Best Car Insurance in Arkansas for 2025 [Review the Top 10 Companies Here]

Geico, Liberty Mutual, and Allstate have the best car insurance in Arkansas. Geico offers the lowest AR car insurance rates at $19/month. Liberty Mutual is known for fast claims processing, and Allstate provides solid coverage options. Compare car insurance in AR to find the best fit for your needs.

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Eric Stauffer

Licensed Insurance Agent

Eric Stauffer is an insurance agent and banker-turned-consumer advocate. His priority is educating individuals and families about the different types of insurance coverage. He is passionate about helping consumers find the best coverage for their budgets and personal needs. Eric is the CEO of C Street Media, a full-service marketing firm and the co-founder of ProperCents.com, a financial educat...

Licensed Insurance Agent

UPDATED: Apr 11, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident car insurance decisions. Comparison shopping should be easy. We are not affiliated with any one car insurance company and cannot guarantee quotes from any single provider.

Our insurance industry partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about car insurance. Our goal is to be an objective, third-party resource for everything car insurance related. We update our site regularly, and all content is reviewed by car insurance experts.

3,792 reviews

3,792 reviewsCompany Facts

Full Coverage in Arkansas

A.M. Best Rating

Complaint Level

Pros & Cons

3,792 reviews

3,792 reviews 11,638 reviews

11,638 reviewsCompany Facts

Full Coverage in Arkansas

A.M. Best Rating

Complaint Level

Pros & Cons

11,638 reviews

11,638 reviewsGeico, Liberty Mutual, and Allstate provide the best car insurance in Arkansas. Geico offers the most affordable car insurance rates in AR, starting at $19 monthly.

Geico is the top choice for budget-conscious drivers, Liberty Mutual stands out for handling car accidents & claims efficiently, and Allstate provides reliable coverage options.

Our Top 10 Company Picks: Best Car Insurance in Arkansas

| Company | Rank | Bundling Discount | A.M. Best | Best For | Jump to Pros/Cons |

|---|---|---|---|---|---|

| #1 | 25% | A++ | Competitive Rates | Geico | |

| #2 | 25% | A | Quick Claims | Liberty Mutual |

| #3 | 25% | A+ | Strong Coverage | Allstate | |

| #4 | 10% | A+ | Innovative Tools | Progressive | |

| #5 | 20% | A+ | Excellent Service | Nationwide |

| #6 | 25% | A | Flexible Discounts | American Family | |

| #7 | 10% | A++ | Military Support | USAA | |

| #8 | 13% | A++ | Comprehensive Policies | Travelers | |

| #9 | 17% | B | Local Agents | State Farm | |

| #10 | 20% | A | Diverse Coverage | Farmers |

Every insurer provides special benefits, ranging from discounts to solid financial support. Compare Arkansas auto insurance quotes to get the best policy for you.

- Geico offers the most affordable car insurance with solid coverage

- Liberty Mutual excels in fast claims processing and flexible policies

- Allstate provides comprehensive protection with reliable local agents

Affordable car insurance doesn’t have to be a problem. Ready to find cheaper car insurance coverage? Enter your ZIP code to begin.

#1 – Geico: Top Overall Pick

Pros

- Low Premiums: Geico has the lowest premiums in Arkansas. Geico car insurance reviews place it among the best low-cost options.

- Financial Stability: Being A++ rated, Geico guarantees reliability and excellent financial support.

- Easy Online Access: The mobile app and website make policy management easy. Geico Little Rock customers can manage coverage online.

Cons

- Limited Local Agents: Geico operates primarily online and has fewer in-store services Arkansas car insurance.

- Few Coverage Options: Compared to competitors, it has fewer add-ons and customization options.

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#2 – Liberty Mutual: Best for Quick Claims

Pros

- Effective Claims Handling: Liberty Mutual is known for its quick claims processing, which makes it a favorite option among Arkansans.

- Applicable Discounts: Provides up to 25% savings with Arkansas car insurance discounts.

- Personalizable Coverage: In car insurance Arkansas, motorists can personalize their coverage.

Cons

- Higher Premiums: Liberty Mutual car insurance reviews show rates higher than competitors, making it less suitable for budget-conscious drivers.

- Inconsistent Customer Support: Some policyholders report mixed experiences with customer service, as seen in reviews of liability car insurance in Arkansas.

#3 – Allstate: Best for Strong Coverage

Pros

- Comprehensive Protection Plans: Provides a variety of policies suited for the needs of Arkansas drivers. Our Allstate car insurance review emphasizes its broad coverage advantages.

- Trustworthy Local Agent Support: A robust agent network provides more straightforward service via Allstate insurance, so policyholders can quickly get help and claim support.

- Accident Forgiveness: This feature protects drivers from having their premiums raised after their first at-fault accident, which is useful for maintaining long-term affordability in AR.

Cons

- Higher Premium Costs: Full coverage rates are more expensive compared to other Arkansas insurers.

- Discounts Can Be Restricted: Certain policyholders might discover that certain discounts are less competitive than those of other insurers.

#4 – Progressive: Best for Innovative Tools

Pros

- Tech-Driven Pricing & AI Tools: Utilizes digital resources to enable drivers to compare quotes. Our Progressive car insurance review has additional information.

- Flexible Policy Adjustment: The Name Your Price tool enables drivers to adjust policies according to budget and requirements.

- Safe Driver Rewards: With Snapshot, defensive drivers can tap potential discounts by showing a good driving pattern.

Cons

- Higher Premiums for Risky Drivers: Progressive Insurance charges higher premiums for risky drivers, so those with past infractions or accidents can find cheaper premiums elsewhere.

- Service Quality Differ: Although many customers have reported excellent service, others have said that customer experiences in Arkansas car insurance are inconsistent.

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#5 – Nationwide: Best for Excellent Service

Pros

- Top-Rated Customer Support: Famous for sound claims service, a solid pick. Find out more in our Nationwide car insurance review.

- Lower Deductibles Over Time: The Vanishing Deductible program rewards safe drivers by lowering their deductibles.

- Substantial Savings With Bundling: Policyholders can get huge discounts by bundling auto, home, and life with Nationwide insurance.

Cons

- Higher Than Average Premiums: Although the service is excellent, other insurers have more affordable rates.

- Limited Digital Features: In car insurance in Arkansas policy management software is not innovative, causing delays in processing.

#6 – American Family: Best for Flexible Discounts

Pros

- Great Discounts: American Family offers several ways to save, thus making it a convenient choice for policyholders. Discover ways to save in our American Family car insurance review.

- Perfect for Teen Drivers and Families: Young driver households can use customized coverage choices and possible discounts in car insurance in Arkansas

- Strong Customer Support: Highly rated for backing policyholders, making it the go-to option for Arkansas drivers.

Cons

- Not Available Everywhere: Some availability is more restricted than others, so it might differ by location. Consider comparing alternatives to Arkansas’s best insurance.

- Higher Rates for Single Drivers: Single drivers without family policies can expect to receive lower-cost options through competitors.

#7 – USAA: Best for Military Support

Pros

- Personalized for Military Personnel: Praised for remarkable service and benefits according to our USAA auto insurance review.

- Affordable Coverage Options: Offers some of the lowest-cost Arkansas vehicle insurance rates to qualified drivers.

- Highly-Rated Claims Handling: Ranks highly in customer satisfaction and effective claims settlement.

Cons

- Exclusive to Military Families: This specialized coverage in car insurance in Arkansas is available only to military personnel and their families.

- Fewer Physical Locations: Mainly provides online assistance, restricting face-to-face service for Arkansas car insurance policyholders.

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#8 – Travelers: Best for Comprehensive Policies

Pros

- Complete Coverage: With some of the broadest policies available, it is an excellent option for individuals looking for top-rated car insurance in Arkansas.

- Green Vehicle Discounts: This company offers discounts for owners of hybrid and electric vehicles.

- Bundling Discounts: Drivers can save big with multi-policy discounts, as outlined in our Travelers car insurance review.

Cons

- Higher Prices: While providing solid coverage, its prices may be more than those of other top-rated Arkansas providers.

- Limited Local Agents: In contrast to competitors, fewer direct agents are present in the state, which could influence customer service availability.

#9 – State Farm: Best for Local Agents

Pros

- Vast Agent Network: Policyholders receive customized advice and counsel from many neighborhood agents. This Statefarm car insurance review points out its excellent regional presence.

- Consistent Pricing: Premiums remain stable over time, offering reliability compared to fluctuating competitors.

- Youth-Friendly Discounts: Provides various savings options for young drivers, assisting families in lowering coverage expenses.

Cons

- Higher Premium Costs: While offering good coverage, premiums in car insurance in Arkansas might be higher.

- Slower Process for Claims: Claims might be slower to file and process, but they include benefits like State Farm car seat replacement for policyholders with young children.

#10 – Farmers: Best for Diverse Coverage

Pros

- Comprehensive Plans: Farmers have flexible insurance plans specifically designed for Arkansas motorists, as our Farmers car insurance review demonstrates.

- Excellent Choice for High-Risk Drivers: This policy is best for individuals who require more individualized rates and provides low-cost premiums for high-risk drivers in Arkansas.

- Solid Financial Stability: Noted for its high financial ratings, guaranteeing that customers are backed by a stable insurer in Arkansas.

Cons

- More for Minimum Coverage: Farmers’ rates might be higher for individuals looking for full coverage car insurance in Arkansas.

- Lack of Digital Tools: Although Farmers has good coverage, it lacks online tools, which may be a disadvantage compared to other providers.

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

AR Auto Insurance Coverage and Premiums

Arkansas car insurance rates vary depending on the provider and coverage. State Farm and USAA offer the lowest premiums, with USAA offering a minimum of $19 and a comprehensive rate of $55.

Arkansas Car Insurance Monthly Rates by Provider & Coverage Level

| Insurance Company | Minimum Coverage | Full Coverage |

|---|---|---|

| $56 | $162 | |

| $47 | $137 | |

| $57 | $165 | |

| $31 | $91 | |

| $34 | $99 |

| $44 | $128 |

| $45 | $131 | |

| $28 | $80 | |

| $38 | $111 | |

| $19 | $55 |

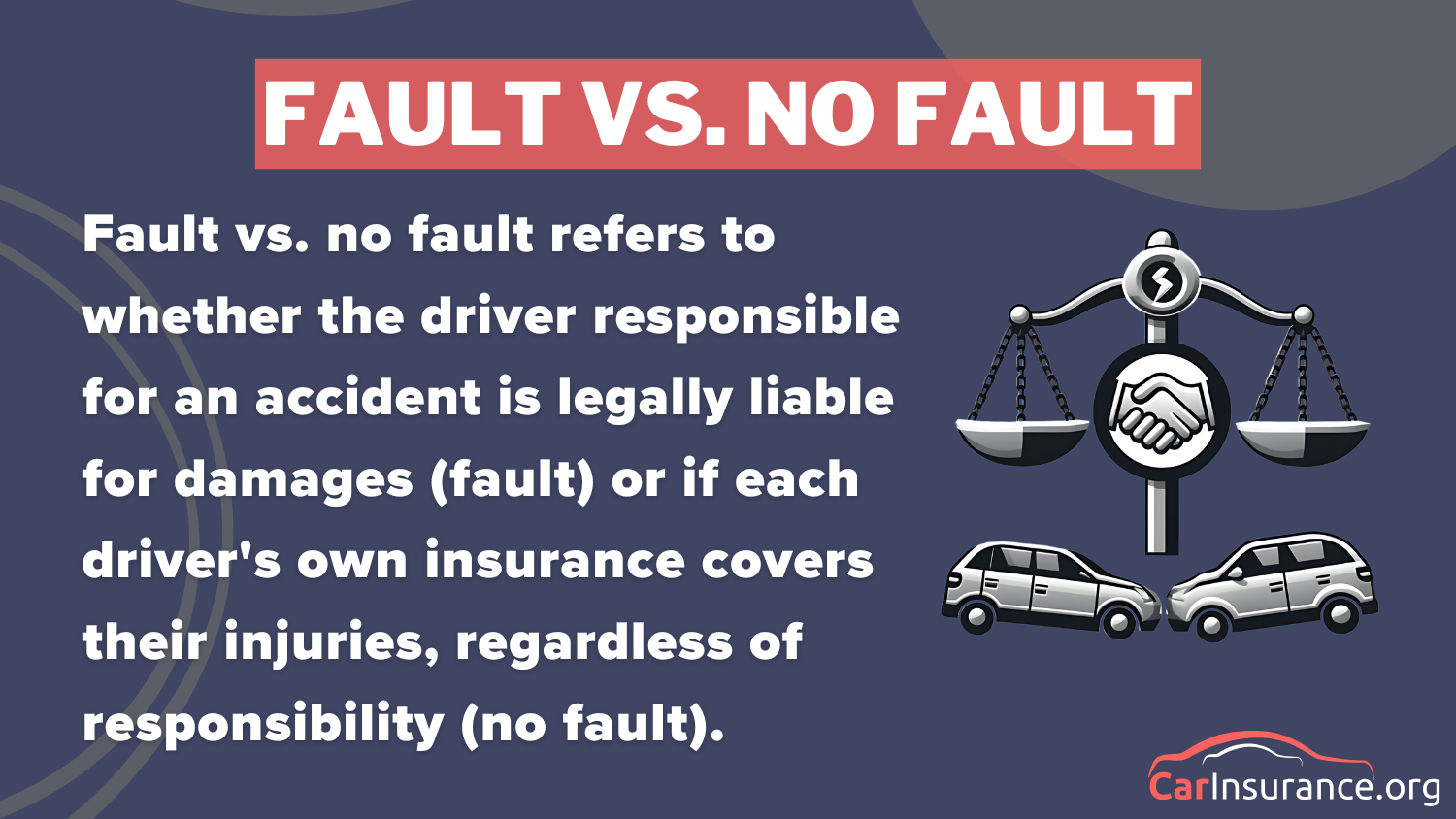

Compare car insurance quotes in AR that provides the best offer. Arkansas is a fault state, where the guilty driver has to pay for damages. Knowing the steps for filing a car insurance claim after an accident ensures a smooth process when seeking compensation.

Minimum Coverage Requirements in Arkansas

Arkansas is an at-fault state, so you’re liable for damages if you get into an accident. Liability insurance and a minimum of $5,000 in PIP for medical expenses are required by the state. Comparing AR insurance quotes is how to get affordable coverage.

Drivers are required to have $25,000 per individual and $50,000 per collision accident for bodily injury, as well as $25,000 for property damage. Such limits cover others but might prove insufficient in cases of serious crashes, leaving you vulnerable financially.

Geico offers exceptional value with competitive rates and comprehensive coverage options, making it one of the top choices for Arkansas drivers seeking reliable auto insurance.Jeffrey Manola Licensed Insurance Agent

Choosing between collision vs. comprehensive car insurance helps protect your own vehicle. Collision covers crash damage, while comprehensive protects against theft, vandalism, and natural disasters.

How to Find the Best Car Insurance in Arkansas

Getting the best car insurance in Arkansas is all about striking a balance between affordability, coverage, and reliability. There are so many insurance providers out there, so it’s crucial to compare them and understand what each policy entails.

Whether you want affordable rates or full protection, by following these five steps, you can get the best car insurance AR can provide.

- Compare the Best Providers: For cheap protection, Geico offers the lowest rates, Liberty Mutual for quick claims settlement, and Allstate for strong policy options. Leading companies, such as State Farm, USAA, and Progressive, also offer valuable benefits depending on different drivers.

- Choose the Right Coverage for Your Needs: Arkansas law mandates liability insurance, but taking full coverage that includes collision and comprehensive insurance is more financially safe. Knowing about different types of car insurance coverage can enable you to make a well-informed choice about the best policy for your vehicle.

- Make Use of Discounts: You can save money by joining safe-driving plans, buying multiple policies, installing anti-theft devices, and using paperless billing. Your credit score can even lower your monthly premium.

- Understand the Risks and Most Common Claims: Locations such as Little Rock have higher chances of accidents, and rear-end accidents, weather damage, and theft claims are common. Comprehensive coverage can provide relief by safeguarding against such unforeseen circumstances.

- Compare Quotes and Reduce Your Expenses: Going around, raising your deductible, and maintaining a good driving record are all surefire ways to save on your premiums and get the best offer.

Whether you’re interested in affordable prices or full coverage protection, these five easy steps will help you find the very best auto insurance AR has available.

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Best Auto Insurance Companies in Arkansas

When shopping for the best car insurance coverage that perfectly fits your budget and vehicle needs, understanding the different types of car insurance coverage and what the provider offers is a must. This guide covers Arkansas’s best car insurance providers, including Geico, Liberty Mutual, and Allstate.

These companies are known for providing affordable and budget-friendly rates, exceptional customer assistance, and convenient claims handling, which are suitable for budget-conscious drivers in Arkansas who want to be satisfied by the perfect coverage while saving big. Enter your ZIP code now and see what your insurer has to offer.

Frequently Asked Questions

Why are Geico, Liberty Mutual, and Allstate ranked among the best car insurance in Arkansas?

The best insurers offer affordability, coverage, and service. Geico, Liberty Mutual, and Allstate rank high for competitive rates and strong policy options. Look at the factors that affect the price of car insurance for expanded insights.

How does Arkansas’ “at-fault” status impact car insurance requirements and coverage?

As an at-fault state, Arkansas requires drivers to carry liability coverage to pay for damages they cause. Compare rates to find the best coverage.

Ready to find affordable car insurance? Get started today by entering your ZIP code into our free comparison tool.

How do age, gender, and location affect car insurance rates in Arkansas?

Young drivers and urban residents face higher rates, while older drivers and rural residents often pay less for Arkansas car insurance.

What are the minimum Arkansas car insurance coverage requirements, and how do they compare to other states?

Arkansas requires $25,000/$50,000 for bodily injury and $25,000 for property damage, which differs from other states’ liability requirements.

Why is liability insurance crucial for Arkansas drivers?

Having Arkansas auto insurance is imperative because it safeguards drivers from paying accident-related expenses themselves. Without it, individuals who are at fault may find themselves with substantial financial burdens.

How does Arkansas’ car insurance cost as a percentage of disposable income compared to the national average?

Arkansas drivers spend about 2.7% of their disposable income on car insurance, aligning with national trends for affordability.

What discounts do top car insurance providers in Arkansas offer?

Safe driving, bundling policies, and good credit can help drivers qualify for discounts and lower Arkansas auto insurance quotes. Explore how to drive safely, no matter the time of day, for more insights.

What unique benefits do USAA, Travelers, and Progressive offer in Arkansas?

USAA serves military families, Travelers has strong coverage options, and Progressive offers discounts for high-mileage and tech-savvy drivers.

How do Arkansas car insurance rates vary by provider and coverage level?

Rates vary by provider and coverage level. Risk factors, driving history, and location greatly influence Arkansas car insurance quotes.

Ready to find cheaper car insurance coverage? Enter your ZIP code to begin.

How can Arkansas drivers lower their car insurance rates?

Maintaining a clean record, reducing coverage on old cars, and comparing quotes help Arkansas drivers lower their auto insurance costs. Learn how to lower your car insurance costs.