Access Car Insurance Review for 2025 [See Rates & Discounts Here]

Access car insurance review examines coverage, pricing, and service. With average monthly rates of $50, it targets budget-conscious drivers. Policy options and service quality receive mixed feedback. This review covers Access car insurance's strengths and drawbacks to help drivers decide.

Daniel Walker

Licensed Insurance Agent

Daniel Walker graduated with a BS in Administrative Management in 2005 and has run his family’s insurance agency, FCI Agency, for over 15 years (BBB A+). He is licensed as an insurance agent to write property and casualty insurance, including home, life, auto, umbrella, and dwelling fire insurance. He’s also been featured on sites like Reviews.com and Safeco. To ensure our content is accura...

Licensed Insurance Agent

UPDATED: Mar 13, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident car insurance decisions. Comparison shopping should be easy. We are not affiliated with any one car insurance company and cannot guarantee quotes from any single provider.

Our insurance industry partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about car insurance. Our goal is to be an objective, third-party resource for everything car insurance related. We update our site regularly, and all content is reviewed by car insurance experts.

UPDATED: Mar 13, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident car insurance decisions. Comparison shopping should be easy. We are not affiliated with any one car insurance company and cannot guarantee quotes from any single provider.

Our insurance industry partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

Access Auto Insurance

Monthly Rates

$50A.M. Best Rating:

N/AComplaint Level:

LowPros

- Low-cost policies starting at $50

- Offers SR-22 coverage for high-risk drivers

- Flexible payment options are available

Cons

- Limited coverage options compared to competitors

- Customer service response times may be slow

- Availability varies by state

Access car insurance review includes Access Auto Insurance Company’s affordable rates and payment plans. With policy rates beginning at $50, it’s a good choice for high-risk drivers needing cheap coverage.

Access Insurance Group specializes in SR-22 policies, and Access Insurance Services offers expedited coverage plans. Some consumers have reported mixed experiences with the claims process, but Access Auto Insurance Company has reasonable plans. Still, it is imperative to examine the coverage limits and customer service.

Access Car Insurance Rating

| Rating Criteria |  |

|---|---|

| Overall Score | 2.7 |

| Business Reviews | 2.0 |

| Claim Processing | 2.0 |

| Company Reputation | 2.0 |

| Coverage Availability | 2.0 |

| Coverage Value | 2.4 |

| Customer Satisfaction | 3.3 |

| Digital Experience | 2.5 |

| Discounts Available | 4.7 |

| Insurance Cost | 3.6 |

| Plan Personalization | 2.0 |

| Policy Options | 2.2 |

| Savings Potential | 3.9 |

Access Insurance Group is possible for drivers with prior offenses, but comparing several quotes guarantees the best value. Knowing what car insurance covers allows you to select a policy with a good balance of cost and protection. Shopping around among various providers is essential to getting the most appropriate coverage.

Reading through Access Auto Insurance, you can now search for auto insurance. Go ahead and enter your ZIP code to get free insurance quotes today.

- Policies start at $50, making them budget-friendly for high-risk drivers

- SR-22 coverage is available for those with prior violations or lapses

- Flexible payment plans help drivers manage costs without hidden fees

Access Car Insurance Rates by Age, Gender, and Driving Record

Access Auto Insurance Company provides competitive premiums based on the level of coverage, age, and gender. The following is an analysis of the estimated monthly premium:

Access Car Insurance Monthly Rates by Coverage Level, Age, & Gender

| Age & Gender | Minimum Coverage | Full Coverage |

|---|---|---|

| Age: 16 Female | $125 | $215 |

| Age: 16 Male | $135 | $230 |

| Age: 18 Female | $110 | $195 |

| Age: 18 Male | $120 | $210 |

| Age: 25 Female | $80 | $145 |

| Age: 25 Male | $90 | $160 |

| Age: 30 Female | $70 | $130 |

| Age: 30 Male | $75 | $140 |

| Age: 45 Female | $60 | $110 |

| Age: 45 Male | $65 | $115 |

| Age: 60 Female | $55 | $100 |

| Age: 60 Male | $60 | $105 |

| Age: 65 Female | $50 | $90 |

| Age: 65 Male | $55 | $95 |

Young drivers will have the most expensive rates, with males aged 16 paying approximately $135 monthly for basic coverage, whereas older drivers will have much lower premiums.

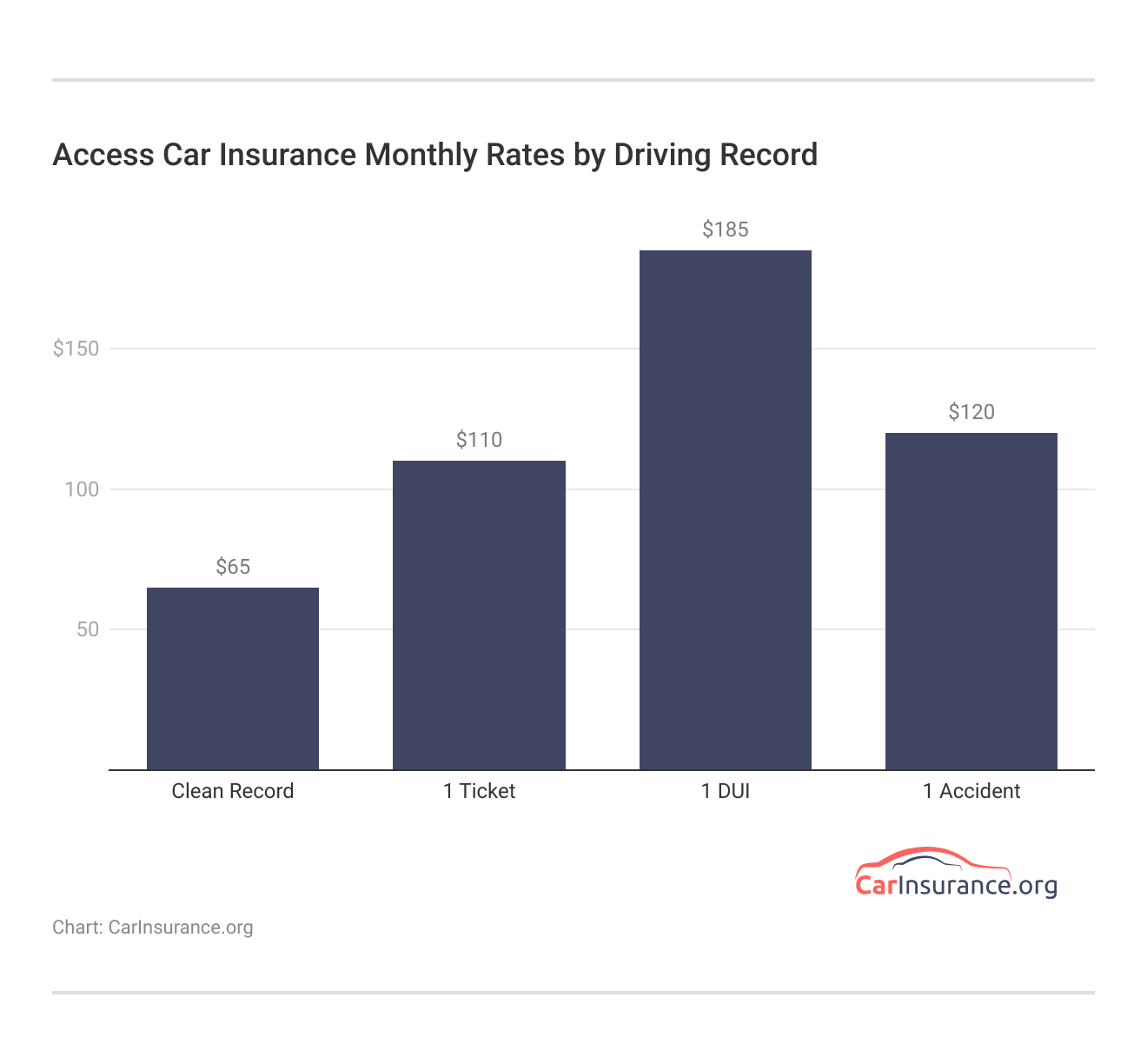

Access Auto Insurance Company varies monthly premiums according to a driver’s record. Drivers with a clean record pay the least, while violations and accidents cause premiums to jump considerably. The following is an estimated breakdown of monthly premiums:

Drivers with a history of DUI or accidents see the highest premium increases, with full coverage rates rising to $220 per month after an accident. However, practicing safe driving tips and maintaining a clean record can help keep insurance costs low.

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Access Auto Insurance: Company Overview

Founded in 1975, Access Auto sells car insurance policies in five states:

Access Insurance Agency does business in several states via subsidiaries, such as Access Insurance Agency of Arizona, LLC, and Access Insurance Agency of Indiana, LLC. These agencies write auto insurance coverage specific to the state laws. If you are an Arizona or Indiana resident, you can obtain a policy through these agencies in your state.

But if you are not within their service areas, you can look up the best car insurance companies online to determine coverage that suits your requirements. Quotes comparison from high-rated providers guarantees you receive the best rates and coverage. Moreover, Access Auto Insurance policyholders can easily manage their policies, check coverage information, and pay bills using the Access Auto account login for simple online access.

Access Auto Insurance Is Highly Rated

Access Auto Insurance has a B+ rating from A.M. Best, suggesting it may not be as financially secure as other companies. However, it is a consideration for those seeking high-risk car insurance options.

On the other hand, if you are looking for a company that offers excellent customer service, you’ll be pleased to know Access Auto Insurance is a Better Business Bureau-accredited company with an A+ rating. Its customer rating on the BBB website received a maximum of five solid stars. Comparing car insurance rates by state can also help determine if Access Auto Insurance offers competitive pricing in your area.

Coverages Offered by Access Auto Insurance

The coverage provided by an Access Auto Insurance policy is basic. The coverage doesn’t offer much customization but provides the legal insurance requirements. You can review the company’s coverages here:

- Bodily injury liability

- Property damage liability

- Uninsured motorist

- Collision coverage

- Comprehensive coverage

- Underinsured motorist

- Roadside assistance

- Rental reimbursement

- SR-22 insurance

While Access Auto Insurance roadside assistance coverage is certainly a nice feature to have, there’s nothing demonstrably shocking about Access Auto’s available coverages. Suppose you’re a driver who wants the maximum coverage or has just taken out a car loan. In that case, you won’t be able to access additional coverage options that could assist you, like custom equipment coverage or GAP insurance.

#NationalInsuranceAwarenessDay is the perfect time to review your auto insurance policy. Make sure you have all the coverage you need & get a free no-obligation quote with us today! https://t.co/hQswFv7Qw2#NationalInsuranceAwarenessDay #DriveInsured #InsuredDriver #DriveSafe pic.twitter.com/MITanfGoT5

— Access Auto Insurance (@access_insure) June 28, 2020

If you need to file a claim, you will need to call the American Access Casualty Company phone number. Although it appears that American Access Auto Insurance underwrites Access Auto’s insurance policies, this relationship is not clearly stated on the Access Auto website, which could be confusing for some drivers.

Read more: American Access Insurance Review

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Access Auto Insurance Offers Competitive Rates

Purchasing insurance through Access Auto may not be a wise choice for drivers on a budget. On average, your Access Auto Insurance payment could be $4,916 per year for full coverage insurance. This rate is steeper than what you would find with most other insurance companies, as you can see here:

Auto Insurance Monthly Rates by Company

| Insurance Company | Monthly Rates |

|---|---|

| $407 | |

| $107 | |

| $212 | |

| $268 | |

| $427 |

| $243 |

| $317 | |

| $272 | |

| $181 | |

| $199 |

Remember, no two drivers pay the same rate. Car insurance companies use an underwriting process to determine your rate. When shopping for quotes online, you’ll need to provide information about yourself and your car, which can include:

- Your name

- Your address

- Your car’s make and model

- Your car’s mileage

- How much you drive in a year

- Your driver’s license number

- The year you got your license

Using statistics and reviewing your driving history, an insurance company assesses your risk level to determine your unique rate. Comparing quotes can help you find the best deal when buying car insurance. If you’re considering Access Auto, use their online quote tool or call the Access Auto Insurance phone number to speak with an agent.

Ways for Drivers to Keep Insurance Rates Low

You should always review your quotes carefully to see which insurance companies can get you the most coverage at the lowest rate as you shop for insurance online. Thankfully, as you can see in the chart below, most major insurance companies offer discounts so you can reduce your rates:

Clearcover Car Insurance Discount by Provider

| Insurance Company | Anti-Theft Device Discount | Multi-Policy Bundling Discount | Defensive Driver Discount | Good Driver Discount | Good Student Discount | Military Discount | Multi-Vehicle Discount | New Car Discount | Paperless Discount | Pay-in-Full Discount | Safe Driver Discount |

|---|---|---|---|---|---|---|---|---|---|---|---|

| 10% | 25% | 10% | 25% | 20% | 5% | 25% | 15% | 10% | 10% | 22% | |

| 25% | 25% | 5% | 25% | 20% | 15% | 20% | 10% | 20% | 20% | 15% | |

| 10% | 20% | 20% | 30% | 15% | 10% | 20% | 5% | 10% | 10% | 30% | |

| 25% | 25% | 15% | 26% | 15% | 10% | 25% | 10% | 10% | 10% | 25% | |

| 35% | 25% | 10% | 20% | 15% | 10% | 25% | 15% | 12% | 12% | 25% |

| 5% | 20% | 10% | 40% | 15% | 20% | 20% | 10% | 15% | 15% | 10% |

| 25% | 10% | 31% | 30% | 10% | 12% | 12% | 20% | 15% | 15% | 30% | |

| 15% | 17% | 15% | 25% | 25% | 5% | 20% | 10% | 15% | 15% | 30% | |

| 10% | 13% | 20% | 10% | 8% | 8% | 8% | 10% | 10% | 10% | 25% | |

| 15% | 10% | 5% | 30% | 10% | 10% | 10% | 20% | 15% | 15% | 15% |

Driving safely, such as stopping for stop signs and not tailgating, keeps your rates down. Knowing how car insurance works demonstrates that having a clean driving record results in lower premiums in the long run. The better your driving record, the less you pay for insurance.

Access Car Insurance: Business Ratings and Consumer Reviews

Access Auto Insurance has mixed reviews on various industry review websites. J.D. Power rates it 780/1,000, which is average customer satisfaction.

Access Business Ratings and Consumer Reviews

| Agency |  |

|---|---|

| Score: 780 / 1,000 Avg. Satisfaction |

|

| Score: A Excellent Business Practices |

|

| Score: 75/100 Fair Coverage Options |

|

| Score: 0.60 Fewer Complaints Than Avg. |

|

| Score: A- Superior Financial Stability |

The Better Business Bureau (BBB) rates it A, which indicates good business practices. Consumer Reports gives it a 75/100, which is fair coverage choices. The National Association of Insurance Commissioners (NAIC) has a 0.60 complaint ratio, which means Access Auto Insurance has fewer complaints than the average in the industry.

A.M. Best gives the company an A- rating, reflecting outstanding financial strength. It suggests that Access Auto Insurance is financially stable and has quality business operations, making it a reliable option when buying a car insurance policy, although customer satisfaction is considered average.

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Pros and Cons of Access Auto Insurance

Pros:

- Affordable for High-Risk Drivers: Discounted premiums for those who have tickets or accidents.

- Flexible Payment Plans: Provides the option for monthly and installment payments.

- Fewer Complaints: NAIC has a 0.60 complaint ratio, below the industry average.

Cons:

- Limited Coverage Options: Fewer add-ons than the large insurers. Learn more about our “Car Insurance Rates by City” for a broader perspective.

- Average Customer Satisfaction: J.D. Power rates it 780/1,000, which reflects mixed ratings.

What You Need to Know About Access Auto Insurance

Access Auto Insurance has the coverage you need to drive and remain protected. However, you may consider working with an insurance company that can provide a home and car bundle discount if you own your home. It is also important to remember that additional coverages like GAP insurance are not available through Access Auto.

Access Auto Insurance provides competitive rates for drivers seeking affordable coverage, but comparing multiple quotes is essential to finding the best value.Brad Larson Licensed Insurance Agent

Since Access Auto provides coverage in certain states, you may need to shop online to find an insurance company offering the different types of car insurance coverage required to protect yourself and your vehicle.

Now that you’ve read this thorough review about Access Auto Insurance, you can feel confident about starting to shop for a car insurance policy. Enter your ZIP code to compare free quotes from insurance companies near you.

Your Opinion Matters!

Rate your insurance provider and provide share feedback with shoppers just like you.

Frequently Asked Questions

What do Clearcover car insurance reviews say about coverage and service?

Clearcover auto insurance reviews highlight affordable rates and a user-friendly mobile app for claims. However, some customers report delays in claims processing and limited availability in certain states.

Where can I find reliable car insurance network reviews?

Consumer review sites like Trustpilot, Better Business Bureau (BBB), and NerdWallet provide reliable car insurance network reviews based on customer experiences and industry analysis.

What services does Access General Insurance Company offer?

Access General Insurance offers non-standard auto insurance policies for high-risk drivers, including liability, collision, and comprehensive coverage, typically through independent agents. If you’re wondering, “How much insurance do I need for my car?” Access General Insurance can help determine the right amount of coverage based on your needs and state requirements.

Where is Access Auto Insurance Indianapolis located?

Access Auto Insurance Indianapolis has multiple offices throughout the city. Their official website provides locations and contact details.

Find the best car insurance at the lowest price—enter your ZIP code below to compare coverage from top insurers.

How do customers rate American Access Casualty Company in reviews?

American Access Casualty Company receives mixed reviews; some customers praise its affordable rates for high-risk drivers, while others report claims handling and customer service issues.

Are there any complaints in Easy GAP Insurance reviews?

Easy Gap Insurance reviews mention concerns about slow claim approvals and communication issues, but many customers appreciate its affordability and coverage for loan gaps after a total loss. Similarly, Access Auto Gap Insurance offers comparable benefits, covering car loan gaps. If needed, you can cancel Gap Insurance by contacting your provider directly.

How can I get an Access Auto Insurance quote?

You can get an Access Auto Insurance quote by visiting their website, calling their customer service line, or contacting a local agent for a personalized estimate.

What does Access Insurance Agency specialize in?

Access Insurance Agency provides auto insurance for high-risk drivers, including SR-22 coverage, liability insurance, and flexible payment plans.

Are there any concerns in Paramount Open Access Insurance reviews?

Paramount Open Access Insurance reviews highlight customer service challenges and delays in claims processing, especially when filing a car insurance claim after an accident. However, some policyholders appreciate the extensive network of healthcare providers and the flexibility All Access car insurance coverage options offer.

What is Clearcover Insurance’s AM Best rating?

AM Best has not rated Clearcover Insurance, as it is a relatively new company. However, it has received financial backing from reputable investors and maintains a strong market presence.

How do I pay online for Integon National Insurance Company?

You can pay Oregon National Insurance Company online through its official website by logging into your account and selecting a payment method. Some policies also allow payments via phone or mobile app.

Where can I find Access Insurance in the Indianapolis office?

Access Insurance has multiple offices in Indianapolis. Visit their official website or call customer service to find the nearest office location. Additionally, understanding what car insurance brokers do can help guide your decisions, and reading user access reviews for insurance can provide valuable insights into the quality of their services.

What do policyholders say in Access Health Lite STM Insurance reviews?

Access Health Lite STM Insurance reviews indicate that policyholders appreciate the affordability of short-term health coverage, but some complain about limited benefits and high out-of-pocket costs.

Daniel Walker

Licensed Insurance Agent

Daniel Walker graduated with a BS in Administrative Management in 2005 and has run his family’s insurance agency, FCI Agency, for over 15 years (BBB A+). He is licensed as an insurance agent to write property and casualty insurance, including home, life, auto, umbrella, and dwelling fire insurance. He’s also been featured on sites like Reviews.com and Safeco. To ensure our content is accura...

Licensed Insurance Agent

Editorial Guidelines: We are a free online resource for anyone interested in learning more about car insurance. Our goal is to be an objective, third-party resource for everything car insurance related. We update our site regularly, and all content is reviewed by car insurance experts.

steph21480

price changes

lh418

Waste of money.

clearreview90

Bad experience cheap insurance

Rissa2012

Cancelled without notice

Brindle1dog1

Not what i expected

Marymorrry

Okay Company

pandanwh

You get what you pay for

Nancy0307

Access Insurance Sample Coverage

vmarin

I like it!

Jgaona18

Really do reccomend