Best Car Insurance in New Mexico for 2025 [Check Out the Top 10 Companies]

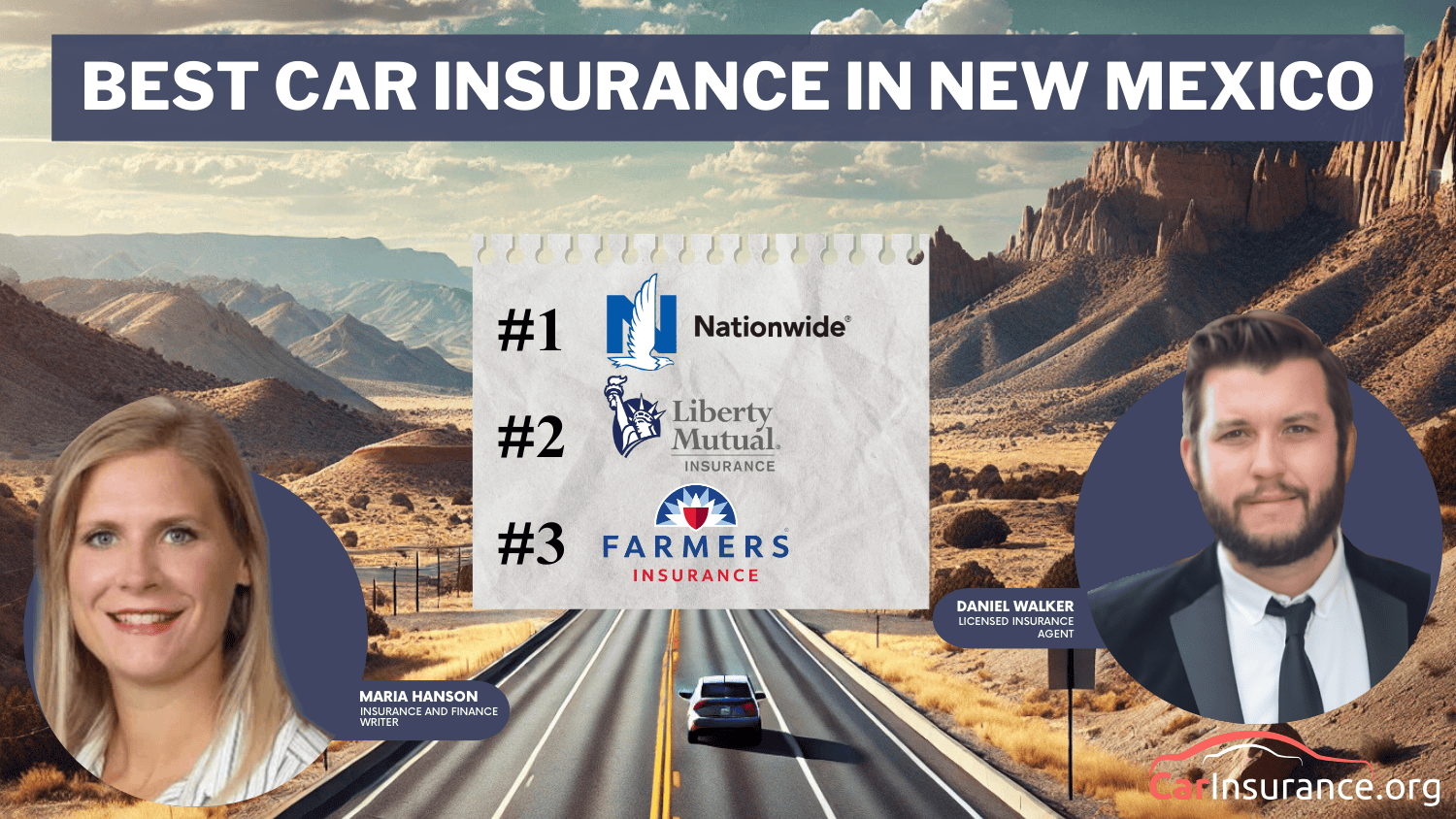

Nationwide, Liberty Mutual and Farmers offer the best car insurance in New Mexico. Nationwide has the most affordable rates at $96/month, along with great financial strength and bundling discounts. Discover our list of the best car insurance companies in New Mexico below.

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Eric Stauffer

Licensed Insurance Agent

Eric Stauffer is an insurance agent and banker-turned-consumer advocate. His priority is educating individuals and families about the different types of insurance coverage. He is passionate about helping consumers find the best coverage for their budgets and personal needs. Eric is the CEO of C Street Media, a full-service marketing firm and the co-founder of ProperCents.com, a financial educat...

Licensed Insurance Agent

UPDATED: Mar 13, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident car insurance decisions. Comparison shopping should be easy. We are not affiliated with any one car insurance company and cannot guarantee quotes from any single provider.

Our insurance industry partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about car insurance. Our goal is to be an objective, third-party resource for everything car insurance related. We update our site regularly, and all content is reviewed by car insurance experts.

3,792 reviews

3,792 reviewsCompany Facts

Full Coverage in New Mexico

A.M. Best Rating

Complaint Level

Pros & Cons

3,792 reviews

3,792 reviews 3,072 reviews

3,072 reviewsCompany Facts

Full Coverage in New Mexico

A.M. Best Rating

Complaint Level

Pros & Cons

3,072 reviews

3,072 reviewsThe best car insurance in New Mexico comes from Nationwide, Liberty Mutual, and Farmers. Nationwide is the top choice, offering strong financial stability, bundling discounts up to 20%, and full coverage starting at $96 per month.

Liberty Mutual has fast claims processing and flexible coverage but at higher rates. Farmers offer discounts, including safe driving and multi-policy savings. Knowing how to lower your car insurance cost helps drivers find affordable options.

Our Top 10 Company Picks: Best Car Insurance in New Mexico

| Company | Rank | Bundling Discount | A.M. Best | Best For | Jump to Pros/Cons |

|---|---|---|---|---|---|

| #1 | 20% | A+ | Strong Financials | Nationwide |

| #2 | 25% | A | Quick Claims | Liberty Mutual |

| #3 | 20% | A | Insurance Discounts | Farmers | |

| #4 | 25% | A+ | Comprehensive Coverage | Allstate | |

| #5 | 10% | A+ | Technology Integration | Progressive | |

| #6 | 25% | A++ | Competitive Pricing | Geico | |

| #7 | 25% | A | Family Focus | American Family | |

| #8 | 13% | A++ | Innovative Discounts | Travelers | |

| #9 | 17% | B | Wide Availability | State Farm | |

| #10 | 10% | A++ | Military Focus | USAA |

Comparing auto insurance from New Mexico providers ensures the best rates without sacrificing coverage. Ready to find cheaper car insurance coverage? Enter your ZIP code to begin.

- Car insurance in New Mexico is affected by theft rates and traffic

- Multi-policy and good driver discounts help lower car insurance costs

- Nationwide is the top pick for affordable rates and financial stability

#1 – Nationwide: Best for Strong Financial Stability

Pros

- Strongly Financial Strength: Our Nationwide car insurance review shows the company holds an A+ rating from A.M. Best, giving New Mexico drivers confidence in claim reliability.

- Budget-Friendly Full Coverage: With rates starting at $96 per month, Nationwide provides one of the most affordable full coverage options in the state.

- Fantastic Bundle Discounts: The drivers of New Mexico will have a budget-friendly option since they save around 20% by bundling auto and home insurance.

Cons

- Expensive Minimum Coverage: Minimum coverage costs go at $76 per month, and Nationwide offers the most expensive minimum coverage of car insurance in New Mexico.

- No Rideshare Coverage: Uber and Lyft drivers in New Mexico may need to look elsewhere, as Nationwide does not offer rideshare insurance in the state.

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#2 – Liberty Mutual: Best for Quick Claims Processing

Pros

- Efficient Claims Processing: Liberty Mutual handles claims quickly, helping drivers get back on the road faster.

- Bundling Discounts: Policyholders can save up to 25% by bundling auto, home, or life insurance, reducing the cost of New Mexico car insurance.

- Customizable Coverage: Add-ons like accident forgiveness and better car replacement provide extra protection.

Cons

- High Rates: Minimum coverage starts at $56/month, and full coverage costs $161/month—higher than many competitors.

- Limited Telematics Discounts: Liberty Mutual lacks strong pay-per-mile or usage-based savings. Find our more in this Liberty Mutual car insurance review.

#3 – Farmers: Best for Insurance Discounts

Pros

- Multiple Discounts: Farmers offer safe driving, multi-policy, and good student discounts. If you’re looking for more discounts, check out this Farmer’s car insurance review.

- Rideshare Coverage: Farmers provides rideshare coverage for Uber and Lyft drivers in N. However, this coverage is not part of the mandatory New Mexico car insurance requirements.

- Strong Financial Stability: Farmers has an A rating from A.M. Best, ensuring reliable coverage and claims processing.

Cons

- High Rates: Farmers charge $46 per month for minimum coverage and $131 per month for full coverage, which is more than Progressive or Geico.

- Limited Digital Features: Farmers lack advanced online tools compared to Progressive and Geico.

#4 – Allstate: Best for Comprehensive Coverage

Pros

- Comprehensive Coverage: Allstate offers accident forgiveness and roadside assistance, making it a strong choice according to our Allstate car insurance review.

- Significant Bundling Discounts: New Mexico drivers can save up to 25% by combining their auto and home insurance policies.

- Financially Secure Provider: Holding an A+ A.M. Best rating, Allstate is a reliable option for policyholders seeking long-term stability.

Cons

- High Minimum Coverage Cost: Allstate’s minimum coverage costs $56 monthly, which is higher than other providers’ and above the average cost of car insurance in New Mexico.

- Inconsistent Customer Service: While many drivers are satisfied, some have reported delays in claims processing and billing concerns.

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#5 – Progressive: Best for Technology Integration

Pros

- Low-Cost Coverage: Progressive offers the cheapest New Mexico car insurance quotes for minimum coverage, starting at $30 monthly.

- Snapshot Savings: The usage-based Snapshot program from Progressive lowers rates for safe drivers.

- Comprehensive Coverage Options: Progressive has gap, rideshare, and customized parts coverage.

Cons

- Limited Bundling Discount: While Progressive offers 10% off for bundling, Geico, Liberty Mutual, and American Family offer 25% off.

- Customer Support: Our Progressive car insurance review shows that some policyholders have reported delays in processing claims and varying support.

#6 – Geico: Best for Competitive Pricing

Pros

- Affordable Minimum Coverage: With rates starting at $32 per month, Geico is one of the cheapest minimum coverage options in New Mexico.

- Strong Financial Stability: Geico holds an A++ rating from A.M. Best, ensuring reliability in handling claims.

- Rideshare Insurance: Geico provides coverage for Uber and Lyft drivers, as highlighted in our Geico car insurance review.

Cons

- Limited In-Person Support: Geico operates mainly online and by phone, reducing in-person service options.

- Fewer Coverage Add-Ons: Geico offers less customization than Allstate or Farmers, which may be a drawback when comparing New Mexico car insurance rates.

#7 – American Family: Best for Family-Oriented Policies

Pros

- Significant Bundling Savings: New Mexico drivers can save up to 25% by bundling auto and home insurance.

- Affordable for Multi-Car Families: American Family’s competitive pricing benefits households with multiple vehicles.

- Reliable Customer Support: Our American Family car insurance review highlights its strong, personalized customer support.

Cons

- Higher Full Coverage Costs: With rates averaging $103 per month, American Family is pricier than competitors like Geico and Progressive for full coverage.

- Limited State Availability: American Family has solid New Mexico auto insurance but operates in fewer states, which may be a drawback for frequent movers.

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#8 – Travelers: Best for Innovative Discounts

Pros

- Exclusive Discounts: Our Travelers car insurance review highlights exclusive discounts for sponsors’ privileges, such as the IntelliDrive safe driving bonus and accident-free track records.

- Financial Stability: With an A++ A.M. Best rating, Travelers guarantees high-quality financial support and secure claims processing in New Mexico.

- Competitive Full Coverage Rates: Travelers offer full coverage at just $91 per month, providing affordable, balanced protection.

Cons

- Limited Local Agents: Travelers work with independent agents. Thus, the services provided are not standardized.

- Higher Minimum Coverage Cost: At $32 monthly, Travelers is pricier than Progressive and State Farm, making it less ideal for budget shoppers.

#9 – State Farm: Best for Wide Availability

Pros

- Affordable Minimum Coverage: At just $24 per month, our State Farm car insurance review shows it offers the lowest minimum coverage rates in New Mexico.

- Strong Local Presence: With plenty of agents statewide, State Farm makes it easy for drivers to get in-person assistance.

- Great Discounts for Young Drivers: Teens and students can lower costs with good student and accident-free discounts.

Cons

- Weaker Financial Rating: Compared to other New Mexico car insurance companies, State Farm has a lower B rating than A.M. Best, trailing behind Geico and Travelers (A++).

- Limited Policy Add-Ons: Unlike Allstate or Liberty Mutual, State Farm does not provide options like gap insurance or accident forgiveness.

#10 – USAA: Best for Military Families

Pros

- Exclusive Military Discounts: USAA offers exclusive discounts to military members, veterans, and their families, which makes coverage more affordable.

- Low-Cost Rate: Our USAA auto insurance review reveals that the company offers the lowest full coverage rates in the state at $65 per month.

- Highly Rated Support: Policyholders appreciate USAA’s excellent claims service and customer support, consistently earning high satisfaction ratings.

Cons

- Restricted Membership: USAA is only available to military members, veterans, and their families, so not everyone can qualify.

- Limited In-Person Assistance: USAA operates mainly online, which may be inconvenient for some.

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

New Mexico Insurance Coverage and Rates

The average New Mexico car insurance cost varies by provider and coverage level, with minimum coverage costing less than full coverage. Geico offers the lowest rates, $32 per month for minimum coverage and $90 for full coverage, while Liberty Mutual charges the highest, $56 and $161 per month.

New Mexico Car Insurance Monthly Rates by Provider & Coverage Level

| Insurance Company | Minimum Coverage | Full Coverage |

|---|---|---|

| $56 | $158 | |

| $36 | $103 | |

| $46 | $131 | |

| $32 | $90 | |

| $56 | $161 |

| $76 | $96 |

| $30 | $86 | |

| $24 | $69 | |

| $32 | $91 | |

| $23 | $65 |

When choosing the right policy, drivers should consider claims handling, customer service, discounts, and prices. The right insurer can provide the best protection, allowing you to meet New Mexico auto insurance requirements.

For Uber and Lyft drivers, rideshare insurance coverage fills in the gap between personal and commercial policies. Otherwise, drivers might have to bear the brunt of high out-of-pocket costs, but companies like Geico and Farmers provide this coverage.

Best New Mexico Car Insurance Discounts

The top car insurance companies in New Mexico offer significant discounts, such as multi-policy and good driver discounts. Companies like Allstate, American Family, and Farmers provide these savings.

Car Insurance Discounts From the Top Providers in New Mexico

| Insurance Company | Available Discounts |

|---|---|

| Multi-Policy Discount, Safe Driver Discount, Anti-Theft Device Discount, New Car Discount | |

| Multi-Policy Discount, Safe Driver Discount, Defensive Driving Course Discount, Good Student Discount | |

| Multi-Policy Discount, Safe Driver Discount, Good Student Discount, Alternative Fuel Discount | |

| Multi-Policy Discount, Defensive Driving Discount, Good Student Discount, Military Discount | |

| Multi-Policy Discount, Good Student Discount, Anti-Theft Device Discount, New Car Discount |

| Multi-Policy Discount, Safe Driver Discount, Accident-Free Discount, Defensive Driving Discount |

| Multi-Policy Discount, Snapshot Discount, Good Student Discount, Homeowner Discount | |

| Multi-Policy Discount, Safe Driver Discount, Defensive Driving Discount, Good Student Discount | |

| Multi-Policy Discount, Safe Driver Discount, Hybrid/Electric Vehicle Discount, New Car Discount | |

| Multi-Policy Discount, Safe Driver Discount, Good Student Discount, Military Discount |

Geico and USAA offer discounts for specific groups, including military members and safe drivers. These discounts help reduce premiums for qualifying customers.

To learn how to lower your car insurance cost, consider discounts for anti-theft devices or good student status. State Farm and Progressive offer such savings.

New Mexico Auto Insurance Discounts by Company

| Insurance Company | Anti-Theft | Bundling | Good Driver | Good Student | UBI |

|---|---|---|---|---|---|

| 10% | 25% | 20% | 10% | 10-20% | |

| 10% | 20% | 15% | 10% | 5-20% | |

| 15% | 20% | 15% | 10% | 5-15% | |

| 10% | 15% | 22% | 15% | 5-20% | |

| 10% | 25% | 20% | 10% | 5-30% |

| 10% | 25% | 20% | 10% | 10-40% |

| 5% | 20% | 20% | 10% | 5-30% | |

| 15% | 25% | 20% | 15% | 5-30% | |

| 10% | 20% | 23% | 10% | 5-20% | |

| 15% | 20% | 30% | 10% | 5-30% |

Compare car insurance rates in New Mexico across providers to find the best deal. Customizing coverage based on available discounts ensures you’re getting the best value.

Key Takeaways for New Mexico Driving

New Mexico’s desert highways and roads present unique challenges to motorists. Albuquerque and Las Cruces have thousands of accidents yearly, increasing the likelihood of accidents.

New Mexico Accidents & Claims per Year by City

| City | Accidents per Year | Claims per Year |

|---|---|---|

| Albuquerque | 15,200 | 12,500 |

| Clovis | 1,700 | 1,400 |

| Farmington | 1,800 | 1,500 |

| Hobbs | 1,500 | 1,200 |

| Las Cruces | 3,100 | 2,600 |

| Rio Rancho | 2,800 | 2,300 |

| Roswell | 1,900 | 1,600 |

| Santa Fe | 2,500 | 2,100 |

The most frequent types of accidents in New Mexico are rear-end crashes, fender crashes, single-vehicle crashes, side crashes, and thefts of cars. These accidents usually occur due to abrupt braking, diversions, or weather-related factors; thus, multiple claims are made.

If you are in an accident, filing a car insurance claim after an accident is necessary to be compensated. It will allow you to repair your vehicle and have peace of mind returned.

5 Most Common Auto Insurance Claims in New Mexico

| Claim Type | Description |

|---|---|

| Rear-End Collision | A vehicle crashes into the back of another, often due to tailgating or sudden stops. |

| Fender Bender | Minor accident typically involving low-speed impacts, often in parking lots or at stoplights. |

| Single Vehicle Accident | Involves only one vehicle, such as hitting a tree, pole, or guardrail due to weather, distraction, or loss of control. |

| Side-Impact Collision | Also known as a T-bone accident, occurs when the side of a vehicle is hit, usually at intersections. |

| Theft Claim | A claim filed for a stolen vehicle or parts, including catalytic converters, tires, or entire cars. |

To have the best coverage, obtaining quotes for car insurance in New Mexico will assist you in discovering the most favorable rates. Whether driving in the city or on remote roads, being prepared for risks ensures your safety.

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

New Mexico Car Insurance Premiums

In 2014, New Mexicans spent $920 annually on car insurance, about 2.76% of their average per capita disposable income (DPI) of $33,358. This is below the national average of $981.77.

| Particulars | 2012 | 2013 | 2014 |

|---|---|---|---|

| Income | $32,526 | $31,573 | $33,358 |

| Full Coverage Average Premiums | $866 | $889 | $920 |

| Percentage of Income | 2.66% | 2.82% | 2.76% |

From 2012 to 2014, car insurance costs in New Mexico rose by about $60. New Mexico auto insurance quotes are similar to those in neighboring states, with Utah’s premiums typically under $900.

Factors that affect the price of car insurance include claim sizes, repair costs, and medical expenses. The dry climate and occasional flash floods or hail also impact premiums.

New Mexico Auto Insurance Premiums

| Category | Grade | Explanation |

|---|---|---|

| Average Claim Size | B+ | Claim sizes are moderate, influenced by repair costs and medical expenses. |

| Weather-Related Risk | B | New Mexico has a dry climate with minimal storm risks, but occasional flash floods and hail can impact claims. |

| Traffic Density | B- | Moderate traffic congestion in Albuquerque and Santa Fe leads to occasional higher accident rates. |

| Vehicle Theft Rate | C+ | Higher-than-average vehicle theft rates, especially in urban areas like Albuquerque. |

| Uninsured Drivers Rate | C | A significant number of drivers in New Mexico are uninsured, leading to higher premium costs. |

Traffic congestion in cities like Albuquerque, a high vehicle theft rate, and the number of uninsured drivers further drive up insurance costs.

Finding the Cheapest Companies in New Mexico

Finding the top vehicle insurance companies in New Mexico is not a simple endeavor, but with the right strategy, you can select the one that best meets your needs and budget.

Follow these five simple steps to make an informed decision that meets your demands and budget.

- Research Top Providers: First, research the top car insurance companies in New Mexico to assess their reputation, financial strength, and coverage options.

- Compare Rates by Coverage: Compare rates from different providers, considering the average car insurance costs in New Mexico and how various levels of coverage impact the price.

- Use Available Discounts: To reduce your premium, seek out available discounts, such as safe driving or bundling policies.

- Consider Special Coverage Needs: If you have special coverage needs, such as rideshare or accident forgiveness, be sure to select a provider that offers these options.

- Review Claims Process and Customer Service: Investigate how each company handles claims and its customer service reputation to ensure a smooth experience when needed.

Following these steps will help you find the best car insurance companies in New Mexico that offer the right coverage at the best price. Compare providers to ensure you’re getting the best deal.

Car Insurance New Mexico Minimum Coverage Policy

In New Mexico, drivers must carry $10,000 for property damage, $25,000 for injuries to one person, and $50,000 for injuries to all individuals in an accident. Uninsured/underinsured motorist coverage is required but can be waived with a signed form.

Opting out of uninsured motorist coverage may not be wise. With 20.3% of drivers uninsured, being involved in a collision with an uninsured motorist could result in considerable out-of-pocket payments.

Car insurance in New Mexico provides crucial coverage for accidents, theft, and weather-related damage, with various discounts available to help drivers save on premiums.

Brandon Frady Licensed Insurance Agent

Consider higher coverage limits to better protect yourself. Compare auto insurance quotes in New Mexico and review how the states rank on uninsured drivers to see how New Mexico compares.

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Top Car Insurance Providers in New Mexico

The best car insurance in New Mexico includes Nationwide, with rates starting at $96 per month, followed by Liberty Mutual and Farmers. Nationwide offers affordable rates, financial stability, and a 20% bundling discount. Liberty Mutual and Farmers provide quick claims and various discounts.

Understanding the different types of car insurance coverage is key. New Mexico car insurance agents can help you choose the best coverage, from liability to comprehensive options. See if you’re getting the best deal on car insurance by entering your ZIP code.

Frequently Asked Questions

What variables influence auto insurance rates in New Jersey?

Rates are influenced by your driving history, car model, location, coverage type, and age. Compare car insurance rates by state here.

Is car insurance more expensive in New Jersey than in other states?

Yes, New Jersey has higher rates due to dense traffic, accidents, and costly repairs. See how much you’ll pay for car insurance by entering your ZIP code into our free comparison tool.

What is the minimum coverage required in New Jersey?

New Jersey requires $15,000 in bodily injury liability per person, $30,000 per accident, and $5,000 in property damage.

Does New Jersey require personal injury protection (PIP)?

Yes, New Jersey mandates Personal Injury Protection (PIP) for medical expenses in accidents, regardless of fault. Look at our GoAuto car insurance review for more insights.

In New Jersey, is it possible to reduce my auto insurance rates?

Yes, by bundling policies, maintaining a clean driving record, choosing a higher deductible, or qualifying for discounts. You can get instant car insurance quotes from top providers by entering your ZIP code.

Are there discounts available for New Jersey car insurance?

Yes, discounts on auto insurance in NM are available for safe drivers, bundling policies, paying in full, or having anti-theft devices.

How does credit score affect car insurance rates in New Jersey?

Insurers may use your credit score, with higher scores leading to lower premiums. Explore our how car insurance works for more insights.

What is the average cost of car insurance in New Jersey?

The average annual cost is around $1,500, but rates vary based on individual factors. See how much you’ll pay for car insurance by entering your ZIP code into our free comparison tool.

Is it legal to drive without insurance in New Jersey?

No, driving without insurance is illegal; penalties include fines and license suspension.

Can my car insurance policy be canceled in New Jersey?

Yes, your policy can be canceled for non-payment, fraud, or policy violations. Read more in our complete guide to car insurance fraud.