Best Car Insurance in Massachusetts for 2025 [Top 10 Companies Ranked]

The best car insurance in Massachusetts starts at $21 per month with Geico, State Farm, and Progressive. Geico is the top pick, offering 25% off bundling discounts and an A++ A.M. Best rating. State Farm offers exceptional customer service, while Progressive offers technologically convenient service.

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Chris Abrams

Licensed Insurance Agent

Chris is the founder of Abrams Insurance Solutions and Marcan Insurance, which provide personal financial analysis and planning services for families and small businesses across the U.S. His companies represent nearly 100 of the top-rated insurance companies. Chris has been a licensed insurance agent since 2009 and has active insurance licenses in all 50 U.S. states and D.C. Chris works tireles...

Licensed Insurance Agent

UPDATED: Apr 17, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident car insurance decisions. Comparison shopping should be easy. We are not affiliated with any one car insurance company and cannot guarantee quotes from any single provider.

Our insurance industry partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about car insurance. Our goal is to be an objective, third-party resource for everything car insurance related. We update our site regularly, and all content is reviewed by car insurance experts.

19,116 reviews

19,116 reviewsCompany Facts

Full Coverage

A.M. Best Rating

Complaint Level

Pros & Cons

19,116 reviews

19,116 reviews 18,154 reviews

18,154 reviewsCompany Facts

Full Coverage

A.M. Best Rating

Complaint Level

Pros & Cons

18,154 reviews

18,154 reviews 13,283 reviews

13,283 reviewsCompany Facts

Full Coverage

A.M. Best Rating

Complaint Level

Pros & Cons

13,283 reviews

13,283 reviewsGeico, State Farm, and Progressive are the top providers for the best car insurance in Massachusetts. Their monthly rates start at just $21.

These companies are among the best car insurance in Massachusetts that offer various discounts, excellent customer service, and affordable rates. See how much you’ll pay for car insurance by entering your ZIP code into our free comparison tool.

Our Top 10 Company Picks: Best Car Insurance in Massachusetts

| Company | Rank | Bundling Discount | A.M. Best | Best For | Jump to Pros/Cons |

|---|---|---|---|---|---|

| #1 | 25% | A++ | Affordable Rates | Geico | |

| #2 | 17% | B | Local Agents | State Farm | |

| #3 | 10% | A+ | Safe Drivers | Progressive | |

| #4 | 10% | A++ | Military Members | USAA | |

| #5 | 25% | A | Young Drivers | Liberty Mutual |

| #6 | 25% | A+ | Comprehensive Coverage | Allstate | |

| #7 | 20% | A+ | Customer Service | Nationwide |

| #8 | 13% | A++ | Bundling Options | Travelers | |

| #9 | 20% | A | Personalized Service | Farmers | |

| #10 | 25% | A | Flexible Coverage | American Family |

Read on to learn everything there is to know about the best car insurance in Massachusetts. Enter your ZIP code above right now to see affordable Massachusetts car insurance rates side by side.

- The best car insurance in Massachusetts has B to A++ A.M. Best rating

- USAA offers the cheapest minimum monthly coverage for $21

- Bundling discounts could save you up to 25% off your premiums

#1 – Geico: Overall Top Pick

Pros:

- Affordable Rates: Among the best car insurance options in Massachusetts, Geico offers low monthly rates starting at $28 and significant savings.

- Excellent Discounts: Massachusetts drivers benefit from discounts of up to 25%, including multi-policy, good driver, and military savings.

- Superb Digital Experience: Geico’s app and website make policy management, claims, and roadside assistance accessible. See more in our Geico car insurance review.

Cons:

- Constrained Service Agents: Geico operates online, providing fewer in-person service options than agent-driven providers in Maryland.

- Higher Premiums for High-Risk Drivers: Drivers with accidents, violations, or poor credit may find Geico’s rates less competitive.

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#2 – State Farm: Best for Local Agents

Pros:

- Competitive Rates: Among the best car insurance in Massachusetts, State Farm offers discounts for multi-policy and safe driving, ensuring affordable coverage.

- Exceptional Customer Service: Offers 24/7 support, claims assistance, and a strong local agent network with personalized service.

- Strong Financial Stability: State Farm is among the leading U.S. insurer known for reliable coverage and quick claims payout.

Cons:

- Higher Rates for High-Risk Drivers: Although State Farm has competitive prices, high-risk drivers in Massachusetts may face higher premiums.

- Limited Digital Features: Utilizes a mobile app but lacks online claims processing, which is not ideal for customers who prefer contactless transactions.

#3 – Progressive: Best for Safe Drivers

Pros:

- Competitive Rates for Safe Drivers: Progressive, among the best car insurance in Massachusetts, offers savings for safe drivers through its Snapshot® program.

- Technologically Convenient: Massachusetts drivers can manage policies, file claims, and access ID cards easily with Progressive’s website and app.

- Diverse Discount Options: Progressive offers up to 10% discounts for Massachusetts residents, such as multi-policy bundles and safe driving rewards.

Cons:

- Higher Rates for High-Risk Drivers: Drivers with past accidents or violations may face higher premiums with Progressive.

- Limited Local Agent Support: Progressive has fewer in-person agents, making it inconvenient for customers who prefer in-person assistance.

#4 – USAA: Best for Military Members

Pros:

- Superior Customer Service & Claims Handling: USAA, among the best car insurance in Massachusetts, is known for great customer satisfaction and seamless claims.

- Competitive Rates for Military Families: Offers the best car insurance in Massachusetts for military families, with up to 10% discounts and flexible coverage.

- Extensive Policy Benefits: Includes accident forgiveness, roadside assistance, and rental reimbursement, solidifying its reputation in Massachusetts.

Cons:

- Membership Restrictions: Only available to military members and their families.

- Limited Physical Branches: Primarily operates online and phone services, limiting for those seeking in-person help with car insurance.

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#5 – Liberty Mutual: Best for Young Drivers

Pros:

- Competitive Rates: Liberty Mutual, the best car insurance in Massachusetts, offers $61 minimum monthly rates, especially for safe drivers and bundles.

- Excellent Customer Support: Local agents provide personalized coverage that meets Massachusetts’ requirements.

- Customizable Coverage Options: Drivers may customize their insurance with options like accident forgiveness for added protection.

Cons:

- Higher Rates for High-Risk Drivers: Competitive for safe drivers, but those with accidents or violations may find premiums higher.

- Mixed Customer Service Reviews: Some Massachusetts customers report delays in claims and service and slower resolution on major claims.

#6 – Allstate: Best for Comprehensive Coverage

Pros:

- Excellent Coverage Options: Allstate offers accident forgiveness, new car replacement, and rideshare insurance, providing extra financial protection.

- Excellent Local Agents: Massachusetts drivers benefit from personalized service and claims assistance from Allstate’s local agents.

- Competitive Discounts: Allstate gives up to 25% discounts for safe driving, bundling policies, and the Drivewise® program.

Cons:

- Higher Premiums: Comprehensive coverage options, but its premiums tend to be higher than cheaper insurers in Massachusetts.

- Varied Customer Service Reviews: Some customers report delays in claims and billing issues.

#7 – Nationwide: Best for Customer Service

Pros:

- Strong Customer Service Reputation: Nationwide is the best car insurance in Massachusetts for customer service, quick claims process, and 24/7 support.

- Comprehensive Coverage: Drivers can choose from several coverage options, including accident forgiveness, vanishing deductibles, and total-loss replacement.

- Multi-Policy Discounts & Affordability: Competitive rates and discounts when bundling auto with home insurance, residents can save while enjoying strong protection.

Cons:

- Limited Local Agents: Provides strong digital and phone support but has fewer physical agents in Massachusetts than some competitors.

- Higher Charges for At-Risk Drivers: Drivers with accidents, tickets, or bad credit may face higher premiums with Nationwide.

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#8 – Travelers: Best for Bundling Options

Pros:

- Competitive Pricing and Discounts: Affordable and best car insurance in Massachusetts, with discounts for safe drivers, bundling, and hybrid vehicles.

- Extensive Coverage Options: Travelers provides customizable insurance policies, such as accident forgiveness, gap insurance, and new car replacement.

- Strong Financial Stability: Known for financial stability and quick claims, a trustworthy choice for the best auto insurance in Massachusetts.

Cons:

- Higher Rates for High-Risk Drivers: High-risk drivers in Massachusetts, such as those with accidents or low credit scores, often face higher rates.

- Limited Local Agent Presence: Fewer local agents in Massachusetts make in-person meetings less accessible despite strong online and phone support.

#9 – Farmers: Best for Customizable Service

Pros:

- Customization Options: The best car insurance in Massachusetts for customization, featuring accident forgiveness and OEM parts replacement.

- Local Agent Support: Personalized service via local agents for claims and policy changes, giving Massachusetts drivers expert support.

- Personalized Discounts: Offer up to 20% discount for safe drivers, a great option for Massachusetts drivers looking to save money without sacrificing coverage.

Cons:

- Higher Premiums: Good customization and support, but its higher rates can be a drawback for Massachusetts drivers seeking affordable rates.

- Limited Availability of Some Discounts: Farmers Insurance has discounts, but some are unavailable in Massachusetts.

#10 – American Family: Best for Flexible Coverage

Pros:

- Excellent Coverage: Offers flexible insurances, which allow drivers to customize their policies like accident forgiveness, gap coverage, etc.

- Competitive Discounts: Drivers can save on insurance by bundling policies, having multiple vehicles, being good students, and completing defensive driving courses.

- Exceptional Customer Service: Offers 24/7 support and personalized service from local agents, making it a top choice for the best car insurance in Massachusetts.

Cons:

- Limited Availability: Fewer local agents and service centers, which may lead to longer wait times for in-person help compared to larger companies.

- Higher Premiums: Base rates may be higher than some competitors and budget-conscious drivers in Massachusetts might find cheaper options elsewhere.

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

MA Insurance Core Coverage Rates

One of the best ways to get every penny’s worth from your car insurance policy is to understand what the state of Massachusetts requires of you as an owner and operator of a motor vehicle in the Bay State.

Massachusetts Car Insurance Monthly Rates by Provider & Coverage Type

| Insurance Company | Collision Coverage | Comprehensive Coverage |

|---|---|---|

| $105 | $35 | |

| $100 | $33 | |

| $98 | $31 | |

| $85 | $30 | |

| $110 | $38 |

| $95 | $34 |

| $90 | $33 | |

| $100 | $32 | |

| $108 | $36 | |

| $85 | $28 |

The rates reflected in the table above are from 2015, so with the upward trend in car insurance premiums over the last three years, the rates for 2019 will be higher. This is why it is so important to educate yourself before you purchase your car insurance policy.

Part of shopping around is looking at the providers in your area and the rates that they are offering for a driver like you. You should get multiple Massachusetts car insurance quotes from insurance companies.

Massachusetts car insurance can be complicated. You must comply with the state’s no-fault insurance laws while also trying to find the best car insurance companies and the cheapest rates.

Massachusetts Car Insurance Monthly Rates by Provider & Coverage Level

| Insurance Company | Minimum Coverage | Full Coverage |

|---|---|---|

| $56 | $143 | |

| $39 | $99 | |

| $47 | $120 | |

| $28 | $72 | |

| $61 | $155 |

| $40 | $103 |

| $37 | $95 | |

| $30 | $78 | |

| $34 | $88 | |

| $21 | $53 |

What is the cheapest car insurance in Massachusetts? How much is the average car insurance in Massachusetts? How do you know which affordable car insurance provider in Massachusetts is right for you? This is where we come in.

We’ll take a look at what factors affect your car insurance rates. We’ll explain how MRB impacts car insurance rates based on your driving record. Driving uninsured in MA can cause serious trouble.

The Typical MA Car Insurance Rates and Coverage

Drivers need to consider personalized factors such as age, driving record, credit history, and location. In Massachusetts, the cheapest car insurance is liability coverage that meets the state minimum requirements.

Finding the best auto insurance in MA depends on affordability, customer satisfaction, claims experience, and financial strength.

Most people first consider the coverage they need and the rates they’ll pay when shopping for car insurance. There is so much more to it than that, though.

Choose an insurance company with strong financial stability, great claims service, and clear policy terms.Brad Larson Licensed Insurance Agent

Understanding your state’s car culture and minimum coverage requirements before buying a policy can save you hours of frustration later.

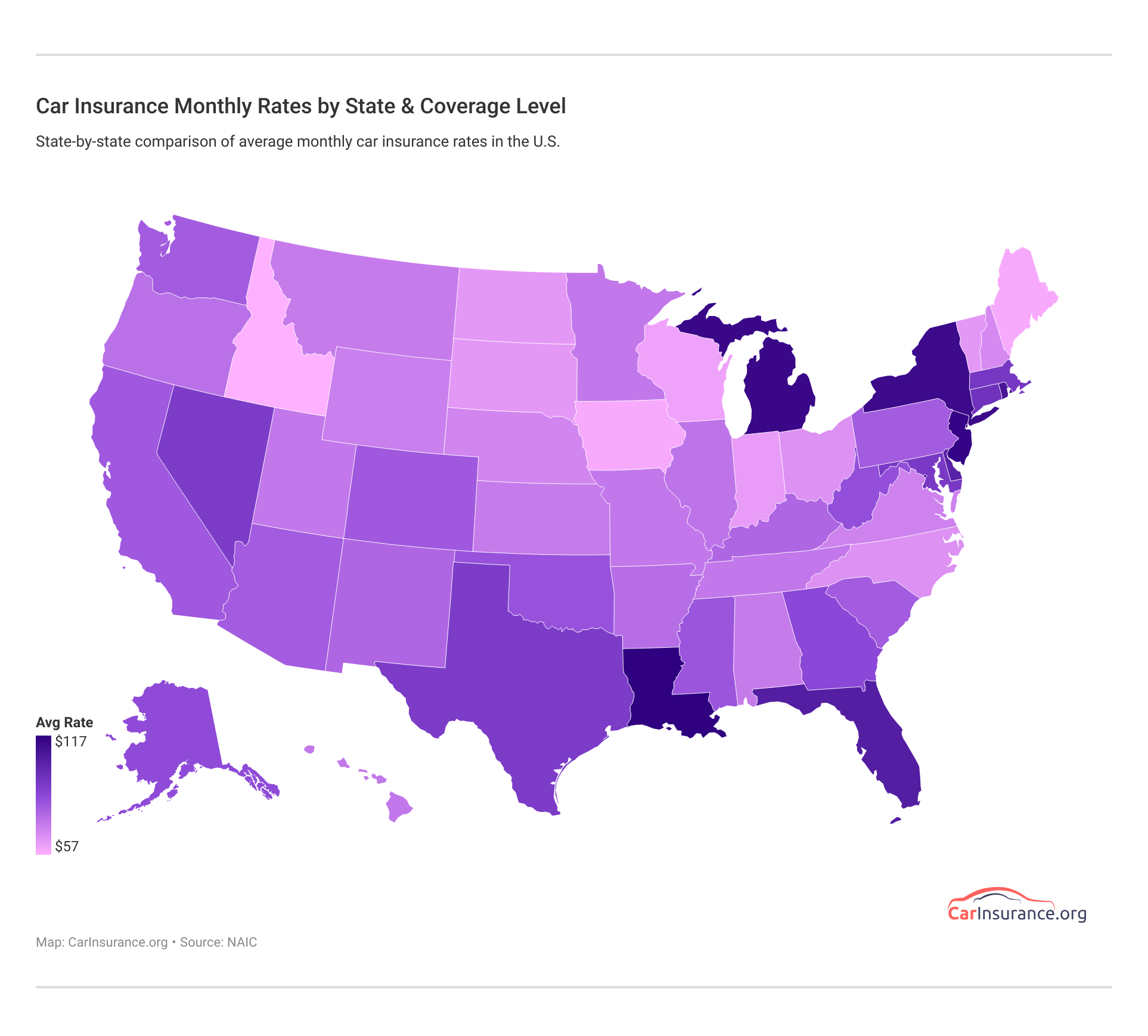

According to the Insurance Information Institute Massachusetts ranks 9th among the top 10 most expensive states for Automobile insurance. This is why shopping around can really save you money. We can help you with that.

Fighting for their country and the right to serve it, the Montford Point Marines changed the face of the Marine Corps forever. #BlackHistoryMonth pic.twitter.com/naw71mXWpb

— USAA (@USAA) February 13, 2025

We’ve analyzed the statistics and reviewed the data on the Bay State to help you make an informed decision. This is especially important when choosing the best car insurance provider in Massachusetts.

Keep scrolling to discover Massachusetts’ minimum requirements and how we can help you maximize your coverage for the best value. Let’s take a look at the average monthly car insurance rates in Massachusetts.

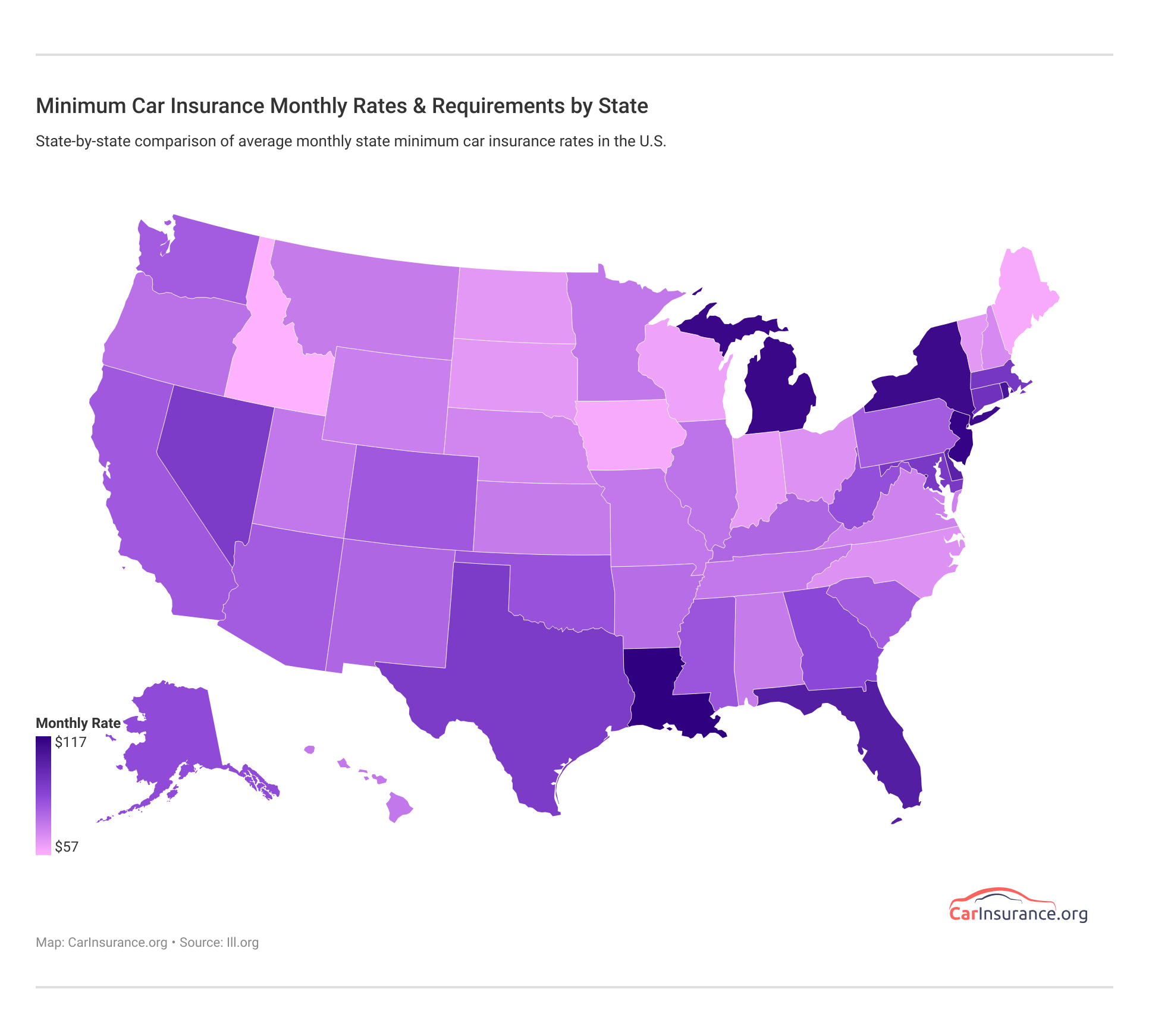

Minimum Car Insurance Coverage Requirements in Massachusetts

Massachusetts requires that all vehicles registered in the Bay State have the following minimum car insurance coverage:

- Bodily Injury Liability: $20,000/$40,000

- Uninsured/Underinsured Motorist: $20,000/$40,000

- Personal Injury Protection: $8,000

- Property Damage Liability: $5,000

AAA also notes that by law a person’s policy must cover any person operating [a] vehicle with [the] owner’s express or implied consent.

Shout out to Allstate customers who use our Drivewise app! A national survey found, on average, Drivewise customers:

📞 handle their phones 44% less while driving

🚀 spend 23% less time driving at high speeds

🚙 have an 11% lower rate of hard braking https://t.co/5GeR2nydjm— Allstate (@Allstate) April 19, 2024

The official state website for Massachusetts also states that:

Your auto insurance policy must list all licensed drivers living in your household who are related to you by blood, marriage, or adoption, including drivers already covered by their own insurance policies.

The Bay State does allow you to exclude household members who don’t drive your car, but only if you have submitted an “exclusion form” to your car insurance provider.

Failing to meet Massachusetts’ minimum car insurance requirements can lead to fines, loss of driving privileges, or even imprisonment. The risks far outweigh the benefits, so always maintain proper coverage.

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Insurance Rates in Massachusetts as a Percentage of Income

On average, 2.2 percent of every Bay State resident’s annual disposable income is spent on car insurance.

This may not seem like a lot, but when broken down, the true cost of choosing the wrong car insurance provider is made clear.

Massachusetts residents have a per capita disposable income of approximately $50,366 a year. Bay Staters spend about $1,129 of that income on car insurance, assuming the driver has no tickets or accidents.

If you’re going to turn this tv off, consider taking the time to quote with Progressive!

— Progressive (@progressive) February 10, 2025

This means that most Massachusetts residents spend around $94 of their $4,197 monthly budget on car insurance.

Car insurance rates in the Bay State have also been on an upward trend, meaning that your monthly budget could be stretched even further in the next few years.

Thinking about moving to Connecticut or New York to avoid the pinch? Forget it.

Which is NOT one of the many nicknames for The Statue of Liberty? pic.twitter.com/1EGF6jYYDs

— Liberty Mutual (@LibertyMutual) November 28, 2023

Connecticut ranks only slightly lower on the Insurance Institute’s list of the top 10 most expensive states for car insurance, and New York actually ranks third highest in the nation.

If you have tickets or an accident, the price could go even higher, regardless of where you live, which is why you should always shop around for car insurance first.

Average Monthly Car Insurance Rates in Massachusetts by Age and Gender

No matter your age or gender, you are most likely going to find yourself shopping for car insurance at some point in your life. External factors such as age and gender that you see as a part of life can add up, though, when purchasing your policy.

One of the most common things that can impact your Mass. auto insurance rates is gender.

In fact, the Consumer Federation of America released a study in 2017 that revealed that women of a certain age are more likely to pay more for car insurance than men in the same age range.

According to their study:

Most large auto insurers charge 40 and 60-year-old women higher rates than men, often more than $100 a year.

This is shocking to many people since the common belief has always been that men, in general, pay more for car insurance at any age level.

Age and gender are just two of the things that go into determining your premiums. Take a look at the table below to see how your marital status can also impact your rates.

Massachusetts Car Insurance Monthly Rates by Provider, Age, & Gender

| Insurance Company | Age: 17 Female | Age: 17 Male | Age: 25 Female | Age: 25 Male | Age: 35 Female | Age: 35 Male | Age: 60 Female | Age: 60 Male |

|---|---|---|---|---|---|---|---|---|

| $300 | $320 | $120 | $125 | $115 | $120 | $95 | $100 | |

| $290 | $310 | $110 | $115 | $105 | $110 | $90 | $95 | |

| $280 | $300 | $105 | $110 | $100 | $105 | $85 | $90 | |

| $270 | $290 | $100 | $105 | $95 | $100 | $80 | $85 | |

| $310 | $330 | $130 | $135 | $125 | $130 | $105 | $110 |

| $280 | $300 | $115 | $120 | $110 | $115 | $90 | $95 |

| $275 | $295 | $110 | $115 | $105 | $110 | $85 | $90 | |

| $290 | $310 | $120 | $125 | $115 | $120 | $95 | $100 | |

| $295 | $315 | $125 | $130 | $120 | $125 | $100 | $105 | |

| $260 | $280 | $95 | $100 | $90 | $95 | $75 | $80 |

The table reveals that Massachusetts is pretty egalitarian when it comes to car insurance rates across age and gender.

This means that your age and gender are two fewer things to worry about as you shop around for the perfect car insurance policy in the Bay State.

While age and gender might not make that big of a difference in the rates that you pay for car insurance, where you live could cost you plenty. Keep scrolling to find out how.

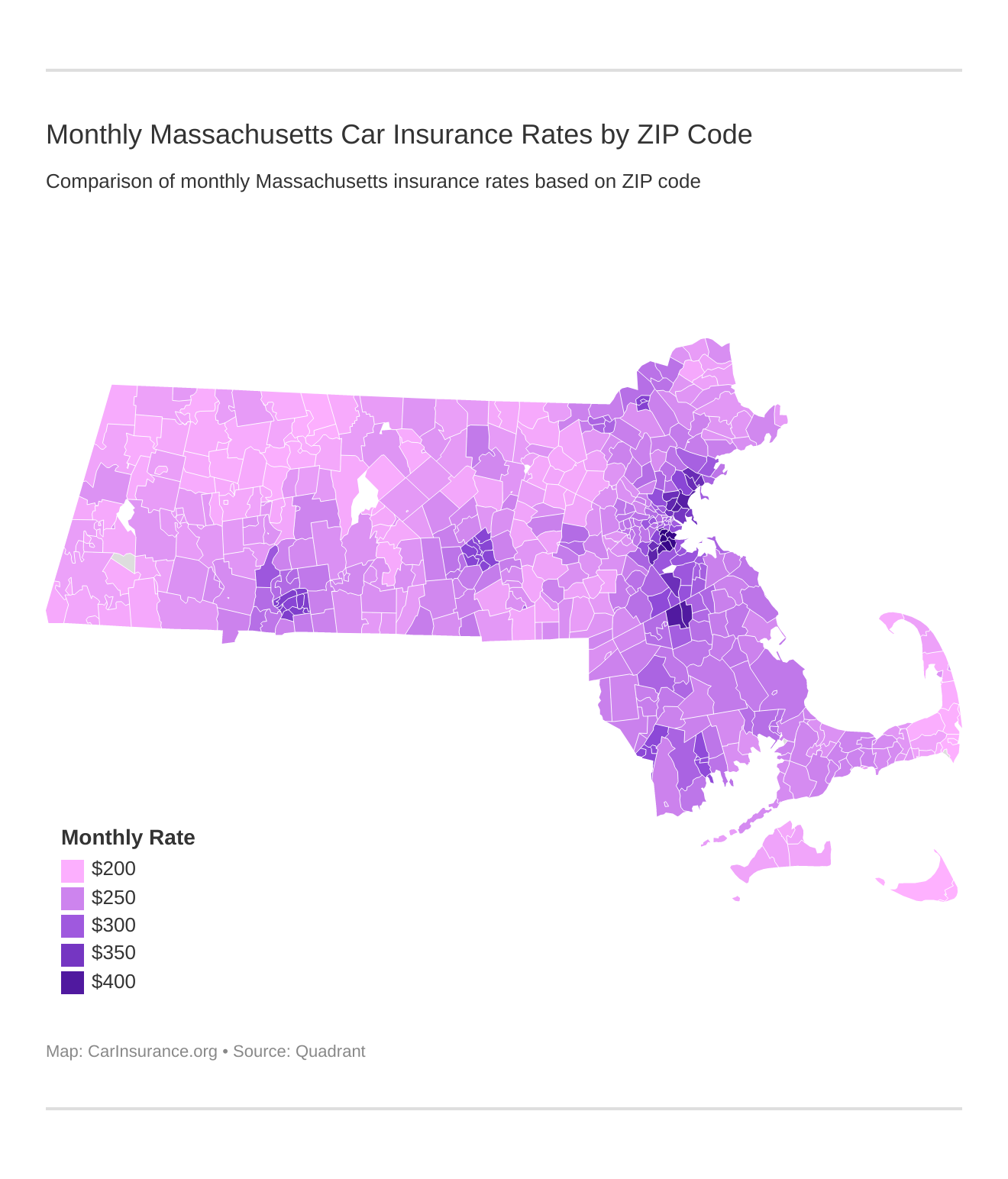

Massachusetts’ Car Insurance Rates by Town

What are Massachusetts’ car insurance rates by town? When choosing the perfect house most people consider the neighborhood or the schools and shopping that are close by. Almost nobody thinks about how their ZIP code could affect their car insurance rates.

Cheapest Zip Codes in Massachusetts for Car Insurance

| Cheapest ZIP Codes | Rates |

|---|---|

| 2554 | $198 |

| 2564 | $198 |

| 2633 | $199 |

| 2650 | $199 |

| 2643 | $200 |

| 2653 | $200 |

| 1360 | $200 |

| 1354 | $201 |

| 1344 | $201 |

| 1342 | $202 |

City life definitely has its perks! As you can see from the table above though, moving just a couple of miles away from the city center could save you a few bucks.

A good example of this can be seen by looking at the difference in insurance rates in the Boston area.

Most Expensive Zip Codes in Massachusetts for Car Insurance

| Most Expensive ZIP Codes | Rates |

|---|---|

| 2199 | $367 |

| 2108 | $356 |

| 2115 | $353 |

| 2110 | $347 |

| 2210 | $341 |

| 2114 | $336 |

| 2118 | $331 |

| 2127 | $327 |

| 2143 | $324 |

| 2144 | $320 |

The data reveals that Roxbury is the most expensive place in the Boston Metro area. In contrast, residents of Roslindale, which is just 4.5 miles away, pay approximately $1,000 less annually for the same coverage.

The comparison between Roxbury and Roslindale makes it clear that where you live in a city matters when it comes to car insurance rates. The city you love could cost you more as well.

Keep scrolling to see how your city stacks up against others in the Bay State when it comes to the cost of car insurance.

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

The Cheapest Car Insurance Rates by City in Massachusetts

Car insurance rates by city in Massachusetts can vary a lot between major cities like Boston and smaller towns. (For more information, read our “Car Insurance Rates by City“).

Part of purchasing the right amount of coverage from a provider you can trust is knowing the average rates in your city. This is where we come in.

Cheapest Cities in Massachusetts for Car Insurance

| Cheapest City | Monthly Rate |

|---|---|

| Northfield | $202 |

| Gill | $202 |

| Erving | $203 |

| Deerfield | $203 |

| South Deerfield | $203 |

| Brewster | $204 |

| Eastham | $204 |

| Ashfield | $205 |

| Adams | $205 |

| Rowe | $205 |

We’ve put all the data into two tables so that you can see just where your city ranks when it comes to the cost of car insurance.

Most Expensive Cities in Massachusetts for Car Insurance

| Most Expensive City | Monthly Rate |

|---|---|

| Nantucket | $198 |

| Siasconset | $198 |

| Chatham | $199 |

| North Chatham | $199 |

| East Orleans | $200 |

| Orleans | $200 |

| Northfield | $200 |

| Gill | $201 |

| Erving | $201 |

| Deerfield | $201 |

With a population density of 13,841 people per square mile, it is no wonder that Boston has some of the highest rates in the state for car insurance. Siasconset, with its population density of only 3,025 people per square mile, boasts one of the lowest rates for car insurance in the Bay State.

Why such a vast difference? The answer is simple. More people mean more cars on the road, which translates into more accidents, resulting in more insurance claims.

Should you ever need to file a claim, it will be good to know where your car insurance company ranks among the others in the Bay State. That is where we come in.

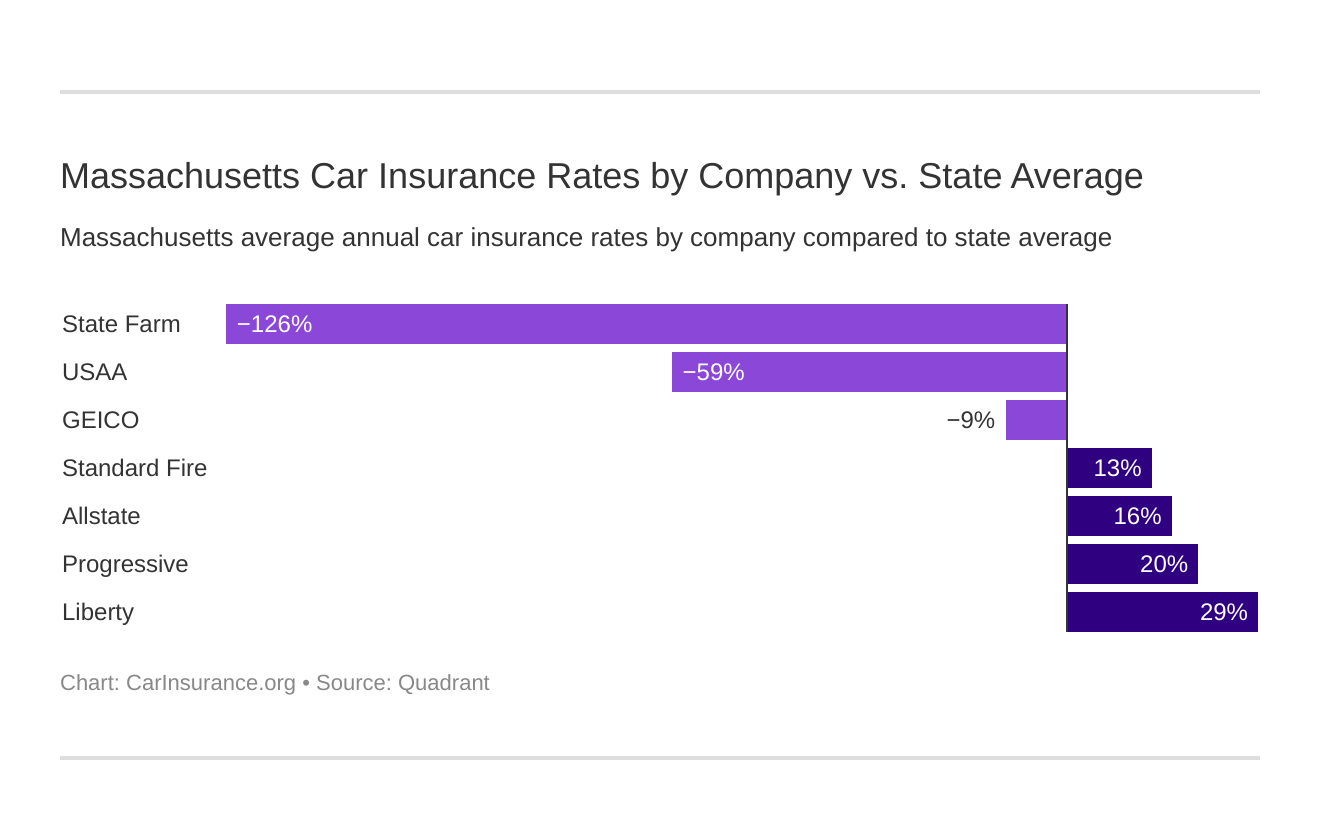

The Cheapest Car Insurance Companies in Massachusetts

Anyone who has ever shopped around knows that it is human nature to start from the lowest price and sort out their purchases from there. This is where we can help.

The table below puts you in control of choosing the best car insurance by showing you just how far your hard-earned money can go when purchasing your car insurance policy.

Cheapest Car Insurance Companies in Massachusetts

| Insurance Company | Monthly Rate | +/- Compared to State Average (Rate) | +/- Compared to State Average (%) |

|---|---|---|---|

| $306 | $50 | 16.42% | |

| $235 | -$21 | -8.81% | |

| $361 | $106 | 29.20% |

| $319 | $64 | 19.90% | |

| $113 | -$142 | -125.58% | |

| $295 | $39 | 13.18% | |

| $161 | -$95 | -59.11% |

Knowing just how mighty your dollar is on the car insurance market is a key component of making a financially responsible decision. Another key factor is understanding that there is more to what goes into determining your rates than what meets the eye.

Everything from your education level to your commuting distance can have an impact on how much you will pay for car insurance. Keep scrolling to find out how we can help.

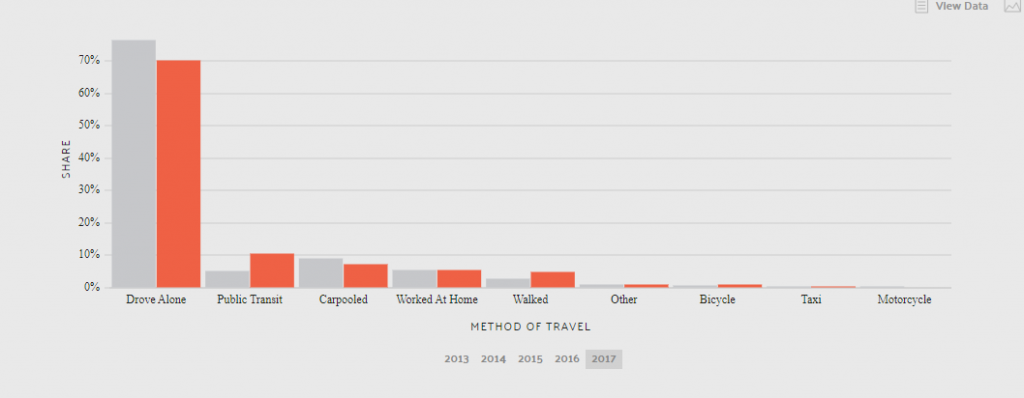

The Best Car Insurance in Massachusetts Rates by Commute

Many residents of the Bay State don’t realize that the more they drive the higher their rates will be. This is why it is just as important to shop around for car insurance as it is for your next new car.

Comparing annual rates that Massachusetts car insurance providers charge their customers based on the miles that these customers travel each year can help you save big.

The table below makes sense of it all so that you can make the best decision for your family budget while keeping the ones you hold dear safe and protected when they travel in your car with you.

Massachusetts Car Insurance Monthly Rates by Provider & Commute Distance

| Insurance Company | 10 Miles Commute | 25 Miles Commute |

|---|---|---|

| $306 | $356 | |

| $279 | $323 | |

| $315 | $366 | |

| $235 | $268 | |

| $362 | $418 |

| $291 | $337 |

| $319 | $371 | |

| $113 | $130 | |

| $278 | $323 | |

| $162 | $188 |

These numbers demonstrate how shorter commute rates translate into money saved on car insurance. However, some of us don’t have a choice when it comes to how much we drive each year.

If your commute is short and sweet, then it might be best to go with a company like State Farm. If your commute is longer, though, you might want to consider choosing USAA.

Longer commute rates increase the chances of an accident. Because USAA has a relatively low loss ratio, it will be more likely to pay out a claim if you are forced to file one.

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Massachusetts Car Insurance Rates by Coverage Level

As you can tell, knowing which company is the cheapest in your area is only part of what goes into deciding on the perfect car insurance provider to protect you and your loved ones in case of an accident.

When making a smart decision, you should also consider how much coverage you will need. The table below can help you get started.

Massachusetts Car Insurance Monthly by Coverage Level for Top Providers

| Insurance Company | Low Coverage | Medium Coverage | High Coverage |

|---|---|---|---|

| $91 | $127 | $169 | |

| $60 | $75 | $98 | |

| $72 | $90 | $120 | |

| $50 | $70 | $90 | |

| $82 | $110 | $150 |

| $70 | $90 | $120 |

| $60 | $80 | $105 | |

| $30 | $45 | $65 | |

| $74 | $98 | $130 | |

| $45 | $60 | $80 |

As you can see, the more coverage you purchase, the more you will pay for that coverage. That is not all there is to it, though.

The age of your car might mean that you need more or less coverage. Your credit can also impact how much you will pay for the coverage you need, no matter how old you are or what type of car you drive.

Massachusetts Car Insurance Rates by Credit History

Massachusetts is one of the few states that prohibit insurers from using your credit score to set your rates.

Because your credit score is not a factor, your driving record is all the more important in the Bay State.

If you should ever decide to move out of Massachusetts, though, you should be aware of the article published by Consumer Reports in 2015, which shocked most Americans.

This article revealed that car insurance providers consider your credit report before they sell you a policy.

One of the main reasons that people with better credit ratings pay less for car insurance is that they are more likely to pay out-of-pocket rather than file a claim should a traffic accident or incident occur.

Experian credit rating asserts that:

A credit score of 700 or above is generally considered good. A score of 800 or above on the same range is considered to be excellent.

The average Bay Stater has a credit score of 710, which is not too shabby.

Cleaning up your credit and/or maintaining a good credit score are not the only ways to save money when shopping for car insurance, though. Keep scrolling to find out just how important safe driving really is.

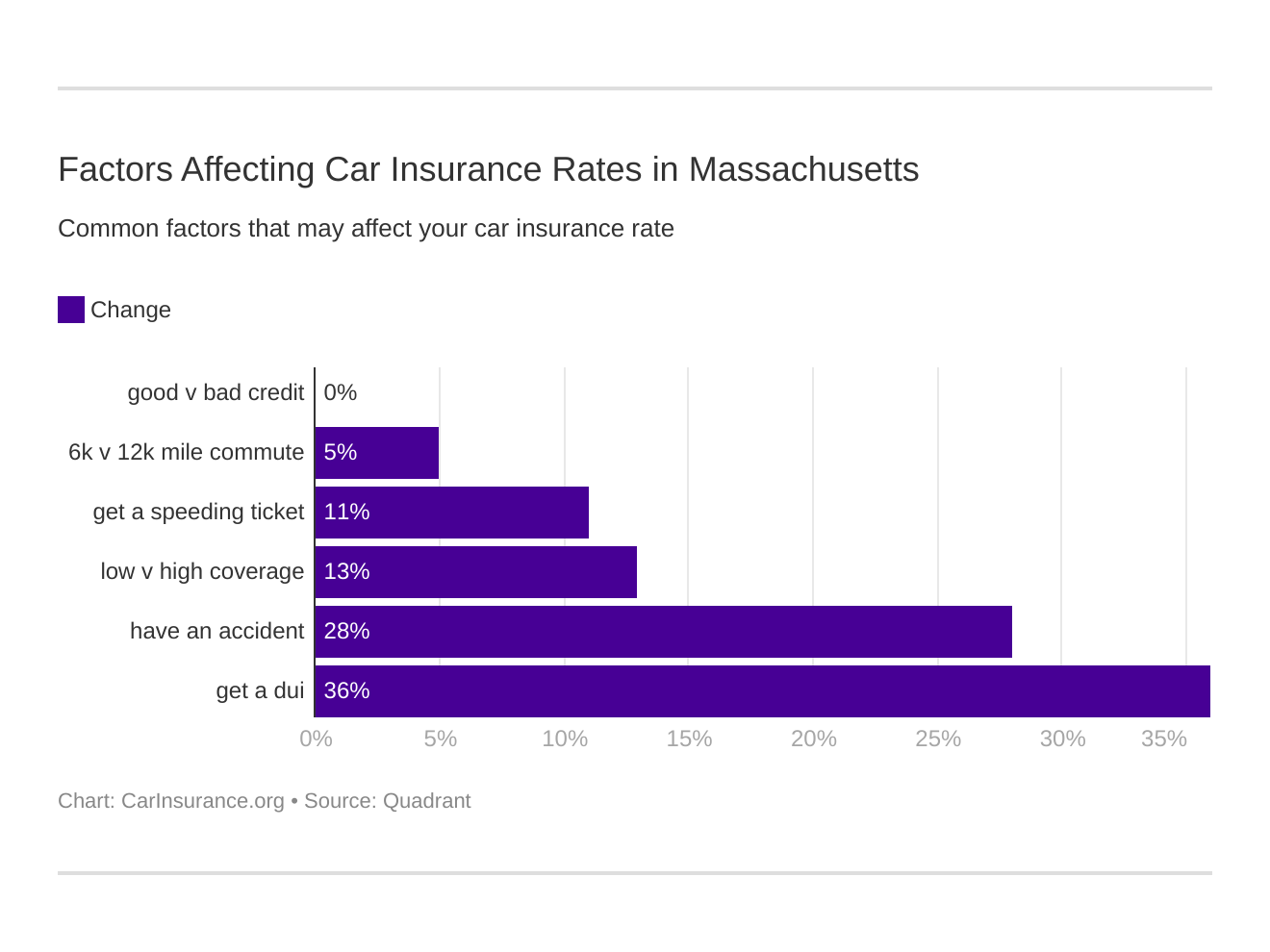

Massachusetts Car Insurance Rates by Driving Record

What you do behind the wheel when driving in Massachusetts can really matter to your wallet when it comes to purchasing car insurance.

Massachusetts operates under what is known as a “Surchargeable Point” system. What does that mean to you? It means that your driving record is as important to the cost of your car insurance policy as any other factor. For example, drivers that have high-risk driving violations such as driving under the influence (DUI) will get higher rates than the national average because they are riskier drivers.

“Surchargeable Points” stay on your driver’s license for six years, so drive defensively and responsibly in the Bay State.

Massachusetts Auto Insurance Monthly Rates by Provider & Driving Record

| Insurance Company | Clean Record | One Ticket | One Accident | One DUI |

|---|---|---|---|---|

| $91 | $106 | $135 | $150 | |

| $60 | $72 | $95 | $115 | |

| $72 | $85 | $110 | $130 | |

| $50 | $58 | $80 | $95 | |

| $82 | $96 | $125 | $145 |

| $70 | $80 | $100 | $120 |

| $60 | $72 | $90 | $110 | |

| $30 | $35 | $50 | $60 | |

| $74 | $85 | $110 | $125 | |

| $45 | $55 | $70 | $85 |

The table above reveals that just one DUI could cost you over $2,000 in insurance premiums. That doesn’t take into account the cost of life and property, so always drink responsibly and never drink and drive.

If you feel that your driving record is wrong, you can always request a review.

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

The Best Car Insurance Companies in Massachusetts

If Ever…

- If the unfortunate arises and you find yourself needing to file a claim, it can be a huge comfort to know that you have chosen the right car insurance provider to have in your corner.

- you’re thinking of switching car insurance in Massachusetts, you need to know how the companies rate.

We have compiled a list of the top-rated car insurance companies in the Bay State, according to A.M. Best rating services, to help you make a more confident decision.

The Largest Companies’ Financial Ratings

A.M. Best is the only global credit rating agency to have a singular focus on the insurance industry. As such, you can trust that the rankings that they provide to you are not influenced by industries outside of the market.

The rankings provided by A.M. Best can help you determine the overall health and viability of all of the insurance providers available to you, which could save you money when shopping for car insurance.

Massachusetts Car Insurance Company A.M. Ratings

| Best Rated Companies | Rating | Outlook |

|---|---|---|

| A+ | Stable | |

| A | Stable | |

| A+ | Stable | |

| A++ | Stable | |

| A | Stable |

| A+ | Stable |

| A+ | Stable | |

| A++ | Stable | |

| A++ | Stable | |

| A++ | Stable |

As you can see, the insurance market in the Bay State is in pretty good condition overall. This is good news for you as a consumer because a healthy insurance market breeds competition, which means that companies are vying for your business, making them more likely to keep their rates as low as possible.

The higher the rating from A.M. Best, the less likely it is that your car insurance company will go bankrupt, and companies with higher ratings are also more likely to pay out your claim should you ever have an accident.

Companies with Best Ratings

A.M. Best ratings are a great place to start as you are trying to determine which car insurance provider is right for you. A.M. Best is not the only one looking out for you, though.

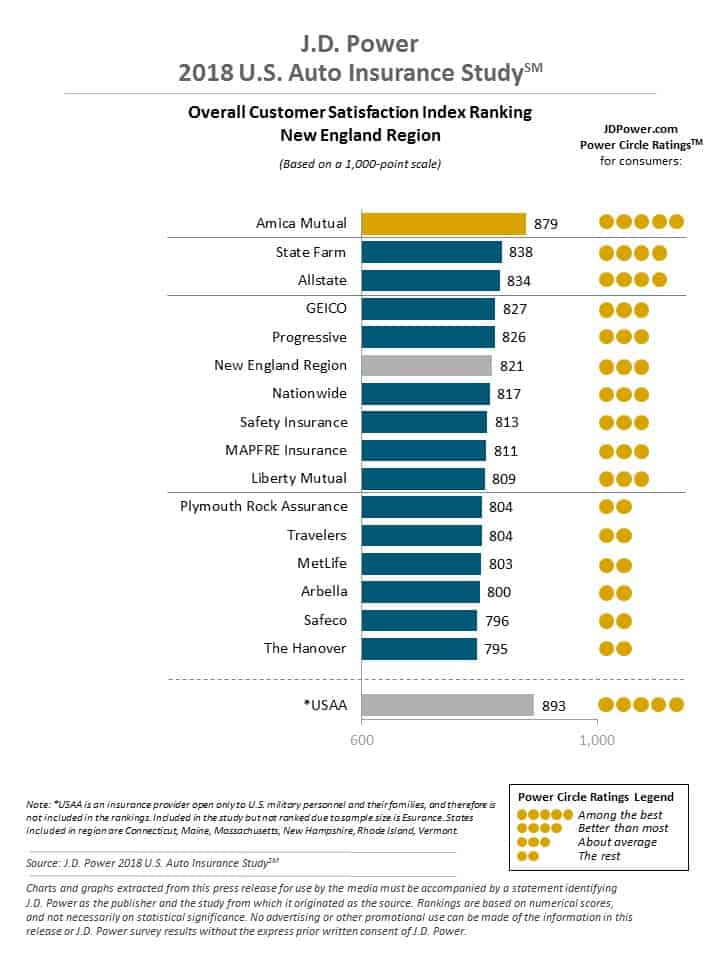

J.D. Power’s auto insurance survey also has your back. What they’ve discovered is that customer satisfaction among car insurance consumers is at an all-time high.

Purchasing car insurance in Massachusetts isn’t always a satisfying experience though. Scroll down to see just which car insurance company in the Bay State has the highest complaint ratio and what that means to your bottom line.

Companies with The Most Complaints

When choosing your car insurance provider you will want to consider how many complaints have been filed against them before making your purchase. This means knowing what the complaint ratio is and what it means to you.

The baseline for the complaint ratio is 1.0. A company with a 1.0 complaint ratio thus has an average number of complaints. Consequently, the more complaints a company has filed against it the higher its complaint ratio will be.

Below is a list of the top 10 best car insurance companies in Massachusetts along with their complaint ratio so that you can see how each one compares.

Massachusetts Car Insurance Company Loss Ratios

| Insurance Company | Direct Premiums Written | Complaint Ratio | Loss Ratio | Market Share |

|---|---|---|---|---|

| $500,000,000 | 0.25 | 70% | 12% | |

| $400,000,000 | 0.18 | 65% | 10% | |

| $350,000,000 | 0.30 | 80% | 6% | |

| $450,000,000 | 0.15 | 65% | 10% | |

| $475,000,000 | 0.22 | 75% | 9% |

| $400,000,000 | 0.10 | 60% | 7% |

| $550,000,000 | 0.18 | 68% | 11% | |

| $600,000,000 | 0.20 | 72% | 14% | |

| $425,000,000 | 0.12 | 66% | 8% | |

| $300,000,000 | 0.05 | 62% | 5% |

Taking the raw data and just looking at the complaint ratio could be deceiving.

In order to put the complaint ratio into context, you should consider the market share that each company has. Higher market shares mean that these companies service more customers.

Servicing more customers raises the possibility that eventually some customers might feel dissatisfied with their service and thereby complain.

Coverage gaps don’t show up until you need them—review your policy before the unexpected happens.Brad Larson Licensed Insurance Agent

This explains why Mapfre Insurance Group has such a high complaint ratio given that it has $1,239,686 in Direct Premiums Written and thereby commands almost 25 percent of the total market share in the Bay State.

If you ever need to file a complaint against your insurance provider you should contact The Massachusetts Division of Insurance.

Here are a few of the ways that you can contact them:

- In person – 1000 Washington Street, Suite 810, Boston, MA 02118

- By Phone – At (617) 521-7794 or toll-free at (877) 563-4467

- Online – https://www.mass.gov/info-details/about-the-division-of-insurance

The Massachusetts Division of Insurance also offers the following options and advice when filing a complaint against your provider:

- Online – https://www.mass.gov/forms/doi-insurance-complaint-submission-form

- Through e-mail simply fill out the complaint form and attach it to an e-mail addressed to [email protected]

- Snail Mail just print out the complaint form and mail it to: Commonwealth of Massachusetts Division of Insurance, Consumer Service Department, 1000 Washington Street, Boston, MA 02118-6200

- Or FAX your complaint form to (617) 753-6830

Now that you know how the loss ratio and complaint can help you determine what car insurance provider might be best for you, it is time to start comparing rates.

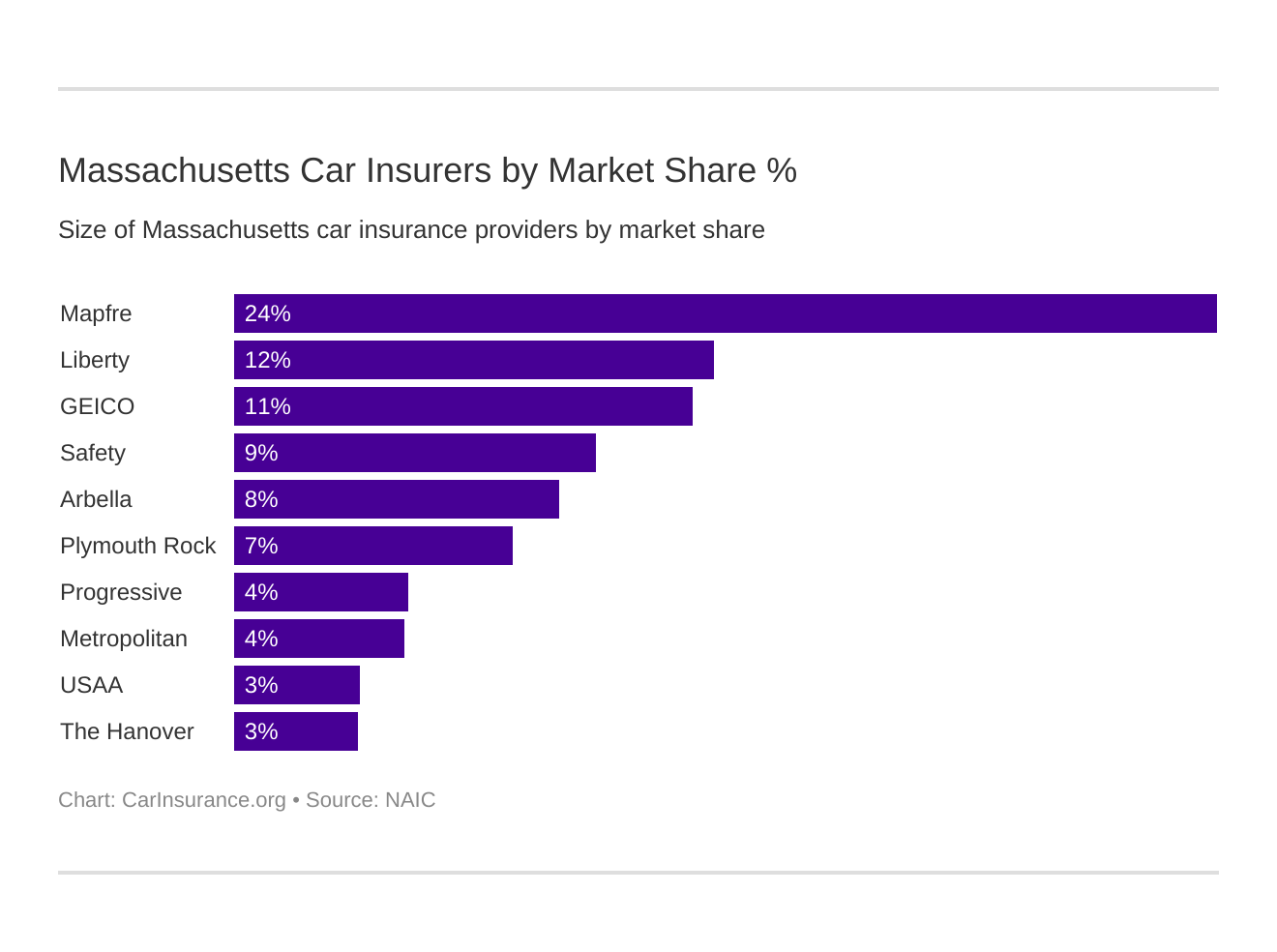

The Largest Insurance Companies in Massachusetts

With all the talk of complaint ratios and loss ratios, it is easy to think that bigger is always better when it comes to purchasing your car insurance policy.

Sometimes, though, it pays to go with a smaller company, even if the rates are just a little higher. The only way to know is to understand what market share truly means.

Massachusetts Car Insurance Company Market Share

| Company Name | Exposures | Market Share |

|---|---|---|

| 54,059 | 1.58% | |

| 39,084 | 1.15% | |

| 6,109 | 0.18% | |

| 436,518 | 12.79% | |

| 187,022 | 5.48% |

| 316,016 | 9.26% | |

| 15,901 | 0.47% | |

| 172,190 | 5.05% | |

| 138,935 | 4.07% |

The data show that Mapfre Insurance Group holds almost a quarter of the entire insurance market in the Bay State.

Mapfre Insurance Group also has $1,239,686 in Direct Premiums Written, which translates to stability within the market because, according to Investopedia:

The main driver for growth…is writing new policies.

Choosing a company with a good market share balanced against the right amount of Direct Premiums Written can help you save money.

Number of Insurers by State

There are 48 domestic insurance providers in the Bay State and 697 foreign ones. So what is the difference between the two?

- Domestic Insurers are those that have been formed under the laws of the state of Massachusetts.

- Foreign Insurers are insurers formed under the laws of any state, district, territory, or commonwealth of the United States other than the Bay State but who have agreed to adhere to the insurance laws that govern the Commonwealth of Massachusetts.

There really is no difference between the 745 insurance providers available to you in Massachusetts. In the end, it all comes down to comfort level.

Dealing with either type of insurer is most definitely more manageable when you understand the laws under which they were formed. We are here to help you with that. Keep reading to find out about the laws that govern driving and car insurance in the Bay State.

Acceptable Forms of Financial Responsibility for Car Insurance Companies in Massachusetts

Unlike most states, Massachusetts does not require drivers to carry proof of insurance while operating a motor vehicle.

This is because law enforcement can access your insurance status electronically through the RMV database.

This can be a real headache for Massachusetts drivers of the Bay State who are pulled over in a state that does require such proof.

Standing on the sidelines ❌

Saving with Progressive ✅ pic.twitter.com/7tbCtdJsmf— Progressive (@progressive) February 15, 2025

To avoid hassles outside Massachusetts, ask your provider where to download and print your insurance ID card. Check if electronic access is available. Since 46 states accept either, having proof ready ensures a smooth experience.

If your car insurance provider does not allow you to access either one, you can always carry a copy of your policy with you just to be on the safe side.

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Additional Coverage Options are Available for Car Insurance in Massachusetts

Because every driver is unique, it could pay off big to add additional liability coverage to your policy.

Massachusetts already requires the purchase of uninsured/underinsured motorist coverage as part of the minimum state requirements, but another option available to you in the Bay State is the addition of MedPay to your policy.

MedPay insurance can help you cover the medical costs of all passengers in your vehicle who are injured in an accident. MedPay will even help pay for the dreaded and notoriously expensive ambulance ride.

When deciding whether to add MedPay or any other type of additional coverage to your policy, it is smart to consider the loss ratios of the companies you are considering.

While NAIC currently only has data regarding the loss ratio as it pertains to Personal Injury Protection the three-year data collected on this type of coverage reveals that Massachusetts has a relatively healthy car insurance market overall.

In 2014 the Bay State had a loss ratio for Personal Injury Protection of just 65 percent. This percentage is good news for you as you shop for car insurance.

Why? What does the loss ratio really mean to you? Simply put:

- A High Loss Ratio (over 100 percent) could indicate that the car insurance companies in Massachusetts are losing money and may need to raise rates in the future.

- A Low Loss Ratio would indicate that companies in the Bay State might have overpriced their policies.

With a loss ratio of 65 percent, Massachusetts falls near the middle, indicating that the overall car insurance market is strong and stable.

The Bay State also ranks 49th in overall uninsured/underinsured motorists, meaning that only 6.2 percent of its drivers are failing to comply with the state minimum requirements, which is good news for you when shopping for coverage.

Fewer uninsured/underinsured motorists on the roadway translates into lower overhead for your car insurance provider, which keeps rates down.

Available Massachusetts Car Insurance Add-ons and Endorsements

Even though Massachusetts has minimum coverage requirements that can help if you sustain an injury or suffer property damage in an accident, sometimes there is just not enough coverage.

This is where choosing the right combination of add-ons or endorsements to add to your policy can help out.

Some of the best-known add-ons include:

- Guaranteed Auto Protection (GAP): This add-on covers your car if it is ever totaled or stolen. If you suffer from either of these unfortunate events, GAP will also pay any money that remains owed on the lease or loan.

- Substitute Transportation– this type of add-on broadens the coverage you receive from your collision and comprehensive components of your policy by paying for a rental car while your car undergoes repairs.

- Towing and Labor—For a small premium, this type of add-on will help you pay for the cost of towing and labor should you need them after an accident.

- Classic Car Insurance-One of the cheapest add-ons available, this type of insurance will cover your classic, antique, or collector vehicle should something happen to it while you are out showing it off.

- Non-Owner Car – This type of coverage is perfect for you if you don’t own a car but still drive on occasion. If you are borrowing your friend’s ride, it will be nice to know that this type of policy will protect you with limited liability coverage for bodily injury and property damage.

- Modified Car Insurance– If you need to stand out from the norm, modifications to your car are a great way to do it. With this type of coverage, all of the additions to your lean machine will be covered should the unfortunate occur.

The type of car you drive is only one of the many factors that the best auto insurance companies in Massachusetts use to determine your rates.

Keep reading to find out how your age, gender, and even where you live can significantly affect the price of your policy.

Massachusetts Car Insurance Laws You Should Know

In Massachusetts, driving without insurance is illegal.

Massachusetts driving and insurance laws can seem overly complicated at times. This is especially true after an accident.

Trying to determine who is responsible for what after an unfortunate event can be a nightmare without the right car insurance provider on your side.

Sometimes just knowing what could happen is enough to prevent it. This is where we come in. We are here to help you gain a better understanding of the laws that will most impact you should the worst occur.

Whether you want to speak to a real person in branch, or do your banking online, there are many ways you can bank with us.

If you need support, get in touch: https://t.co/PBQ6UL8e26 pic.twitter.com/nHDrHeLoLb

— Nationwide (@AskNationwide) January 2, 2025

Knowing your responsibilities and the consequences for everyone after an accident will make you more aware behind the wheel.

This starts with a good grasp of the car insurance laws in the Bay State.

Let’s refresh. As we began our journey together, we told you that Massachusetts has the following minimum coverage requirements:

- Bodily injury liability: $20,000/$40,000

- Uninsured/Underinsured Motorist: $20,000/$40,000

- Personal injury protection: $8,000

- Property damage liability: $5,000

Before 2007, the car insurance market in the Bay State was also highly regulated, limiting consumers’ options and discounts when shopping for their policy. That all changed when the insurance commissioner and the Massachusetts state legislature instituted Managed Competition.

Managed Competition opened up the car insurance market to providers who had previously shunned the Bay State, and in just three years’ time:

Massachucettes drivers…saved nearly a half-billion dollars in car insurance premium since managed competition was instituted.

More competition and less regulation may be good for your bottom line when shopping for car insurance, but it means that you have to pay more attention to the finer details as you do.

This starts by understanding how the laws in the Bay State are determined.

How State Laws are Determined

The state legislature is responsible for determining the laws that govern car insurance and driving in the Commonwealth of Massachusetts. Under Section 340, it has been determined that everyone who owns or operates a motor vehicle must maintain a liability policy or vehicle liability bond.

Confused about the difference between a liability policy and a vehicle surety bond? You are not alone. Plainly put:

- A Liability Policy is held by a vehicle owner to protect themselves and their passengers against bodily injury or property damage after an accident.

- A Surety Bond is held by a company and ensures consumers’ financial security.

Surety bonds are usually held by entities such as driving schools to protect both the student and the general population during the time the student driver spends on the road.

Windshield Coverage

Student drivers are not the only hazard on the road. There are also a plethora of things that are lying along the roadway in the Bay State that could come flying up and hit your windshield.

If this happens, you will want to know which types of damage require definite repair and which types the state of Massachusetts ignores.

You will also want to know just what your car insurance policy will cover. Generally speaking, according to CarWindshields.info:

“If you have comprehensive insurance, the repair/replace is either at no cost to you or there is a $100 deductible (only if you opr into it), regardless of your normal comprehensive deductible. If your car has less than 20,000 miles…you can have OEM parts.

Be forewarned that filing windshield damage on your car insurance policy may result in a rate hike so it is good to know what types of damage require repair by law and which types you can ignore if you choose to.

Every car registered in Massachusetts must pass the mandatory vehicle safety inspection.

As part of this safety inspection, each vehicle in the Bay State must meet the following minimum insurance requirements when it comes to the condition of its windshield:

- Windshield wipers that can remove rain, snow, and other types of moisture from the field of view

- Windshield Wiper Fluid Dispenser must be found to be in working order

- All Windshields must be constructed from safety glass

- Stickers cannot obstruct the field of view

- Non-reflective tint can only be applied along the top six inches of the windshield

- Cracks or other areas of damage are not allowed within the path of the windshield wipers

- Chips cannot be larger than a quarter

Tickets for violations of any of these things are generally left up to the law enforcement officer’s discretion if you are pulled over, and the first and second offenses carry with them a fine of $250.

If you have a third offense, your license will be suspended for up to 90 days. All of these penalties could land you in the high-risk driver category, so why not just get any questionable damage repaired?

High-Risk Insurance

Nobody’s perfect, but having a less-than-perfect driving record in the Bay State could cost you big time when it comes to purchasing your car insurance policy.

This is because filing a claim against your provider, tickets, and accidents can all land you in the high-risk driver category. Drivers with even minor driving violations in their history are charged higher rates compared to those with a clean record.

Given the sheer amount of bad driving in Massachusetts, according to national standards, if you are a high-risk driver, you are not alone.

Risky behavior behind the wheel can lead to higher amounts of Surchargeable Points being placed on your license.

The more “Surchargeable Points” you accrue, the higher your rates will be because car insurance is what is known as a risk market. What this means is that each time a provider ensures you, they are betting on the fact that you won’t get a ticket or cause an accident.

If you do become involved in a traffic incident, the insurance provider has essentially lost the bet. Car insurance providers are businesses, which means that they must recoup their losses.

If you have been involved in a traffic incident, you have contributed to that loss, which makes you a high-risk driver.

Because “Surchargeable Points” place you in the high-risk driver category and can stay with you for 6 years, it is best to avoid them at all costs.

If you do find yourself racking up a few, though, all hope is not lost when it comes to shopping for car insurance.

Low-Cost Insurance

We all know that low-cost insurance is a given if you have a good and clean driving record. What do you do, though, if your driving record is less than perfect?

The best option for you if you find yourself with one too many “Surchargeable Points” is to shop around and look for insurance discounts. Some of these discounts could include:

- Good Student DiscountsAvailable to students who maintain a certain GPA

- Military/Veteran Discounts– These are offered to active duty or retired military personnel upon proof of service.

- Defensive Driving Course Discount– This becomes available to you with proof that you have completed a state-approved defensive driving course.

Even if your provider does not offer a defensive driver discount, taking a course designed to improve your skills behind the wheel can help keep your rates down.

While proof may be required to activate any of these discounts, it is your responsibility to maintain your eligibility in each program.

If your grades slip or your active duty status changes, you should always notify your car insurance provider.

Failure to notify your car insurance provider regarding changes in your eligibility could result in a charge of fraud being brought against you.

Automobile Insurance Fraud in Massachusetts

The state of Massachusetts recognizes four areas of fraud:

- Fake Insurance Companies– This area covers fake insurers who collect premiums for false policies.

- Unlicensed Insurance Companies– This area of fraud applies when a legitimate company is operating without a license.

- Fraud committed by Individuals—Individuals operating within the insurance industry who collect premiums without the intention of paying those premiums forward to the auto insurance company fall into this category.

- Fraud committed by Consumers– Consumers who exaggerate injuries or damages on a claim made to their insurance agency, and those who provide their car insurance provider with false information in order to procure discounts, fall into this area of fraud.

Repair shops or individuals handling your vehicle’s repair or replacement after an accident can also commit insurance fraud. Carefully monitoring billing and filing practices helps prevent fraudulent charges.

Should you ever find yourself the victim of fraud or need to report a case of fraud on behalf of someone you love, the state of Massachusetts has provided several ways to do so:

- For assistance, reach the Massachusetts Division of Insurance at (617) 521-7794.

- To file a complaint, visit www.mass.gov/doi.

- Additionally, the Insurance Fraud Bureau of Massachusetts (IFB) can be contacted at (800) 323-7283 or online at www.ifb.org.

If you are caught committing insurance fraud, penalties could include:

- Being charged with a felony, which is punishable with up to five years in prison or six months to 2 1/2 years in jail

- A fine of $500 to $10,000, or both

- Civil penalties such as fines and the loss of your business license

Statute of Limitations

As with all laws, the laws of the Commonwealth of Massachusetts come with statutes of limitations.

The Bay State has a three-year statute of limitations on the following infractions with regard to insurance fraud and car insurance claims:

- Personal injury (Ch. 260 §4)

- Fraud (Ch. 260 §2A)

- Injury to personal property (Ch. 260 §4)

While statutes of limitations are commonplace across the United States, a few driving laws are unique to the Bay State.

Massachusetts Specific Driving Laws

In the great state of Massachusetts, it is illegal to drive with a gorilla in the back seat of your car. It kind of makes you wonder how that law ever became law.

Okay, so the law actually states:

Whoever leads or drives a bear or other dangerous wild animal or causes it to travel upon or be covered over a public way unless properly secured in some covered vehicle or cage shall be punished by a fine of not less than five or more than $20.

It sounds more fun to say gorilla than bear, though.

It is illegal to curse within Middleborough’s city limits, so be mindful of your words when driving down Main Street during rush hour. Christmas has also been outlawed in the Bay State since 1659, but don’t let that turn you away.

Massachusetts is a great state that prioritizes its residents’ safety. That’s why it has vehicle licensing laws to protect Bay Staters from bodily injury or property damage.

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Massachusetts Vehicle Licensing Laws

Along with the minimum coverage requirements in the Bay State, Massachusetts has also instituted various laws governing how you register your vehicle. One of the most important of these is that you acquire and maintain a valid car insurance policy.

As in most states, registering your vehicle in Massachusetts begins with obtaining a car insurance policy from a state-licensed agent.

If you recently bought a car, your agent must complete the Application for Registration of Title before you sign it. Then, take it to your nearest RMV branch to begin the registration process.

You will also need the following when you arrive at RMV, so come prepared:

- A signed copy of the Application for Registration and Title

- Out-of-state title for your vehicle (if applicable)

- Payment for the registration fee

- Proof of insurance, so bring a copy of your policy

- Bill of sale and statement of mileage (if you are titling a car previously not owned by you)

Registration fees are as follows:

- Passenger vehicles will cost $60

- Motorcycles will cost $20

- Title fee of $75

After your registration is completed, you will have seven days to get your vehicle safety inspected; otherwise, your registration will become invalid.

The Bay State also protects you if you have bought a lemon, but that doesn’t mean that you shouldn’t do your homework before you make your purchase.

Along with vehicle registration and lemon laws, the Bay State participates in the national program REAL ID.

According to Mass.gov, proof of citizenship or lawful residence within the United States is required to obtain a learner’s permit, driver’s license, or Massachusetts ID card.

You will also need:

- A Social Security number

- Proof of Massachusetts residency

Once you arrive at the RMV, you will need to determine whether you want to get a standard driver’s license/ID or a REAL ID.

As you make your choice, keep in mind that you will need a REAL ID to fly within the United States or to enter any federal building. Getting one will also require you to present additional documentation at the RMV.

All first-time applicants for REAL ID will have to come into their nearest RMV office in person with the proper documentation.

Penalties for Driving Without Insurance

If you are caught driving without insurance in the Bay State the penalties and fines can really add up.

Some of these penalties for the first offense include:

- A Fine of $500 to $5,000

- And/or imprisonment for 1 year

A second offense (if it occurs within six years) could end up costing you a license suspension for up to one year.

All vehicle registrations and car insurance policies are linked by computer to RMV. Should your coverage lapse your previous car insurance provider will notify the RMV who will block your registration.

As a consumer, according to the state of Massachusetts, you do have rights, though.

First, and foremost, car insurance providers in the Bay State cannot discriminate against you based on demographic factors.

Some of your other rights include:

- Your right not to be denied coverage based on your credit history.

- Your right to know why you were denied if it comes to that.

- The right to an explanation of how your driving record has impacted your rates.

- You have the right to view your driving history available at www.mass.gov/mrb for a small fee.

- Your right to cancel your policy at any time you choose to do so.

- You have the right to a notice of your car insurance provider’s intent to cancel your policy.

- And you have the right to appeal the cancelation.

- You also have the right to be notified of non-renewal.

All of these rights can be super important to you should you have a teen driver on your policy.

Teen Driving Laws

The Bay State has a multi-stage (or graduated) licensing process. This process helps teen drivers gain experience over time instead of immediately driving on the open highway with a license and the wind in their hair.

The stages that teen drivers in Massachusetts must progress through are as follows:

- Learner’s Permit– Beginning at age 16, teenagers can apply for a learner’s permit. They must provide identification, be accompanied by a parent or guardian, and complete the application. They must also pass a written and vision exam, including traffic laws and road sign recognition.

- Junior Operator License– At 16 1/2 teenagers can apply for a junior operator’s license. This requires the completion of driver’s education and an additional 40 hours of supervised practice. This level requires the teen driver to hold a learner’s permit with a clean record for six months before applying.

- A Full License requires the applicant must be 18 years old and have held a junior operator license for 12 months before applying.

The AAA also recommends a parent-teen driving contract as a means of encouraging teenagers to behave properly while behind the wheel.

There are restrictions for each stage of the driver’s licensing process for teens in the Bay State as well. These include:

- Learner’s Permit holder must be with a licensed adult at least 21 years old who has one year of driving experience. This stage also requires 40 hours of supervised practice with a driver aged 21 or older.

- Junior Operator’s License – These teens cannot drive with passengers under 18 unless they are immediate family and an experienced driver aged 21 or older is present. They also cannot operate a vehicle between 12:30 a.m. and 5 a.m. unless accompanied by a parent or guardian.

- Full License – All restrictions are lifted but the driver must comply with all traffic and safety laws designated by the Commonwealth of Massachusetts.

Once you receive your driver’s license you will want to keep it in good standing of course.

Driver’s License Renewal Procedures

No matter what age you are you will eventually have to renew your driver’s license. When that time comes it will be good to know what the Bay State requires of you depending on your age.

As you have seen, teen drivers are a category all their own, but what about older drivers?

New older drivers’ insurance rate?

byu/Joe_Peanut inInsurance

Older drivers in the Bay State can renew their licenses every five years, like the general population. However, those 75 or older must renew in person, as each renewal requires a vision test.

If you are a part of the general population and you want to renew your license online simply go to the state’s website and follow the directions.

New Residents

New residents to Massachusetts can follow the same procedures as residents of the Bay State when it comes to receiving their first license.

Part of this procedure is proving residency, though and you can do so by first establishing yourself as a resident of the Bay State.

Some ways to establish residency include:

- Filing a state income tax return

- Enrolling your dependents in public school

- Receiving public assistance

- Buying property meant to be used as your primary residence

- Or becoming employed

If you’re a resident of the Bay State and you have your license, you will be expected to follow all traffic laws set forth by the Commonwealth.

Negligent Operator Treatment System

Being a good driver in the Bay State can prevent you from accruing “Surchargeable Points”. We have done a lot of talking about “Surchargeable Points” up until now, but how do they work?

Simply put, “Surchargeable Points” are points added to your license as a result of surchargeable incidents.

Surchargeable incidents fall into one of four categories:

- Major traffic violations-5 SDIP Points

- Major at-fault accidents-4 SDIP Points

- Minor traffic violations-2 SDIP Points

- Minor at-fault accidents-3 SDIP Points

These are all part of the Massachusetts Safe Driver Insurance Program (SDIP) guidelines.

You can have SDIP points removed sooner than six years by following the “Clean in 3” criteria.

These criteria are as follows:

The value of surcharge points for each surchargeable incident is reduced by 1 point if: (1) you have three or fewer surchargeable incidents on your driving record in the six years immediately preceding your policy’s effective date, (2) the most recent surcharge date is at least three years before your policy’s effective date, and (3) you have at least 3 years of driving experience.

Reducing your “Surchargeable Points” is one way to lower your car insurance rates, but knowing the rules of the road can help you avoid those points altogether.

Massachusetts’ Rules of the Road

It doesn’t matter which state you drive in, there are always going to be rules of the road.

Understanding the rules in Massachusetts can help you avoid all of those pesky points on your license.

Understanding the laws and obeying them can also help you be more informed when looking to get the best deal on car insurance.

Keep scrolling to find out all of the ways that we can help you do just that.

No-Fault Vs. At-Fault

You may have already discovered that Massachusetts is a no-fault state, but what does that mean to you exactly?

What this means to you is that in the Bay State, your car insurance provider will be the one who is initially responsible for your injuries or damages.

No-fault systems do not allow for payouts for pain and suffering.

In order to recoup pain and suffering or other monetary damages resulting from a car accident in a no-fault state, you will have to file a third-party claim or a lawsuit.

Seatbelt and Car Seat Laws

Insurance laws in the Bay State may seem a bit complex, but Massachusetts is pretty straightforward when it comes to seat belt and car seat safety requirements.

In Massachusetts, seatbelt and car safety violations are primary offenses. This means law enforcement can pull you over solely for not wearing a seatbelt or improperly securing a child.

If you are 13 or older, you must wear a seatbelt at all times while the vehicle is in motion, regardless of your seat.

The fine for not doing so is $25, according to the Insurance Institute for Highway Safety.

If your child is 7 years old or younger and is less than 57 inches tall, they must be in a safety seat.

Children over 57 inches in height between the ages of 8 and 15 may wear an adult seat belt.

Failure to comply will result in a fine of $25.

Keep Right and Move Over Laws

The Bay State requires that drivers keep to the right unless they are turning or legally passing someone.

Massachusetts has enforced the Move Over Law since March 22, 2009. Drivers must move over and slow down when approaching police, firefighters, paramedics, tow truck drivers, roadside assistance, and maintenance workers on the highway.

If you fail to move over and slow down, you are putting these professionals at risk, and it could cost you up to $100 in fines.

Speeding Laws

Massachusetts also has various other laws designed to keep everyone safe while on the road. Some of these laws govern the speed at which you are allowed to travel in specific areas.

Some of the more general speed limits in the Bay State are:

- Highway and Interstate…………………………………………..65 MPH

- Two-lane roads………………………………………………………55 MPH

- Highways outside of thickly settled areas………………….50 MPH

- On undivided highways outside thickly settled areas….40 MPH

- Inside thickly settled areas………………………………………30 MPH

- Residential areas…………………………………………………….30 MPH Max.

- School zones…………………………………………………………..20 MPH

A thickly settled area is an area in which residential or commercial structures are under 200 feet apart.

If you’re caught speeding in the Bay State, you could be fined $50 plus $10 for each mile over the first 10 mph. Avoid trouble by obeying speed limits or letting someone else drive.

Ridesharing

Nationwide Ridesharing services are on the rise. There are some rules that you should consider before beginning your career as a rideshare driver.

If you intend to use your car for ridesharing purposes, you must inform your car insurance provider. You must also carry a minimum of liability coverage as follows:

- Liability coverage for accidents of $50,000 for any individual injured

- $100,000 per accident and $30,000 for property damage

- $100,000 per accident and $30,000 for uninsured protection

Uber and Lyft also offer additional insurance to back you up if you drive for them.

Automation

Ridesharing is not the only thing changing the face of Massachusetts’ streets and highways.

The use of automation and crash avoidance devices has become increasingly popular in the past few years. While backup cameras and collision avoidance systems have been proven to help reduce crashes, many people are leery of full automation, and for good reason.

There is no question that automation is the wave of the future. What that means to the auto insurance industry remains to be seen.

Massachusetts Safety Laws

Laws that are necessary to keep you driving safely.

You may not have a new car with the latest safety features, but you can still take steps to make Bay State roads safer for everyone.

One of these things is to ensure that when you are hauling your gear around, it is tied down the right way. Section 36 of the laws of the Commonwealth of Massachusetts even requires that you secure your load.

Loose cargo is only one of the many things that can cause the roads in the Bay State to become hazardous.

Keep reading to discover what else you can do to make sure that everyone arrives alive.

DUI Laws

According to Responsibility.org, the Bay State saw 120 Alcohol-related fatalities in 2017 alone.

The possible penalties for OUI/DUI offenses in the Commonwealth of Massachusetts are as follows:

- First Offense – No more than 2 1/2 years in jail, fines of $500-$5,00, and a license suspension of one year with no consideration for hardship for at least three months.

- Second Offense -Up to 2 1/2 years in jail, fines of $600-$10,00, license suspension of two years, no consideration for hardship for at least one year, and an interlock-ignition device to be installed at your expense.

- Third Offense – Up to five years in State Prison, fines $1,000-$15,000, license suspension of up to eight years, with no consideration for hardship for two years, and the installation of an interlock device at your expense.

- Fourth Offense – Up to five years in State Prison, fines of $1,000-$25,000, a license suspension of 10 years with no consideration for hardship for five years, forfeiture of your vehicle to the state, and the installation of an interlock device at your expense.

- Fifth Offense—Up to five years in State Prison, fines of $2,000-$50,000, your license revoked for life, and forced forfeiture of your vehicle to the state without compensation.

It is not worth the risk, so just don’t do it.

Marijuana-Impaired Driving Laws

Alcohol is not the only thing that can get you into trouble when driving in the Bay State. Getting high and then climbing behind the wheel could also cost you.

Penalties for your first offense of driving under the influence of marijuana include:

- Probation for one year

- Being required to complete the 24D program

- Loss of driving privileges for 45-90 days

The laws regarding marijuana use behind the wheel of a car are relatively new, so you should keep checking Mass.gov for the latest information.

Distracted Driving Laws

Distracted driving laws in the Bay State are also ones that you should keep your eye on.

Currently, Massachusetts prohibits the use of cell phones by all drivers, as well as other mobile devices, to text or send an email while operating a motor vehicle.

It doesn’t matter if you are stopped at a red light; the rules still apply.

This is also a primary law, which means that law enforcement can pull you over for it without the need for another infraction.

There are a few things you can do to avoid the hassle. The first is to just turn the phone off. If you can’t bear that idea, there are a few apps out there to help you.

We all have places to go and people to see, but the road really is a better place to be without all of the distractions.

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Vehicle Theft Problem in Massachusetts

Driving in the Bay State carries some risk. Distracted drivers and unsecured loads are not the only hazards, though.

Sometimes, the risks can occur when you aren’t even behind the wheel. Things such as vehicle theft and vandalism can ruin your day. Keep scrolling to find out how we can help you avoid these risks or make them better if the worst should happen.

The number one stolen vehicle in the Bay State is a 2000 Honda Civic

Top 10 Most Stolen Cars in Massachusetts

| Make/Model | Rank | Vehicle Year | Thefts |

|---|---|---|---|

| Honda Civic | 1 | 2000 | 426 |

| Honda Accord | 2 | 1997 | 402 |

| Toyota Camry | 3 | 2014 | 260 |

| Toyota Corolla | 4 | 2010 | 203 |

| Dodge Caravan | 5 | 2005 | 188 |

| Ford Pickup (Full Size) | 6 | 2004 | 178 |

| Nissan Altima | 7 | 2005 | 156 |

| Jeep Cherokee/Grand Cherokee | 8 | 1999 | 143 |

| Honda CR-V | 9 | 1999 | 107 |

Even if your vehicle doesn’t appear on the list above, it might still be a good idea to invest in comprehensive coverage.

This type of coverage does not just cover the loss if your vehicle is stolen or vandalized. Comprehensive also covers damage done in case of a natural disaster.

Vehicle Thefts by City

Now that you know what types of cars are most popular with thieves, let’s examine the top 10 cities in the Bay State, according to the FBI, for vehicle theft.

Massachusetts Car Thefts by City

| City | Motor Vehicle Thefts |

|---|---|

| Boston | 1,223 |

| Springfield | 587 |

| Lawrence | 581 |

| Worcester | 519 |

| Lowell | 401 |

| Brockton | 280 |

| New Bedford | 274 |

| Fall River | 237 |

| Lynn | 221 |

| Holyoke | 129 |

Don’t let these numbers fool you. Just because these cities ranked in the top ten for vehicle thefts in Massachusetts does not make them more dangerous overall.

More people in a smaller area just means more chances for crimes to be recorded.

Road Fatalities That Occur in Massachusetts

It is something that none of us likes to think about when we are driving, but the possibility is always there

Whether they are the result of weather conditions or driver error, driving fatalities are a reality of life on the road.

Keep scrolling to find out how the Bay State compares.

Fatal Crashes by Weather Conditions and Light Conditions

Sometimes something as ordinary as the time of day or a sudden rainstorm can present drivers with just the wrong conditions.

Massachusetts Weather-Related Driving Fatalities by Lighting Condition

| Weather Condition | Daylight | Dark, but Lighted | Dark | Dawn or Dusk | Other / Unknown | Total |

|---|---|---|---|---|---|---|

| Normal | 133 | 56 | 70 | 22 | 1 | 282 |

| Rain | 10 | 15 | 12 | 1 | 0 | 38 |

| Snow/Sleet | 0 | 4 | 2 | 2 | 0 | 8 |

| Other | 0 | 2 | 0 | 0 | 0 | 2 |

| Unknown | 3 | 2 | 1 | 0 | 0 | 6 |

| TOTAL | 146 | 79 | 85 | 25 | 1 | 336 |

Looking at the table reveals just how dangerous certain types of weather or light conditions can be

If the worst should happen you will want to have the best car insurance provider you can have on your side.

Fatalities by County

Below is a table showing the five-year trend for the top 10 counties in Massachusetts and their fatalities.

Massachusetts Driving Fatalities by County (2023)

| County | Total Fatalities |

|---|---|

| Berkshire County | 15 |

| Hampden County | 44 |

| Bristol County | 46 |

| Norfolk County | 44 |

| Plymouth County | 30 |

| Barnstable County | 12 |

| Essex County | 40 |

| Hampshire County | 6 |

| Middlesex County | 48 |

| Suffolk County | 19 |

These numbers can seem scary if you live in one of these counties, but they don’t have to be.

The best way to avoid becoming a statistic is to obey all traffic and safety laws.

Urban vs. Rural Fatalities

It is easy to understand that those who live in the city have a greater chance of bumping into one another with their cars just because there are so many people in such a small area.

Country life is not without its challenges, though.

Massachusetts Traffic Fatalities: Urban vs. Rural

| Year | Rural Fatalities | Urban Fatalities | Total Fatalities |

|---|---|---|---|

| 2019 | 18 | 355 | 373 |

| 2020 | 15 | 360 | 375 |

| 2021 | 14 | 375 | 389 |

| 2022 | 13 | 380 | 393 |

| 2023 | 12 | 390 | 402 |

The table above demonstrates that no matter where you live, it is always best to slow down, entertain responsibly, and obey all of the traffic laws in the Bay State.

Fatalities by Person Type

Data from NHTSA shows that white non-Hispanics are nearly 200% more likely to die in fatal car accidents. In 2017, out of 264 roadway deaths, 202 were white non-Hispanics, while 18 were black non-Hispanics.

One life is one life too many, though, so please designate a driver, pay attention at all times when you are on the road, and never drink and drive.

Fatalities by Crash Type