Best Car Insurance in South Dakota (2025)

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Eric Stauffer

Licensed Insurance Agent

Eric Stauffer is an insurance agent and banker-turned-consumer advocate. His priority is educating individuals and families about the different types of insurance coverage. He is passionate about helping consumers find the best coverage for their budgets and personal needs. Eric is the CEO of C Street Media, a full-service marketing firm and the co-founder of ProperCents.com, a financial educat...

Licensed Insurance Agent

UPDATED: Mar 13, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident car insurance decisions. Comparison shopping should be easy. We are not affiliated with any one car insurance company and cannot guarantee quotes from any single provider.

Our insurance industry partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about car insurance. Our goal is to be an objective, third-party resource for everything car insurance related. We update our site regularly, and all content is reviewed by car insurance experts.

18,154 reviews

18,154 reviewsCompany Facts

Full Coverage in SD

A.M. Best Rating

Complaint Level

Pros & Cons

18,154 reviews

18,154 reviews 13,283 reviews

13,283 reviewsCompany Facts

Full Coverage in SD

A.M. Best Rating

Complaint Level

Pros & Cons

13,283 reviews

13,283 reviews 3,072 reviews

3,072 reviewsCompany Facts

Full Coverage in SD

A.M. Best Rating

Complaint Level

Pros & Cons

3,072 reviews

3,072 reviewsUninsured Motorists 7.70%

Home to Mount Rushmore National Memorial, the Black Hills National Forest, Crazy Horse Memorial, and hundreds of miles of rolling prairies, the breathtaking state of South Dakota encompasses over 77,000 square miles and hosts more than two million visitors each year.

Often referred to as the land of “infinite variety” because of its diverse terrain, South Dakota ranks as the 16th-largest state in the U.S., but it is the fifth-least-densely populated state in the country.

So whether you’re one of the two million-plus visitors enjoying a camping vacation in your RV in the great plains or you’re a long-time resident of the Blizzard State just trucking through an intense winter, one thing is for sure: you’re going to need South Dakota car insurance.

But just because you need car insurance, doesn’t mean it’s going to be an easy thing to get your hands on especially with hundreds of car insurance companies out there ready and willing to take your money.

Don’t get discouraged yet. In just a few minutes, we can give you all the information you’ll need to make an educated decision about which car insurance company to go with, while simultaneously giving you the best car insurance rate possible.

In this guide, we’ll cover South Dakota car insurance cost, coverage, culture, laws, risks, dangers of the road, and much more.

Let’s cover South Dakota car insurance rates and coverage first.

Ready to start comparing rates? Use our FREE comparison tool. It’s easy just enter your ZIP code to get started.

What Are the South Dakota Car Insurance Coverage Requirements & Rates?

We’re not here to waste your time, so we want to start with the basics: how much does car insurance cost? Could you be paying too much for your existing car insurance policy? What kind of coverage do you need to have?

To help you better understand the answers to these questions, let’s take a look at South Dakota’s car culture.

What Is South Dakota’s Car Culture Like?

According to The Hartford, if you spend any time driving in South Dakota, you’ll soon find wide-open spaces and otherworldly landscapes. You’ll also find cities that feel more like small towns, vast farms and ranches, and a diverse culture shaped by waves of immigration and by the Native American tribes who have been living on this land for many centuries and whose members still make up a significant portion of the state’s population.

Since the state of South Dakota is very large and also under-populated, many roads are empty and service locations like grocery stores, gas stations, and hotels are spread out. South Dakota drivers rely heavily on their vehicles to get them from one side of the state to the other.

Harsh winters, farmland, and rough terrain might also play into what kind of vehicle a South Dakota driver prefers. The Ford F-150 is the most popular vehicle in the state.

What Are the South Dakota Minimum Coverage Requirements?

It is South Dakota state law that every driver must have car insurance. But what kind of car insurance do drivers need to have? Why even car insurance in the first place?

To make it short and sweet, car insurance helps prevent drivers who have been in an accident from going bankrupt.

South Dakota is an at-fault car accident state. This means that any driver who causes an accident is financially responsible to cover any accident-related costs, i.e., damages to a vehicle or building or medical bills.

But let’s get right to the point — here are South Dakota’s minimum liability insurance requirements:

- $25,000 liability coverage for bodily injury or death of one person in an accident caused by the owner/driver of the insured vehicle

- $50,000 liability coverage for total bodily injury or death liability in an accident caused by the owner/driver of the insured vehicle

- $25,000 liability coverage for property damage per accident caused by the owner/driver of the insured vehicle.

The amounts listed above are the amounts of coverage you get with your policy — not what you pay to your insurance company. However, these amounts may not be enough to cover all costs in the case of a serious accident.

Remember that liability coverage doesn’t apply to your own injuries or vehicle damage after a South Dakota car accident. You’ll need different (additional) coverage for if you’re involved in a car accident and no one else’s coverage applies to your losses.

You can (and in some situations should) carry more coverage to protect you in case a serious crash results in significant car accident injuries and vehicle damage. Once your bodily injury coverage and property damage liability coverage policy limits are exhausted, you are personally on the financial hook. Higher insurance limits can help protect your assets in the event of a serious crash.

We always like to say that having more insurance is better insurance. After all, no one wants to pay thousands of dollars worth of medical and vehicle damage bills.

What Are the Forms of Financial Responsibility?

Now that we’ve got your attention, let’s talk about forms of financial responsibility. It sounds sort of serious, doesn’t it?

A form of financial responsibility is a form showing you have proof of insurance. It also shows you can and will be held responsible when or if you cause an accident.

When a law enforcement officer pulls you over, you must be able to show your license, registration, and proof of insurance. If you cannot provide proof of insurance or you are caught driving without insurance, you will be penalized.

Not only is it the law to have car insurance, but it’s also the law that all drivers must carry proof of insurance in their car or on their person at all times while in a vehicle.

Acceptable forms of proof of insurance are:

- Valid liability insurance ID cards

- Copy of your current car’s insurance policy

- Valid insurance binder (a temporary form of car insurance)

- Electronic insurance ID cards

According to the South Dakota Department of Public Safety Motor Vehicle Division, a conviction for driving without proof of insurance is considered a “Class 2 Misdemeanor” punishable by 30 days in jail, a $100 fine, or both.

In addition, the offender’s driver’s license will be suspended for at least 30 days, and up to one year.

What Percentage of Income is Premiums?

When we’re talking about an insurance premium, we’re talking about the amount of money you will pay for your insurance policy over one year. When we’re talking about your premium as a percentage of your income, we want to know how much of your income you will spend on car insurance in one calendar year.

In 2014, South Dakota residents spent an average of $744.28 per year on their car insurance policy.

South Dakota’s average income per capita in the same year (2014) was $41,825.00. Drivers in South Dakota spend an average of 1.78 percent of their total disposable income a year on car insurance alone.

Countrywide, Americans pay an average of $981 per year for their car insurance policy, so South Dakotans spend about $240 less than the average driver spends on insurance in the U.S.

From 2012 – 2014, South Dakota car insurance increased in price by about $55. When we look at surrounding states, North Dakota drivers paid $768.09 in 2014 for an insurance premium and Nebraska drivers paid $805.99 for the same policy in the same year. Keep in mind that since this data was polled in 2014, rates are expected to be a little higher today.

What Are the Average Monthly Car Insurance Rates in SD (Liability, Collision, Comprehensive)?

The data from the table below is pulled directly from the National Association of Insurance Commissioners.

South Dakota Average Monthly Car Insurance Costs (2023)

| Coverage Type | Monthly Cost |

|---|---|

| Liability | $26 |

| Collision | $127 |

| Comprehensive | $113 |

| Combined | $190 |

As we’ve said above, having minimum insurance means you are a law-abiding citizen. However, it doesn’t mean you won’t be stuck paying for costs from accidents that exceed your minimum insurance policy.

Having better insurance doesn’t cost you as much as you might think and some insurance providers might even cut you a break on your rate if you have better coverage. It’s a win-win.

Are you looking for even more insurance? Check out these additional coverage options below.

What Are the Additional Liability Coverage Options in South Dakota?

South Dakota Car Insurance Additional Coverage

| Coverage Type | 2019 | 2021 | 2022 |

|---|---|---|---|

| Medical Payments (MedPay) | 72 | 74 | 76 |

| Uninsured/Underinsured Motorist (UUM) | 5 | 6 | 7 |

The two types of additional coverage listed in the table above are not required by the state of South Dakota. So why are we mentioning them?

7.70 percent of motorists in South Dakota are uninsured. This means the state is ranked 42nd in the U.S. for uninsured drivers.

While this number isn’t particularly high, it’s still a frightening thought that uninsured drivers are living in South Dakota.

Have you ever wondered what happens when you get into a car accident with an uninsured driver?

When you get into an accident with an uninsured driver and it was caused by them, they were at-fault and technically owe you money to fix your car and pay for your medical bills.

However, while paying for these medical bills and/or vehicle damages, this uninsured driver will likely file for bankruptcy and you will never see a dime of the money that is rightfully owed to you.

Having uninsured/underinsured motorist coverage takes care of you if you ever get into an accident with an uninsured driver.

Okay, so now that we’ve got additional liability coverage insurance out of the way, let’s talk about loss ratio percentage.

Loss ratio percentage is often a way we can measure a company’s financial strength. It also tells us how many filed claims were paid by an insurance company.

A claim is a form you fill out with your insurance company after you get into an accident.

If a company has a loss ratio percentage that is too high (over 100 percent) the company might be at risk of going bankrupt because they are paying for too many filed claims. Some of these claims could be fraudulent. If an insurance company goes bankrupt, you might end up paying for incurred accidental damages on your own.

On the other hand, if a company has a low loss ratio percentage (under 50 percent), then that company might be scamming its clients. Think about it. If you’re an insurance company that pays for less than half of claims, you’re not a very helpful insurance company.

Take a look at the chart above. All of these types of coverages have great loss ratio percentages — not too high and not too low.

Are There Add-Ons, Endorsements, & Riders?

Are you interested in even more insurance? Medpay and uninsured liability insurance are just two of the many options you can add to a basic policy.

Click on the links below to learn more about each type of car insurance.

- Guaranteed Auto Protection (GAP)

- Personal Umbrella Policy (PUP)

- Rental Reimbursement

- Emergency Roadside Assistance

- Mechanical Breakdown Insurance

- Non-Owner Car Insurance

- Modified Car Insurance Coverage

- Classic Car Insurance

- Pay-As-You-Drive or Usage-Based Insurance

Add one or add them all — the more insurance you have, the more money you’ll save in the long run.

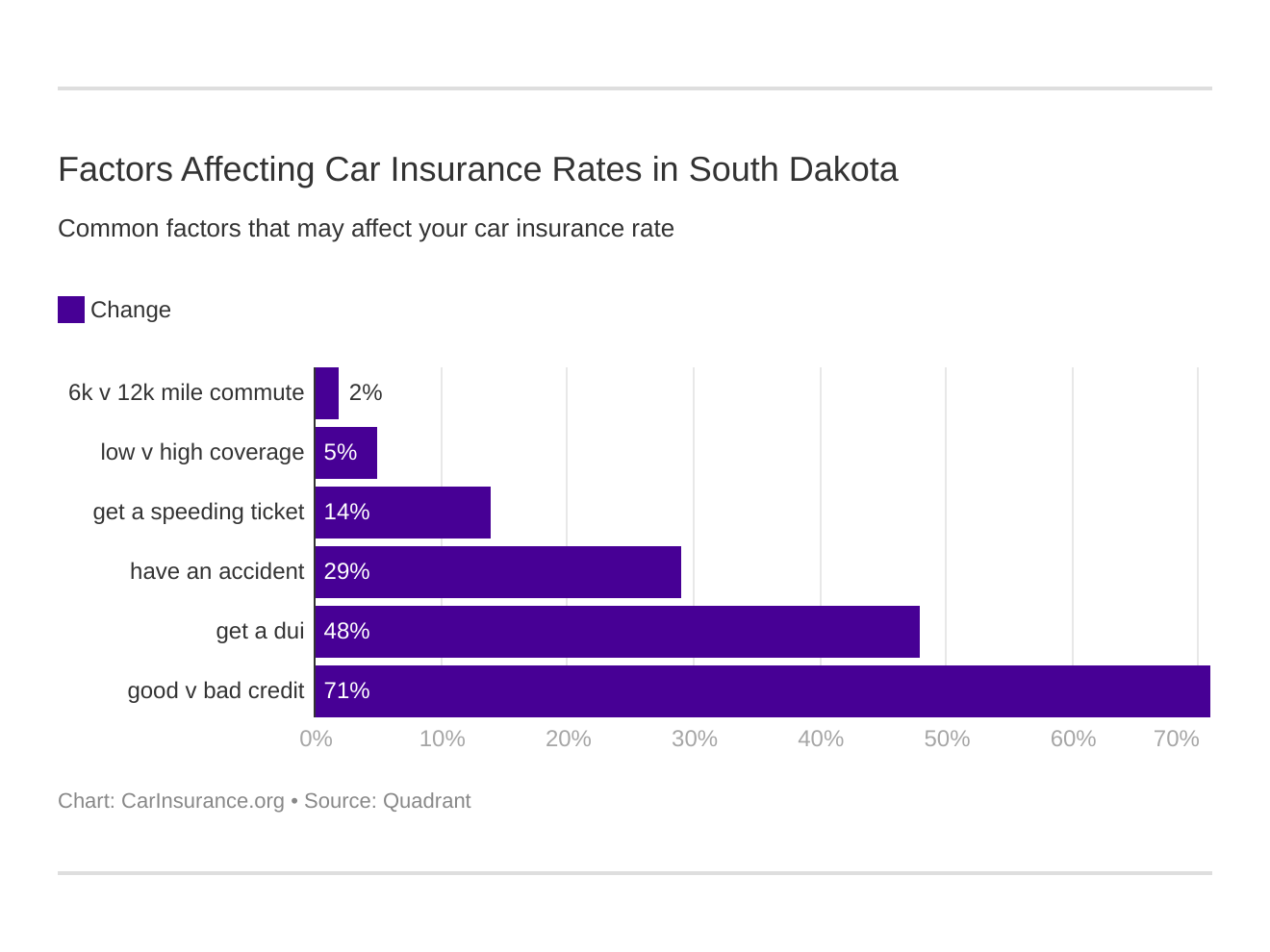

Up next: what factors affect your car insurance rate?

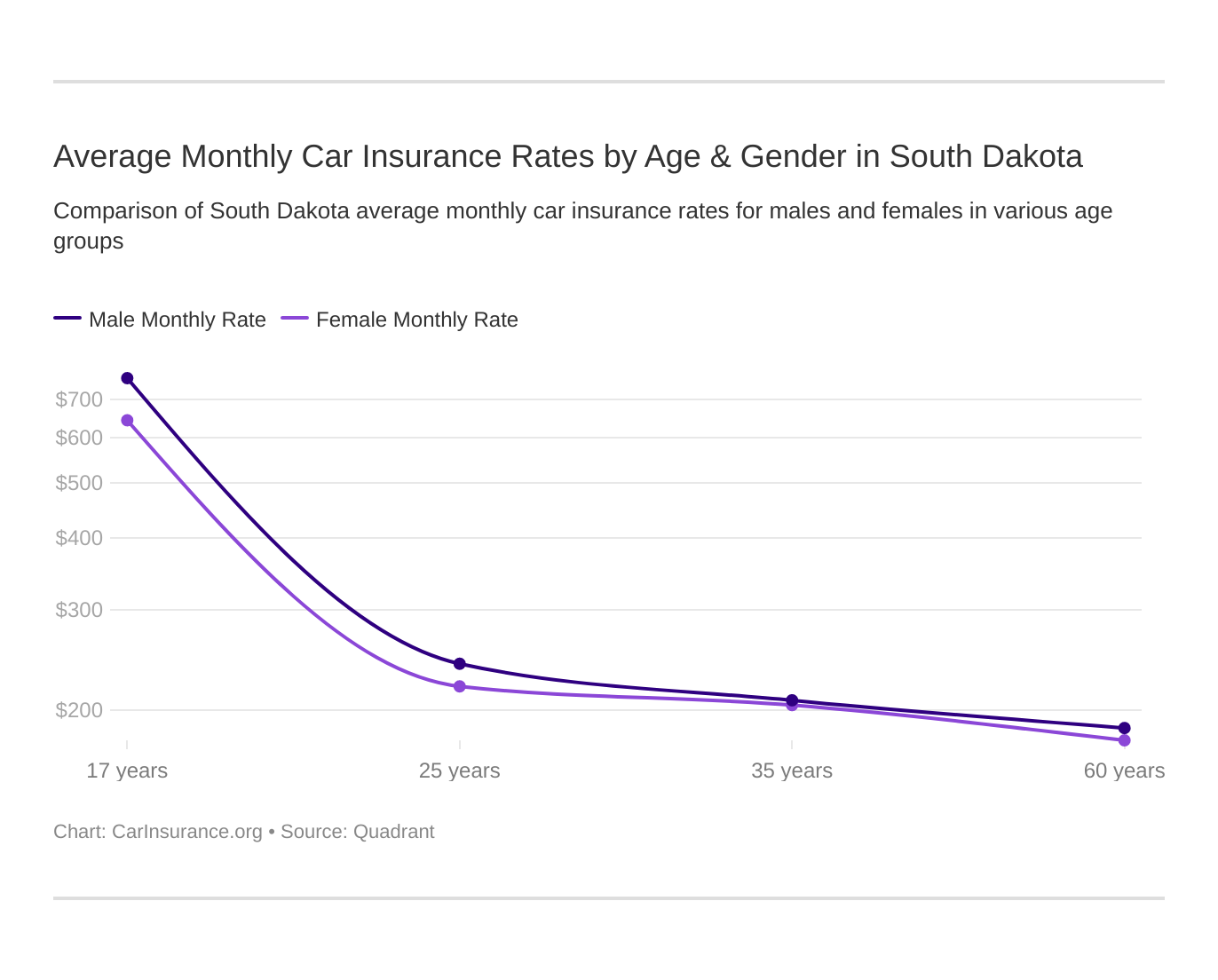

What Are the Average Monthly Car Insurance Rates by Age & Gender in SD?

Did you know factors like gender, marital status and age can affect your car insurance rate?

Car insurance companies know that the younger you are, the less driving experience you have, which means you are more likely to be involved in a car accident.

South Dakota Car Insurance Monthly Rates by Provider, Age, & Gender

| Insurance Company | Age: 17 Female | Age: 17 Male | Age: 25 Female | Age: 25 Male | Age: 35 Female | Age: 35 Male | Age: 60 Female | Age: 60 Male |

|---|---|---|---|---|---|---|---|---|

| $850 | $1,015 | $233 | $255 | $206 | $211 | $182 | $195 | |

| $502 | $738 | $243 | $299 | $243 | $243 | $215 | $215 | |

| $677 | $813 | $232 | $255 | $218 | $222 | $187 | $198 | |

| $398 | $470 | $173 | $166 | $197 | $186 | $188 | $174 | |

| $677 | $813 | $232 | $255 | $218 | $222 | $187 | $198 |

| $644 | $732 | $225 | $235 | $179 | $177 | $148 | $152 | |

| $1,345 | $1,510 | $371 | $413 | $352 | $383 | $278 | $338 | |

| $321 | $412 | $146 | $164 | $134 | $131 | $113 | $113 |

Most people think men pay more for car insurance than women, but this is not the case. Women generally pay less for car insurance than men do because women are considered to be more responsible than men.

Even though it’s silly, South Dakota hasn’t created a law that bans gender-based car insurance rates.

The data from the table above is based on actual purchased coverage by the state population and includes rates for high-risk drivers and those who choose to purchase more than the state minimum as well as other types of coverage not required, such as uninsured/underinsured motorist, PIP, and MedPay.

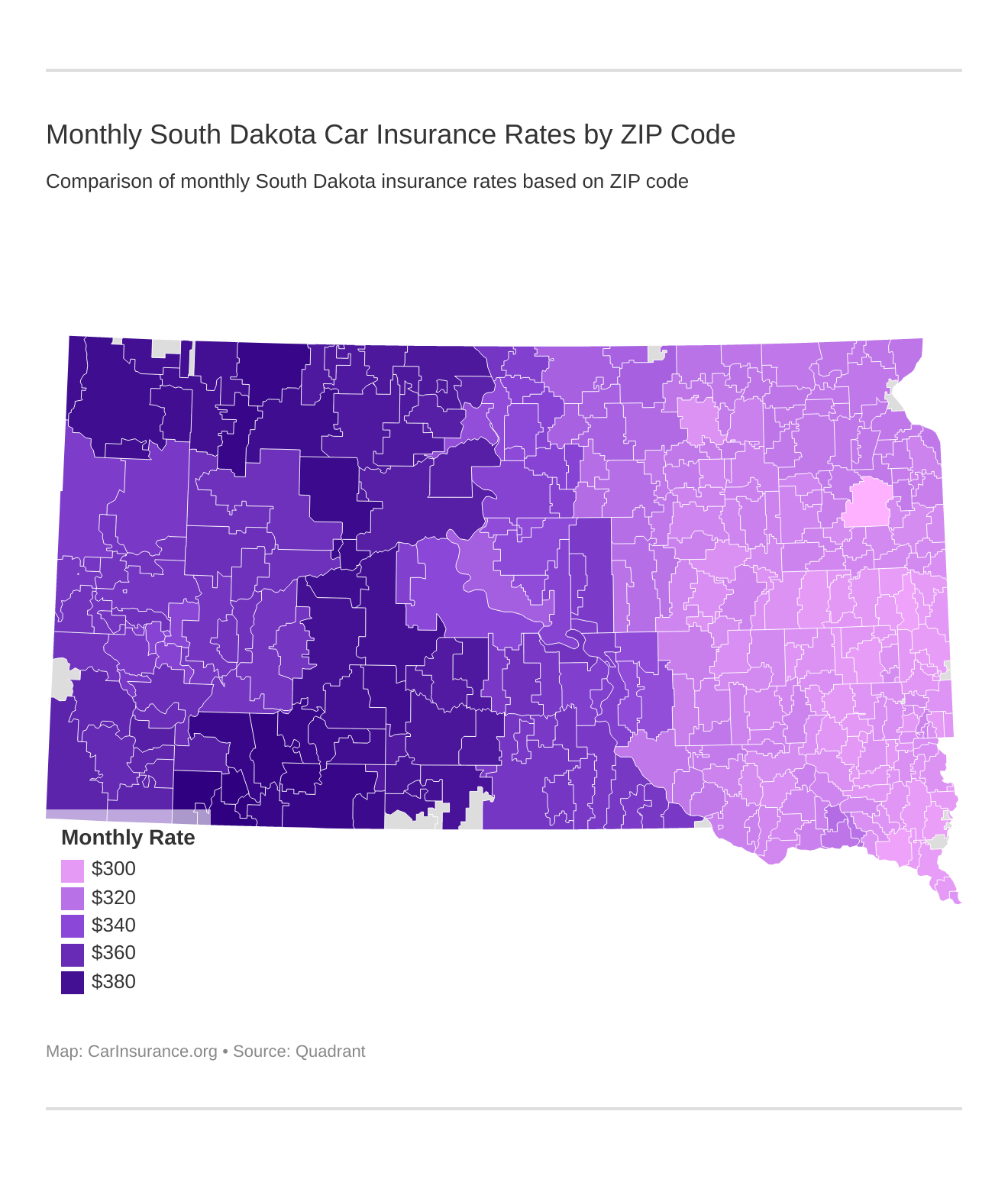

How does ZIP code affect auto insurance? Factors like traffic, crime, and claim frequency in your area all matter. Find out how your ZIP code compares against other zips in South Dakota.

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

What Are the Best South Dakota Car Insurance Companies?

With so many reputable car insurance companies out there to choose from, how do you pick just one to insure you? Most people choose a car insurance company based on their rate, but what are some other factors you should look out for when choosing an insurance company?

Customer service, complaint data, loss ratio, and AM Best ratings are all things to research when you are looking for a new insurance company.

We cover all of these things and more, up next.

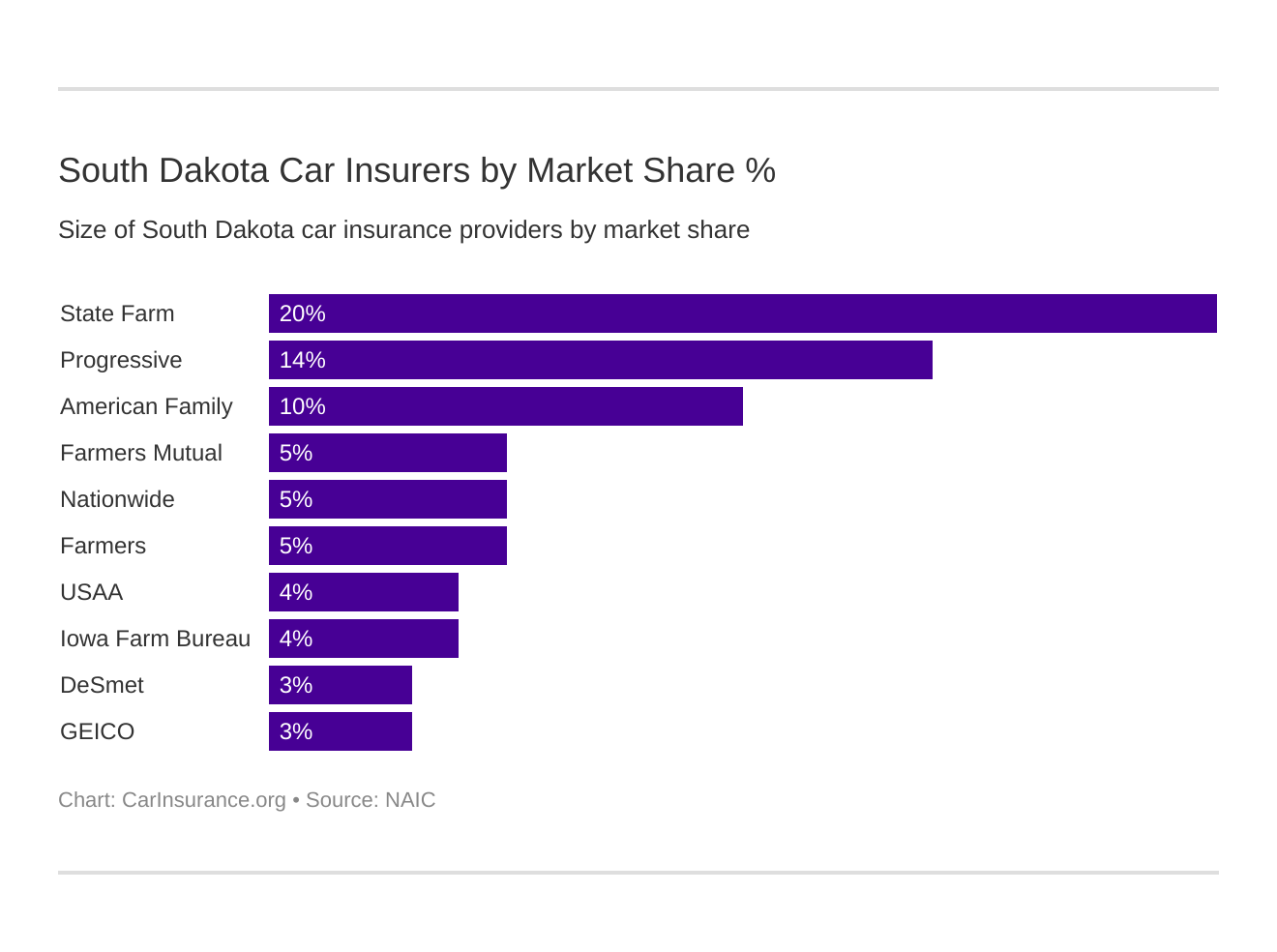

What Are the Financial Ratings For the 10 Largest Insurance Companies in South Dakota?

Car Insurance Company Ratings and Market Data

| Company | AM Best Rating | Direct Premiums Written | Loss Ratio | Market Share |

|---|---|---|---|---|

| A+ | $48,000 | 65% | 9% | |

| A | $52,467 | 59% | 10% | |

| A | $27,061 | 63% | 5% | |

| A++ | $17,660 | 74% | 3% | |

| A+ | $26,794 | 58% | 5% |

| A+ | $75,757 | 59% | 14% | |

| A | $45,000 | 61% | 8% | |

| B | $107,435 | 66% | 20% | |

| A++ | $38,000 | 62% | 7% | |

| A++ | $23,416 | 79% | 4% |

As you can see from the table above, these top 10 insurance companies have excellent AM Best ratings. Similar to loss ratio percentages, AM Best ratings are important because they measure a company’s financial strength.

Take note: all of these companies have good loss ratio percentages – they are all between 50 – 100 percent.

What Are the South Dakota Companies with the Best Ratings?

Standing on a curb in the middle of a busy intersection after you’ve been in an accident, trying to get ahold of someone from your insurance company to try to start filing a claim, the last thing you want to hear on the other end of the line is an unhelpful, annoyed voice.

Customer service satisfaction is everything when it comes to insurance companies — in fact, the only communication you might ever have with your insurance company is after you’ve been in a serious accident.

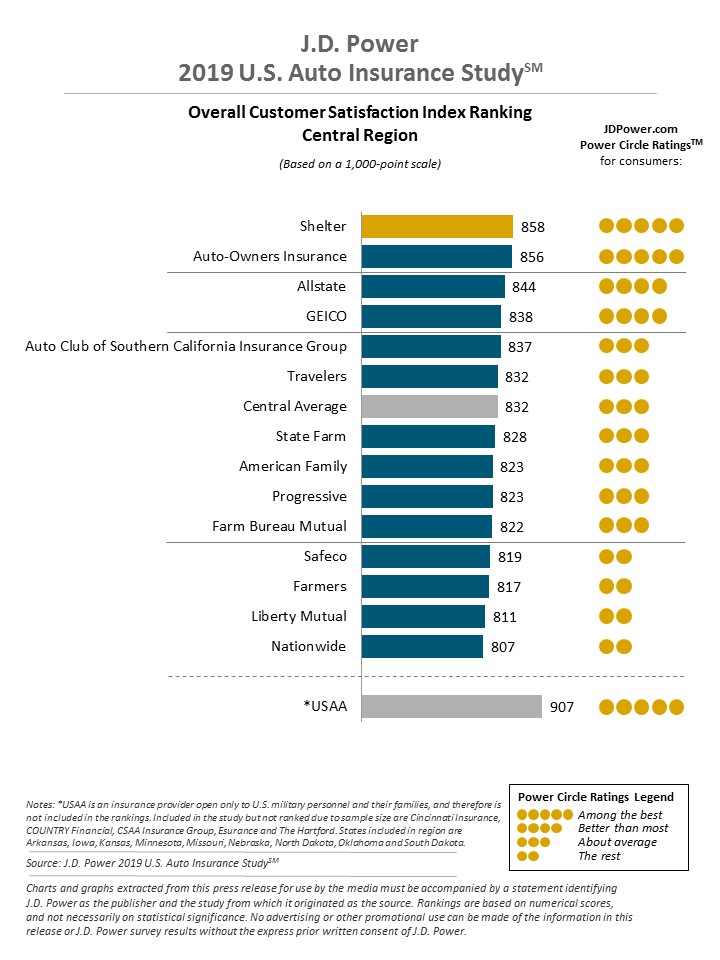

J.D. Power conducted a study ranking car insurance companies in South Dakota and the surrounding area. The 2019 U.S. Auto Insurance Study, now in its 20th year, examines customer satisfaction in five factors (in order of importance): interaction, policy offerings, price, billing process and policy information, and claims.

The study is based on responses from 42,759 auto insurance customers and was fielded from February – April 2019.

Except for USAA (a company that only services military members and their families), Shelter was ranked as the number one car insurance company in the central region of the U.S.

What Are the Complaint Statistics for the Top 10 Largest Insurance Companies in South Dakota?

All companies receive complaints, but how a company chooses to handle a complaint is what matters.

The data from the table below is brought to you from the NAIC.

South Dakota Insurance Company Complaint Statistics

| Company | National Median Complaint Ratio | Company Complaint Ratio 2022 | Total Complaints 2022 |

|---|---|---|---|

| 1 | 1.03 | 343 | |

| 1 | 0.79 | 73 | |

| 1 | 0 | 0 | |

| 1 | 1.1 | 19 | |

| 1 | 0.77 | 32 |

| 1 | 0.28 | 25 |

| 1 | 0.75 | 120 | |

| 1 | 1.08 | 50 | |

| 1 | 0.44 | 1482 | |

| 1 | 0.6 | 4 |

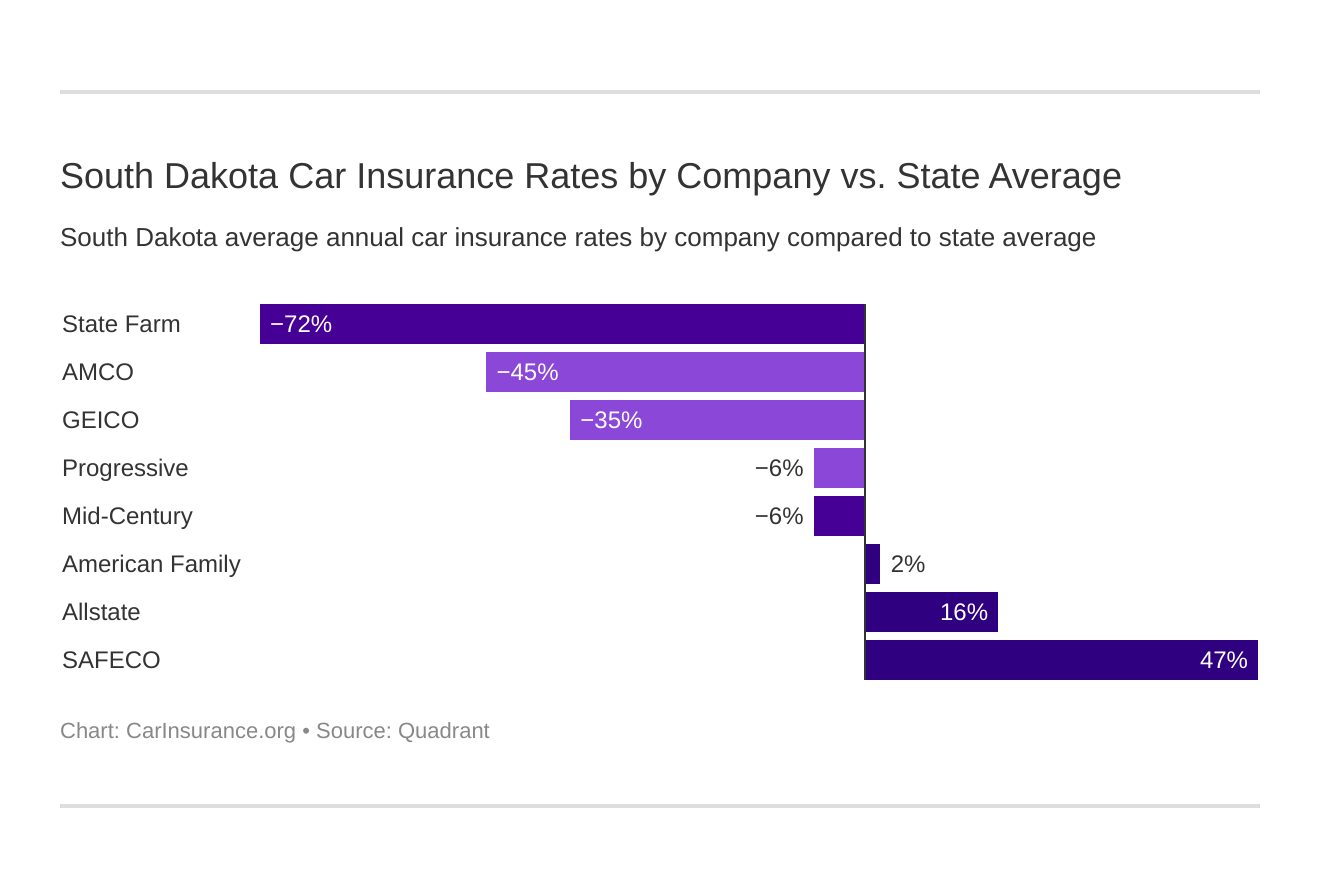

What Are the Cheapest Companies in South Dakota?

We’re not saying this is always going to be the case, but generally, State Farm Mutual Auto has the cheapest car insurance rate in South Dakota. See below.

Cheapest Car Insurance Companies in South Dakota

| Company | Monthly Rate | Compared to State | Percentage Compared to State |

|---|---|---|---|

| $393 | +$48.38 | +14.03% | |

| $337 | -$7.78 | -2.26% | |

| $317 | -$28.26 | -8.19% | |

| $244 | -$101.10 | -29.31% | |

| $342 | -$3.26 | -0.95% |

| $311 | -$33.48 | -9.71% | |

| $624 | +$279.97 | +81.43% | |

| $191 | -$153.50 | -44.52% |

Now that you know what companies carry the cheapest insurance premiums, it’s time to focus on more factors that can affect your rate.

What Are the Commute Rates by Companies in South Dakota?

Did you know that your average mileage rate per year can affect your car insurance rate?

Car Insurance Rates by Commute Distance in South Dakota

| Company | 10-mile Commute | 25-mile Commute |

|---|---|---|

| $384 | $403 | |

| $333 | $341 | |

| $313 | $313 | |

| $241 | $247 | |

| $624 | $624 |

| $227 | $227 |

| $311 | $311 | |

| $187 | $196 |

Sometimes, a car insurance company won’t base your rate on the average number of miles you drive per year. Take a look at Farmers, Liberty Mutual, Nationwide and Progressive. It doesn’t matter if you drive 10 miles per day or 25 miles per day, the rate is still the same.

What Are the Coverage Level Rates by Companies in South Dakota?

If you can afford the payment every month, having more car insurance is always considered better car insurance. Some car insurance companies will agree and will give you a better rate on your insurance premium if you have more insurance.

Look at the table below to see what we mean.

South Dakota Car Insurance Monthly by Coverage Level for Top Providers

| Company | Low | Medium | High |

|---|---|---|---|

| $382 | $393 | $405 | |

| $340 | $347 | $324 | |

| $300 | $310 | $329 | |

| $237 | $244 | $251 | |

| $613 | $623 | $636 |

| $215 | $226 | $241 |

| $304 | $309 | $322 | |

| $185 | $192 | $197 |

For just a few hundred dollars per year, you could have high coverage car insurance. Ask your insurance provider if they have discounts on insurance if you opt for more than what is required by the state.

What Are the Credit History Rates by Companies in South Dakota?

If you have great credit, you might be able to save some money on your car insurance policy.

South Dakota Car Insurance Monthly Rates by Provider & Credit Score

| Insurance Company | Good Credit | Fair Credit | Bad Credit |

|---|---|---|---|

| $326 | $375 | $469 | |

| $265 | $313 | $391 | |

| $286 | $299 | $373 | |

| $136 | $201 | $251 | |

| $426 | $542 | $678 |

| $190 | $216 | $271 |

| $276 | $299 | $374 | |

| $129 | $167 | $208 |

On the other hand, if you wreck your credit history, you might wind up paying hundreds of dollars more for your insurance. Car insurance companies charge more money to people with lower credit scores because they are considered to be high-risk clients.

According to Experian, in 2017, South Dakota’s average credit score was 700. This score is higher than the national average of 675.

Concerned about your low credit score? Don’t worry — as soon as you increase your score, your car insurance rate should significantly decrease.

What Are the Driving Record Rates by Companies in South Dakota?

You guessed it — your driving record is the most significant factor affecting your car insurance rate. Car insurance companies want to know if you’ve been in an accident, if you’ve gotten a DUI, if you’ve been given a traffic ticket, if you’re a reckless driver, and more. All of this is evaluated by your car insurance company after they’ve pulled your license.

Take a look at the drastic rate differences in the table below.

South Dakota Car Insurance Monthly Rates by Provider & Driving Record

| Insurance Company | Clean Record | One Ticket | One Accident | One DUI |

|---|---|---|---|---|

| $326 | $365 | $379 | $504 | |

| $245 | $280 | $360 | $464 | |

| $267 | $319 | $337 | $329 | |

| $154 | $154 | $260 | $408 | |

| $526 | $638 | $652 | $679 |

| $164 | $191 | $228 | $326 |

| $269 | $324 | $363 | $290 | |

| $179 | $191 | $203 | $191 |

While just one traffic ticket can cost you hundreds of dollars per year, one DUI might cost you thousands of dollars per year.

How Many Insurers Are There in South Dakota?

What is the difference between foreign and domestic insurance laws?

Number of Licensed Insurers in South Dakota

| Year | Foreign Insurers | Total Licensed Insurers | |

|---|---|---|---|

| 2019 | 16 | 834 | 850 |

| 2022 | 25 | 1,464 | 1,489 |

As you can see, there are many more foreign insurers than there are domestic. Domestic insurance laws are formed by the laws of the state of South Dakota and foreign insurance laws are formed under the laws of the U.S.

Keep in mind that the laws formed under the state of South Dakota might not apply to the rest of the U.S.

What Are the South Dakota State Laws?

It’s near impossible to know every state law by heart, so we decided to create this short section on some of South Dakota’s driving laws. Knowing the rules and laws of the road can help keep you safe and avoid accidents and traffic tickets while driving.

You might be thinking that you already know many of these, but since some laws change every day, it might be a great idea to refresh your memory.

First, let’s discuss car insurance laws.

What Are the Car Insurance Laws in South Dakota?

Have you ever wondered how car insurance laws are formed?

According to the NAIC, state laws have considerable influence on auto insurance. Each state determines the type of tort law and threshold (if any) that applies in the state, the type and amount of liability insurance required, and the system used for approval of insurer rates and forms.

Also, the states have enacted varying seat belt requirements, drunk driving laws, and maximum speed limits.

In South Dakota, car insurance rates/forms must be filed with and approved by the state insurance department before they can be used. This process holds a car insurance company accountable and does not allow them to increase a rate based on an unfair judgment.

Windshield Coverage

South Dakota and the central region of the U.S. is known for having wind and dust storms which can cause rocks and pebbles to fly up and hit your windshield.

Unfortunately for South Dakota drivers, there isn’t a law that states insurance companies must replace a broken windshield without some kind of deductible. However, if you have comprehensive coverage, your policy will likely cover “free” windshield repair.

If you do have to pay a deductible or go through insurance to get it repaired, here are some laws that you should be aware of:

- The consumer has the right to choose the repair vendor

- Aftermarket crash parts allowed with written notice in an estimate

High-Risk Insurance

If you get into a car accident or you’re caught drinking and driving, you may need to apply for SR22 insurance or high-risk insurance.

A South Dakota SR-22 car insurance certificate, or financial responsibility insurance form, is a document of proof that a driver is financially responsible for carrying the minimum car insurance as required by the state.

You may also be required to get SR-22 insurance if the following applies:

- You are a driver with unsatisfied judgments

- A driver whose licenses were revoked

- A driver who is under mandatory insurance supervision

- A driver with three or more mandatory insurance violation convictions on their driving record

When you get a DUI or a traffic ticket, your insurance company will raise your rates — unfortunately, the same thing happens when you are required to get high-risk insurance.

Low-Cost Insurance

At this time, South Dakota does not have a government-assisted car insurance program for low-income families. Hawaii, California and New Jersey are the only states in the country that do offer some sort of aid with car insurance for families who need it based on income levels.

Don’t be discouraged by this, because there are many more ways you can pinch pennies when it comes to your hefty insurance policy.

Ask your provider if you qualify for any of these discounts below:

- Good driver discount

- Home owner’s discount

- Military discount

- Multi-car discount

- Student discount

Remember to always shop around when looking for the best insurance rate.

Automobile Insurance Fraud in South Dakota

What is auto insurance fraud?

Auto insurance fraud is when you knowingly file a false claim or you stage an accident to collect insurance money.

According to the Insurance Information Institute, insurance fraud can be “hard” or “soft.” Hard fraud occurs when someone deliberately fabricates claims or fakes an accident.

Soft insurance fraud, also known as opportunistic fraud, occurs when people pad legitimate claims, for example, or, in the case of business owners, list fewer employees or misrepresent the work they do to pay lower premiums for worker’s compensation.

Auto insurance fraud and claim buildup added between $4.8 billion – $6.8 billion to closed auto injury claim payments in 2007, according to the Insurance Research Council’s November 2008 study, Fraud and Buildup in Auto Insurance Claims: 2008 Edition.

It’s difficult to commit insurance fraud, so it’s not something you can do by accident. Insurance fraud in the state of South Dakota is punishable by fines and jail time.

If you or someone you know would like to contact the South Dakota Division of Insurance, please give them a call at (605) 773-3563 or visit their office at the address listed below:

124 S Euclid Ave, Pierre, SD 57501

You can also email them by clicking here.

Statute of Limitations

The statute of limitations law tells you how much time you have to file a claim after an accident. This law protects both the insurance company and the driver.

In South Dakota, you have three years after you get into an accident to file a claim for personal injury and six years after to file a claim for property damage.

Unless you want to be stuck paying for medical bills and vehicle repair bills, we suggest you file a claim with your insurance company immediately after you are involved in an accident and/or natural disaster.

What Are the Vehicle Licensing Laws?

Every state has different licensing laws. Let’s start this section with REAL ID laws.

REAL ID

Have you ever heard of a REAL ID?

After October 2020, all South Dakota drivers will need a REAL ID to get through airport security and board a domestic flight. Drivers will also need a REAL ID when going through a federal building.

Note: You will not need a REAL ID to vote or to drive after October 2020.

What Are the Penalties for Driving Without Insurance?

Please don’t drive without car insurance. If you do and get caught, you’re looking at some serious penalties.

It doesn’t matter if it’s your first time being convicted of driving without car insurance or your 15th time — the penalties are always the same. Take a look below.

- Fine: $100 and/or 30 days imprisonment

- License suspension for 30 days to one year

- Filing proof of insurance (SR-22) with the state for three years from the date of conviction

Failure to file proof will result in the suspension of vehicle registration, license plates, and driver license. Always, always, always carry your proof of insurance card on you. We can’t stress it enough.

Acceptable forms of proof of insurance are:

- Copy of your current car’s insurance policy

- Electronic car insurance card

- Valid liability insurance ID cards

- Valid insurance binder (a temporary form of car insurance)

If you always have your cell phone on you, remember that you can show proof of insurance by logging onto your insurance account and pulling up your electronic insurance card.

What Are the Teen Driver Laws?

Did you know that South Dakota is the only state in the U.S. where you can get a driver’s permit at age of 14? Take a look at the table for more laws about teen driving below.

South Dakota Teen Driver Licensing Requirements

| License Type | Age Requirement | Holding Period | Supervised Driving Hours | Passenger Restrictions |

|---|---|---|---|---|

| Instruction Permit | 14 years | 275 days (180 days with Driver's Education) | 50 hours (10 at night, 10 in inclement weather) | N/A |

| Restricted Minor's Permit | 14 years and 6 months | 6 months | N/A | First 6 months: Immediate family only; After 6 months: 1 passenger under 21 outside of household |

| Operator's License | 16 years | Completion of Restricted Minor's Permit requirements | N/A | N/A |

Here are some laws and restrictions that are intended to keep young drivers safe while on the road.

South Dakota Teen Driver License Restrictions

| License Type | Nighttime Driving Restrictions | Passenger Restrictions | Minimum Age for Lifting Restrictions |

|---|---|---|---|

| Instruction Permit | 10 p.m. - 6 a.m. (unless accompanied by a parent/guardian) | N/A | N/A |

| Restricted Minor's Permit | 10 p.m. - 6 a.m. (unless driving to/from school, work, or church event) | First 6 months: Immediate family members only; After 6 months: One passenger under 21 outside of household | 16 years |

| Operator's License | None | None | N/A |

What Are the Driver’s License Renewal Procedures?

In the state of South Dakota, it doesn’t matter how old you are, you must renew your driver’s license every five years.

Proof of adequate vision is required at every renewal for those 65 and older and for those renewing their license in person.

All drivers may renew their license every other time online or by mail.

What Is the Procedure for New Residents?

If you are a new resident in the state of South Dakota, you must transfer your driver’s license within 90 days. If you have a Commercial Driver’s License (CDL) holder, you have 30 days.

But what happens if you are a nomad RV camper? Three states in the U.S. are considered to be RV or “nomad” friendly: Texas, Florida, and South Dakota.

Watch the video below to see how you can establish a nomadic residency in South Dakota.

If you are a new resident, you’re also going to need to let your provider know you will need South Dakota car insurance. Please be aware that some insurance providers don’t cover drivers in certain states.

Remember South Dakota’s minimum liability car insurance requirements are:

- $25,000 liability coverage for bodily injury or death of one person in an accident caused by the owner/driver of the insured vehicle

- $50,000 liability coverage for total bodily injury or death liability in an accident caused by the owner/driver of the insured vehicle

- $25,000 liability coverage for property damage per accident caused by the owner/driver of the insured vehicle

Negligent Operator Treatment System (NOTS)

According to NOLO, in South Dakota, “reckless driving” is a crime. The offense is defined as driving:

- “carelessly and heedlessly in disregard of the rights or safety of others,” or

- “without due caution and circumspection and at a speed or in a manner so as to endanger or be likely to endanger any person or property.”

In other words, reckless driving is operating a vehicle in a manner that poses a danger to other people or property. Careless driving is a Class 2 misdemeanor. Convicted motorists are looking at up to 30 days in jail and/or a maximum of $500 in fines.

The difference between reckless and careless driving is subtle. Generally, reckless driving involves the operation of a vehicle that’s dangerous, whereas more subtle instances of bad driving might be in the careless driving category.

What Are the South Dakota Rules of the Road?

The following information is brought to you from the IIHS.

Whether you’re just passing through on a vacation to see Mount Rushmore or you’re a resident in South Dakota, knowing the rules of the road can save your life and save you money in traffic tickets.

Keep reading as we discuss important driving rules in South Dakota.

Fault vs. No-Fault

South Dakota is an at-fault car accident state. This means any driver who causes an accident is financially responsible for covering the costs of damage repairs and medical bills resulting from that accident.

Because South Dakota is an at-fault state, it’s always better to have more insurance than what is legally required.

Seat Belt & Car Seat Laws

Click it or ticket! South Dakota has implemented the following seat belt and car seat laws for your safety.

South Dakota Seat Belt (Updated 2025)

| Category | Requirement |

|---|---|

| Effective Since | January 1, 1995 |

| Primary Enforcement | No (Only applies to passengers ages 5 to 17 in the front seat) |

| Secondary Enforcement | Yes (For drivers and passengers 18+ in the front seat) |

| Applicable Age/Seats | 5-17 years old (Front seat, primary enforcement) |

| 18+ years old (Front seat, secondary enforcement) | |

| First Offense Max Fine | $20 |

Children also need to be buckled up safely while in a moving vehicle.

South Dakota Seat Belt and Car Seat Laws

| Type of Car Seat Required | Age/Weight Requirement |

|---|---|

| Car Seat | Required for children 4 years and younger and weighing less than 40 pounds |

| Adult Seat Belt Permissible | Required for ages 5 through 17 and for all children 40+ pounds, regardless of age |

| Preference for Rear Seat | No legal preference stated in South Dakota law |

| Maximum Base Fine | $25 |

Break these laws, and you’ll have to pay $25 plus fees.

Have you ever wondered if it is against the law in the state of South Dakota to ride in the cargo area of a pickup truck? While riding in the back of a pickup truck is not illegal in South Dakota, please use caution if and when you choose to ride in one.

Keep Right or Move Over Laws

Keep right or move over laws are pretty self-explanatory, so we’ll make this section short and sweet.

In South Dakota, there aren’t any specific keep right or move over laws. You can drive in the left lane or the right as long as there aren’t any emergency vehicles trying to pass you.

AAA says state law requires drivers to reduce speed and vacate the lane closest to official emergency vehicles, including tow trucks and wreckers.

Speed Limit Laws

South Dakota has higher-than-average speed limits. See below for South Dakota’s maximum speed limits.

Speed Limit Laws in South Dakota

| Type of Roadway | Speed Limit |

|---|---|

| Rural Interstates | 80 mph |

| Urban Interstates | 80 mph |

| Other Limited Access Roads | 70 mph |

| Other Roads | 70 mph |

If you’re caught speeding, you’ll receive a fine and points on your record. Once your insurance company finds out about your speeding ticket, your rates will go up until the points fall off your record.

Ridesharing

If you need a ride, call a ridesharing company. If you want to drive for a ridesharing company, you’re going to need ridesharing insurance.

To see what car insurance companies offer ridesharing insurance in South Dakota, click here.

Automation on the Road

What is automation on the road?

The IIHS says that automation involves using radar, camera, and other sensors to perform parts or all of the driving task on a sustained basis instead of the driver. One example is adaptive cruise control, which continually adjusts the vehicle’s speed to maintain a set minimum following distance.

Features such as automatic braking, which acts as a backup if the human driver fails to brake, or blindspot detection, which provides additional information to the driver, aren’t considered automation under this definition.

South Dakota currently does not have any laws on vehicle automation, but you can check back with IIHS every so often to see if this has changed.

What Are the Safety Laws in South Dakota?

In this next section, we’ll talk about safety laws, including DUI laws, texting and driving laws, impaired driving laws, and much more.

DUI Laws

In 2017, there were 35 alcohol-impaired driving fatalities in South Dakota.

South Dakota DUI Laws

| Category | Details |

|---|---|

| Offense Name | Driving Under the Influence (DUI) |

| Standard BAC Limit | 0.08% |

| High BAC Limit | 0.17% |

| Look-Back Period | 10 years |

| Implied Consent Law | Drivers must submit to chemical testing if suspected of DUI. Refusal results in a 1-year license suspension. |

| Underage DUI | Drivers under 21 years old with a BAC of 0.02% or higher face fines, jail time, and license suspension. |

| Ignition Interlock Device (IID) | May be required for high BAC levels or repeat offenses. |

| 1st Offense | Class 1 Misdemeanor - Up to 1 year jail, $2,000 fine, 30 days - 1-year license revocation |

| 2nd Offense | Class 1 Misdemeanor - Up to 1 year jail, $2,000 fine, 1-year license revocation |

| 3rd Offense (within 10 years) | Class 6 Felony - Up to 2 years jail, $4,000 fine, 1-year license revocation |

| 4th Offense (within 10 years) | Class 5 Felony - Up to 5 years jail, $10,000 fine, 2-year license revocation |

| 5th+ Offense | Class 4 Felony - Up to 10 years jail, $20,000 fine, 3-year license revocation |

Unsure about the penalties for breaking one of these serious laws? See the table below.

South Dakota DUI Penalties

| Offense Number | License Suspension/Revocation | Imprisonment | Fine | Additional Penalties |

|---|---|---|---|---|

| First Offense | 30 days to 1 year | Up to 1 year | Up to $2,000 | Mandatory chemical dependency evaluation if BAC ≥ 0.17% |

| Second Offense | Minimum 1 year | Up to 1 year | Up to $2,000 | Participation in 24/7 Sobriety Program; mandatory chemical dependency evaluation |

| Third Offense | Minimum 1 year | Up to 2 years | Up to $4,000 | Classified as Class 6 Felony; mandatory chemical dependency evaluation |

| Fourth Offense | Minimum 2 years | Up to 5 years | Up to $10,000 | Classified as Class 5 Felony; mandatory chemical dependency evaluation |

| Fifth and Subsequent Offenses | Minimum 3 years | Up to 10 years | Up to $20,000 | Classified as Class 4 Felony; mandatory chemical dependency evaluation |

Drunk driving is no joke in South Dakota. Break this law just one time and you’ll be looking at prison time, license suspension, and will most likely have to pay thousands of dollars in fines.

Marijuana-Impaired Driving Laws

In the state of South Dakota, if you are under 21 years old, there is a zero-tolerance policy for driving while using THC and metabolites.

If you’re over the age of 21 and you’re using drugs of any kind while driving, you can be penalized for impaired driving.

Distracted Driving Laws

According to AAA, texting while driving is prohibited. In some cities, including Aberdeen and Rapid City, texting while driving is a standard offense. Additionally, in some cities, including Box Elder, handheld cell phone use is prohibited.

South Dakota's cell phone use laws

| Provision | Details |

|---|---|

| Hand-Held Device Ban | No statewide prohibition on the use of hand-held devices while driving. |

| Ban for Young Drivers | Drivers holding a learner's permit or intermediate license are prohibited from using any cell phone, whether hand-held or hands-free, while driving. |

| Texting While Driving Ban | All drivers are prohibited from texting while driving. |

| Enforcement | Texting while driving is enforced as a secondary offense, meaning a driver must be stopped for another violation before being cited for texting. |

| Enforcement | Texting while driving is enforced as a secondary offense, meaning a driver must be stopped for another violation before being cited for texting. |

What Should I Know About Driving in South Dakota?

Now that we’ve discussed car insurance laws, South Dakota driving laws, and rules of the road, it’s time to get into some of the risks and dangers of the road.

In this section, we will talk about important topics like vehicle theft, road fatality rates, traffic congestion, and South Dakota commute statistics. First up, let’s go over vehicle theft statistics.

Is There Vehicle Theft in South Dakota?

The table below shows the most popular types of vehicles stolen. The year listed is the most popular model stolen.

Most Stolen Vehicles in South Dakota (2023 Report)

| Make/Model | Year of Vehicle | Thefts |

|---|---|---|

| Chevrolet Pickup (Full Size) | 1994 | 52 |

| Ford Pickup (Full Size) | 2001 | 47 |

| Chevrolet Impala | 2004 | 24 |

| Dodge Pickup (Full Size) | 2001 | 23 |

| Honda Civic | 1996 | 23 |

| GMC Pickup (Full Size) | 1994 | 22 |

| Chevrolet Malibu | 2003 | 20 |

| Chevrolet Pickup (Small Size) | 1997 | 17 |

| Ford Taurus | 2006 | 17 |

| Jeep Cherokee/Grand Cherokee | 1999 | 17 |

This next list is brought to you by the FBI. It shows the vehicle theft rate by the city in South Dakota in 2017. Find your city in the table below.

Vehicle Theft by City in South Dakota

| City | Motor Vehicle Thefts |

|---|---|

| Sioux Falls | 1,118 |

| Rapid City | 457 |

| Aberdeen | 39 |

| Brookings | 16 |

| Watertown | 24 |

| Mitchell | 35 |

According to this list, Sioux Falls had 469 reported vehicle thefts in 2017.

How Many Road Fatalities Occur in South Dakota?

Road fatalities often happen for a few different reasons. Understanding how they happen and what causes them can help you avoid them and help keep you safe while on South Dakota roads.

In this section, we’ll discuss fatality statistics: how they happen, where they happen, and what causes them to happen the most frequently.

But first, what is the most dangerous road in South Dakota?

What Is the Most Fatal Highway in South Dakota?

According to Geotab.com, the South Dakota portion of US-18 sees an average of around five crashes per year. South Dakota’s portion of US-18 is known as the Oyate Trail, named for the Tribal lands it passes.

To determine the most dangerous highway in each U.S. state, Geotab calculated a Fatal Crash Rate based on the annual number of road fatalities and fatal crashes according to the National Highway Traffic Safety Administration and then adjusted it for the average daily traffic counts provided by the Federal Highway Administration.

South Dakota’s portion of US-18 received an average crash rate of 1.4. It is considered to be the seventh-dangerous highway in the U.S.

Fatal Crashes by Weather Condition & Light Condition

Did weather or light conditions influence the fatal crash rate in South Dakota?

Fatal Crashes by Weather Condition and Light Condition in South Dakota

| Weather Condition | Daylight | Dark, but Lighted | Dark | Dawn or Dusk | Other / Unknown | Total |

|---|---|---|---|---|---|---|

| Normal | 56 | 2 | 36 | 2 | 2 | 98 |

| Rain | 1 | 0 | 3 | 1 | 0 | 5 |

| Snow/Sleet | 4 | 0 | 1 | 0 | 0 | 5 |

| Other | 1 | 0 | 0 | 0 | 0 | 1 |

| Unknown | 0 | 0 | 2 | 0 | 0 | 2 |

| TOTAL | 62 | 2 | 42 | 3 | 2 | 111 |

According to this table above, many of these crashes took place in broad daylight. Some happened in the dark, but for the most part, weather and light conditions did not affect the fatality rate.

Fatalities (All Crashes) by County

Here is a list showing traffic fatality rates by counties in South Dakota.

Traffic Fatalities by County in South Dakota

| County | Fatalities 2013 | 2014 | 2015 | 2016 | 2017 | Fatalities Per 100K Population 2013 | 2014 | 2015 | 2016 | 2017 |

|---|---|---|---|---|---|---|---|---|---|---|

| Aurora County | 4 | 1 | 3 | 2 | 0 | 147.22 | 36.4 | 109.41 | 72.73 | 0 |

| Beadle County | 2 | 1 | 4 | 0 | 2 | 10.95 | 5.51 | 22.03 | 0 | 11.02 |

| Bennett County | 1 | 1 | 1 | 0 | 0 | 28.89 | 29.11 | 29.4 | 0 | 0 |

| Bon Homme County | 2 | 2 | 0 | 3 | 0 | 28.64 | 28.65 | 0 | 43.05 | 0 |

| Brookings County | 7 | 4 | 2 | 4 | 3 | 21.17 | 12.01 | 5.92 | 11.75 | 8.76 |

| Brown County | 2 | 4 | 1 | 1 | 1 | 5.23 | 10.43 | 2.6 | 2.57 | 2.55 |

| Brule County | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 |

| Buffalo County | 0 | 0 | 0 | 1 | 0 | 0 | 0 | 0 | 49.21 | 0 |

| Butte County | 1 | 2 | 1 | 2 | 3 | 9.73 | 19.52 | 9.8 | 19.75 | 29.68 |

| Campbell County | 1 | 0 | 1 | 2 | 0 | 72.89 | 0 | 70.72 | 144.09 | 0 |

| Charles Mix County | 5 | 1 | 1 | 1 | 3 | 54.43 | 10.82 | 10.68 | 10.66 | 31.82 |

| Clark County | 3 | 1 | 0 | 1 | 0 | 82.9 | 27.46 | 0 | 27.47 | 0 |

| Clay County | 1 | 2 | 2 | 1 | 0 | 7.19 | 14.39 | 14.5 | 7.17 | 0 |

| Codington County | 2 | 5 | 2 | 2 | 2 | 7.18 | 17.89 | 7.17 | 7.13 | 7.12 |

| Corson County | 3 | 3 | 0 | 1 | 2 | 71.28 | 71.87 | 0 | 24.24 | 47.59 |

| Custer County | 1 | 3 | 5 | 2 | 1 | 11.9 | 35.58 | 59.17 | 23.21 | 11.51 |

| Davison County | 2 | 0 | 3 | 2 | 1 | 10.13 | 0 | 15.21 | 10.09 | 5.08 |

| Day County | 4 | 2 | 2 | 0 | 1 | 71.71 | 36.33 | 36.36 | 0 | 18.11 |

| Deuel County | 1 | 2 | 0 | 0 | 0 | 23.32 | 46.51 | 0 | 0 | 0 |

| Dewey County | 3 | 0 | 0 | 0 | 1 | 53.76 | 0 | 0 | 0 | 17.14 |

| Douglas County | 0 | 0 | 0 | 1 | 0 | 0 | 0 | 0 | 34.36 | 0 |

| Edmunds County | 0 | 3 | 6 | 2 | 2 | 0 | 75.51 | 150.11 | 50.79 | 51.03 |

| Fall River County | 2 | 1 | 1 | 0 | 2 | 29.35 | 14.61 | 14.71 | 0 | 29.91 |

| Faulk County | 0 | 0 | 2 | 1 | 0 | 0 | 0 | 86.73 | 43.01 | 0 |

| Grant County | 2 | 3 | 1 | 1 | 3 | 27.61 | 41.81 | 14.1 | 14.09 | 42.49 |

| Gregory County | 2 | 3 | 2 | 0 | 0 | 47.27 | 71.01 | 47.72 | 0 | 0 |

| Haakon County | 1 | 1 | 0 | 0 | 0 | 53.16 | 54.17 | 0 | 0 | 0 |

| Hamlin County | 1 | 1 | 1 | 1 | 0 | 16.99 | 16.92 | 16.85 | 17.01 | 0 |

| Hand County | 2 | 0 | 1 | 1 | 0 | 59.36 | 0 | 30.31 | 30.47 | 0 |

| Hanson County | 1 | 1 | 7 | 1 | 1 | 29.39 | 29.23 | 206.73 | 29.5 | 29.21 |

| Harding County | 1 | 1 | 1 | 0 | 2 | 79.37 | 80.26 | 78.8 | 0 | 161.03 |

| Hughes County | 1 | 0 | 1 | 1 | 3 | 5.74 | 0 | 5.7 | 5.69 | 16.98 |

| Hutchinson County | 1 | 1 | 2 | 0 | 0 | 13.9 | 13.84 | 27.52 | 0 | 0 |

| Hyde County | 0 | 0 | 0 | 3 | 0 | 0 | 0 | 0 | 224.05 | 0 |

| Jackson County | 0 | 2 | 3 | 3 | 6 | 0 | 61.16 | 91.41 | 90.99 | 182.43 |

| Jerauld County | 0 | 0 | 0 | 0 | 2 | 0 | 0 | 0 | 0 | 98.62 |

| Jones County | 1 | 1 | 1 | 1 | 2 | 102.77 | 104.49 | 108.93 | 106.95 | 213.68 |

| Kingsbury County | 1 | 2 | 0 | 1 | 2 | 19.74 | 39.59 | 0 | 20.09 | 40.39 |

| Lake County | 2 | 2 | 0 | 1 | 2 | 16.8 | 16.54 | 0 | 7.93 | 15.61 |

| Lawrence County | 7 | 6 | 8 | 10 | 8 | 28.06 | 24.26 | 32.26 | 39.71 | 31.46 |

| Lincoln County | 5 | 5 | 4 | 3 | 6 | 10.02 | 9.69 | 7.55 | 5.5 | 10.59 |

| Lyman County | 3 | 1 | 0 | 3 | 0 | 77.96 | 25.91 | 0 | 76.53 | 0 |

| Marshall County | 0 | 1 | 1 | 1 | 1 | 0 | 21.32 | 20.98 | 20.88 | 20.82 |

| Mccook County | 2 | 2 | 1 | 0 | 2 | 35.8 | 36.09 | 18.29 | 0 | 36.37 |

| Mcpherson County | 1 | 0 | 0 | 0 | 0 | 41.25 | 0 | 0 | 0 | 0 |

| Meade County | 7 | 6 | 6 | 4 | 3 | 26.5 | 22.44 | 22.39 | 14.62 | 10.71 |

| Mellette County | 2 | 1 | 2 | 0 | 0 | 97.7 | 48.38 | 98.72 | 0 | 0 |

| Miner County | 1 | 0 | 1 | 0 | 0 | 43.23 | 0 | 45.25 | 0 | 0 |

| Minnehaha County | 11 | 14 | 10 | 9 | 12 | 6.17 | 7.72 | 5.44 | 4.84 | 6.36 |

| Moody County | 1 | 3 | 4 | 0 | 1 | 15.52 | 46.64 | 61.85 | 0 | 15.2 |

| Pennington County | 9 | 13 | 16 | 10 | 17 | 8.5 | 12.09 | 14.8 | 9.18 | 15.43 |

| Perkins County | 1 | 1 | 0 | 0 | 1 | 33.15 | 33.18 | 0 | 0 | 33.62 |

| Potter County | 0 | 0 | 0 | 1 | 1 | 0 | 0 | 0 | 44.05 | 44.82 |

| Roberts County | 4 | 2 | 4 | 5 | 5 | 39.04 | 19.43 | 39.17 | 48.91 | 48.65 |

| Sanborn County | 1 | 1 | 1 | 0 | 1 | 42.99 | 42.92 | 42.64 | 0 | 40.82 |

| Shannon County | 6 | 2 | 6 | 14 | 11 | 0 | 0 | 0 | 0 | 0 |

| Spink County | 1 | 0 | 0 | 1 | 2 | 15.23 | 0 | 0 | 15.62 | 31.2 |

| Stanley County | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 |

| Sully County | 0 | 0 | 1 | 0 | 1 | 0 | 0 | 71.12 | 0 | 71.07 |

| Todd County | 1 | 2 | 0 | 1 | 1 | 10.01 | 20.13 | 0 | 9.9 | 9.94 |

| Tripp County | 0 | 1 | 0 | 1 | 0 | 0 | 18.15 | 0 | 18.21 | 0 |

| Turner County | 0 | 4 | 1 | 2 | 2 | 0 | 48.84 | 12.3 | 24.19 | 24.05 |

| Union County | 2 | 0 | 2 | 2 | 1 | 13.55 | 0 | 13.45 | 13.34 | 6.65 |

| Walworth County | 1 | 4 | 2 | 3 | 0 | 18.17 | 72.36 | 36.82 | 54.54 | 0 |

| Yankton County | 3 | 9 | 7 | 3 | 6 | 13.25 | 39.68 | 30.86 | 13.26 | 26.48 |

| Ziebach County | 3 | 2 | 0 | 0 | 0 | 105.12 | 69.93 | 0 | 0 | 0 |

Traffic Fatalities: Rural vs. Urban

Generally, more traffic fatalities occur in rural areas than they do in urban areas. This could be because there are fewer emergency service locations in rural areas.

See the table below.

Traffic Fatalities in South Dakota: Rural vs. Urban

| Year | Rural Fatalities | Urban Fatalities | Total Fatalities |

|---|---|---|---|

| 2008 | 108 | 13 | 121 |

| 2009 | 120 | 11 | 131 |

| 2010 | 127 | 13 | 140 |

| 2011 | 96 | 15 | 111 |

| 2012 | 117 | 16 | 133 |

| 2013 | 118 | 17 | 135 |

| 2014 | 115 | 21 | 136 |

| 2015 | 114 | 20 | 134 |

| 2016 | 103 | 13 | 116 |

| 2017 | 109 | 20 | 129 |

The closer your crash site is to a hospital, the better chance you have of survival.

Fatalities by Person Type

Did person type or vehicle type have anything to do with the fatality rate in South Dakota?

Traffic Fatalities in South Dakota by Person Type

| Person Type | 2019 | 2020 | 2021 | 2022 | 2023 |

|---|---|---|---|---|---|

| Occupants | |||||

| - Passenger Car | 34 | 40 | 38 | 36 | 37 |

| - Light Truck – Pickup | 22 | 25 | 27 | 26 | 28 |

| - Light Truck – Utility | 17 | 19 | 20 | 21 | 22 |

| - Light Truck – Van | 10 | 12 | 11 | 13 | 14 |

| - Large Truck | 3 | 4 | 5 | 4 | 5 |

| - Other/Unknown Occupants | 1 | 2 | 1 | 2 | 1 |

| Total Occupants | 87 | 102 | 102 | 102 | 107 |

| Motorcyclists | 14 | 16 | 18 | 17 | 19 |

| Nonoccupants | |||||

| - Pedestrian | 9 | 11 | 10 | 12 | 11 |

| - Bicyclist and Other Cyclist | 1 | 1 | 2 | 1 | 2 |

| Total Nonoccupants | 10 | 12 | 12 | 13 | 13 |

| Total Fatalities | 111 | 130 | 132 | 132 | 139 |

According to this list above, cars were most often involved in fatal accidents.

Fatalities by Crash Type

What types of crashes resulted in a fatal accident?

Traffic Fatalities in South Dakota by Crash Type

| Crash Type | 2019 | 2020 | 2021 | 2022 | 2023 |

|---|---|---|---|---|---|

| Total Fatalities | 102 | 141 | 148 | 137 | 140 |

| Alcohol-Related | 28 | 49 | 45 | 42 | 44 |

| Speed-Related | 24 | 42 | 40 | 38 | 39 |

| Motorcycle Crashes | 14 | 27 | 25 | 26 | 28 |

| Pedestrian Crashes | 8 | 11 | 10 | 12 | 11 |

| Bicyclist Crashes | 0 | 0 | 1 | 1 | 2 |

Single-vehicle crashes and crashes involving a roadway departure were most likely to result in a road fatality.

Five-Year Fatality Trend for the Top 10 Biggest Counties in South Dakota

See below.

Five-Year Fatality Trend for the Top Ten Most Populous Counties in South Dakota

| County | 2019 | 2020 | 2021 | 2022 | 2023 |

|---|---|---|---|---|---|

| Minnehaha | 11 | 14 | 10 | 9 | 12 |

| Pennington | 9 | 13 | 16 | 10 | 17 |

| Lincoln | 5 | 5 | 4 | 3 | 6 |

| Brown | 2 | 4 | 1 | 1 | 1 |

| Brookings | 7 | 4 | 2 | 4 | 3 |

| Codington | 2 | 5 | 2 | 2 | 2 |

| Meade | 7 | 6 | 6 | 4 | 3 |

| Lawrence | 7 | 6 | 8 | 10 | 8 |

| Yankton | 3 | 9 | 7 | 3 | 6 |

| Davison | 2 | 0 | 3 | 2 | 1 |

Fatalities Involving Speeding by County

Speeding also causes road fatalities in South Dakota.

Traffic Fatalities in South Dakota by County

| County | Fatalities 2013 | 2014 | 2015 | 2016 | 2017 | Fatalities Per 100K Population 2013 | 2014 | 2015 | 2016 | 2017 |

|---|---|---|---|---|---|---|---|---|---|---|

| Aurora County | 1 | 0 | 0 | 0 | 0 | 36.81 | 0 | 0 | 0 | 0 |

| Beadle County | 0 | 0 | 1 | 0 | 0 | 0 | 0 | 5.51 | 0 | 0 |

| Bennett County | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 |

| Bon Homme County | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 |

| Brookings County | 1 | 1 | 1 | 1 | 1 | 3.02 | 3 | 2.96 | 2.94 | 2.92 |

| Brown County | 0 | 1 | 0 | 0 | 0 | 0 | 2.61 | 0 | 0 | 0 |

| Brule County | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 |

| Buffalo County | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 |

| Butte County | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 |

| Campbell County | 0 | 0 | 0 | 1 | 0 | 0 | 0 | 0 | 72.05 | 0 |

| Charles Mix County | 2 | 0 | 0 | 1 | 1 | 21.77 | 0 | 0 | 10.66 | 10.61 |

| Clark County | 1 | 0 | 0 | 0 | 0 | 27.63 | 0 | 0 | 0 | 0 |

| Clay County | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 |

| Codington County | 2 | 3 | 2 | 1 | 0 | 7.18 | 10.73 | 7.17 | 3.57 | 0 |

| Corson County | 2 | 0 | 0 | 0 | 0 | 47.52 | 0 | 0 | 0 | 0 |

| Custer County | 0 | 2 | 0 | 1 | 0 | 0 | 23.72 | 0 | 11.61 | 0 |

| Davison County | 0 | 0 | 2 | 0 | 0 | 0 | 0 | 10.14 | 0 | 0 |

| Day County | 0 | 0 | 2 | 0 | 1 | 0 | 0 | 36.36 | 0 | 18.11 |

| Deuel County | 0 | 1 | 0 | 0 | 0 | 0 | 23.26 | 0 | 0 | 0 |

| Dewey County | 1 | 0 | 0 | 0 | 1 | 17.92 | 0 | 0 | 0 | 17.14 |

| Douglas County | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 |

| Edmunds County | 0 | 3 | 0 | 1 | 0 | 0 | 75.51 | 0 | 25.39 | 0 |

| Fall River County | 0 | 0 | 0 | 0 | 1 | 0 | 0 | 0 | 0 | 14.95 |

| Faulk County | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 |

| Grant County | 0 | 0 | 0 | 0 | 1 | 0 | 0 | 0 | 0 | 14.16 |

| Gregory County | 2 | 2 | 2 | 0 | 0 | 47.27 | 47.34 | 47.72 | 0 | 0 |

| Haakon County | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 |

| Hamlin County | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 |

| Hand County | 1 | 0 | 0 | 1 | 0 | 29.68 | 0 | 0 | 30.47 | 0 |

| Hanson County | 0 | 0 | 4 | 0 | 1 | 0 | 0 | 118.13 | 0 | 29.21 |

| Harding County | 0 | 1 | 0 | 0 | 1 | 0 | 80.26 | 0 | 0 | 80.52 |

| Hughes County | 0 | 0 | 0 | 1 | 1 | 0 | 0 | 0 | 5.69 | 5.66 |

| Hutchinson County | 0 | 1 | 1 | 0 | 0 | 0 | 13.84 | 13.76 | 0 | 0 |

| Hyde County | 0 | 0 | 0 | 3 | 0 | 0 | 0 | 0 | 224.05 | 0 |

| Jackson County | 0 | 0 | 2 | 2 | 0 | 0 | 0 | 60.94 | 60.66 | 0 |

| Jerauld County | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 |

| Jones County | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 |

| Kingsbury County | 0 | 1 | 0 | 0 | 0 | 0 | 19.79 | 0 | 0 | 0 |

| Lake County | 1 | 0 | 0 | 0 | 0 | 8.4 | 0 | 0 | 0 | 0 |

| Lawrence County | 1 | 0 | 2 | 5 | 2 | 4.01 | 0 | 8.07 | 19.85 | 7.87 |

| Lincoln County | 2 | 0 | 1 | 2 | 3 | 4.01 | 0 | 1.89 | 3.66 | 5.29 |

| Lyman County | 1 | 1 | 0 | 2 | 0 | 25.99 | 25.91 | 0 | 51.02 | 0 |

| Marshall County | 0 | 0 | 1 | 1 | 0 | 0 | 0 | 20.98 | 20.88 | 0 |

| Mccook County | 1 | 1 | 1 | 0 | 0 | 17.9 | 18.05 | 18.29 | 0 | 0 |

| Mcpherson County | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 |

| Meade County | 3 | 5 | 1 | 0 | 1 | 11.36 | 18.7 | 3.73 | 0 | 3.57 |

| Mellette County | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 |

| Miner County | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 |

| Minnehaha County | 3 | 3 | 0 | 3 | 3 | 1.68 | 1.65 | 0 | 1.61 | 1.59 |

| Moody County | 0 | 1 | 0 | 0 | 0 | 0 | 15.55 | 0 | 0 | 0 |

| Pennington County | 2 | 2 | 4 | 4 | 3 | 1.89 | 1.86 | 3.7 | 3.67 | 2.72 |

| Perkins County | 0 | 0 | 0 | 0 | 1 | 0 | 0 | 0 | 0 | 33.62 |

| Potter County | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 |

| Roberts County | 2 | 0 | 2 | 2 | 0 | 19.52 | 0 | 19.59 | 19.57 | 0 |

| Sanborn County | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 |

| Shannon County | 4 | 0 | 1 | 0 | 7 | 0 | 0 | 0 | 0 | 0 |

| Spink County | 0 | 0 | 0 | 0 | 1 | 0 | 0 | 0 | 0 | 15.6 |

| Stanley County | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 |

| Sully County | 0 | 0 | 0 | 0 | 1 | 0 | 0 | 0 | 0 | 71.07 |

| Todd County | 0 | 1 | 0 | 1 | 0 | 0 | 10.07 | 0 | 9.9 | 0 |

| Tripp County | 0 | 0 | 0 | 1 | 0 | 0 | 0 | 0 | 18.21 | 0 |

| Turner County | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 |

| Union County | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 |

| Walworth County | 1 | 0 | 1 | 1 | 0 | 18.17 | 0 | 18.41 | 18.18 | 0 |

| Yankton County | 1 | 0 | 0 | 2 | 0 | 4.42 | 0 | 0 | 8.84 | 0 |

| Ziebach County | 3 | 0 | 0 | 0 | 0 | 105.12 | 0 | 0 | 0 | 0 |

Fatalities in Crashes Involving an Alcohol-Impaired Driver (BAC = .08+) by County

From 2008 – 2017, 412 fatal crashes occurred because of alcohol-impaired driving in South Dakota.

Alcohol-Impaired Driving Fatalities by County in South Dakota

| County | Fatalities 2013 | 2014 | 2015 | 2016 | 2017 | Fatalities Per 100K Population 2013 | 2014 | 2015 | 2016 | 2017 |

|---|---|---|---|---|---|---|---|---|---|---|

| Aurora County | 1 | 0 | 1 | 0 | 0 | 36.81 | 0 | 36.47 | 0 | 0 |

| Beadle County | 0 | 1 | 3 | 0 | 0 | 0 | 5.51 | 16.52 | 0 | 0 |

| Bennett County | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 |

| Bon Homme County | 1 | 1 | 0 | 0 | 0 | 14.32 | 14.32 | 0 | 0 | 0 |

| Brookings County | 1 | 4 | 1 | 0 | 0 | 3.02 | 12.01 | 2.96 | 0 | 0 |

| Brown County | 0 | 0 | 1 | 0 | 0 | 0 | 0 | 2.6 | 0 | 0 |

| Brule County | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 |

| Buffalo County | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 |

| Butte County | 0 | 1 | 0 | 1 | 2 | 0 | 9.76 | 0 | 9.87 | 19.79 |

| Campbell County | 0 | 0 | 0 | 1 | 0 | 0 | 0 | 0 | 72.05 | 0 |

| Charles Mix County | 5 | 1 | 1 | 1 | 1 | 54.43 | 10.82 | 10.68 | 10.66 | 10.61 |

| Clark County | 1 | 0 | 0 | 0 | 0 | 27.63 | 0 | 0 | 0 | 0 |

| Clay County | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 |

| Codington County | 1 | 0 | 0 | 1 | 0 | 3.59 | 0 | 0 | 3.57 | 0 |

| Corson County | 0 | 0 | 0 | 0 | 1 | 0 | 0 | 0 | 0 | 23.79 |

| Custer County | 0 | 1 | 2 | 0 | 0 | 0 | 11.86 | 23.67 | 0 | 0 |

| Davison County | 0 | 0 | 2 | 0 | 0 | 0 | 0 | 10.14 | 0 | 0 |

| Day County | 0 | 0 | 2 | 0 | 1 | 0 | 0 | 36.36 | 0 | 18.11 |

| Deuel County | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 |

| Dewey County | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 |

| Douglas County | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 |

| Edmunds County | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 |

| Fall River County | 1 | 1 | 1 | 0 | 1 | 14.67 | 14.61 | 14.71 | 0 | 14.95 |

| Faulk County | 0 | 0 | 2 | 0 | 0 | 0 | 0 | 86.73 | 0 | 0 |

| Grant County | 1 | 2 | 0 | 1 | 0 | 13.8 | 27.87 | 0 | 14.09 | 0 |

| Gregory County | 1 | 0 | 0 | 0 | 0 | 23.64 | 0 | 0 | 0 | 0 |

| Haakon County | 0 | 1 | 0 | 0 | 0 | 0 | 54.17 | 0 | 0 | 0 |

| Hamlin County | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 |

| Hand County | 0 | 0 | 1 | 0 | 0 | 0 | 0 | 30.31 | 0 | 0 |

| Hanson County | 0 | 0 | 0 | 1 | 1 | 0 | 0 | 0 | 29.5 | 29.21 |

| Harding County | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 |

| Hughes County | 0 | 0 | 0 | 1 | 0 | 0 | 0 | 0 | 5.69 | 0 |

| Hutchinson County | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 |

| Hyde County | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 |

| Jackson County | 0 | 1 | 2 | 2 | 0 | 0 | 30.58 | 60.94 | 60.66 | 0 |

| Jerauld County | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 |

| Jones County | 0 | 1 | 0 | 1 | 0 | 0 | 104.49 | 0 | 106.95 | 0 |

| Kingsbury County | 0 | 2 | 0 | 0 | 1 | 0 | 39.59 | 0 | 0 | 20.19 |

| Lake County | 0 | 1 | 0 | 1 | 0 | 0 | 8.27 | 0 | 7.93 | 0 |

| Lawrence County | 6 | 1 | 2 | 5 | 2 | 24.05 | 4.04 | 8.07 | 19.85 | 7.87 |

| Lincoln County | 1 | 2 | 0 | 0 | 2 | 2 | 3.88 | 0 | 0 | 3.53 |

| Lyman County | 0 | 1 | 0 | 0 | 0 | 0 | 25.91 | 0 | 0 | 0 |

| Marshall County | 0 | 0 | 1 | 1 | 0 | 0 | 0 | 20.98 | 20.88 | 0 |

| Mccook County | 0 | 1 | 0 | 0 | 0 | 0 | 18.05 | 0 | 0 | 0 |

| Mcpherson County | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 |

| Meade County | 3 | 3 | 1 | 1 | 1 | 11.36 | 11.22 | 3.73 | 3.65 | 3.57 |

| Mellette County | 0 | 1 | 1 | 0 | 0 | 0 | 48.38 | 49.36 | 0 | 0 |

| Miner County | 0 | 0 | 1 | 0 | 0 | 0 | 0 | 45.25 | 0 | 0 |

| Minnehaha County | 3 | 3 | 3 | 2 | 5 | 1.68 | 1.65 | 1.63 | 1.07 | 2.65 |

| Moody County | 0 | 2 | 1 | 0 | 0 | 0 | 31.09 | 15.46 | 0 | 0 |

| Pennington County | 2 | 4 | 2 | 3 | 3 | 1.89 | 3.72 | 1.85 | 2.75 | 2.72 |

| Perkins County | 1 | 1 | 0 | 0 | 1 | 33.15 | 33.18 | 0 | 0 | 33.62 |

| Potter County | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 |

| Roberts County | 2 | 0 | 3 | 1 | 1 | 19.52 | 0 | 29.38 | 9.78 | 9.73 |

| Sanborn County | 0 | 0 | 0 | 0 | 1 | 0 | 0 | 0 | 0 | 40.82 |

| Shannon County | 4 | 1 | 5 | 12 | 6 | 0 | 0 | 0 | 0 | 0 |

| Spink County | 0 | 0 | 0 | 1 | 1 | 0 | 0 | 0 | 15.62 | 15.6 |

| Stanley County | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 |

| Sully County | 0 | 0 | 1 | 0 | 0 | 0 | 0 | 71.12 | 0 | 0 |

| Todd County | 1 | 1 | 0 | 1 | 0 | 10.01 | 10.07 | 0 | 9.9 | 0 |

| Tripp County | 0 | 0 | 0 | 1 | 0 | 0 | 0 | 0 | 18.21 | 0 |

| Turner County | 0 | 1 | 1 | 1 | 0 | 0 | 12.21 | 12.3 | 12.09 | 0 |

| Union County | 0 | 0 | 0 | 1 | 0 | 0 | 0 | 0 | 6.67 | 0 |

| Walworth County | 1 | 1 | 0 | 1 | 0 | 18.17 | 18.09 | 0 | 18.18 | 0 |

| Yankton County | 1 | 2 | 2 | 1 | 3 | 4.42 | 8.82 | 8.82 | 4.42 | 13.24 |

| Ziebach County | 2 | 0 | 0 | 0 | 0 | 70.08 | 0 | 0 | 0 | 0 |

If you live in Shannon County, keep an eye out for drunk drivers. There were 28 alcohol-related fatalities in Shannon County that occurred from 2013 – 2017.

Teen Drinking & Driving

According to responsibility.org, In 26 states and D.C., under-21 alcohol-related driving fatalities per 100,000 population were at or below the national average of 1.2 deaths per 100,000.

South Dakota’s average was 2.8. After Montana, South Dakota has the second-highest teen drinking and driving fatality rate in the country.

Teen Drinking and Driving in South Dakota

| DUI Arrest (Under 18 years old) | DUI Arrests (Under 18 years old) Total Per Million People | Rank |

|---|---|---|

| 77 | 361.02 | 1 |

According to this table above, South Dakota is the most dangerous state in the U.S. for teenage DUIs.

Emergency Response Time

As we previously stated, emergency response time is crucial when you’ve just been seriously injured in a severe accident. Seconds can sometimes mean the difference between life and death.

Check out these average response times in the table below.

Emergency Response Times in South Dakota

| Area of Crash Site | Time of Crash to EMS Notification | EMS Notification to EMS Arrival | EMS Arrival at Scene to Hospital Arrival | Time of Crash to Hospital Arrival | Total Fatal Crashes |

|---|---|---|---|---|---|

| Rural | 4.07 mins | 15.17 mins | 33.87 mins | 51.33 min | 91 |

| Urban | 3.69 mins | 7.31 mins | 21.17 mins | 30.08 mins | 20 |

What Should I Know About Transportation in South Dakota?

Car insurance companies often base their rates on state averages. These averages can include traffic congestion time, car ownership, commute time, and other important factors like what type of transportation commuters use the most.

Buckle up as we tackle this last section in our ultimate guide to South Dakota car insurance.

Car Ownership

How many cars do South Dakota residents own?

According to Data USA, the following chart displays the households in South Dakota distributed between a series of car ownership compared to the national averages. The largest share of households in South Dakota have 2 cars, followed by 3 cars.

The orange bars show South Dakota’s average and the gray bars represent the national average.

Commute Time

Using averages, employees in South Dakota have a shorter commute time (16.3 minutes) than the normal U.S. worker (25.5 minutes). Additionally, 1.24 percent of the workforce in South Dakota have “super commutes” over 90 minutes.

Commuter Transportation

In 2017, the most common method of travel for workers in South Dakota was Drove Alone, followed by those who Carpooled and those who Worked At Home.

Traffic Congestion in South Dakota

Great news for South Dakota drivers! According to Inrix, South Dakota doesn’t have any cities on the most traffic-congested cities in America list.

We’ve come to the end of the road — it’s time to start shopping for your very own South Dakota car insurance policy. All you have to do is use our free tool by entering your zip in this box below.

Happy shopping.