10 Best Car Insurance Companies for 2025 [Your Guide to the Top Providers]

Geico, State Farm, and Progressive are the best car insurance companies. State Farm car insurance rates are competitive, starting at just $52 per month. The top car insurance providers offer a combination of affordable rates, comprehensive coverage options, and strong customer service.

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Eric Stauffer

Licensed Insurance Agent

Eric Stauffer is an insurance agent and banker-turned-consumer advocate. His priority is educating individuals and families about the different types of insurance coverage. He is passionate about helping consumers find the best coverage for their budgets and personal needs. Eric is the CEO of C Street Media, a full-service marketing firm and the co-founder of ProperCents.com, a financial educat...

Licensed Insurance Agent

UPDATED: Mar 13, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident car insurance decisions. Comparison shopping should be easy. We are not affiliated with any one car insurance company and cannot guarantee quotes from any single provider.

Our insurance industry partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about car insurance. Our goal is to be an objective, third-party resource for everything car insurance related. We update our site regularly, and all content is reviewed by car insurance experts.

UPDATED: Mar 13, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident car insurance decisions. Comparison shopping should be easy. We are not affiliated with any one car insurance company and cannot guarantee quotes from any single provider.

Our insurance industry partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

18,154 reviews

18,154 reviewsCompany Facts

Full Coverage From the Best Companies

A.M. Best Rating

Complaint Level

Pros & Cons

18,154 reviews

18,154 reviews 13,283 reviews

13,283 reviewsCompany Facts

Full Coverage From the Best Companies

A.M. Best Rating

Complaint Level

Pros & Cons

13,283 reviews

13,283 reviewsThe best car insurance companies are Geico, State Farm, and Progressive, with competitive rates starting at $52 per month.

Geico stands out for its easy-to-use system and quick claims process. State Farm provides thorough coverage and great customer service, while Progressive gives you the option to tailor your needs.

Our Top 10 Company Picks: Best Car Insurance Companies

| Company | Rank | Bundling Discount | A.M. Best | Best For | Jump to Pros/Cons |

|---|---|---|---|---|---|

| #1 | 25% | A++ | Extensive Discounts | Geico | |

| #2 | 17% | B | Cheap Rates | State Farm | |

| #3 | 10% | A+ | Budgeting Tools | Progressive | |

| #4 | 25% | A+ | Unique Perks | Allstate | |

| #5 | 10% | A++ | Military Benefits | USAA | |

| #6 | 20% | A | Coverage Add-ons | Farmers | |

| #7 | 25% | A | Flexible Policies | Liberty Mutual |

| #8 | 20% | A+ | Bundling Discounts | Nationwide |

| #9 | 13% | A++ | Comprehensive Coverage | Travelers | |

| #10 | 25% | A | Family Focused | American Family |

These companies stand out for low prices, easy claims, and solid coverage. No matter if you care most about cost, service, or flexibility, they give you good value.

Stop overpaying for car insurance. Our free quote comparison tool allows you to shop for quotes from the top providers near you by entering your ZIP code. Read our car insurance guide for more details.

- Get the best car insurance plans starting at $52 monthly

- Geico stands out for its discounts and State Farm for its customer service

- Progressive’s Snapshot program can help you save based on your driving

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#1 – Geico: Top Overall Pick

Pros

- Competitive Rates: Geico has good rates, with basic coverage starting at just $59 a month. Our Geico car insurance review provides more details.

- Lots of Discounts: They offer a bunch of discounts that can help you save even more, making it easier to keep your costs down.

- Easy-to-Use App: Geico’s app makes it simple to manage your policy, pay your bills, and file claims—all from your phone.

Cons

- Limited Local Agents: Geico mostly works online, so there aren’t as many local agents around as you might find with other companies.

- No Gap Insurance: Geico doesn’t offer gap insurance, so if that’s something you need, you’ll have to check out other options.

#2 – State Farm: Best for Cheap Rates

Pros

- Trusted Agents: State Farm is a top car insurance company with many local agents who give personal help and support when you need it.

- Affordable Rates: State Farm offers car insurance starting at $52 a month, making it a good choice if you want solid coverage at a budget-friendly price.

- Excellent Customer Service: State Farm offers friendly, easy-to-reach customer service, making it a great choice for car insurance.

Cons

- Limited Discounts: Discount options are fewer if policies are not bundled. Check out our State Farm Car Insurance Review.

- Full Coverage Costs More: While minimum coverage is affordable, full coverage may cost more than some other top car insurance companies.

#3 – Progressive: Best for Budgeting Tools

Pros

- Snapshot Program: Progressive’s program helps you save money based on how you drive, making it a great option for affordable car insurance.

- Flexible Payment Plans: Progressive offers easy payment options, so it’s easier for people to afford good car insurance.

- Competitive Rates: Progressive offers low rates starting at $53 monthly, making car insurance affordable for many. Find out more in our Progressive Car Insurance Review.

Cons

- Rate Increases After Claims: Filing a claim might raise your rates, which can be a downside compared to other top car insurance companies.

- Customer Service Reviews: Progressive occasionally receives mixed reviews on customer service among the best car insurance companies.

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#4 – Allstate: Best for Unique Perks

Pros

- Unique Perks: Allstate has helpful perks, like accident forgiveness, that make it a strong choice for car insurance.

- Drive Wise Program: This program rewards safe driving, which is awesome for drivers who want to save money with the best car insurance company.

- Great Value for Coverage: Allstate starts at just $54 per month for minimum coverage, making it a solid pick among car insurance companies for drivers looking for a good deal.

Cons

- Reasonable Premiums: Full coverage might be a bit more expensive with this car insurance company, but it can still be a good value for certain drivers.

- Discount Limits: Some discounts only work if you meet certain rules, so not everyone can get them. Get more details in Allstate’s Car Insurance Review.

#5 – USAA: Best for Military Benefits

Pros

- Military Discounts: USAA is for military members and their families, offering special benefits that distinguish it from other car insurance companies.

- Lowest Rates: USAA has some of the lowest rates for military members, starting at $48 monthly. Read more about its rates in this USAA Car Insurance Review.

- Great Customer Service: It’s known for great customer service and gets top ratings compared to other car insurance companies.

Cons

- Restricted Eligibility: Only military members, veterans, and their families can get coverage, which limits its availability to other drivers.

- Limited Physical Locations: USAA has fewer in-person offices than many other car insurance companies.

#6 – Farmers: Best for Coverage Add-ons

Pros

- Comprehensive Add-Ons: Farmers is one of the best car insurance companies because it offers extra coverage, such as rideshare and custom parts.

- Personalized Policies: Farmers lets you pick the coverage that fits your needs, making it a great choice among car insurance companies.

- Competitive Minimum Rates: With rates starting at just $50 a month, Farmers offers affordable basic coverage that works for many people.

Cons

- Higher Full-Coverage Rates: Full coverage plans may be more expensive compared to other best car insurance companies. Learn more in Farmers Car Insurance Review.

- Mixed Customer Service Reviews: Some people say Farmers’ customer service is helpful, while others have had problems. It’s good to know this before choosing a policy.

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#7 – Liberty Mutual: Best for Flexible Policies

Pros

- Customizable Policies: Liberty Mutual offers flexible options, making it a top choice among car insurance companies. Get more details in our Liberty Mutual Car Insurance Review.

- Competitive Rates: With rates starting at $55 per month, Liberty Mutual is a great pick from car insurance companies for budget-conscious drivers.

- Unique Features: They offer perks like replacing a new car if it is totaled and forgiving your first accident, making it a good choice for drivers who want more from their insurance.

Cons

- Drivers Face Higher Rates: Rates can be higher for high-risk drivers compared to other best car insurance companies.

- Discounts May Not Apply: Some discounts might not work in certain areas or situations, so they are not always available.

#8 – Nationwide: Best for Bundling Discounts

Pros

- Great Bundling Discounts: Nationwide gives good discounts when you bundle your auto and home insurance, making it a top pick among car insurance companies.

- Affordable Rates: With coverage starting at $56 a month, it’s an affordable option for many customers. Learn more about its rates in our Nationwide Car Insurance Review.

- Helpful Customer Support: They are known for their great customer service, so they are a trusted choice when it comes to choosing a car insurance company.

Cons

- Fewer Options: Nationwide offers fewer policy choices, which might be a downside if you’re looking for more coverage from car insurance companies.

- Rate Increases: Your insurance costs can go up after you file a claim, which might be a concern for drivers who want steady rates with a top insurance company.

#9 – Travelers: Best for Comprehensive Coverage

Pros

- Comprehensive Coverage: Travelers is known for offering a wide range of coverage options to fit different needs. Visit our Travelers car insurance review for more info.

- Affordable Minimum Coverage: Their minimum coverage starts as low as $58 per month, making them a budget-friendly choice.

- Customizable Policies: Travelers lets you shape your policy to fit your needs, so you get options that work better for you.

Cons

- Limited Local Agents: Travelers may have fewer local agents compared to other best car insurance companies, which can impact in-person assistance.

- Discount Availability: Travelers’ discounts may not be as comprehensive or varied as those from some other best car insurance companies.

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#10 – American Family: Best for Families

Pros

- Family-Friendly Plans: American Family is the best car insurance company, offering discounts for teens and safe drivers. Learn more in our American Family Car Insurance Review.

- Low Rates: With minimum coverage starting at $45 monthly, it’s one of the most affordable options among the best car insurance companies.

- Great Customer Service: They are known for their kind and helpful support, which makes them easy to work with and dependable when it comes to car insurance.

Cons

- Limited Availability: Coverage is unavailable in every state, making it harder for some people to get compared to other car insurance companies.

- Fewer Specialty Options: They offer fewer unique coverage choices than some other big-name best car insurance companies.

Understanding Car Insurance

So, if you’re wondering how car insurance works, car insurance helps cover costs if your car is damaged, stolen, or involved in an accident. You pay the insurance company a set amount regularly, and in return, they help cover expenses when something goes wrong.

Car Insurance Monthly Rates by Provider & Coverage Level

| Insurance Company | Minimum Coverage | Full Coverage |

|---|---|---|

| $54 | $147 | |

| $45 | $135 | |

| $50 | $140 | |

| $59 | $128 | |

| $55 | $155 |

| $56 | $138 |

| $53 | $142 | |

| $52 | $130 | |

| $58 | $145 | |

| $48 | $125 |

It’s an agreement between you and the insurer, explaining what is covered and how much you pay. Choosing the right policy is important to make sure it fits your needs and protects you when you need it most.

Car insurance acts as a financial shield, protecting you from the unexpected costs of accidents or vehicle damage. Without it, you’d face the full burden of repair or replacement expenses after an accident.

When choosing the best car insurance companies, focus on coverage that fits your needs and budget to get the most value.Michelle Robbins Licensed Insurance Agent

Car insurance helps pay for repairs or replaces your car if it is totaled, so you’re not stuck dealing with everything on your own. It gives you the support you need to get back on the road, which is why it’s important to check company rankings before picking the right one.

The Importance of Car Insurance

Car insurance is more than a legal requirement. It’s protection for drivers, passengers, and everyone on the road. Choosing from the top vehicle insurance companies gives you reliable coverage. Without insurance, a single accident could leave you with overwhelming debt from medical bills and repairs.

When you bundle, you don’t have to pick 😉 #NFLDraft pic.twitter.com/LL0aBcY0Dm

— GEICO (@GEICO) April 27, 2023

Car insurance helps cover costs if something goes wrong, like fixing your car, paying medical bills, or handling legal fees. It gives you peace of mind, knowing you won’t have to face big expenses alone after an accident.

Read more: How Much Insurance Do I Need for My Car?

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

How to Get the Best Car Insurance Discounts

When you’re choosing a car insurance company, it’s a good idea to see what discounts they have. Many companies offer ways to help you save, like discounts for safe driving, bundling your insurance, or having a good credit score.

Car Insurance Discounts From the Top Providers in Companies

| Insurance Company | Available Discounts |

|---|---|

| Drivewise, bundling, new car, good student, and early signing discounts. | |

| Bundling, good student, multi-vehicle, and early signing discounts. | |

| Bundling, claims-free, home ownership, good student, and professional affiliation discounts. | |

| Good driver, bundling, military, federal employee, student, safe driver, and membership/affinity discounts. | |

| Bundling, auto pay, new car, and good student discounts. |

| Vanishing Deductible, bundling, good student, and safe driving discounts. |

| Snapshot, bundling, continuous insurance, homeownership, and online quote discounts. | |

| Safe driver, bundling, student away from home, good student, and auto pay discounts. | |

| Bundling, safe driver, early quote, and continuous insurance discounts. | |

| Military, good student, bundling, safe driver, and annual payment discounts. |

Also, check which discounts apply to you and compare companies to see where you can save the most. Also, consider how easy it is to qualify for discounts and whether they apply automatically or require extra steps. Reading reviews can help you find a company that offers good savings and reliable coverage.

Read more: The Different Types of Car Insurance Coverage

Coverage Options

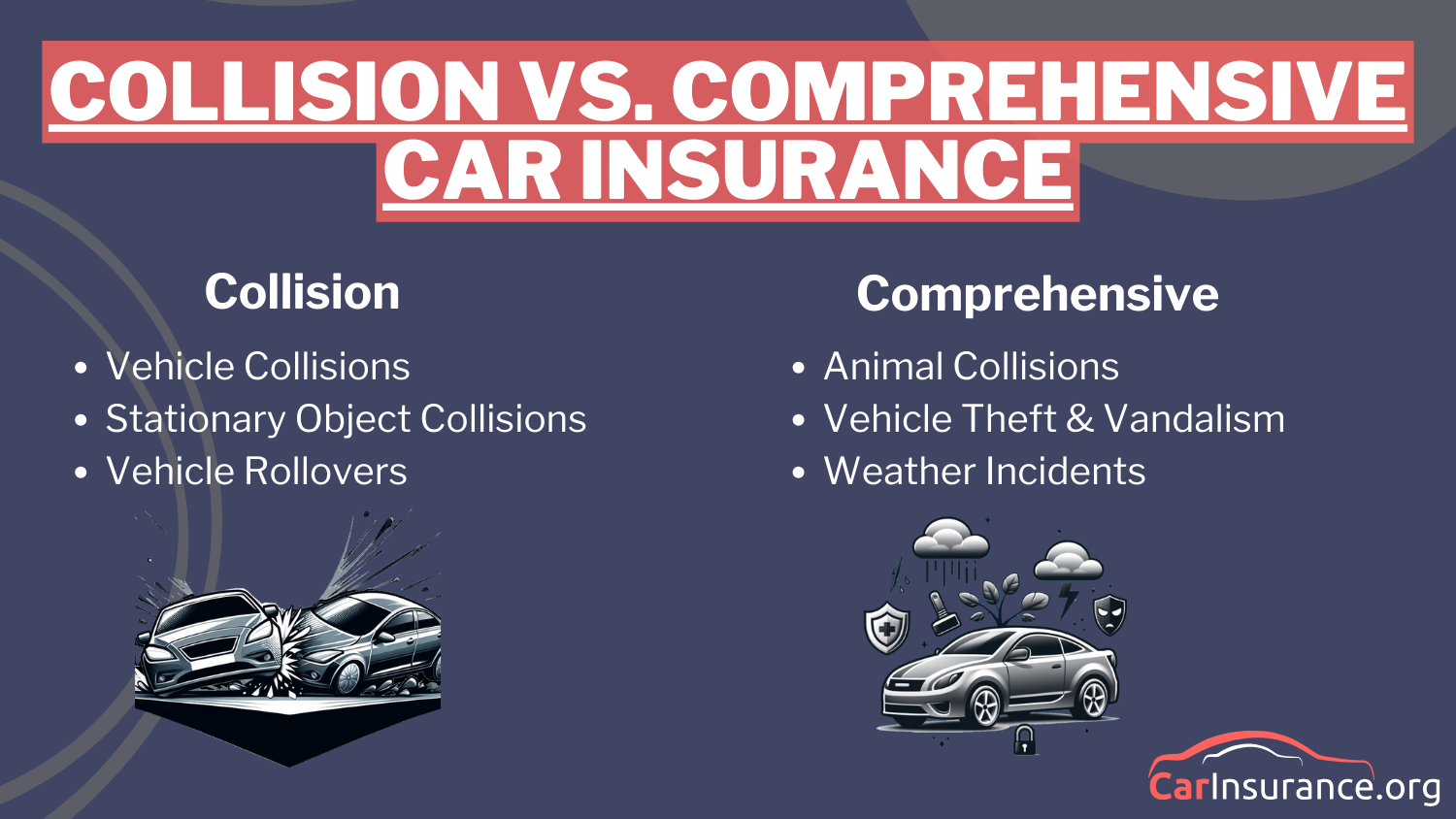

When choosing a car insurance company, consider the coverage they offer. Different companies provide options like liability, collision, or comprehensive coverage based on your needs.

For example, if you live in a place where storms, floods, or other disasters happen a lot, comprehensive coverage can help pay for car damage. But if you drive an older car, basic liability coverage might be enough to meet the law’s rules. Some insurance companies also let you add things like roadside help or rental car coverage to give you extra peace of mind.

Read more: If my car breaks down, will insurance cover a rental?

Customer Service

Good customer service matters when picking car insurance. Choose a company that is easy to talk to, ready to help, and quick to respond when you need them.

Additionally, consider how easy it is to file a claim and how quickly they handle it. A company with good service can make the process smoother and less stressful. To learn more, visit our guide ‘Why Do You Need Car Insurance?‘ to find the right coverage for your needs.

How to Choose the Best Car Insurance Coverage

Choosing the best car insurance means looking at collision and comprehensive coverage. Collision insurance helps pay for accident damage, while comprehensive covers things like theft, storms, and other unexpected events. Thinking about how you drive, your history, and your budget can help you find a plan that gives you good protection at a price that works for you.

Compare different providers to ensure you get the type of car insurance coverage tailored to your needs. This guarantees you’re fully protected while staying within your financial goals.

Case Studies: Real-Life Examples of the Best Car Insurance Companies

These case studies show different insurance companies help people, making it easier for you to choose the right car insurance.

Case Study 1: Geico – Affordable and Simple

John, 32, from Texas, needed affordable car insurance and chose Geico because their $59 monthly premium fit his budget. He appreciated how easy it was to file claims online, which made everything less stressful and kept his finances in check. Find out more in our guide on the 7 benefits of teaching your teen to drive.

Case Study 2: Progressive – Flexible Discounts

Michael, 28, from Florida, was looking for an affordable insurance plan that could grow with him. After researching top car insurance companies in the USA, he went with Progressive because they offered discounts for driving safely and bundling policies together.

Case Study 3: State Farm – Helpful Service and Reliable Coverage

Sarah, 45, from Ohio, wanted to save money on car insurance. She chose State Farm because they took the time to explain everything in a simple way. They helped her understand her options and find the right coverage for her needs. With their support, Sarah felt good about her choice and knew she was in good hands.

Geico, State Farm, and Progressive offer good prices, helpful service, and flexible options that fit your needs, no matter your situation.

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Choosing the Best Car Insurance Companies

When choosing the best car insurance companies, it’s important to assess your needs, compare quotes, and check the reputation of different companies. This helps ensure you find a policy that provides the right coverage at a fair price. But first, you must understand why you need car insurance.

Compare insurers based on coverage, rates, and customer service to find the best car insurance that fits your needs.Justin Wright Licensed Insurance Agent

To find the right car insurance, think about the cost, what the policy covers, and how easy it is to work with the company when you need to file a claim. Comparing different options can help you get good coverage and feel secure. See if you’re getting the best deal on car insurance by entering your ZIP code.

Frequently Asked Questions

What are the best car insurance companies?

The best car insurance companies include well-known providers like State Farm, Geico, Progressive, and American Family. These companies are often praised in the best car insurance reviews for their affordability, coverage options, and customer service.

How do I find great car insurance?

To find great car insurance, compare car insurance companies’ reviews online, check for discounts, and assess your coverage needs. Look for providers that rank highly in the best auto insurance reviews. No matter how much coverage you need, you can find the lowest rates by entering your ZIP code into our free comparison tool.

What factors determine the ranking of car insurance companies?

The rankings of car insurance companies are usually evaluated based on pricing, customer satisfaction, claims process, and financial strength. The best auto insurance reviews consider these factors when compiling their lists.

Read more: Car Maintenance Expenses

Are there reliable sources for finding the best car insurance reviews?

Trusted platforms like J.D. Power, car insurance.org, and A.M. Best provide reliable car insurance reviews to help you make informed choices.

What’s better: State Farm vs Root car insurance?

When comparing State Farm vs Root car insurance, State Farm often scores higher in best car insurance reviews for reliability and customer service, while Root focuses on usage-based plans, which may suit drivers who drive less.

What are the top car insurance companies in the USA?

The top car insurance companies in the USA include State Farm, Allstate, Geico, and Progressive. These providers rank highly in the best vehicle insurance reviews for their financial stability and coverage options. To learn more on how the states rank on uninsured drivers, check out this article.

How can I find the best car insurance deals?

To find the best car insurance deals, start by exploring the best car insurance reviews to see which providers are highly rated, then compare quotes from different companies, bundle your policies, and take advantage of available discounts.

What makes a company one of the best auto insurance companies?

The best auto insurance companies provide reliable coverage, quick claims processing, and excellent customer service. They also score well in great car insurance companies’ reviews and offer customizable plans. Shopping for insurance can feel overwhelming, but you don’t have to do it alone. Enter your ZIP code into our free comparison tool to get started.

Are there good car insurance companies for families?

Yes, many good car insurance companies like American Family and State Farm offer discounts for families, such as savings for teen drivers and safe driving programs. Learn all the details in our guide, How Your Children Will Impact Your Car Insurance Policy.

What’s the best way to compare the top car insurance agencies?

To compare top car insurance agencies, read car insurance companies’ reviews, check their ratings in the best vehicle insurance lists, and get quotes from multiple providers to ensure you get the right coverage at the best price.

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Eric Stauffer

Licensed Insurance Agent

Eric Stauffer is an insurance agent and banker-turned-consumer advocate. His priority is educating individuals and families about the different types of insurance coverage. He is passionate about helping consumers find the best coverage for their budgets and personal needs. Eric is the CEO of C Street Media, a full-service marketing firm and the co-founder of ProperCents.com, a financial educat...

Licensed Insurance Agent

Editorial Guidelines: We are a free online resource for anyone interested in learning more about car insurance. Our goal is to be an objective, third-party resource for everything car insurance related. We update our site regularly, and all content is reviewed by car insurance experts.