |

| 99561 | #59 | $231 | $14 | Chefornak |

| 99578 | #59 | $231 | $14 | Eek |

| 99589 | #59 | $231 | $14 | Goodnews Bay |

| 99614 | #59 | $231 | $14 | Kipnuk |

| 99651 | #59 | $231 | $14 | Platinum |

| 99656 | #59 | $231 | $14 | Red Devil |

| 99748 | #59 | $231 | $14 | Kaltag |

| 99564 | #59 | $231 | $14 | Chignik |

| 99756 | #59 | $231 | $14 | Manley Hot Springs |

| 99613 | #59 | $231 | $14 | King Salmon |

| 99602 | #59 | $231 | $14 | Holy Cross |

| 99767 | #59 | $231 | $14 | Rampart |

| 99622 | #60 | $231 | $13 | Kwigillingok |

| 99591 | #60 | $231 | $13 | Saint George Island |

| 99606 | #61 | $231 | $12 | Iliamna |

| 99625 | #61 | $231 | $12 | Levelock |

| 99640 | #61 | $231 | $12 | Nondalton |

| 99647 | #61 | $231 | $12 | Pedro Bay |

| 99653 | #61 | $231 | $12 | Port Alsworth |

| 99554 | #61 | $231 | $12 | Alakanuk |

| 99563 | #61 | $231 | $12 | Chevak |

| 99581 | #61 | $231 | $12 | Emmonak |

| 99585 | #61 | $231 | $12 | Marshall |

| 99657 | #61 | $231 | $12 | Russian Mission |

| 99662 | #61 | $231 | $12 | Scammon Bay |

| 99750 | #61 | $231 | $12 | Kivalina |

| 99751 | #61 | $231 | $12 | Kobuk |

| 99761 | #61 | $231 | $12 | Noatak |

| 99766 | #61 | $231 | $12 | Point Hope |

| 99770 | #61 | $231 | $12 | Selawik |

| 99773 | #61 | $231 | $12 | Shungnak |

| 99621 | #62 | $231 | $11 | Kwethluk |

| 99630 | #62 | $231 | $11 | Mekoryuk |

| 99634 | #62 | $231 | $11 | Napakiak |

| 99668 | #62 | $231 | $11 | Sleetmute |

| 99627 | #62 | $230 | $11 | Mc Grath |

| 99675 | #62 | $230 | $11 | Takotna |

| 99620 | #63 | $230 | $10 | Kotlik |

| 99632 | #63 | $230 | $10 | Mountain Village |

| 99666 | #63 | $230 | $10 | Nunam Iqua |

| 99763 | #63 | $230 | $10 | Noorvik |

| 99667 | #63 | $230 | $10 | Skwentna |

| 99658 | #64 | $230 | $9 | Saint Marys |

| 99626 | #64 | $230 | $9 | Lower Kalskag |

| 99650 | #64 | $230 | $9 | Pilot Station |

| 99727 | #64 | $230 | $9 | Buckland |

| 99736 | #64 | $230 | $9 | Deering |

| 99721 | #65 | $230 | $8 | Anaktuvuk Pass |

| 99749 | #65 | $230 | $8 | Kiana |

| 99786 | #65 | $230 | $8 | Ambler |

| 99741 | #66 | $230 | $7 | Galena |

| 99661 | #66 | $230 | $7 | Sand Point |

| 99612 | #67 | $230 | $6 | King Cove |

| 99604 | #67 | $230 | $6 | Hooper Bay |

| 99752 | #68 | $230 | $3 | Kotzebue |

| 99551 | #68 | $230 | $3 | Akiak |

| 99684 | #69 | $230 | $1 | Unalakleet |

| 99742 | #69 | $230 | $1 | Gambell |

| 99769 | #69 | $230 | $1 | Savoonga |

| 99772 | #69 | $230 | $1 | Shishmaref |

| 99659 | #69 | $230 | $1 | Saint Michael |

| 99671 | #69 | $230 | $1 | Stebbins |

| 99607 | #70 | $230 | $0 | Kalskag |

| 99655 | #70 | $230 | $0 | Quinhagak |

| 99754 | #71 | $229 | -$1 | Koyukuk |

| 99771 | #71 | $229 | -$1 | Shaktoolik |

| 99784 | #72 | $229 | -$2 | White Mountain |

| 99778 | #73 | $229 | -$3 | Teller |

| 99633 | #73 | $229 | -$3 | Naknek |

| 99739 | #74 | $229 | -$4 | Elim |

| 99676 | #75 | $229 | -$6 | Talkeetna |

| 99685 | #76 | $229 | -$7 | Unalaska |

| 99753 | #76 | $229 | -$7 | Koyuk |

| 99762 | #76 | $229 | -$7 | Nome |

| 99783 | #76 | $229 | -$7 | Wales |

| 99785 | #76 | $229 | -$7 | Brevig Mission |

| 99730 | #76 | $229 | -$7 | Central |

| 99692 | #77 | $229 | -$9 | Dutch Harbor |

| 99603 | #78 | $228 | -$16 | Homer |

| 99663 | #78 | $228 | -$16 | Seldovia |

| 99556 | #79 | $228 | -$24 | Anchor Point |

| 99574 | #79 | $228 | -$24 | Cordova |

| 99677 | #79 | $228 | -$24 | Tatitlek |

| 99664 | #80 | $227 | -$31 | Seward |

| 99686 | #81 | $227 | -$32 | Valdez |

| 99568 | #82 | $226 | -$39 | Clam Gulch |

| 99639 | #83 | $226 | -$44 | Ninilchik |

| 99572 | #83 | $226 | -$44 | Cooper Landing |

| 99610 | #83 | $226 | -$44 | Kasilof |

| 99605 | #84 | $226 | -$48 | Hope |

| 99631 | #84 | $226 | -$48 | Moose Pass |

| 99545 | #85 | $225 | -$55 | Kongiganak |

| 99672 | #86 | $225 | -$57 | Sterling |

| 99611 | #87 | $224 | -$63 | Kenai |

| 99669 | #88 | $224 | -$71 | Soldotna |

| 99550 | #89 | $211 | -$224 | Port Lions |

| 99608 | #89 | $211 | -$224 | Karluk |

| 99615 | #89 | $211 | -$224 | Kodiak |

| 99624 | #89 | $211 | -$224 | Larsen Bay |

| 99643 | #89 | $211 | -$224 | Old Harbor |

| 99644 | #89 | $211 | -$224 | Ouzinkie |

| 99926 | #90 | $208 | -$263 | Metlakatla |

| 99925 | #91 | $208 | -$264 | Klawock |

| 99921 | #92 | $207 | -$269 | Craig |

| 99689 | #93 | $206 | -$281 | Yakutat |

| 99903 | #93 | $206 | -$281 | Meyers Chuck |

| 99929 | #94 | $206 | -$283 | Wrangell |

| 99923 | #95 | $206 | -$286 | Hyder |

| 99922 | #96 | $205 | -$289 | Hydaburg |

| 99919 | #97 | $205 | -$297 | Thorne Bay |

| 99927 | #98 | $205 | -$298 | Point Baker |

| 99901 | #99 | $203 | -$316 | Ketchikan |

| 99918 | #99 | $203 | -$316 | Coffman Cove |

| 99928 | #99 | $203 | -$316 | Ward Cove |

| 99801 | #100 | $199 | -$363 | Juneau |

| 99811 | #100 | $199 | -$363 | Juneau |

| 99821 | #100 | $199 | -$363 | Auke Bay |

| 99835 | #101 | $198 | -$382 | Sitka |

| 99836 | #101 | $198 | -$382 | Port Alexander |

| 99825 | #102 | $198 | -$384 | Elfin Cove |

| 99840 | #102 | $198 | -$384 | Skagway |

| 99827 | #103 | $197 | -$396 | Haines |

| 99826 | #104 | $196 | -$398 | Gustavus |

| 99824 | #105 | $196 | -$403 | Douglas |

| 99833 | #105 | $196 | -$403 | Petersburg |

| 99830 | #106 | $196 | -$406 | Kake |

| 99832 | #106 | $196 | -$406 | Pelican |

| 99841 | #106 | $196 | -$406 | Tenakee Springs |

| 99829 | #106 | $196 | -$406 | Hoonah |

| 99820 | #107 | $195 | -$418 | Angoon |

We have collated the rates for every ZIP code/city in Alaska and you can use the search box to look for rates in your area.

The Best Auto Insurance Companies in Alaska

When we say the best car insurance companies in Alaska, we mean those you can rely on to pay your claims when needed. They might not have the cheapest rates, but you should choose an insurer based on their financial ratings, customer reviews, complaints data, etc.

An insurance policy might be an unwanted purchase for you, but you must carefully assess and thoroughly research your insurer before committing to a policy.Michelle Robins Licensed Insurance Agent

When you’re stuck on a highway with a mechanical breakdown or rental coverage, your insurer should attend to your needs immediately. You can also ensure that by looking at the customer satisfaction data of insurance companies. In the next few sections, we will look at factors that can help you decide on your insurance company in Alaska.

Financial Ratings of the Leading Insurance Companies in Alaska

Your insurance company collects premiums from you, makes a collective pool, and then disburses money for claims from that pool among those who need it.

The long-term financial viability of your insurer should be considered a major factor in your car insurance price. Any new entrant in the market without extensive knowledge about the management of premiums and disbursements wouldn’t be able to settle your claims in the long run.

Financial Ratings of Top Companies in Alaska

Similarly, old players in the market might not always have the assets to manage a large payout in the event of a catastrophe in your location.

Financial ratings can tell you an insurer’s long-term viability. We have collated the A.M. Best ratings for the leading insurers in Alaska. A.M. Best ratings assess the financial viability of a business in the long-run after a thorough analysis of its assets and debt-paying ability in the future. Any rating of A+, A, and B+ means good financial standing in the market.

Insurance Companies with Best Customer Ratings in Alaska

Existing customers of insurance companies can be a reliable source to talk about the quality of services an insurer provides. Once you have shortlisted the companies for your car insurance policy, you must conduct web research for the customer ratings of these insurers.

Customer ratings can offer you insights such as the overall satisfaction level, other similar insurers in your location, reasons people bought a policy from a specific insurer, their intent to renew with the same insurer, etc.

These granular pieces of information can provide you with the information you need to make a final decision on the insurance company you go with. Who is the cheapest car insurance company in AK? Review the average auto insurance rates by the company below:

Another data point that you can look at before buying a policy is the number of complaints against an insurance company. If everything else looks good on paper, the complaint data can give you an idea about customer satisfaction levels.

Customer Complaints of Leading Insurers in Alaska

| Company | Total Complaints |

|---|---|

| 163 | |

| 15 |

| 333 | |

| 222 |

| 120 | |

| 1482 | |

| 9 |

| 296 |

In the table above, State Farm Group has the highest number of customer complaints; however, it also has the largest market share in Alaska. Rather than looking at the absolute number of complaints, you should look at the proportion of complaints to an insurer’s market share. Read more on State Farm vs American Family to determine if one is better for your circumstances.

You also have the option to cancel your car insurance policy mid-term if you aren’t satisfied with your insurer’s services.

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

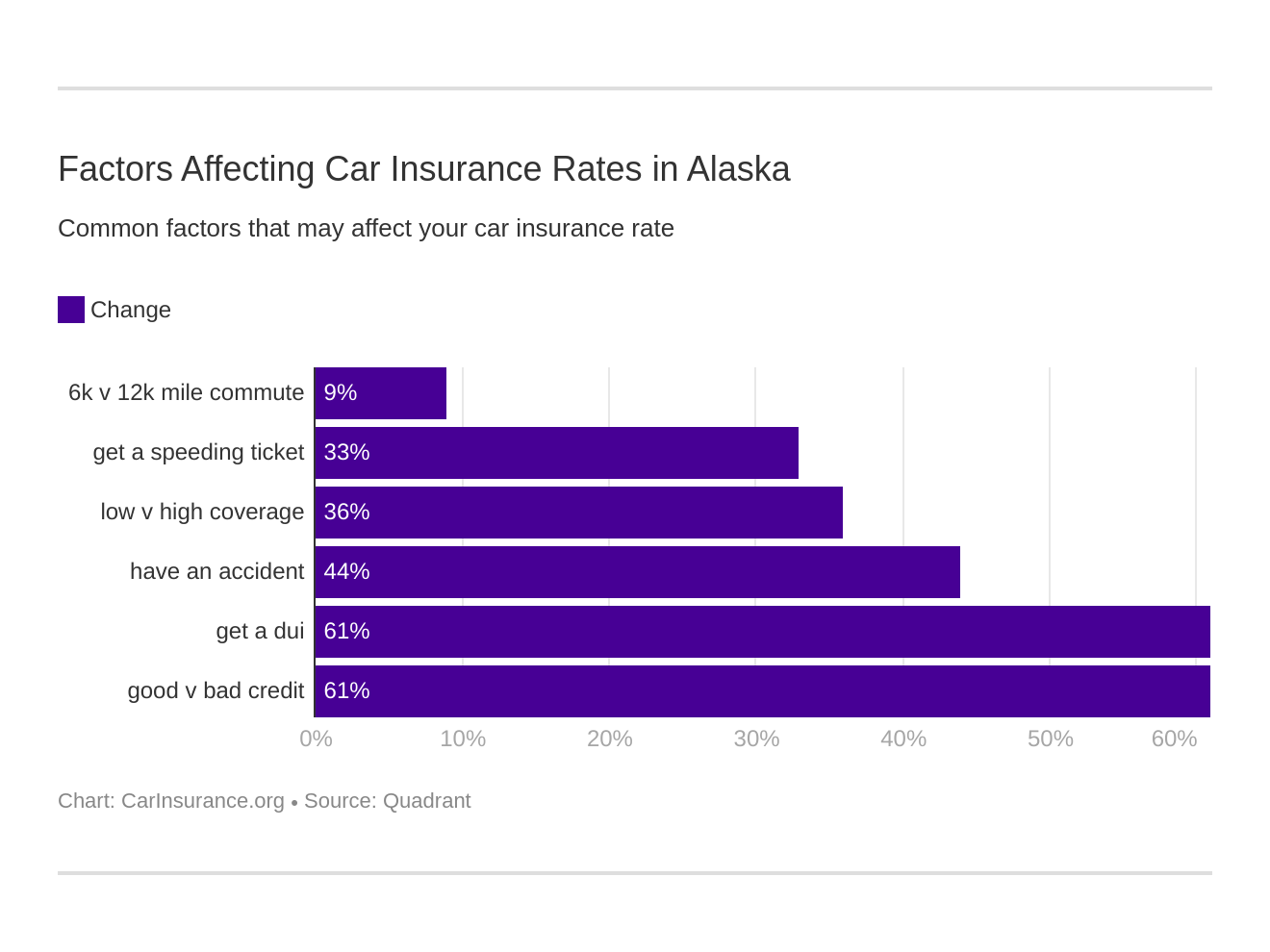

Alaska’s Insurance Premiums By Credit History

Credit history is another factor for premium car insurance costs. As the table shows, insurance companies penalize people with poor credit histories with higher premiums.

Alaska Car Insurance Monthly Rates by Credit Score

| Insurance Company | Good Credit | Fair Credit | Bad Credit |

|---|---|---|---|

| $230 | $247 | $310 | |

| $200 | $230 | $280 | |

| $220 | $245 | $290 | |

| $210 | $237 | $273 | |

| $245 | $260 | $310 |

| $220 | $240 | $290 |

| $238 | $249 | $279 | |

| $134 | $166 | $257 | |

| $225 | $240 | $265 | |

| $153 | $182 | $279 |

As per the State of Credit survey in 2017 by Experian, the average vantage score of Alaskans was 668, while the national average was 675. Vantage score, developed by Equifax, Experian, and TransUnion, is a credit-rating model for consumers that scores them between 300 and 850.

While Alaska’s vantage score is close to the national average, Alaskans have the highest average balance on their credit cards in the US.

Leading Car Insurance Companies in Alaska

After learning a lot about insurance companies and their premium rates in Alaska, let’s examine the leading players in the state’s auto insurance market and their overall share.

Leading Car Insurance Companies in Alaska

| Company | Rank | Direct Written Premiums | Loss Ratio | Market Share |

|---|---|---|---|---|

| #1 | $133,816 | 78% | 29% | |

| #2 | $83,687 | 69% | 18% | |

| #3 | $82,637 | 68% | 18% | |

| #4 | $59,507 | 46% | 13% | |

| #5 | $50,922 | 68% | 11% | |

| #6 | $16,337 | 64% | 3% |

| #7 | $14,042 | 65% | 3% |

| #8 | $10,332 | 66% | 2% |

These six insurance companies capture the majority of the Alaska market, with the State Farm Group holding the largest share. To learn more as to why they’re the leading company in Alaska, read our State Farm review.

State Laws in Alaska

Knowing about the laws of your state with respect to car insurance and driving helps you to keep your insurance rates low.

The pages of your DMV website, driver’s handbook, and car insurance documentation contain many laws and to-do’s. You aren’t required to remember everything on the go, but it’s always recommended to know the basics.

Specifically, laws related to insurance for high-risk drivers, restrictions on cellphone usage, teen driving, penalties for driving without insurance, etc. are some of the laws that can save you a lot of hassle later on.

Car insurance laws are in effect mainly for two reasons:

- To protect everyone on the roads through mandatory liability coverage that pays for third-party damages in the event of an accident

- To make sure that insurance companies adhere to the laid-down principles for determining premium rates and offer coverage to everyone, barring a few exceptions

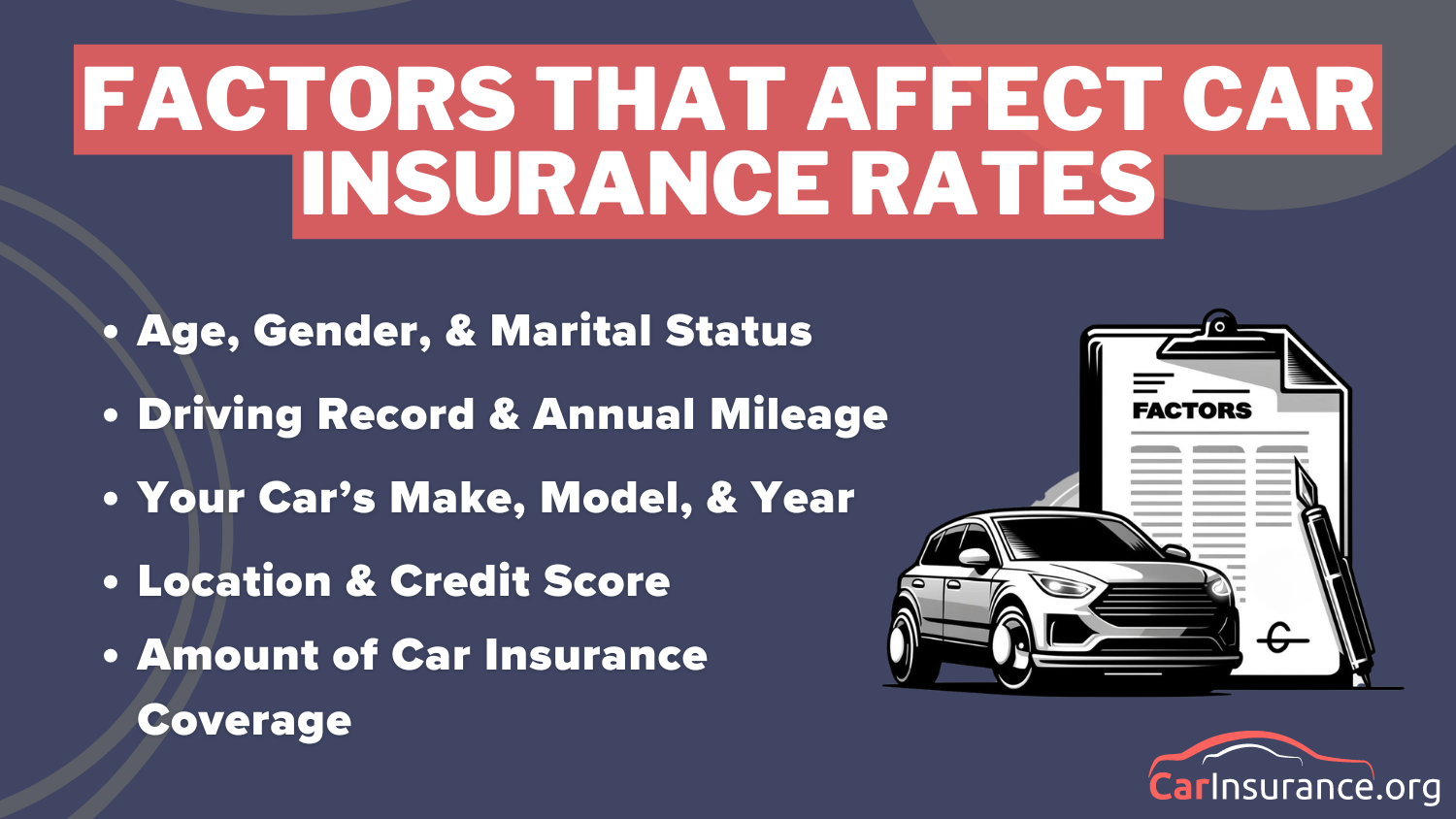

Behind the premium rates that you are charged, insurance companies utilize the combined experience of underwriters and actuaries to design a rating model. The rating model of insurers uses many factors to determine your premiums, such as your car’s make and model, age, marital status, physical address, driving history, vehicle usage, etc.

When there are so many factors and calculations involved, a regulatory body for consumer protection must exist. The Division of Insurance in Alaska oversees insurers’ operations and drafts laws.

These 6 major factors affect auto insurance rates in Alaska. Now, let’s look at some laws that might impact you while driving.

Windshield Coverage Laws in Alaska

If not taken care of immediately, cracks or chips in windshields can lead to personal injuries. Though most states have specific laws regarding windshield repair, Alaska doesn’t discuss windshield repair or replacement.

Companies like Geico can usually cover windshield replacements at no extra cost if the policy is under comprehensive coverage. Therefore, before buying car insurance, ensure that your insurance policy has windshield coverage to avoid any unnecessary expenses.

High-Risk Insurance in Alaska

What happens if you’re a high-risk driver in the sense that you tend to be involved in accidents and speeding violations quite frequently?

You would end up making regular claims for damages leading to an unusually high loss ratio for your insurer. At times, insurers might have to make more payments for claims than they receive in premiums. Hence, insurers can refuse coverage if they deem a motorist as a high-risk driver.

To be fair to everyone, Alaska offers coverage to high-risk drivers under the Alaska Automobile Insurance Plan.

The Alaska Automobile Insurance Plan works like an association where every insurer (with a license to operate in Alaska) has to participate and offer coverage to a specific percentage of motorists directly proportional to its market share.

Once an eligible motorist applies for coverage under the plan, he/she is assigned an insurer from the pool with whom he/she is guaranteed coverage for three years. It’s always best to prepare for the worst to get the best results after an accident.

If State Farm’s market share is 28 percent in Alaska, they would have to offer coverage to 28 percent of the high-risk drivers in the pool. Through this plan, the risk is shared amongst all the insurers in the state. Though you would get coverage under this plan, the premiums tend to be quite high.

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Penalties for Driving Without Car Insurance in Alaska

State laws in Alaska require motorists to carry the minimum liability coverage insurance at all times while their vehicle is registered (with exceptions in certain remote areas).

Anyone driving without car insurance in Alaska can be penalized with a fine of up to $500 and a possible driver’s license suspension for up to a year. If an uninsured motorist is involved in an accident, the license can be suspended for up to three years.

Vehicle Theft in Alaska

After all the information in the previous sections, you are now well-versed in the state laws related to driving and car insurance in your state.

5 Most Common Car Insurance Claims in Alaska

Claim Type Portion of Claims Cost per Claim

Collision 4% $5,010

Comprehensive 3% $2,042

Property Damage 2% $5,314

Bodily Injury 1% $22,734

Uninsured Motorist 1% $10,000

For instance, you should also know that Alaska is home to some of the most expensive tollways in the United States, so plan your driving here accordingly.

Vehicle Theft in Alaska

| Rank | Make & Model | Year of Vehicle | Thefts |

|---|---|---|---|

| #1 | Ford Pickup | 2020 | 162 |

| #2 | Chevrolet Pickup | 2018 | 141 |

| #3 | GMC Sierra | 2019 | 127 |

| #4 | Toyota Tacoma | 2021 | 115 |

| #5 | Honda Civic | 2015 | 94 |

| #6 | Dodge Ram Pickup | 2022 | 88 |

| #7 | Jeep Cherokee/Grand Cherokee | 2017 | 76 |

| #8 | Ford Explorer | 2016 | 64 |

| #9 | Subaru Outback | 2023 | 57 |

| #10 | Chevrolet Silverado | 2020 | 49 |

In the next few sections, we will present facts about your state, such as car theft stats, fatality rates, teen drunk driving numbers, and EMS response time.

How to Get the Best Car Insurance in Alaska

Before making any final decisions about your insurance company, it is important to learn as much as possible about your local insurance providers and what car insurance covers. Call your local insurance agent to clarify any questions that you might have.

Questions to consider asking include, “What is the best coverage plan for me/my family/my situation?” “What are the minimum coverage requirements in my state, and what form of coverage do you recommend?” “Do you guys offer any bundle discounts if I take out both my auto insurance and home insurance with you?” and “What is the average rate of insurance quotes you guys offer?”

Before making any big insurance decisions, you need to investigate different companies; use our free tool to compare insurance quotes near you.

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Frequently Asked Questions

Is car insurance required in Alaska?

Yes, car insurance is mandatory in Alaska for all drivers. Liability insurance covers $50,000 for bodily injury per person, $100,000 for bodily injury per accident, and $25,000 for property damage.

There is also an optional uninsured/underinsured motorist coverage, which will protect your money further, especially if the mandatory insurance does not cover it.

What types of car insurance do I need in Alaska?

The state minimums are required, but many drivers opt for additional coverage due to Alaska’s unique driving conditions. Three of the most common coverages include comprehensive coverage, collision coverage, and roadside assistance. Be sure to use our comparison tool below to compare different coverages for your needs.

How can I save on car insurance in Alaska?

Your car insurance premium can be reduced in several ways, such as bundling your auto, home, renters, or life insurance together under one insurer, which often gives a discount. Another is having a clean driving record, which can reduce rates through a Safe Driver Discount, so learn how to drive safely to keep your insurance and car safe.

An anti-theft device installed into the car can also lower premiums. Finally, paying everything upfront instead of installments will also give a pay-in-full discount.

Does car insurance cover wildlife collisions in Alaska?

Comprehensive coverage often includes protection against wildlife collisions, which is important in Alaska due to the prevalence of large animals on the roads. However, check with your insurer to ensure this coverage is included in your policy.

Can I get car insurance if I have a bad driving record in Alaska?

Yes, you can still get car insurance in Alaska, but your rates will likely be higher if you have accidents, DUIs, or traffic violations on your record. High-risk drivers can often find coverage through companies like Progressive or Geico, which specialize in insuring those with poor driving histories.

How can I file a car insurance claim in Alaska?

Filing a claim after an accident typically involves contacting your insurer via their claims hotline, website, or mobile app. Be sure to have details about the accident or incident (including photos, police reports, and witness statements, if applicable). Many insurers in Alaska also have local agents who can assist with claims in person.

Does car insurance cover weather-related damage in Alaska?

Yes, comprehensive insurance will cover damage caused by severe Alaskan weather conditions such as snow, ice, or hail.

Is it more expensive to insure a car in Alaska?

Car insurance in Alaska may be more expensive than in other states due to the state’s harsh weather conditions, wildlife risks, and remote areas where roadside assistance may be limited. The insurance cost can vary depending on your driving history, the make/model of your vehicle, and the region of Alaska where you live.

Can I use my car insurance if I’m out of state?

Your car insurance coverage generally applies anywhere within the United States and its territories. However, if you plan to drive outside the U.S., like in Canada, you may need additional coverage or notify your insurer.

Should I change my car insurance if I move to Alaska?

If you’re relocating to Alaska, you must update your policy to reflect your new address. Also, you may need to adjust your coverage due to Alaska-specific driving conditions, such as coverage for wildlife collisions and weather-related damage.