Best Car Insurance in Minnesota for 2025 [Check Out the Top 10 Companies]

Discover the best car insurance in Minnesota with leading providers such as State Farm, Progressive, and Geico. Minnesota car insurance rates start as low as $27 per month. Comparing MN car insurance quotes can help you choose the best coverage for your vehicle, driving habits, and personal needs.

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Jeff Root

Licensed Insurance Agent

Jeff is a well-known speaker and expert in insurance and financial planning. He has spoken at top insurance conferences around the U.S., including the InsuranceNewsNet Super Conference, the 8% Nation Insurance Wealth Conference, and the Digital Life Insurance Agent Mastermind. He has been featured and quoted in Nerdwallet, Bloomberg, Forbes, U.S. News & Money, USA Today, and other leading fina...

Licensed Insurance Agent

UPDATED: Apr 22, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident car insurance decisions. Comparison shopping should be easy. We are not affiliated with any one car insurance company and cannot guarantee quotes from any single provider.

Our insurance industry partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about car insurance. Our goal is to be an objective, third-party resource for everything car insurance related. We update our site regularly, and all content is reviewed by car insurance experts.

18,154 reviews

18,154 reviewsCompany Facts

Full Coverage in Minnesota

A.M. Best Rating

Complaint Level

Pros & Cons

18,154 reviews

18,154 reviews 13,283 reviews

13,283 reviewsCompany Facts

Full Coverage in Minnesota

A.M. Best Rating

Complaint Level

Pros & Cons

13,283 reviews

13,283 reviews 19,116 reviews

19,116 reviewsCompany Facts

Full Coverage in Minnesota

A.M. Best Rating

Complaint Level

Pros & Cons

19,116 reviews

19,116 reviewsState Farm, Progressive, and Geico offer the best car insurance in Minnesota, starting at $27 monthly.

These providers are the leading companies in Minnesota, offering excellent discounts and providing satisfactory customer service. This car insurance guide will help you find the best car insurance in Minnesota that suits your car needs.

Our Top 10 Company Picks: Best Car Insurance in Minnesota

| Company | Rank | Bundling Discount | A.M. Best | Best For | Jump to Pros/Cons |

|---|---|---|---|---|---|

| #1 | 17% | A++ | Reliable Coverage | State Farm | |

| #2 | 10% | A+ | Competitive Rates | Progressive | |

| #3 | 25% | A++ | Many Discounts | Geico | |

| #4 | 10% | A++ | Military Families | USAA | |

| #5 | 25% | A+ | Comprehensive Options | Allstate | |

| #6 | 13% | A++ | Customizable Policies | Travelers | |

| #7 | 20% | A | Local Agents | Farmers | |

| #8 | 25% | A | Family Discounts | American Family | |

| #9 | 25% | A | Flexible Coverage | Liberty Mutual |

| #10 | 20% | A+ | Claims Satisfaction | Nationwide |

Keep reading to find the best car insurance in Minnesota that fits your needs and budget. Get the right car insurance coverage at the best price — enter your ZIP code to shop for coverage from the top Minnesota insurers.

- State Farm has the best car insurance rates and discounts in MN

- Geico offers up to 25% discounts and has an A++ A.M. Best rating

- Bundling discounts may help you save 10% to 25% off your premiums

#1 – State Farm: Top Pick Overall

Pros

- Large Agent Network: State Farm’s agents can help you find the best car insurance rates in Minnesota. Check more in our State Farm car insurance review.

- Competitive Rates & Discounts: Affordable premium prices, particularly for driver safety records, continue to reduce premiums through various discount programs.

- Efficient Claims & High Satisfaction: State Farm’s reliable claims process enables 24/7 support with a convenient app, making it the best option for car insurance in Minnesota.

Cons

- Higher Premiums for High-Risk Drivers: Your driving history influences the premium rates State Farm provides, so you must review different options to find the best deal.

- Limited Coverage Customization: Customers receive standard coverage from State Farm, but the company provides fewer customization choices than its competitors.

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#2 – Progressive: Best for Customizable Coverage

Pros

- Extensive Discounts Available: Offers the best car insurance in Minnesota at a premium level by offering multiple discount options. Read more in our Progressive car insurance review.

- Exceptional Digital & Claims Experience: Modern drivers will appreciate the convenience of a well-rated mobile app and user-friendly online features.

- Attractive Rates for High-Risk Drivers: Offers discounts for safe drivers, competitive prices, and flexible insurance solutions.

Cons

- Higher Premiums for Low-Risk Drivers: Progressive’s premium rates often become higher for drivers who maintain a safe driving record.

- Limited Local Agent Support: Operations focus on online services, which reduces the number of local agent locations in the state.

#3 – Geico: Best for Budget-Friendly Rates

Pros

- Affordable Premiums: Geico, the best car insurance in Minnesota, offers affordable premiums and can save up to 25% off bundling discounts. See more on Geico Car Insurance Review.

- Strong Digital Experience: Delivers a user-friendly digital platform combined with mobile app features that enable policy management.

- Reliable Financial Strength: Dependable finances ensure prompt claims payments, earning recognition as the best car insurance provider in Minnesota.

Cons

- Limited Local Agent: The online and phone-based operations limit local drivers’ access to in-person agent services.

- Higher Rates for High-Risk Drivers: Geico’s rates rise significantly for drivers with accidents, DUIs, or poor credit.

#4 – USAA: Best for Military Families

Pros

- Outstanding Customer Service: USAA, one of the best car insurance providers in Minnesota, excels in claims satisfaction with fast, expert assistance.

- Competitive Military Rates: USAA’s car insurance review provides rate breakdowns for lower premiums and exclusive military family discounts.

- Military-Friendly Coverage: USAA, the best car insurance in Minnesota, offers accident forgiveness, roadside assistance, and customizable coverage.

Cons

- Limited Eligibility: Inaccessible to most due to USAA’s military-only membership.

- No Local Offices: USAA operates online and by phone, with no physical offices in Minnesota, despite being one of the best car insurance companies in the state.

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#5 – Allstate: Best for Comprehensive Options

Pros

- Strong Local Agent Network: Allstate has a reliable network of agents in Minnesota for personalized help with policies and claims.

- Comprehensive Options: As the best car insurance in Minnesota, it offers liability to full coverage, accident forgiveness, and roadside assistance.

- Competitive Discounts: Discounts for safe driving and bundling make Allstate the best car insurance in Minnesota. Find more details in our Allstate car insurance review.

Cons

- Higher Premiums: Allstate’s rates may be higher for some drivers, particularly those with past violations.

- Customer Service Variability: Service quality varies across provider network locations, with customers finding exceptional agents but also facing issues with claims or billing.

#6 – Travelers: Best for Customizable Policies

Pros

- Customizable Options: According to Travelers car insurance review, they offer accident forgiveness, new car replacement, and gap insurance, ideal for premium coverage.

- Excellent Discounts: They provide savings for safe driving, hybrid vehicles, and bundling policies, appealing to drivers who are looking for the best insurance in Minnesota.

- Financial Strength: Has strong stability and a reliable claims process, reinforcing its status as the best insurance provider in Minnesota.

Cons

- Higher Premiums: Rates may be higher for young or high-risk drivers than the market average, which is something to consider when seeking the best insurance companies in Minnesota.

- Limited Local Agents: Travelers have fewer local agents in Minnesota, which might disadvantage those preferring in-person service.

#7 – Farmers: Best for Local Agents

Pros

- Strong Local Agent Network: Farmers Insurance agents offer personalized support, making it one of the best car insurance providers in Minnesota.

- Excellent Coverage Options: Tailored policies, including accident forgiveness and rideshare coverage, contribute to its reputation as the best car insurance in Minnesota.

- Solid Discounts for Savings: Discounts for bundling home and auto and safe driving make Farmers Insurance appealing. Read this Farmers car insurance review for more.

Cons

- Higher Premiums: Premiums are higher unless multiple discounts are applied, which can impact its ranking as the best car insurance in Minnesota.

- Limited Online Policy Management: The digital policy management system is functional but lacks the seamless experience of fully digital providers.

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#8 – American Family: Best for Family Discounts

Pros

- Strong Local Presence: Offers customized policies and services, making it one of the best car insurance options in the state. See more in our American Family car insurance review.

- Generous Discounts: Check out safe driving tips to earn discounts, making American Family a top choice for the best car insurance in Minnesota.

- Excellent Customer Satisfaction: It is known for fast claims and excellent service, making it the best car insurance provider in Minnesota.

Cons

- Higher Premiums for Some Drivers: Not ideal for younger or high-risk drivers, resulting in higher premiums.

- Limited Online Servicing Options: Some customers find online servicing options limited and require face-to-face assistance from an agent.

#9 – Liberty Mutual: Best for Flexible Coverage

Pros

- Strong Local Presence: Minnesota drivers receive the best car insurance through state-specific policies that address local winter driving needs.

- Customizable Coverage Options: Drivers can manage their insurance better by adding accident forgiveness and new car replacement options.

- Competitive Discounts: A Liberty Mutual car insurance review highlights discounts of up to 25% for bundling, making it one of the best car insurance options in Minnesota.

Cons

- Higher Premiums for Some Drivers: Offers excellent Minnesota car insurance, but prices are often high for young and risky drivers, which may deter budget-conscious customers.

- Mixed Customer Service Reviews: Liberty Mutual’s best car insurance in Minnesota earns mixed reviews, with praise for coverage but complaints about claims delays.

#10 – Nationwide: Best for Claims Satisfaction

Pros

- Strong Coverage Options: The Nationwide car insurance review highlights coverage benefits like accident forgiveness, total loss replacement, and vanishing deductibles.

- Competitive Discounts: Provides multiple savings opportunities through their multi-policy, safe driving, bright driving, and defensive driving course initiatives.

- Reliable Claims Process: Minnesota drivers receive 24/7 claims help and access to approved repair shops, reinforcing Nationwide as the best car insurance in Minnesota.

Cons

- Higher Than Average Premiums: Nationwide offers reliable policies, but its prices are higher than those of other providers.

- Limited Local Agent Availability: Customers may experience difficulty locating local agents, especially in rural regions.

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Getting Minnesota’s Car Insurance Coverage and Discounts

Minnesota is really a great place to live. The North Star State also cares about the safety and security of its residents, which is why it has passed legislation to ensure that all drivers in the Land of 10,000 Lakes are protected. Knowing these requirements and who is really offering you the best price for them can be tricky, though. That is where we come in.

Car Insurance Discounts from Top Minnesota Providers

| Insurance Company | Anti-Theft | Bundling | Good Driver | Good Student | UBI |

|---|---|---|---|---|---|

| 10% | 25% | 25% | 20% | 30% | |

| 25% | 25% | 25% | 20% | 30% | |

| 10% | 20% | 30% | 15% | 30% | |

| 25% | 25% | 26% | 15% | 25% | |

| 35% | 25% | 20% | 15% | 30% |

| 5% | 20% | 40% | 15% | 40% |

| 25% | 10% | 30% | 10% | $231/yr | |

| 15% | 17% | 25% | 25% | 30% | |

| 15% | 13% | 10% | 8% | 30% | |

| 15% | 10% | 30% | 10% | 30% |

We’re here to help you sort through the confusion by providing insight into all the data you need to make an informed decision about your car insurance provider and policy. Keep scrolling to find out just what your minimum insurance requirements, rights, and responsibilities are as a driver on Minnesota roadways.

Minnesota minimum coverage requirements

| Coverage Type | Typical Requirement |

|---|---|

| Bodily Injury Liability | $30,000 per person $60,000 per accident |

| Property Damage Liability | $10,000 per accident |

| Personal Injury Protection (PIP) | $40,000 total ($20,000 for medical expenses, $20,000 for non-medical expenses) |

| Uninsured/Underinsured Motorist Bodily Injury | $25,000 per person $50,000 per accident |

From the Minnesota Marine Art Museum to Minnesota’s North Shore Scenic Drive, there is a lot to see and do in the North Star State. This explains why there are approximately 5 million registered vehicles on the road in Minnesota. That is almost one car for every resident.

![Best Car Insurance in Minnesota for 2025 [Check Out the Top 10 Companies]](https://www.carinsurance.org/wp-content/uploads/2019/10/Best-Car-Insurance-in-Minnesota-2.png)

Uninsured Motorists 11.5

With so many cars on the road, there are bound to be some accidents. This could leave you with a huge headache if you are forced to navigate the claims process and car insurance premium laws on your own. Having the right car insurance provider on your side can help you cut through all the red tape and get things back to normal quickly, though.

How do you know that you have chosen the right provider? Keep reading to find out about some simple tips that can help you choose your car insurance provider with confidence.

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Minnesota’s Car Culture

In the North Star State, the “Minnesota Nice” extends beyond the office or supermarket. This is why many tourists and newcomers to the Minnesota car culture often remark about the lack of aggression displayed on Minnesota roadways. That is, of course, unless you live in Minneapolis-St. Paul, which Infoplease ranks 14th on its list of the top 25 U.S. Cities with the worst road rage.

Just because most Minnesotans aren’t as vocal as drivers in other states doesn’t mean that they aren’t silently judging your lack of driving ability, though. All jokes aside, residents of the North Star State are great people who desire to share the road with each other and get from point A to point B with as little conflict or incident as possible.

<blockquote class=”twitter-tweet” data-media-max-width=”560″><p lang=”en” dir=”ltr”>It’s no joke how much money you can save when you bundle with the Personal Price Plan®. It is pretty funny though. 😁 <a href=”https://t.co/COhT4EGKg0″>pic.twitter.com/COhT4EGKg0</a></p>— State Farm (@StateFarm) <a href=”https://twitter.com/StateFarm/status/1866482028763607165?ref_src=twsrc%5Etfw”>December 10, 2024</a></blockquote> <script async src=”https://platform.twitter.com/widgets.js” charset=”utf-8″></script>

Harsh Minnesota winters can sometimes make this a near-impossible endeavor, but the Minnesota spirit is harder than anything that Mother Nature can throw at it. This hardy spirit has made residents of the North Star State savvy shoppers who want to get the most out of every dollar they spend.

This is why we’ve collected all the information you need in one place, so you can make the best decision for yourself and your loved ones when it’s time to purchase your car insurance policy.

Minnesota’s Minimum Coverage Requirements

Because driving conditions on the roads in Minnesota can sometimes be more hazardous than those in other places across the United States, the Minnesota Department of Public Safety (DPS), Minnesota Driver and Vehicle Servis (DVS), and the state legislature have worked together to create the minimum car insurance requirements for drivers in the North Star State.

These minimum mandatory requirements for liability coverage are as follows:

- $30,000 in bodily injury liability coverage for one person injured in an accident.

- $60,000 in bodily injury liability coverage for two or more people injured in an accident.

- $10,000 for property damages occurring as a result of an accident.

Minnesota also requires that you carry the following Personal Injury Protection coverage:

- $40,000 per person per accident

- $20,000 for medical expenses

- $20,000 to cover any other expenses, such as lost wages that were incurred due to a car accident

The North Star State requirements don’t stop there. As a driver in Minnesota, you are also required to carry the following amounts in Uninsured and Underinsured Motorist Coverage:

- $25,000 to cover injuries to one person for both UM and UMI

- $50,000 to cover injuries to two or more people for UM and UMI

With so much coverage required by the North Star State, you will want to ensure that you are getting the most for your money when you purchase your car insurance policy. You will also want to ensure that you have the proper forms of financial responsibility in case you get pulled over or are involved in an accident.

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Form of Financial Responsibility

The Minnesota Legislature has mandated that:

No motor carrier and no interstate carrier shall operate a vehicle until it has obtained and has in effect the minimum amount of financial responsibility required.

This is part of the statutes that define Minnesota’s financial responsibility laws. Simply put, the financial responsibility laws in the North Star State require all drivers to carry the minimum amount of coverage mandated by law and to have proof of insurance to demonstrate compliance. This is why forms of financial responsibility are often referred to as proof of insurance.

Drivers use them to prove that they have a valid car insurance policy or surety bond. A surety bond is also referred to as an SR-22 insurance form, and it may be required if you have an accident or other driving offenses on your record. If asked to provide proof of insurance in the North Star State, you can always present your physical policy, which will tell the demanding part that your policy is valid.

In the Land of 10,000 Lakes, you also have two other ways that you can prove that you are within the letter of the law, which are:

- An e-insurance card that can be accessed through your auto insurance provider’s app on your smartphone, laptop, tablet, or other electronic devices.

- A printed copy of your Insurance ID Card is usually mailed to you shortly after you purchase your policy, or it can be emailed to you so that you can print it out at your convenience.

Be aware that Minnesota does have penalties if you fail to present the proper proof of insurance. Some of these penalties may include:

- A misdemeanor charge

- A $200 fine

- Community service

Why would you risk it, though, when modern-day conveniences have made proving your financial responsibility so easy?

Percentage of Income Spent on Premiums

Now that you know what is expected of you as a driver on Minnesota’s roadways, it is time to start crunching numbers. According to Business Insider, Minnesota ranks 19th in the nation in terms of the amount Americans pay for car insurance premiums annually. The Insurance Information Institute (III) also ranks the North Star State 39th nationally for average auto insurance expenditures.

Minnesota’s icy roads raise risk—term life insurance offers affordable protection, and bundling with auto can boost savings.Jeff Root Licensed Insurance Agent

This is good news for residents of the North Star State, as it means that the overall cost of car insurance in Minnesota is below the national average. Car insurance rates have remained relatively consistent as a percentage of income over the last few years. On average, around 2.01 percent of every Minnesotan’s annual disposable income is spent on car insurance.

With a per capita disposable income of $42,516 per year earned by residents of the North Star State and $875.49 of that being spent to maintain insurance on your vehicle, this means that the average cost for a Minnesotan is around $73 of their $3,543 monthly budget to drive in the Land of 10,00 Lakes.

The price of car insurance is also higher than in Wisconsin and Iowa, where residents pay around $717 and $684 per year for car insurance coverage. This is why it is so important to get the best price when shopping for your car insurance policy in the North Star State.

Average Monthly Car Insurance Rates in MN (Liability, Collision, Comprehensive)

Finding out how to get the most for your money when shopping for a car insurance policy means understanding what is required of you as a vehicle owner in Minnesota.

Car Insurance Monthly Rates by State & Coverage Level

| State | Minimum Coverage | Full Coverage |

|---|---|---|

| California | $100 | $200 |

| Florida | $110 | $210 |

| Georgia | $95 | $185 |

| Illinois | $95 | $195 |

| Minnesota | $80 | $170 |

| Nevada | $100 | $180 |

| New York | $120 | $230 |

| Ohio | $85 | $175 |

| Texas | $90 | $190 |

| Washington | $105 | $205 |

The rates reflected above are from the National Association of Insurance Commissioners’ (NAIC) 2014/2015 Auto Insurance Database Report, which could mean that the rates in 2019 are slightly higher. Because rates can sometimes fluctuate, it’s a good idea to shop around for your car insurance policy. Part of this process is becoming a well-informed consumer.

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Additional Car Insurance Coverage in Minnesota

When deciding which car insurance provider is right for you, core coverage is not the only consideration. In fact, sometimes it pays to have more auto insurance coverage than just what the state requires. This is why insurers in the North Star State provide you with the following additional coverage options:

- Umbrella Insurance: This type of liability coverage protects you in the event that you find yourself being sued as a result of an accident, and the underlying policy limits have been exhausted.

- Collision Coverage: This addition to your policy covers you if you hit another vehicle, your vehicle is hit by someone else, you hit a stationary object, or your vehicle rolls over unintentionally.

- Comprehensive Coverage: This type of coverage protects you from damage caused by vandalism, theft, natural disasters, or animal strikes.

Given that animal strikes are common at certain times of the year in the North Star State, it could prove useful to invest in additional liability options.

When deciding on additional coverage options, it is always a good idea to consider the loss ratio of the companies with which you are considering doing business. Take a look at the table below to see the loss ratio trends for Minnesota.

Minnesota Car Insurance Loss Ratios (2022–2024)

| Loss Ratio | 2022 | 2023 | 2024 |

|---|---|---|---|

| Personal Injury Protection | 70% | 68% | 66% |

| Medical Payments (MedPay) | 50% | 48% | 46% |

| Uninsured/Underinsured Motorist | 56% | 55% | 56% |

As you can see, Minnesota has made a major turnaround in its MedPay loss ratio. What does this mean to you? It means that Minnesota car insurance companies are constantly amending their business practices to improve the market’s overall health. Looking at the loss ratio trends gives you an indication of how the car insurance market as a whole is performing in the North Star State.

- A High Loss Ratio (over 100 percent) means that companies are losing money because they are paying out too many claims compared to the amount of premium they collect, which may cause them financial trouble in the long term.

- A Low Loss Ratio indicates that these companies might have over-priced their auto insurance policies or overestimated the number and severity of claims they expected to receive.

The gains in MedPay are really good news for the health of Minnesota’s overall insurance market. The loss ratios for uninsured/underinsured motorists (UM/UIM) are also good news, considering that 11.5 percent of all drivers in the North Star State are uninsured, ranking Minnesota 27th in the nation. Keep reading to learn about other ways to protect against unseen events.

Add-ons and Endorsements for Car Insurance in Minnesota

Minnesotans have more than just insurance options for additional liability coverage. When purchasing your car insurance policy in the North Star State, you also have a variety of add-ons and endorsements to choose from. The options can help you pay for things like a mechanical breakdown or renting a car, and they can help you protect yourself in the case of a total loss. Some of the most popular add-ons and endorsement options in the North Star State include:

- Guaranteed Auto Protection (GAP): If your car is ever stolen or totaled in an accident, this add-on can help you cover the loss by paying off the lease or loan.

- Rental Reimbursement: This handy add-on will help if you ever need a rental car while your car is being repaired after an accident.

- Emergency Roadside Assistance: Getting caught on the side of the road is no fun. This type of add-on can help alleviate some of the pain of getting a flat or needing a tow if your car breaks down while you’re driving.

- Non-Owner Car Insurance: Don’t own a car, but still enjoy driving occasionally? This add-on is perfect for you, then, because it offers liability coverage even if the car you’re driving isn’t registered in your name.

- Mechanical Breakdown Insurance: This type of coverage can help you make up the difference in the cost of repair bills should you ever need help.

- Classic Car Insurance: Classic cars need special care and special coverage. This type of add-on is perfect for protecting your prized possession.

- Modified Car Insurance: If you like to soup up your wheels, this type of coverage can help cover the cost of repairing the modifications you have made should they become damaged in a crash.

The type of car you drive or the possibility of a mechanical breakdown are not the only things that you should consider as you construct a car insurance policy that suits all of your needs. Sometimes, just being who you are can affect how much you pay, which is why it’s best to shop around. Keep reading to find out how you can help keep your rates down, no matter who you are.

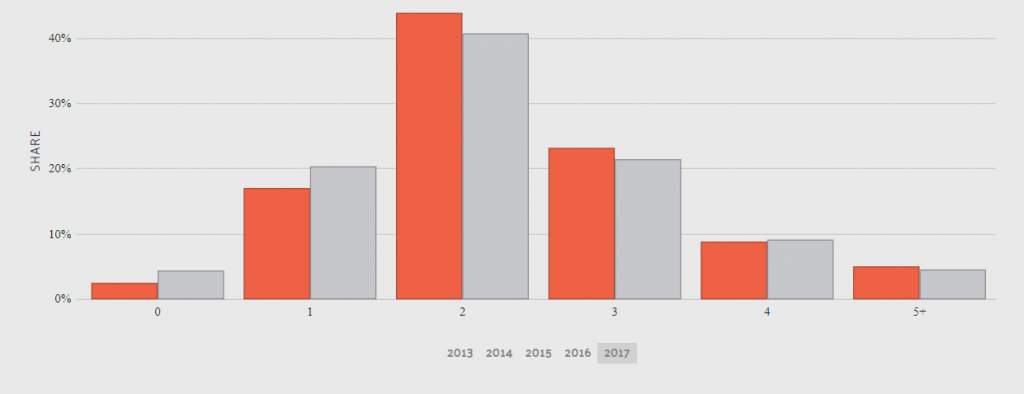

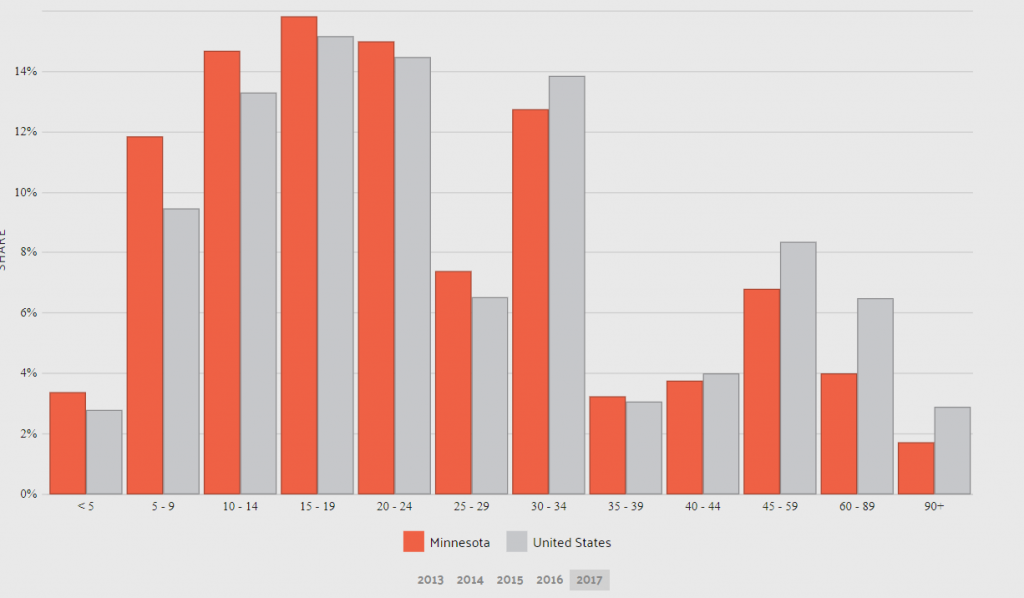

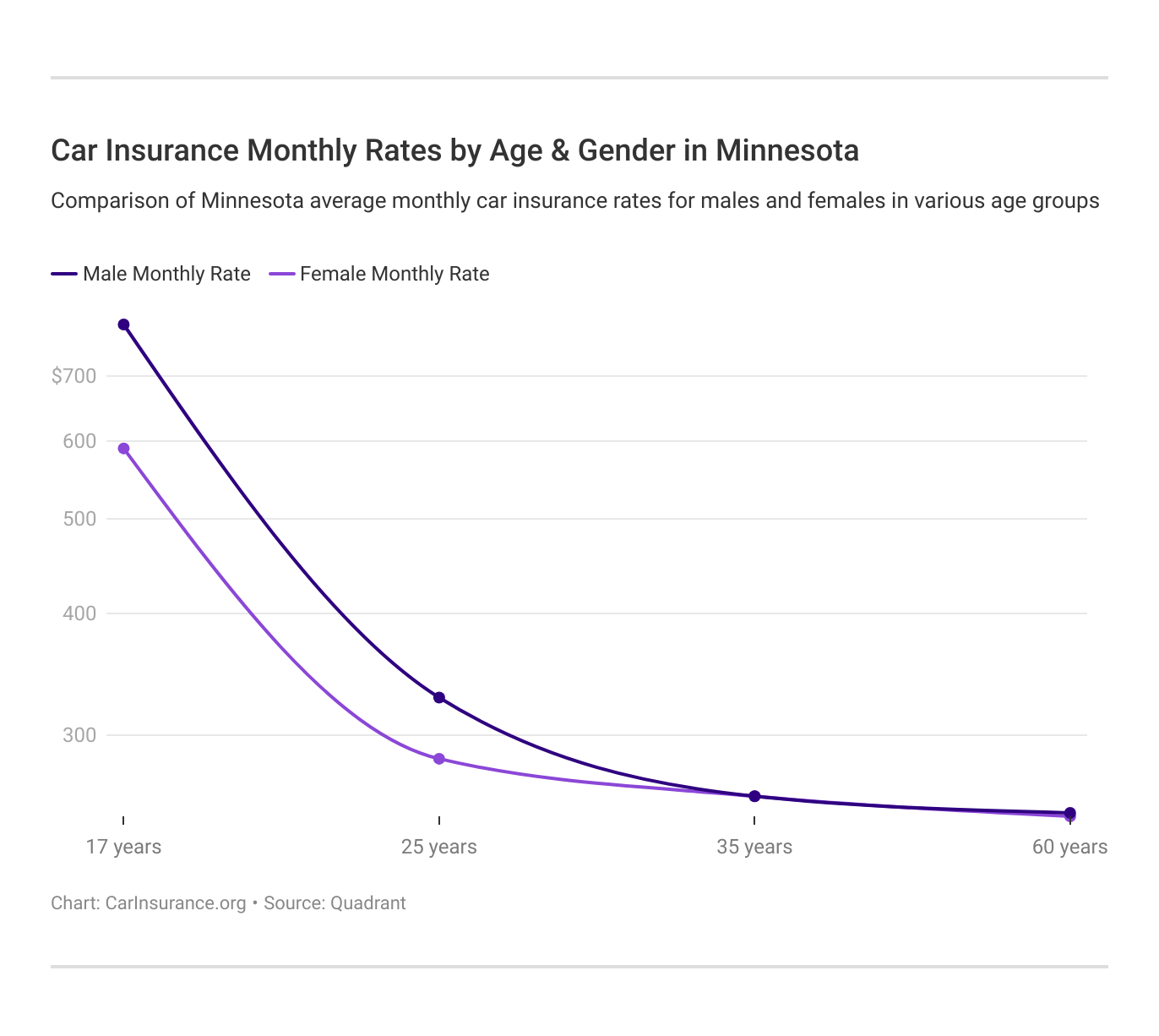

Average Monthly Car Insurance Rates by Age & Gender in MN

No matter your age or gender, most of us will eventually need to buy car insurance. When it’s time to make a purchase, you’ll want to know how these things will affect you.

According to the Consumer Federation of America:

48 percent of Americans think auto insurers charge men more for coverage than women, while only 23 percent of mericans think that women are chargesd more.

The reality is that women are more likely to pay more, according to their 2017 study.

| Company | Married 35-year old female annual rate | Married 35-year old male annual rate | Married 60-year old female annual rate | Married 60-year old male annual rate | Single 17-year old female annual rate | Single 17-year old male annual rate | Single 25-year old female annual rate | Single 25-year old male annual rate |

|---|---|---|---|---|---|---|---|---|

| Allstate Indemnity | $3,023.30 | $3,023.30 | $2,908.43 | $2,908.43 | $6,885.00 | $9,968.67 | $3,677.99 | $3,860.95 |

| American Family Mutual | $2,233.79 | $2,233.79 | $2,025.26 | $2,025.26 | $6,086.73 | $8,812.61 | $2,233.79 | $2,519.05 |

| Illinois Farmers Ins | $2,041.64 | $2,038.65 | $1,965.24 | $2,076.17 | $5,820.43 | $5,872.48 | $2,672.81 | $2,612.21 |

| Geico General | $2,661.52 | $2,641.10 | $2,544.82 | $2,473.72 | $5,545.67 | $7,047.50 | $2,494.27 | $2,579.67 |

| Liberty Mutual Fire | $9,604.65 | $9,604.65 | $9,510.34 | $9,510.34 | $18,911.44 | $28,385.86 | $9,604.65 | $13,376.94 |

| AMCO Insurance | $1,970.26 | $1,978.45 | $1,753.51 | $1,860.69 | $5,026.90 | $6,105.97 | $2,312.50 | $2,403.62 |

| State Farm Mutual Auto | $1,542.45 | $1,542.45 | $1,374.37 | $1,374.37 | $3,334.79 | $4,106.75 | $1,786.56 | $1,474.15 |

| USAA CIC | $1,895.96 | $1,879.44 | $1,726.56 | $1,724.94 | $5,042.84 | $5,519.17 | $2,473.98 | $2,629.95 |

As the table above shows, teenage drivers are still the most expensive people to insure, regardless of gender. The ability of car insurance companies to use gender as a factor for setting your rates is also a hotly debated issue among people, such as University of Minnesota Law School professor Daniel Schwarcz, who believes that:

If companies are not allowed to use “outdated stereotypes based on generalities” about men and women, the insurers will have to consider “more directly” such measures as the number if miles driven, the number of years customers have been driving, and where they live.

Many drivers agree with this as well. For now, age and gender are still allowed to be considered in the North Star State. They are not the only things under consideration, though. Some of those direct measures that Daniel Schwarcz discussed are factors as well.

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

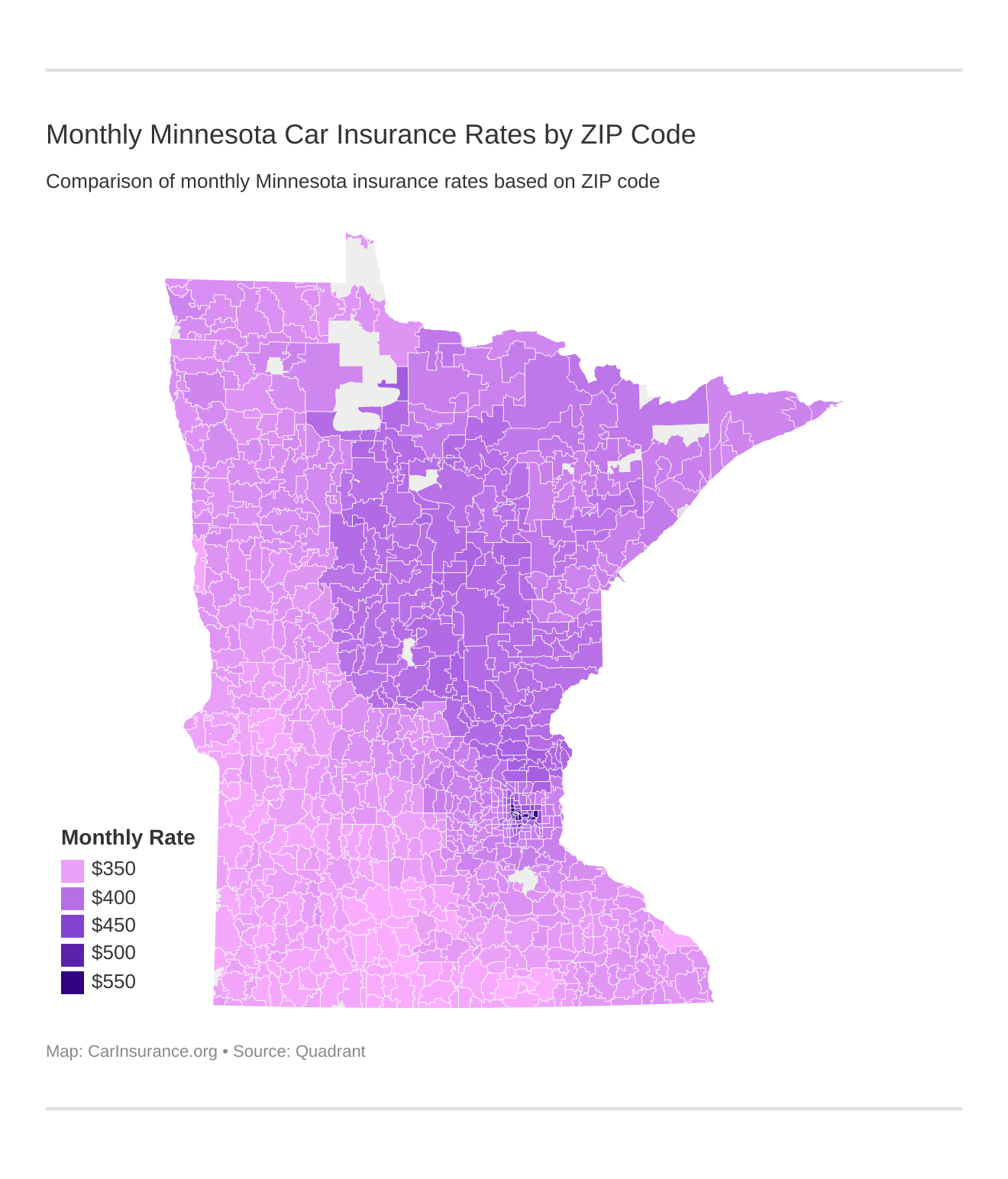

Cheapest Car Insurance Rates by ZIP Code in Minnesota

Most people don’t realize that their car insurance rates can be impacted just by the neighborhood that they call home. Sometimes, just crossing the street into a new ZIP code can make a world of difference. Take a look at the tables below to find out what we mean.

As the largest city in Minnesota, Minneapolis boasts no less than 68 ZIP codes. Not everyone in these ZIP codes pays the same for car insurance, though. The data reveals that Minneapolis residents who live near the U.S.

| Most Expensive ZIP Codes in Minnesota | City | Average Annual Rate by ZIP Code | Most Expensive Company | Most Expensive Annual Rate | 2nd Most Expensive Company | 2nd Most Expensive Annual Rate | Cheapest Company | Cheapest Annual Rate | 2nd Cheapest Company | 2nd Cheapest Annual Rate |

|---|---|---|---|---|---|---|---|---|---|---|

| 55411 | MINNEAPOLIS | $6,620.56 | Liberty Mutual | $20,934.87 | Allstate | $6,404.25 | State Farm | $3,337.51 | USAA | $3,688.43 |

| 55106 | SAINT PAUL | $6,563.33 | Liberty Mutual | $20,971.66 | Allstate | $6,567.98 | State Farm | $3,568.79 | USAA | $3,711.58 |

| 55101 | SAINT PAUL | $6,547.31 | Liberty Mutual | $20,971.66 | Allstate | $6,523.85 | State Farm | $3,460.84 | USAA | $3,504.15 |

| 55103 | SAINT PAUL | $6,520.89 | Liberty Mutual | $20,971.66 | Allstate | $6,523.85 | State Farm | $3,315.39 | USAA | $3,504.15 |

| 55404 | MINNEAPOLIS | $6,491.18 | Liberty Mutual | $20,934.87 | Allstate | $6,588.35 | State Farm | $2,895.66 | USAA | $3,328.08 |

| 55412 | MINNEAPOLIS | $6,434.63 | Liberty Mutual | $20,934.87 | Allstate | $6,465.92 | State Farm | $3,297.21 | USAA | $3,688.43 |

| 55107 | SAINT PAUL | $6,404.50 | Liberty Mutual | $20,971.66 | Allstate | $6,136.19 | State Farm | $3,003.66 | USAA | $3,261.85 |

| 55454 | MINNEAPOLIS | $6,394.17 | Liberty Mutual | $20,934.87 | Allstate | $6,568.73 | State Farm | $2,770.93 | USAA | $3,328.08 |

| 55415 | MINNEAPOLIS | $6,385.64 | Liberty Mutual | $20,934.87 | Allstate | $6,568.73 | State Farm | $2,861.81 | USAA | $3,328.08 |

| 55407 | MINNEAPOLIS | $6,382.20 | Liberty Mutual | $20,346.17 | Allstate | $6,595.26 | State Farm | $2,988.98 | USAA | $3,582.41 |

| 55408 | MINNEAPOLIS | $6,370.83 | Liberty Mutual | $20,934.87 | Allstate | $6,588.35 | State Farm | $2,894.22 | USAA | $3,183.53 |

| 55402 | MINNEAPOLIS | $6,353.00 | Liberty Mutual | $20,934.87 | Allstate | $6,568.73 | State Farm | $2,824.38 | USAA | $3,328.08 |

| 55455 | MINNEAPOLIS | $6,349.43 | Liberty Mutual | $20,934.87 | Allstate | $6,531.88 | State Farm | $2,935.21 | USAA | $3,328.08 |

| 55104 | SAINT PAUL | $6,339.29 | Liberty Mutual | $20,346.17 | Allstate | $6,523.85 | State Farm | $3,032.21 | USAA | $3,328.08 |

| 55405 | MINNEAPOLIS | $6,320.72 | Liberty Mutual | $20,934.87 | Allstate | $6,601.34 | State Farm | $2,824.38 | USAA | $3,688.43 |

| 55406 | MINNEAPOLIS | $6,257.62 | Liberty Mutual | $20,346.17 | Allstate | $6,568.73 | State Farm | $2,777.97 | USAA | $3,222.20 |

| 55414 | MINNEAPOLIS | $6,254.15 | Liberty Mutual | $20,346.17 | Allstate | $6,531.88 | State Farm | $2,681.89 | USAA | $3,328.08 |

| 55403 | MINNEAPOLIS | $6,252.05 | Liberty Mutual | $20,934.87 | Allstate | $6,568.73 | State Farm | $2,800.79 | USAA | $3,328.08 |

| 55413 | MINNEAPOLIS | $6,248.33 | Liberty Mutual | $20,934.87 | Allstate | $6,370.10 | State Farm | $2,907.36 | USAA | $3,271.06 |

| 55401 | MINNEAPOLIS | $6,221.83 | Liberty Mutual | $20,934.87 | Allstate | $6,370.10 | State Farm | $2,859.24 | USAA | $3,328.08 |

| 55114 | SAINT PAUL | $6,200.17 | Liberty Mutual | $20,346.17 | Allstate | $6,523.85 | State Farm | $2,503.54 | USAA | $3,328.08 |

| 55102 | SAINT PAUL | $6,187.71 | Liberty Mutual | $20,346.17 | Allstate | $5,927.14 | State Farm | $2,977.73 | USAA | $3,261.85 |

| 55409 | MINNEAPOLIS | $6,109.20 | Liberty Mutual | $20,346.17 | Allstate | $6,509.73 | State Farm | $2,954.03 | USAA | $3,183.53 |

| 55130 | SAINT PAUL | $5,798.28 | Liberty Mutual | $14,314.34 | Allstate | $6,462.88 | State Farm | $3,582.91 | USAA | $3,711.58 |

| 55450 | MINNEAPOLIS | $5,758.23 | Liberty Mutual | $20,934.87 | Allstate | $5,069.73 | USAA | $2,531.82 | State Farm | $2,935.21 |

Bank Stadium pays an average of $6,385, while those who reside near North Commons Park pay almost $300 more. If you move into the Minneapolis neighborhood near Lyndale Farmstead Park, though, you will be paying about $200 less than those near U.S. Bank Stadium.

| Cheapest ZIP Codes in Minnesota | City | Average Annual Rate by ZIP Codes | Most Expensive Company | Most Expensive Annual Rate | 2nd Most Expensive Company | 2nd Most Expensive Annual Rate | Cheapest Company | Cheapest Annual Rate | 2nd Cheapest Company | 2nd Cheapest Annual Rate |

|---|---|---|---|---|---|---|---|---|---|---|

| 56007 | ALBERT LEA | $3,976.80 | Liberty Mutual | $12,222.48 | Allstate | $4,039.14 | State Farm | $1,827.79 | Nationwide | $2,389.63 |

| 56088 | TRUMAN | $3,983.87 | Liberty Mutual | $12,222.48 | Allstate | $4,013.12 | State Farm | $1,668.01 | Farmers | $2,453.16 |

| 56120 | BUTTERFIELD | $4,009.53 | Liberty Mutual | $12,222.48 | Allstate | $4,110.95 | State Farm | $1,690.81 | USAA | $2,438.90 |

| 55912 | AUSTIN | $4,009.81 | Liberty Mutual | $11,792.33 | Allstate | $4,094.03 | State Farm | $1,858.67 | USAA | $2,502.58 |

| 56159 | MOUNTAIN LAKE | $4,014.86 | Liberty Mutual | $12,222.48 | Allstate | $4,206.30 | State Farm | $1,741.80 | USAA | $2,438.90 |

| 55987 | WINONA | $4,017.60 | Liberty Mutual | $11,372.14 | Allstate | $4,391.76 | State Farm | $1,909.06 | Nationwide | $2,489.07 |

| 56039 | GRANADA | $4,018.94 | Liberty Mutual | $12,222.48 | Allstate | $4,013.12 | State Farm | $1,641.11 | Nationwide | $2,530.75 |

| 56027 | ELMORE | $4,022.41 | Liberty Mutual | $12,222.48 | Allstate | $4,216.61 | State Farm | $1,636.38 | Farmers | $2,391.86 |

| 56073 | NEW ULM | $4,027.34 | Liberty Mutual | $12,222.48 | Allstate | $4,007.85 | State Farm | $1,673.65 | USAA | $2,438.90 |

| 56181 | WELCOME | $4,027.96 | Liberty Mutual | $12,222.48 | Allstate | $4,144.34 | State Farm | $1,678.68 | Nationwide | $2,530.75 |

| 56062 | MADELIA | $4,029.17 | Liberty Mutual | $12,222.48 | Allstate | $4,007.85 | State Farm | $1,698.53 | USAA | $2,438.90 |

| 56031 | FAIRMONT | $4,029.28 | Liberty Mutual | $12,222.48 | Allstate | $4,013.12 | State Farm | $1,647.15 | Nationwide | $2,530.75 |

| 56127 | DUNNELL | $4,029.53 | Liberty Mutual | $12,222.48 | Allstate | $4,206.30 | State Farm | $1,763.52 | Farmers | $2,448.45 |

| 56087 | SPRINGFIELD | $4,029.60 | Liberty Mutual | $12,222.48 | Allstate | $4,143.10 | State Farm | $1,706.84 | USAA | $2,438.90 |

| 56054 | LAFAYETTE | $4,032.56 | Liberty Mutual | $12,222.48 | Allstate | $4,007.85 | State Farm | $1,774.45 | Farmers | $2,585.62 |

| 56081 | SAINT JAMES | $4,032.94 | Liberty Mutual | $12,222.48 | Allstate | $4,007.85 | State Farm | $1,698.42 | USAA | $2,438.90 |

| 56075 | NORTHROP | $4,036.97 | Liberty Mutual | $12,222.48 | Allstate | $4,013.12 | State Farm | $1,881.71 | Nationwide | $2,530.75 |

| 56098 | WINNEBAGO | $4,037.01 | Liberty Mutual | $12,222.48 | Allstate | $4,216.61 | State Farm | $1,718.76 | Farmers | $2,436.29 |

| 56019 | COMFREY | $4,041.92 | Liberty Mutual | $12,222.48 | Allstate | $4,013.12 | State Farm | $1,670.30 | USAA | $2,438.90 |

| 56041 | HANSKA | $4,042.96 | Liberty Mutual | $12,222.48 | Allstate | $4,007.85 | State Farm | $1,677.99 | USAA | $2,438.90 |

| 56001 | MANKATO | $4,043.78 | Liberty Mutual | $11,927.85 | Allstate | $4,376.76 | State Farm | $2,014.61 | Nationwide | $2,615.86 |

| 56085 | SLEEPY EYE | $4,044.59 | Liberty Mutual | $12,222.48 | Allstate | $4,007.85 | State Farm | $1,633.33 | USAA | $2,438.90 |

| 56036 | GLENVILLE | $4,046.92 | Liberty Mutual | $12,222.48 | Allstate | $4,216.61 | State Farm | $1,837.88 | Farmers | $2,408.30 |

| 56171 | SHERBURN | $4,047.15 | Liberty Mutual | $12,222.48 | Allstate | $4,206.30 | State Farm | $1,713.97 | Nationwide | $2,530.75 |

| 56162 | ORMSBY | $4,048.38 | Liberty Mutual | $12,222.48 | Allstate | $4,144.34 | State Farm | $1,881.71 | Nationwide | $2,530.75 |

Your neighborhood is not the only geographic factor that car insurance companies consider when determining how much you will pay for your policy. Sometimes, the city that you love can cost you big bucks as well.

Cheapest Car Insurance Rates by City in Minnesota

From sights along the Mighty Mississippi as it meanders through Minneapolis-St.. Paul, to the tiny town of Funkley, where Funkley Bar becomes City Hall when the City Council meets, the North Star State has some of the most beautiful and interesting cities in the nation. The city you call home could be against you when it comes time to buy car insurance, though.

This is why having the right information in your hands as you determine which car insurance provider is right for you could help you avoid a costly mistake when investing in your policy. We’ve put together research that can help you invest wisely. Take a look at the tables below to see what residents of your hometown are paying for their car insurance policies.

| Cheapest Cities in Minnesota | Average Annual Rate by City | Most Expensive Company | Most Expensive Annual Rate | 2nd Most Expensive Company | 2nd Most Expensive Annual Rate | Cheapest Company | Cheapest Annual Rate | 2nd Cheapest Company | 2nd Cheapest Annual Rate |

|---|---|---|---|---|---|---|---|---|---|

| Albert Lea | $3,976.80 | Liberty Mutual | $12,222.48 | Allstate | $4,039.14 | State Farm | $1,827.79 | Nationwide | $2,389.63 |

| Truman | $3,983.87 | Liberty Mutual | $12,222.48 | Allstate | $4,013.12 | State Farm | $1,668.01 | Farmers | $2,453.16 |

| Butterfield | $4,009.53 | Liberty Mutual | $12,222.48 | Allstate | $4,110.95 | State Farm | $1,690.81 | USAA | $2,438.90 |

| Austin | $4,009.81 | Liberty Mutual | $11,792.33 | Allstate | $4,094.03 | State Farm | $1,858.67 | USAA | $2,502.58 |

| Mountain Lake | $4,014.86 | Liberty Mutual | $12,222.48 | Allstate | $4,206.30 | State Farm | $1,741.80 | USAA | $2,438.90 |

| Goodview | $4,017.60 | Liberty Mutual | $11,372.14 | Allstate | $4,391.76 | State Farm | $1,909.06 | Nationwide | $2,489.07 |

| Granada | $4,018.95 | Liberty Mutual | $12,222.48 | Allstate | $4,013.12 | State Farm | $1,641.11 | Nationwide | $2,530.75 |

| Elmore | $4,022.41 | Liberty Mutual | $12,222.48 | Allstate | $4,216.61 | State Farm | $1,636.38 | Farmers | $2,391.86 |

| New Ulm | $4,027.34 | Liberty Mutual | $12,222.48 | Allstate | $4,007.85 | State Farm | $1,673.65 | USAA | $2,438.90 |

| Welcome | $4,027.96 | Liberty Mutual | $12,222.48 | Allstate | $4,144.34 | State Farm | $1,678.68 | Nationwide | $2,530.75 |

| Madelia | $4,029.17 | Liberty Mutual | $12,222.48 | Allstate | $4,007.85 | State Farm | $1,698.53 | USAA | $2,438.90 |

| Fairmont | $4,029.28 | Liberty Mutual | $12,222.48 | Allstate | $4,013.12 | State Farm | $1,647.15 | Nationwide | $2,530.75 |

| Dunnell | $4,029.53 | Liberty Mutual | $12,222.48 | Allstate | $4,206.30 | State Farm | $1,763.52 | Farmers | $2,448.45 |

| Springfield | $4,029.60 | Liberty Mutual | $12,222.48 | Allstate | $4,143.10 | State Farm | $1,706.84 | USAA | $2,438.90 |

| Lafayette | $4,032.56 | Liberty Mutual | $12,222.48 | Allstate | $4,007.85 | State Farm | $1,774.45 | Farmers | $2,585.62 |

| St. James | $4,032.94 | Liberty Mutual | $12,222.48 | Allstate | $4,007.85 | State Farm | $1,698.42 | USAA | $2,438.90 |

| Northrop | $4,036.97 | Liberty Mutual | $12,222.48 | Allstate | $4,013.12 | State Farm | $1,881.71 | Nationwide | $2,530.75 |

| Winnebago | $4,037.01 | Liberty Mutual | $12,222.48 | Allstate | $4,216.61 | State Farm | $1,718.76 | Farmers | $2,436.29 |

| Comfrey | $4,041.92 | Liberty Mutual | $12,222.48 | Allstate | $4,013.12 | State Farm | $1,670.30 | USAA | $2,438.90 |

| Hanska | $4,042.96 | Liberty Mutual | $12,222.48 | Allstate | $4,007.85 | State Farm | $1,677.99 | USAA | $2,438.90 |

| Sleepy Eye | $4,044.59 | Liberty Mutual | $12,222.48 | Allstate | $4,007.85 | State Farm | $1,633.33 | USAA | $2,438.90 |

| Glenville | $4,046.92 | Liberty Mutual | $12,222.48 | Allstate | $4,216.61 | State Farm | $1,837.88 | Farmers | $2,408.30 |

| Sherburn | $4,047.15 | Liberty Mutual | $12,222.48 | Allstate | $4,206.30 | State Farm | $1,713.97 | Nationwide | $2,530.75 |

| Ormsby | $4,048.38 | Liberty Mutual | $12,222.48 | Allstate | $4,144.34 | State Farm | $1,881.71 | Nationwide | $2,530.75 |

| Lewisville | $4,051.00 | Liberty Mutual | $12,222.48 | Allstate | $4,007.85 | State Farm | $1,712.06 | USAA | $2,438.90 |

With a population of around 18,000, it’s no wonder that car insurance rates in Albert Lea are lower compared to the sprawling city of Minneapolis, where Minnesotans pay an average of over $2,000 more.

| Most Expensive Cities in Minnesota | Average Annual Rate by City | Most Expensive Company | Most Expensive Annual Rate | 2nd Most Expensive Company | 2nd Most Expensive Annual Rate | Cheapest Company | Cheapest Annual Rate | 2nd Cheapest Company | 2nd Cheapest Annual Rate |

|---|---|---|---|---|---|---|---|---|---|

| Minneapolis | $6,106.69 | Liberty Mutual | $19,767.41 | Allstate | $6,275.74 | State Farm | $2,860.94 | USAA | $3,270.39 |

| St. Paul | $5,972.08 | Liberty Mutual | $18,511.98 | Allstate | $6,141.30 | State Farm | $3,006.99 | USAA | $3,309.17 |

| Little Canada | $5,397.29 | Liberty Mutual | $14,314.34 | Allstate | $5,939.60 | USAA | $3,246.25 | State Farm | $3,375.84 |

| Brooklyn Center | $5,250.46 | Liberty Mutual | $13,733.42 | Allstate | $5,517.75 | State Farm | $2,657.84 | USAA | $3,027.14 |

| Falcon Heights | $5,110.86 | Liberty Mutual | $14,384.20 | Allstate | $5,605.47 | State Farm | $2,445.02 | USAA | $3,000.34 |

| Columbia Heights | $5,103.52 | Liberty Mutual | $13,733.42 | Allstate | $5,453.46 | State Farm | $2,631.03 | USAA | $2,963.85 |

| Maplewood | $5,061.15 | Liberty Mutual | $14,314.34 | Allstate | $5,382.25 | State Farm | $2,720.57 | USAA | $2,960.39 |

| Waskish | $5,023.66 | Liberty Mutual | $15,228.53 | Farmers | $4,564.50 | State Farm | $2,148.12 | Nationwide | $2,950.86 |

| St. Francis | $5,003.38 | Liberty Mutual | $15,094.54 | Allstate | $4,711.37 | State Farm | $2,460.88 | USAA | $3,193.94 |

| Martin Lake | $5,003.33 | Liberty Mutual | $15,094.54 | Allstate | $4,712.34 | State Farm | $2,459.40 | USAA | $3,193.94 |

| Richfield | $5,002.58 | Liberty Mutual | $14,343.36 | Allstate | $5,308.16 | State Farm | $2,566.97 | USAA | $2,790.97 |

| Lake George | $4,999.75 | Liberty Mutual | $15,228.53 | Farmers | $4,491.44 | State Farm | $2,185.55 | USAA | $3,008.87 |

| South St. Paul | $4,994.42 | Liberty Mutual | $14,314.34 | Allstate | $5,331.35 | State Farm | $2,667.84 | USAA | $2,987.88 |

| Columbus | $4,992.05 | Liberty Mutual | $15,094.54 | Allstate | $4,758.69 | State Farm | $2,382.94 | Nationwide | $3,130.44 |

| Bethel | $4,984.06 | Liberty Mutual | $15,094.54 | Allstate | $4,711.37 | State Farm | $2,424.09 | USAA | $3,193.94 |

| East Bethel | $4,978.05 | Liberty Mutual | $15,094.54 | Allstate | $4,712.66 | State Farm | $2,477.33 | USAA | $3,193.94 |

| Fridley | $4,971.65 | Liberty Mutual | $13,733.42 | Allstate | $5,492.04 | State Farm | $2,618.39 | USAA | $2,807.34 |

| Almelund | $4,966.16 | Liberty Mutual | $15,094.54 | Allstate | $5,026.47 | State Farm | $2,406.80 | USAA | $2,915.46 |

| Isanti | $4,955.17 | Liberty Mutual | $15,094.54 | Allstate | $4,790.79 | State Farm | $2,422.96 | Nationwide | $3,215.12 |

| Garrison | $4,948.90 | Liberty Mutual | $15,228.53 | Allstate | $4,537.69 | State Farm | $2,148.12 | USAA | $2,902.05 |

| Andover | $4,946.23 | Liberty Mutual | $15,094.54 | Allstate | $5,081.81 | State Farm | $2,396.83 | USAA | $2,982.27 |

| Grandy | $4,945.76 | Liberty Mutual | $15,094.54 | Allstate | $4,770.32 | State Farm | $2,406.80 | Nationwide | $3,215.12 |

| Swatara | $4,945.15 | Liberty Mutual | $15,228.53 | Allstate | $4,489.01 | State Farm | $2,148.12 | Nationwide | $2,993.69 |

| Taylors Falls | $4,943.22 | Liberty Mutual | $15,094.54 | Allstate | $5,026.47 | State Farm | $2,406.80 | USAA | $2,915.46 |

| Centerville | $4,940.45 | Liberty Mutual | $15,094.54 | Allstate | $4,928.00 | State Farm | $2,248.59 | USAA | $2,780.77 |

More people mean more cars on the road, which explains the drastic difference in premium prices between Albert Lea and Minneapolis, since more cars usually translate into more accidents.

With more accidents come more claims filed against car insurance companies, leading to higher rates for everyone. Should you ever find yourself in the unfortunate position of needing to file a claim, you will want a great car insurance provider on your side. That is where we come in.

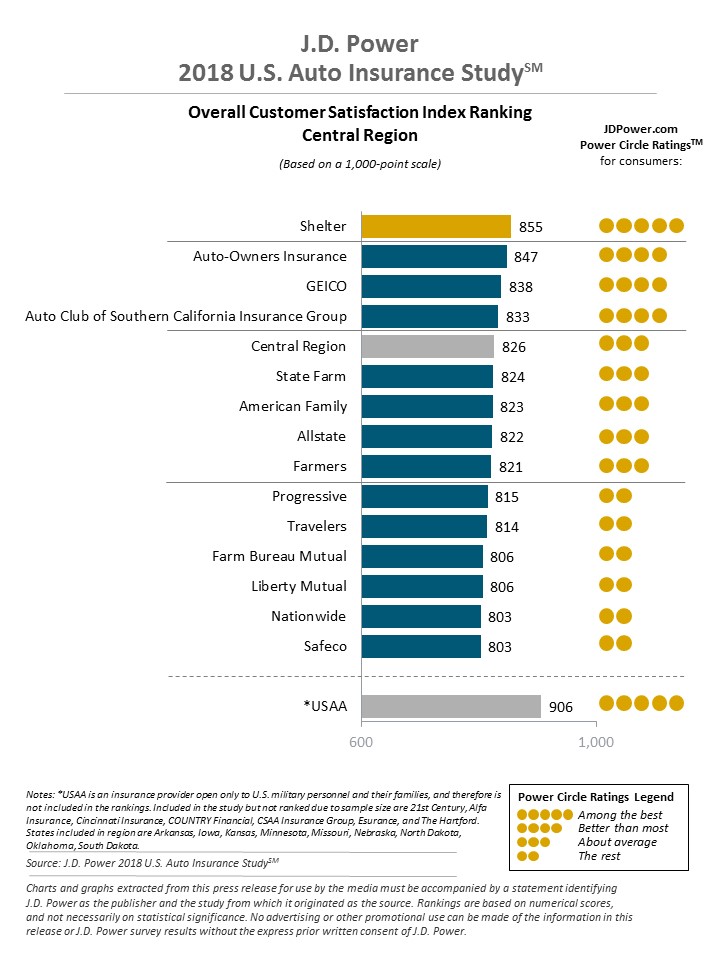

The Best Car Insurance Companies in Minnesota

With so many car insurance companies in Minnesota, it can be difficult to determine which provider is right for you. Having trusted agencies like A.M. Best and JD Power look out for you makes it easier, though. Take a look at what they have to say about the top companies in the North Star State.

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

The Financial Rating of the Largest Auto Insurance Companies

As the only worldwide company with a singular focus on the insurance market, A.M. Best has become one of the most trusted agencies in the global insurance industry, used by organizations such as the National Association of Insurance Commissioners (NAIC). The table below shows you how they have rated the biggest insurance providers in the North Star State.

808-Imported-from-Manual-Input-2019-10-24.csv

| Best Rated Companies | Rating | Outlook |

|---|---|---|

| A+ | Stable | |

| A | Stable | |

| A++ | Stable | |

| A | Stable | |

| A++ | Stable | |

| A | Stable |

| A+ | Stable | |

| A++ | Stable | |

| A++ | Stable | |

| A++ | Stable |

When you choose a company that has been given an A++ rating and/or a stable outlook by A.M. Best, you are choosing a company that has a good loss ratio and a great outlook for future growth and prosperity. Understanding a company’s financial stability and loss ratio can help you choose a car insurance provider that will be more likely to pay out your claim should you ever need to file one.

Companies With the Best Car Insurance Ratings

Just like A.M. Best has your back when it comes to understanding the car insurance market and its overall viability, so too does JD Power. What they have found is that customer satisfaction ratings with car insurance providers are at a record high.

Buying car insurance in Minnesota isn’t always as great as the perfect pan of “Hot Dish. Making sure you have all the information you need to make an informed decision before purchasing your car insurance policy can make the experience more pleasant.

Buying car insurance in Minnesota isn’t always as great as the perfect pan of “Hot Dish. Making sure you have all the information you need to make an informed decision before purchasing your car insurance policy can make the experience more pleasant.

Companies With the Most Complaints

Before choosing a car insurance provider to help protect you and your family, it’s a good idea to find out their complaint ratio. This complaint ratio can help you determine where each car insurance provider in your area stands in relation to its competitors. This can save you money by giving you insight into who is competing for your business.

The complaint ratio’s baseline is 1.0. This means that the higher the complaint ratio is above the baseline of 1.0, the more complaints there are against a car insurance company. Below is a list of the top ten car insurance companies in the North Star State, along with their complaint ratios, so you can see how each one performs.

809-Minn-Complaint-Ratio-2019-10-24.csv

| Insurance Provider | Direct Premiums written | Complaint Ratio | Loss Ratio | Market Share |

|---|---|---|---|---|

| $200,235 | 0.5 | 60.51% | 5.56% | |

| $418,487 | 0.79 | 62.97% | 11.62% | |

| $103,671 | 0.53 | 61.26% | 2.88% | |

| $212,804 | 0 | 56.43% | 5.91% | |

| $129,987 | 0.68 | 74.00% | 3.61% | |

| $110,671 | 5.95 | 60.04% | 3.07% |

| $586,357 | 0.75 | 62.53% | 16.27% | |

| $891,085 | 0.44 | 65.52% | 24.73% | |

| $106,222 | 0.09 | 65.96% | 2.95% | |

| $110,895 | 0.74 | 73.57% | 3.08% |

Don’t let the raw numbers fool you. Just because a company has a high complaint ratio doesn’t mean it’s a bad company to do business with. To get a fuller picture of the complaint ratio, you have to consider the company’s market share. Looking at the table in this light reveals that although American Family Insurance Group has a complaint ratio that is a bit on the high side also has a higher portion of the market share.

More market share means more customers, which means a higher possibility for complaints overall. We truly hope that you never need to file a complaint against your car insurance provider, but if it should come to that, the state of Minnesota has a few ways for you to do so. Some of these ways include:

- Online at https://mn.gov/commerce/consumers/file-a-complaint/

- Email your questions to [email protected]

- By Mail at 85 7th Place East, Suite 500, St. Paul, MN 55101

Now that you are gaining a better grasp of how to use the loss ratio and complaint ratio to negotiate a better price on your car insurance policy, it is time to start looking at what those companies are charging for coverage.

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

The Cheapest Car Insurance Companies in Minnesota

Every good shopper knows that you never take the first price given to you if you can help it. Being able to haggle means knowing what competitors charge for the same goods or services on the market. We are here to help you with that. The table below gives you a glimpse into what the biggest competitors in your area are charging on average.

This is information that can help you gain the upper hand when shopping for your car insurance policy.

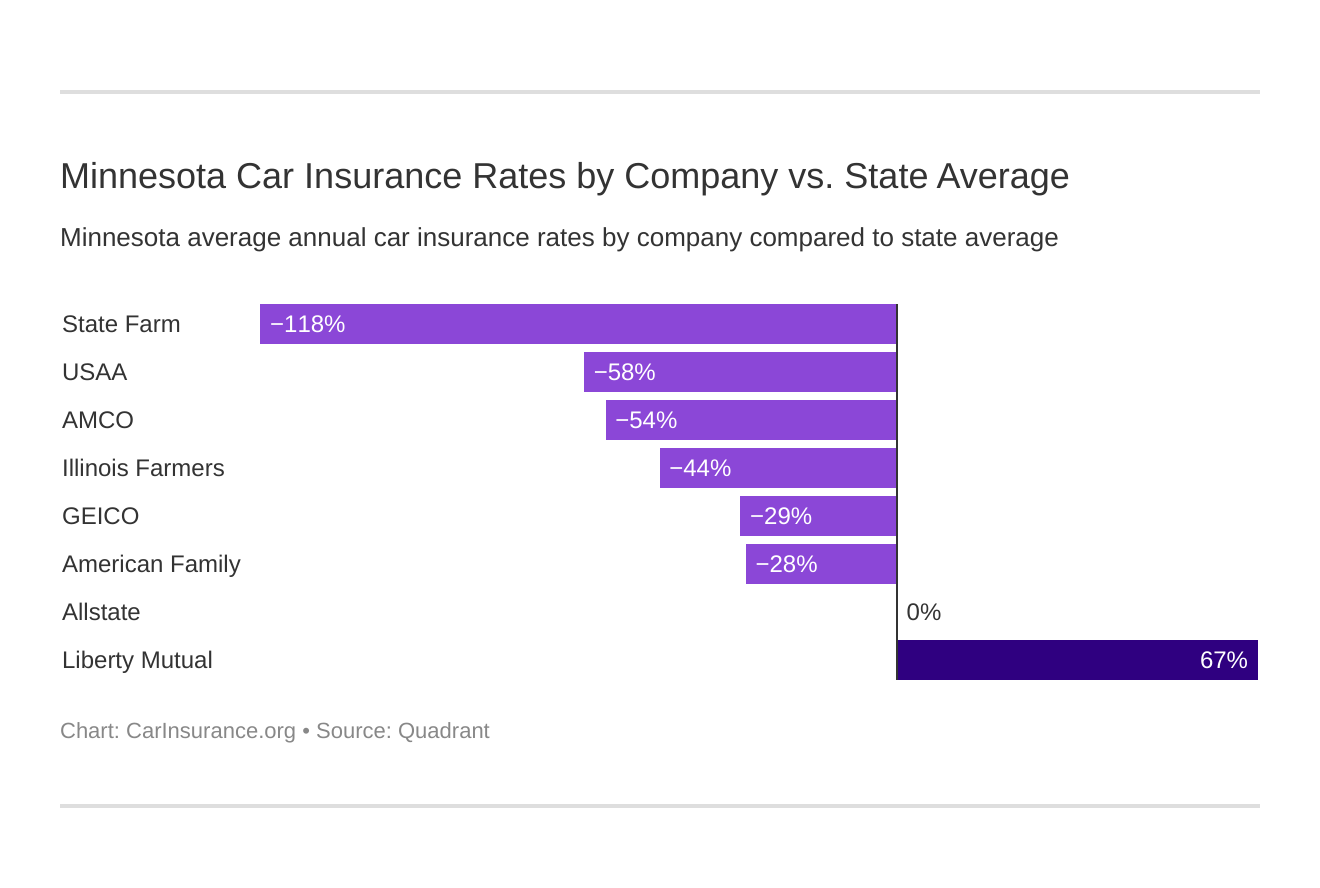

810-Minn-chae-co-2019-10-24.csv

| Company | Average Annual Rate | +/- Compared to State Average (Rate) | +/- Compared to State Average (%) |

|---|---|---|---|

| $4,532 | $19 | $0 | |

| $3,521 | -$992 | $0 | |

| $3,137 | -$1,376 | $0 | |

| $3,499 | -$1,015 | $0 | |

| $13,564 | $9,050 | $1 |

| $2,926 | -$1,587 | -$1 | |

| $2,067 | -$2,447 | -$1 | |

| $2,862 | -$1,652 | -$1 |

Knowing how far your dollar will stretch with each competitor on the market can help you save money. Before you become a customer, though, you will want to know how each of these companies determines your rates. We have talked a little about your age and gender, as well as how where you live can impact your rates.

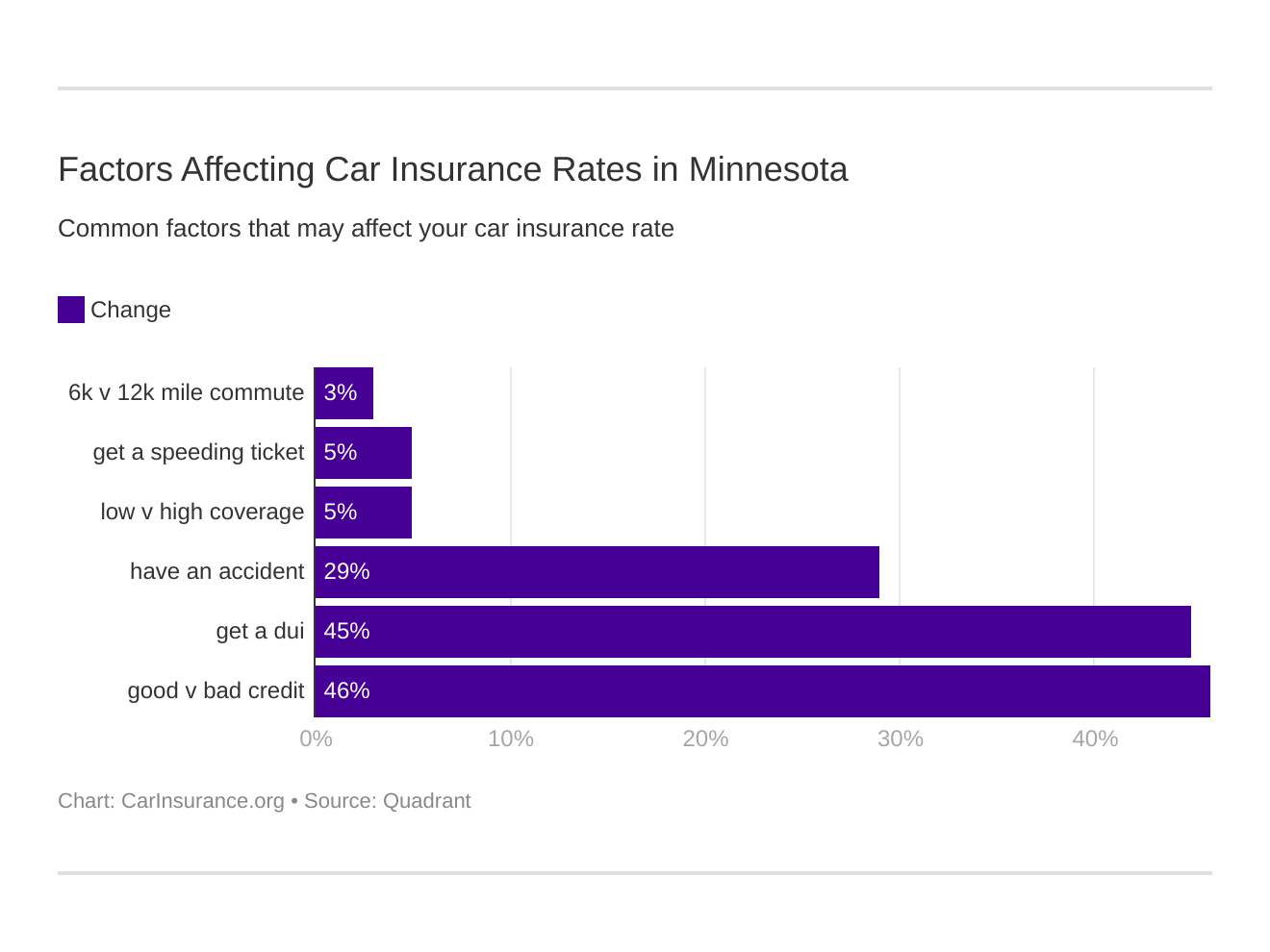

Did you know that how much you drive can also play a role in how companies decide how much they should charge you? Keep reading to find out more.

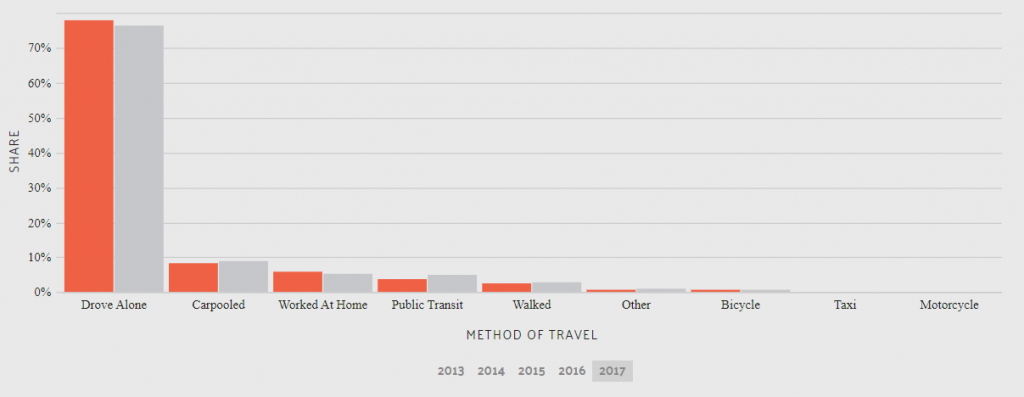

Commute Rates by Company in Minnesota

Driving is mostly a game of chance. One thing that you can pretty much count on, though, is the fact that the more you drive, the higher your insurance premiums will most likely be. This is why it pays big dividends sometimes to shop before you buy.

Across the country, car insurance providers charge customers based on the number of miles they travel annually, and looking at the numbers reveals that residents of the North Star State really are on the go.

More people on the roads means a greater chance of traffic incidents, which can lead to higher rates. This is why car insurance providers consider how much you drive when determining your premiums.

811-Minn-commute-2019-10-24.csv

| Company | 10 miles commute. 6000 annual mileage. | 25 miles commute. 12000 annual mileage. |

|---|---|---|

| $4,532 | $4,532 | |

| $3,480 | $3,563 | |

| $3,137 | $3,137 | |

| $3,452 | $3,545 | |

| $13,165 | $13,962 |

| $2,926 | $2,926 |

| $2,011 | $2,123 | |

| $2,824 | $2,899 |

The table reveals that car insurance companies in Minnesota are pretty fair when it comes to charging you for every mile you drive. This is where a fine eye for detail comes in, though. Choosing a company like State Farm or USAA could save you money no matter how long your commute is because they are both the lowest-priced carriers in this category, and their rates do not fluctuate much with every mile you put behind you.

Keep in mind, though, that these companies might also have a complaint or loss ratio that might cause you to reconsider, so getting all of your ducks in a row before targeting an insurance provider is always the best decision.

The Coverage Level Rates by Company in Minnesota

Understanding where you live, who you are, and how healthy a particular car insurance company might be is only part of the process of purchasing your car insurance policy. You will also need to consider how much coverage you need and find out what that coverage will cost you. The table below can help you get started.

812-Minn-cost-by-coverage-level-2019-10-24.csv

| Company | Low Coverage | Medium Coverage | High Coverage |

|---|---|---|---|

| $4,467 | $4,529 | $4,600 | |

| $3,513 | $3,618 | $3,433 | |

| $3,023 | $3,150 | $3,240 | |

| $3,395 | $3,497 | $3,603 | |

| $13,241 | $13,575 | $13,875 |

| $2,767 | $2,947 | $3,065 |

| $1,985 | $2,074 | $2,141 | |

| $2,780 | $2,860 | $2,946 |

It goes without saying that the higher your coverage level, the more money you will pay for car insurance premiums. That is not all there is to it, though. For instance, a new car may require more coverage, while an older car with high mileage might require less.

The price for this coverage may also be influenced by other factors, such as where you live or the length of your commute. Another factor is your driving record, of course. But did you know that things like your education level and credit score can also impact how much you pay? Keep reading to find out how.

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Credit-Based Insurance Rates for Each Company in Minnesota

Your actions on the road have obvious consequences when it comes to paying for car insurance. However, your financial habits can also play a significant role. According to a 2015 article published by Consumer Reports, car dealerships and credit card companies use your credit score to determine your risk level:

Car insurers are also rifling through your credit files to…predict the odds that you’ll file a claim.

This means that too many unpaid or delinquent bills on your credit report could cost you big time when it comes time to purchase your car insurance policy.

844-Minn-Credit-2019-10-24.csv

| Company | Good Credit | Fair Credit | Poor Credit |

|---|---|---|---|

| $3,344 | $3,603 | $6,649 | |

| $2,564 | $3,190 | $4,809 | |

| $2,655 | $2,841 | $3,917 | |

| $2,861 | $3,434 | $4,201 | |

| $9,555 | $12,228 | $18,908 |

| $2,490 | $2,807 | $3,482 |

| $1,344 | $1,843 | $3,014 | |

| $1,905 | $2,193 | $4,487 |

People with better credit scores get better rates on car insurance because the insurance provider assumes that if a person with good credit has an accident, they will most likely pay out of pocket rather than file a claim. This doesn’t mean that maintaining a clean driving record doesn’t have its advantages, though.

Keep scrolling to find out some of the ways that defensive driving and responsible behavior behind the wheel can save you money on car insurance.

Driving Record Rates by Company in Minnesota

What you do behind the wheel in the North Star State is important, not just for the safety of others with whom you share the road. Your behavior behind the wheel can also cost you more money when it comes time to invest in car insurance. Take a look at the table below to see how.

845-Min-Driving-Record-2019-10-24.csv

| Company | Clean Record | With 1 Speeding Violation | With 1 DUI | With 1 Accident |

|---|---|---|---|---|

| $3,293 | $4,316 | $5,739 | $4,780 | |

| $2,367 | $2,683 | $4,776 | $4,259 | |

| $2,687 | $3,054 | $3,428 | $3,382 | |

| $2,319 | $2,484 | $5,500 | $3,691 | |

| $9,957 | $10,738 | $19,913 | $13,646 |

| $2,322 | $2,753 | $3,547 | $3,083 |

| $1,900 | $2,067 | $2,067 | $2,234 | |

| $2,126 | $2,532 | $4,082 | $2,706 |

The drastic difference in rates between a driver with a clean record and one who has had one speeding ticket or accident illustrates the importance of exercising good driving habits on Minnesota roadways. If you think your driving skills need work, the North Star State also has a list of approved accident prevention courses.

You can also request a certified copy of your Minnesota driving record by printing out the request form and mailing it to the Driver and Vehicle Services Unit at 445 Minnesota Street, Suite 161, St. Paul, MN, 55101-5161. You can also request one online for your convenience.

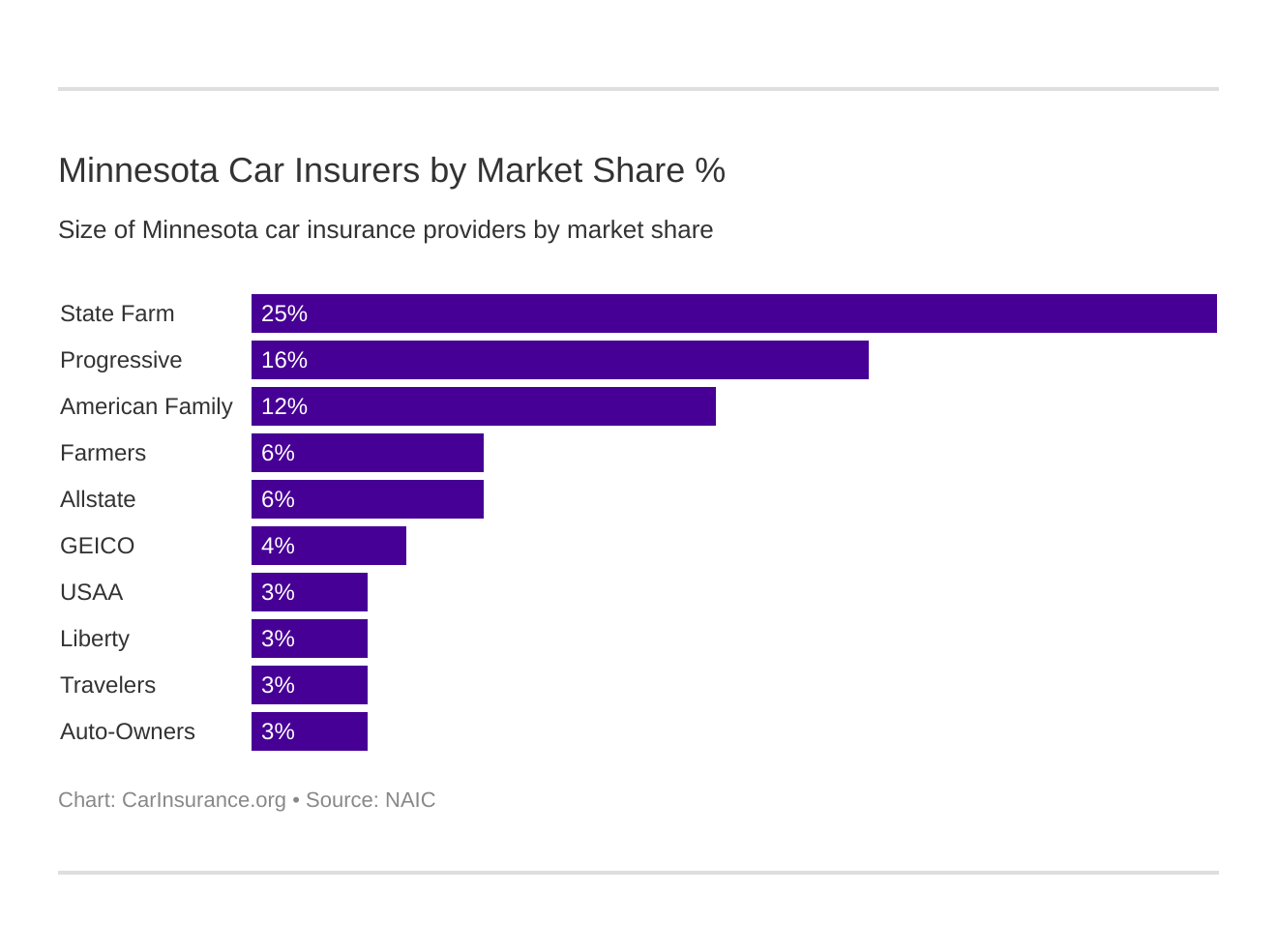

Largest Car Insurance Providers in Minnesota

We have talked a little bit about market share, which is the percentage of the overall market that a particular car insurance company controls.

Market share is much more than that, though. It is the key to understanding how loss ratios and complaint ratios work to save you money on car insurance by examining how market share relates to direct premiums written.

846-Minn-Market-Share-2019-10-24.csv

| Company | Direct Premiums Written | Market Share |

|---|---|---|

| $200,235 | 5.56% | |

| $418,487 | 11.62% | |

| $103,671 | 2.88% | |

| $212,804 | 5.91% | |

| $129,987 | 3.61% | |

| $110,671 | 3.07% |

| $586,357 | 16.27% | |

| $891,085 | 24.73% | |

| $106,222 | 2.95% | |

| $110,895 | 3.08% |

As the table shows, State Farm has the largest share of the Minnesota car insurance market, with almost $900,000 in Direct Premiums Written. This indicates that the car insurance market as a whole is pretty healthy in the North Star State, which translates into safety for you as a consumer once you purchase your car insurance policy.

These companies write new policies as a means of growth rather than raising their rates to increase their bottom line.

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

The Number of Insurers by State

Minnesota has 39 domestic insurers and 816 foreign insurers, all operating in the State. That is 855 options for car insurance companies in the Land of 10,000 Lakes. So, what is the difference between the two? Simply states:

- A domestic insurer is one that has been formed under the laws of a state, such as Minnesota.

- A foreign insurer is one formed under the laws of any state, district, territory, or commonwealth of the United States other than the state of Minnesota.

Both types of insurers must adhere to the laws governing car insurance providers in the North Star State, regardless of their location. The choice between one or the other is a personal one. Dealing with either type of insurer is easier, though, when you understand the laws under which they are formed and the ones that they must comply with.

Minnesota State Laws on Car Insurance

Trying to navigate your way through all of the laws that govern car insurance in the North Star State can be a confusing and frustrating task. Attempting to understand just which laws apply to whom after an accident can complicate things even more. Gaining a good grasp of these laws before you are ever involved in an accident can help. This is where we come in.

We are here to guide you through the ins and outs of Minnesota laws concerning car insurance so that, should you ever need to negotiate them, you won’t find yourself drowning in legal jargon and feeling deflated like an old tire on the side of the road. We have already discussed the minimum requirements for car insurance coverage in the North Star State.

Did you know that there are insurance requirements for registering a vehicle and age-related factors for getting your driver’s license in Minnesota, too? Almost every aspect of vehicle ownership and operation in the North Star State is regulated to protect drivers, passengers, and the general public from injury, loss, or damage.

Determining State Laws

You may be wondering just who is responsible for writing the laws that govern car ownership, vehicle registration, and driver’s licenses in the Land of 10,000 Lakes. Like all other laws in Minnesota, laws and regulations for these things begin in the various chambers and subcommittees that make up the Minnesota State Legislature.

The State Legislature, in conjunction with the Minnesota Department of Commerce and the Minnesota Department of Transportation, has determined the various safety, vehicle registration, driver’s license, and insurance laws in the North Star State. Chief among these is that Minnesota has been designated a “No-Fault” state. What this means is that:

Certian expenses resulting from the personal injuries of a car owner, the owner’s family, and the driver and occupants of the owner’s car are paid by the car owner’s insurance company regardless of who is at fault in causing an auto accident.

This system is designed to minimize the delay in paying for medical or rehabilitation services after an accident. After the passage of laws that designated Minnesota as a “No-Fault” state, companies operating in the North Star State were required to sign the No-Fault Certificate Form. This form stated that:

These companies formally agreed to provide Minnesota no-fault benefits to their non-Minnesota insureds if those insureds are involved in an accident while driving their vehicle in Minnesota.

This means that all drivers and passengers involved in a car accident with a driver from Minnesota will be covered.

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Getting Windshield Coverage

Accidents are not the only thing that the right car insurance provider can help you pay for. Damage to your windshield is also covered under certain provisions within your standard car insurance policy. This is important to know, considering that in Minnesota:

It is illegal to drive a vehicle if the windshield is discolored or cracked in a way that limits the driver’s clear view.

If you are found to be in violation, you may be subject to citations and fees. When it’s time to repair your windshield, you have the right to choose who provides the service. Keep in mind, though, that if you choose a vendor who is not preferred by your car insurance provider, you might be stuck paying the difference in cost.

Getting High-Risk Auto Insurance

The more tickets, accidents, and claims you have, the higher your rates will be. That is just an unavoidable fact of driving, no matter which state you live in. If you live in the North Star State, though, you could be required to obtain an SR-22 form if you are determined to be a high-risk driver.

While Minnesota does not require the SR-22 form, you may be required to obtain a certificate of insurance to reinstate your license if it has been revoked. The North Star State also has the Minnesota Automobile Insurance Plan, which is meant to provide insurance for drivers who cannot obtain car insurance on the open market due to the risk that they pose to car insurance providers.

Getting Low-Cost Insurance

Drivers who pose a greater risk to insurance companies’ bottom lines are not the only ones who have specific protections under Minnesota state laws and provisions. In the Land of 10,000 Lakes, the Minnesota Automobile Insurance Plan also helps low-income drivers find a fair price on car insurance.

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Automobile Insurance Fraud

Because Minnesota is a no-fault state, the chances of insurance fraud being committed in the North Star State are increased. In fact, according to Consumer Watchdog:

No-fault’s mandatory payments create incentives to increase medical treatment and encourage fraud for those people without other forms of health coverage.

This increase in fraudulent claims is one reason why car insurance rates in no-fault states like Minnesota are generally higher. Some opponents of the no-fault system also believe that limiting a person’s responsibility for their poor driving habits encourages them to behave recklessly behind the wheel, since the financial responsibility for causing an accident will not fall on them as the at-fault driver.

Reckless drivers or people without health insurance are not the only ones who may be responsible for committing fraud. According to III, fraud may also be committed by:

- Applicants for insurance

- Policy-holders

- Third-party claimants

- Doctors or other healthcare professionals who might inflate the billing costs

- Repair shops and mechanics who claim damage in excess of what is actually present or who claim previous damages on a new claim

These are just some of the people or vendors who might be liable for committing insurance fraud. To be safe, you should always keep track of all transactions and billing invoices after a car accident. Penalties for committing insurance fraud could include:

- 90 days in jail and a fine of up to $1,000 for a charge of fraud where the value is up to $500

- Up to 5 years in jail and a fine of no more than $10,000 for a charge of fraud where the value is between $1,000 and $5,000

- Up to 10 years imprisonment and a fine of up to $20,000 for a charge of fraud where the value is between $5,000 and $35,000

- 20 years in prison and a fine of up to $100,000 for a charge of fraud where the value is more than $35,000

If you think that you have been the victim of fraud, you can visit the Minnesota Attorney General’s website and report it to the authorities.

Statute of Limitations

The statute of limitations on claims of insurance fraud begins the moment a loss occurs and lasts 7 years. Fraud cases are not the only things that have a statute of limitations, though. There is also a statute of limitations on how long you have to report a claim after a traffic accident or incident.

NOLO states that if you are injured in a car accident, you have a two-year statute of limitations to file a claim, which begins to run from the date of the accident. Wrongful death claims have a three-year statute of limitations that also begins to run from the date of the accident.

Specific Minnesota Driving Laws

Minnesotans aren’t serious all of the time, as the law that states that you can not cross state lines with a duck on your head proves. The North Star state also has a strange law that says that all bathtubs must have feet. You are also not allowed to park your elephant on Main Street. Okay, so the last one was just an old Minnesota urban legend.

A law that is not an urban legend states that it is perfectly legal to drive in reverse without wearing a seatbelt. It is illegal, though, to drive down Lake Street in Minneapolis in a red car. Zipper-merging is not the law, though, but it is strongly recommended by MnDOT. There are many other general traffic regulations in Minnesota, which can be found in more detail on the Minnesota Legislature website.

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

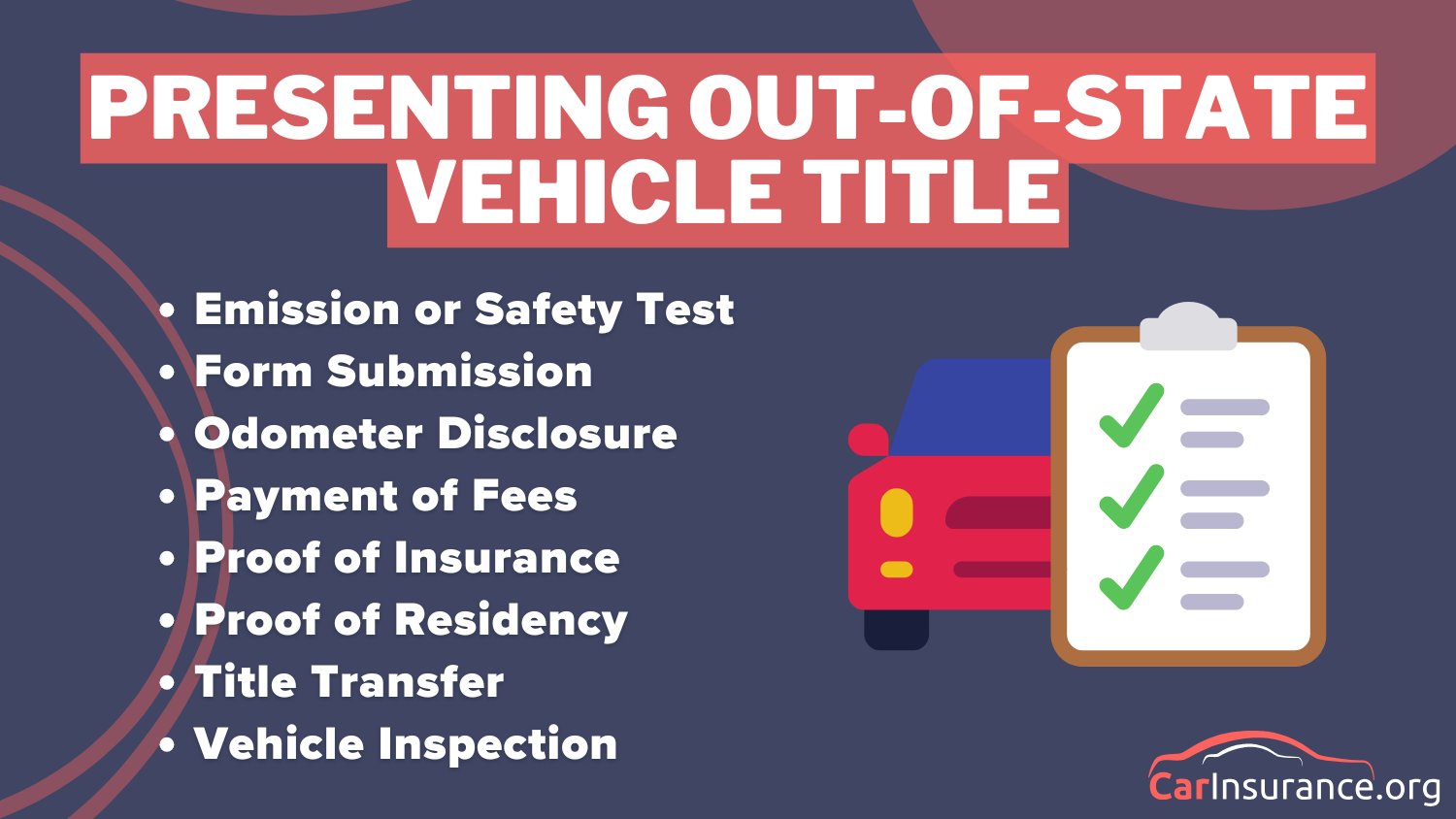

Vehicle Licensing Laws in Minnesota

Minnesota does not just have general traffic regulations or car insurance laws on the books. The North Star State also has laws that determine the requirements for registering your vehicle in the Land of 10,000 Lakes. Some of these requirements may include the following:

- Presenting the foreign state title of a vehicle previously registered or purchased out-of-state

- Providing an odometer reading

- Presenting your driver’s license or state-issued ID

- And presenting proof of insurance

The North Star State also participates in the REAL ID program, which requires that you bring specific forms of identification when seeking your Minnesota driver’s license or state ID with the REAL ID endorsement attached to it. The Minnesota DVS website has a printable version of the REAL ID identification and accepted documents list.

Penalties for Driving Without Insurance

Just like there are penalties for driving with an expired tag in Minnesota, there are also penalties for driving without car insurance. For your first offense, you could be fined between $200 and $ 1,000 or be required to perform community service. You could also face up to 90 days in prison.

Why risk it, though, when you have all of the information you need right here to make an educated decision that could save you money when purchasing your car insurance policy? Should you get pulled over or need to prove that you have car insurance to register a vehicle, the North Star State allows you to use the following ways to prove your financial responsibility:

- A printed car insurance ID card

- An e-insurance card that can be presented on your cell phone or other handheld devices

In addition to laws governing vehicle registration requirements in Minnesota, the North Star State also regulates who can become a licensed driver.

Teen Driver Laws

Most teenagers can’t wait to experience the freedom that the open road provides. In Minnesota, though, that freedom has limits. Some of these limits dictate the hours that teenagers can be on the road. For instance, for the first 6 months of licensure, a teenager can not drive between the hours of 12 a.m. and 5 a.m.

There are also passenger limits for the first 6 months, which limit the number of passengers in a teenage driver’s car to one person under the age of 20. For the second 6 months, that limit increases to 3. Cell phone use and texting are also completely illegal for drivers under 18, except when making a 911 call.

Any underage driver who is caught drinking and driving is also subject to the regular DWI laws and sanctions mandated by the state of Minnesota. Teenagers in Minnesota can obtain their Instructional Permit at age 15 with parental consent. This type of license requires that a licensed adult over 21 be present in the vehicle when it is in operation.

At 16 years of age, a Minnesota teen can apply for a Provisional License. They must have 40 hours of logged supervised driving time prior to applying. The person who signed the driving log must also have completed a 90-minute supplemental parent-child curriculum, unless the teenager has logged 50 hours of practice driving.

A full, unrestricted driver’s license becomes an option upon the teenager’s 18th birthday. This is, of course, if the teenager does not have any legal restrictions on their driving record, such as suspensions or revocations.

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Driver’s License Renewal Procedures

Teen drivers are not the only ones with restrictions on obtaining and maintaining their driver’s licenses in the North Star State. The general population is required to renew their Minnesota driver’s license every four years and must do so in person each time, as they must prove they have adequate vision to operate a motor vehicle.

Older drivers are also subject to the same renewal regulations. The Minnesota Office of Traffic Safety offers a four-hour Defensive Driving Training Course for people over age 55 at various locations.

The Minnesota Department of Public Safety offers tips and considerations for older drivers and their family members who may be concerned about driving safety in Minnesota.

The Hartford also offers tips for talking to aging family members about the possibility that they might not be the safest when they are behind the wheel. Getting older doesn’t mean that you become a bad driver. It just means that, as the Minnesota Office of Traffic Safety points out:

Older drivers are morelike.y to get killed or injured because they are more likely to become physically fragile and less able to recover from injuries.

The Minnesota Office of Traffic Safety also notes that one out of every four traffic fatalities in Minnesota is a person over the age of 65, so be careful out there.

The Procedure of Car Insurance for New Residents in Minnesota

Teenage drivers and older Minnesotans are not the only ones subject to specific license renewal procedures for driving laws. New residents of the North Star State must also meet their own requirements to become legally sanctioned drivers in Minnesota. According to the Minnesota Department of Human Services, you are considered a resident of Minnesota based on the following criteria:

- If you are physically present in the state

- If you reside in Minnesota voluntarily and do not maintain a home elsewhere, and have done so for 30 days

The Minnesota Department of Public Safety then requires that you obtain insurance before registering your vehicle in the North Star State and that you pass a knowledge test regarding Minnesota’s driving laws if you have a valid license from another state. As a new resident, you will need to:

- Complete the Minnesota Driver’s License Application

- Present one primary and one secondary form of identification

- Present your license from your previous state of residence

- Pass the vision test

If you would like to study the Minnesota driving laws before attempting to obtain your driver’s license in the North Star State the Minnesota DVS has an online driver’s handbook to help you.

Now that you know how to get your driver’s license and register your vehicle, it is time for us to help you understand how to keep them in good standing. This means understanding just what types of things the driving and safety laws in Minnesota prohibit.

Negligent Operator Treatment System

Unlike most states, Minnesota does not operate under a point system. Instead, the North Star State depends on the Minnesota Safe and Sober Campaign. Just because the North Star State does not mean that you can drive like a maniac.

The Minnesota Department of Driver and Vehicle Services will still suspend your driver’s license if you get too many moving violations in a specified amount of time. The Minnesota DVS considers the following as major violations:

- Reckless Driving

- Not carrying enough insurance

- Driving under the Influence (DUI)

Minnesota DVS also considers the following as non-moving violations but still ticket-worthy offenses:

- Inattentive driving