Allstate vs. Nationwide Car Insurance for 2025 [Which is Better?]

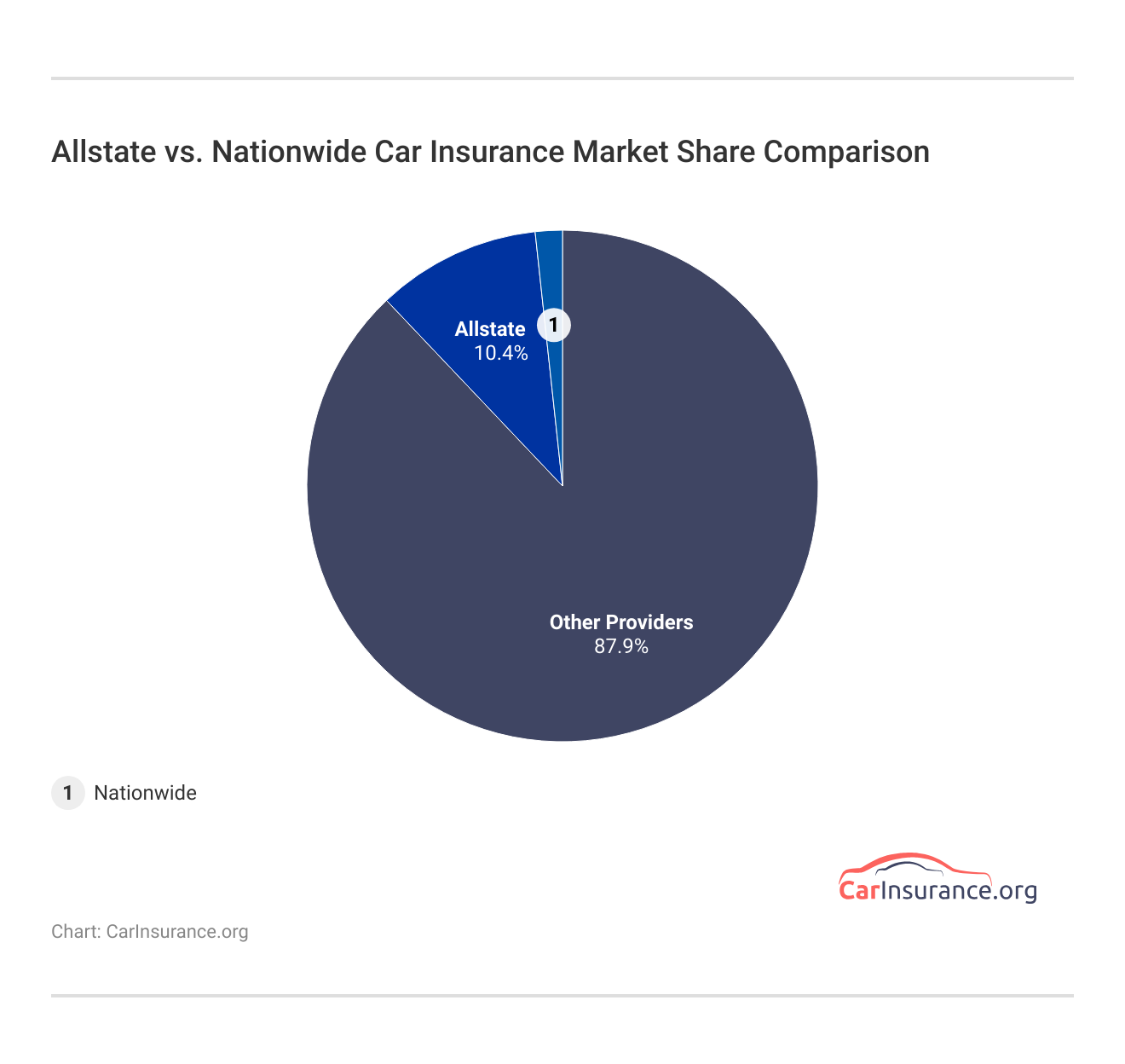

Our comparison of Allstate vs. Nationwide car insurance shows that Nationwide is the more affordable option with rates starting at $87 per month. Allstate car insurance has a larger market share and a better financial rating from A.M. Best, Nationwide's affordability makes it a more popular choice.

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Chris Abrams

Licensed Insurance Agent

Chris is the founder of Abrams Insurance Solutions and Marcan Insurance, which provide personal financial analysis and planning services for families and small businesses across the U.S. His companies represent nearly 100 of the top-rated insurance companies. Chris has been a licensed insurance agent since 2009 and has active insurance licenses in all 50 U.S. states and D.C. Chris works tireles...

Licensed Insurance Agent

UPDATED: Mar 19, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident car insurance decisions. Comparison shopping should be easy. We are not affiliated with any one car insurance company and cannot guarantee quotes from any single provider.

Our insurance industry partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about car insurance. Our goal is to be an objective, third-party resource for everything car insurance related. We update our site regularly, and all content is reviewed by car insurance experts.

UPDATED: Mar 19, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident car insurance decisions. Comparison shopping should be easy. We are not affiliated with any one car insurance company and cannot guarantee quotes from any single provider.

Our insurance industry partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

3,071 reviews

3,071 reviewsCompany Facts

Min. Coverage

A.M. Best Rating

Complaint Level

Pros & Cons

3,071 reviews

3,071 reviewsWhen comparing Allstate vs. Nationwide car insurance, Nationwide will be more affordable for the majority of drivers buying car insurance.

You’ve narrowed your car insurance shopping down to Allstate and Nationwide, and now you’re ready to compare affordable Allstate vs. Nationwide car insurance rates.

Read through our Allstate vs. Nationwide car insurance guide and learn about the car insurance rates, coverage options, discounts, and third-party ratings at two of the top companies in the United States.

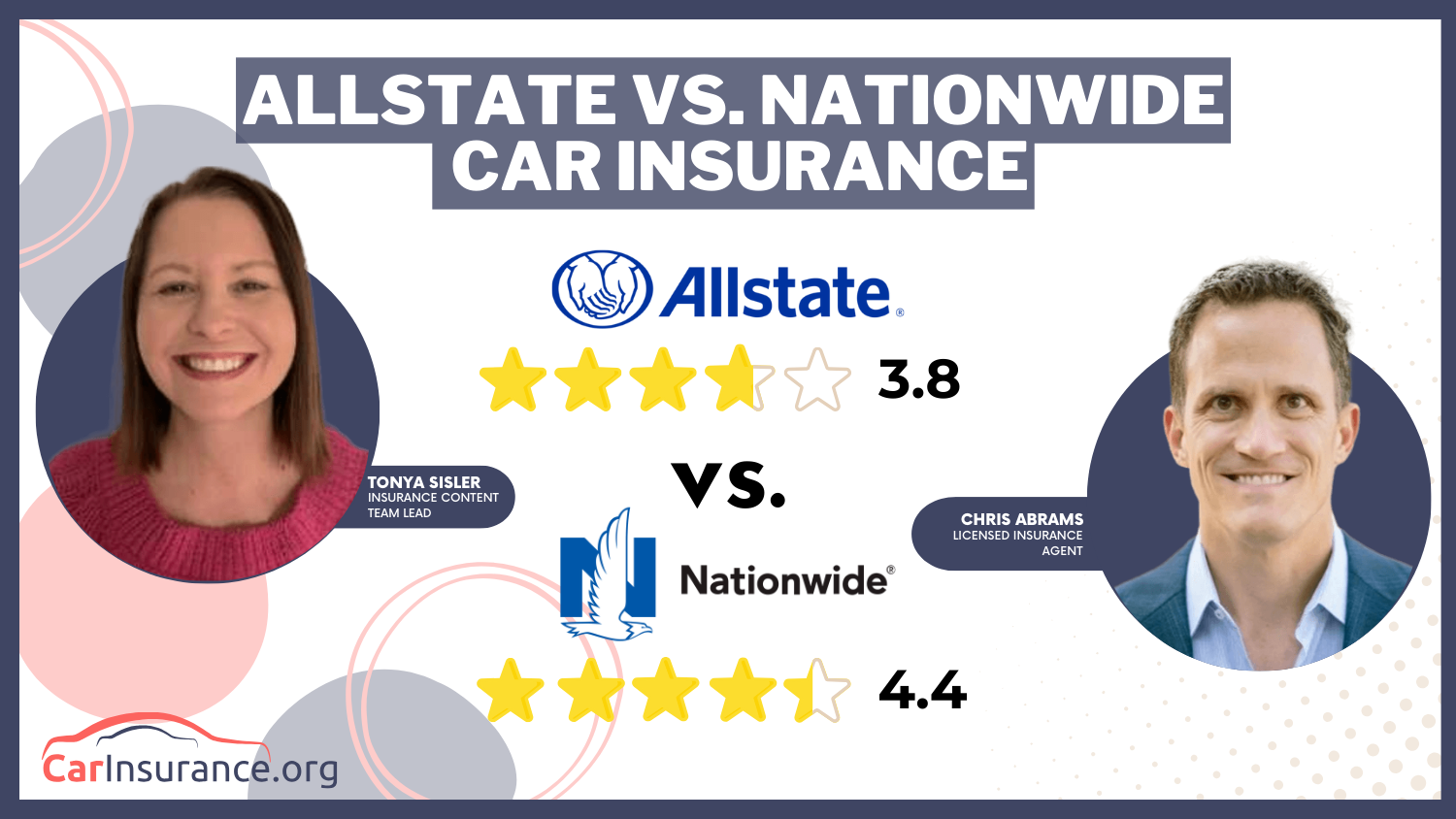

Allstate vs. Nationwide Car Insurance Rating

| Rating Criteria |  |

|

|---|---|---|

| Overall Score | 3.8 | 4.4 |

| Business Reviews | 4.0 | 4.5 |

| Claim Processing | 3.0 | 3.5 |

| Company Reputation | 4.5 | 4.5 |

| Coverage Availability | 5.0 | 5.0 |

| Coverage Value | 3.5 | 4.3 |

| Customer Satisfaction | 2.0 | 2.0 |

| Digital Experience | 4.5 | 4.5 |

| Discounts Available | 5.0 | 5.0 |

| Insurance Cost | 3.4 | 4.5 |

| Plan Personalization | 4.5 | 4.5 |

| Policy Options | 3.4 | 4.7 |

| Savings Potential | 3.9 | 4.7 |

| Allstate Review | Nationwide Review |

As you explore details about Allstate vs. Nationwide car insurance quotes, you’ll gain insight on how to get cheap auto insurance. Enter your ZIP code in the free comparison tool above to compare the best companies near you.

- Nationwide insurance is more affordable than Allstate

- Allstate insurance has a larger market share

- You can save money when bundling home and car insurance

Allstate vs. Nationwide Car Insurance Rates

Nationwide auto insurance is cheaper on average than Allstate. However, your monthly premium will vary based on the personal factors that determine car insurance rates. These factors include age, gender, marital status, commute mileage, credit score, and driving record.

Learn More: Factors That Affect the Price of Car Insurance

Continue reading this guide to learn more about factors that affect the price of car insurance.

Rates by Age and Gender

Age is a significant factor in determining auto insurance rates. Car insurance companies correlate your age to your overall driving experience. How do Allstate vs. Nationwide car insurance companies weigh these different factors?

Let’s break down the Allstate and Nationwide auto insurance rates to find out.

Allstate vs. Nationwide Full Coverage Car Insurance Monthly Rates by Age & Gender

| Age & Gender |  |

|

|---|---|---|

| 16-Year-Old Female | $868 | $586 |

| 16-Year-Old Male | $910 | $679 |

| 30-Year-Old Female | $240 | $177 |

| 30-Year-Old Male | $252 | $194 |

| 45-Year-Old Female | $231 | $161 |

| 45-Year-Old Male | $228 | $164 |

| 60-Year-Old Female | $214 | $141 |

| 60-Year-Old Male | $220 | $149 |

Nationwide car insurance is cheaper than Allstate Corporation car insurance, and teen and young adult drivers pay the most for auto insurance. Take advantage of discounts for student drivers to cut down on costs, and teen drivers should stay on a parent’s policy.

Read More: The Perks of Staying on Your Parents’ Car Insurance Policy

Gender and marital status are also considered in your risk profile. Statistically, women and married people appear to be safer drivers. Married drivers are more likely to secure affordable car insurance rates, while single drivers pay more.

Rates by Driving Record

The most crucial factor that determines your car insurance rates is your driving record. Infractions on your driving history can raise your auto insurance rates significantly.

What do car insurance rates look like at Allstate and Nationwide when either company reviews your driving record? Let’s compare and see which company is the cheapest.

Allstate vs. Nationwide Full Coverage Car Insurance Monthly Rates

| Driving Record |  |

|

|---|---|---|

| Clean Record | $228 | $164 |

| Not-At-Fault Accident | $321 | $230 |

| Speeding Ticket | $268 | $196 |

| DUI/DWI | $385 | $338 |

Allstate has more expensive rates, and will also penalize you more for an infraction. With both Allstate and Nationwide, a DUI will cost you the most. Tickets will also raise rates (Learn More: Citation vs Ticket: Are they the same thing?).

Rates by Mileage

Driving less lowers your chance of getting into an accident and filing a claim. Therefore, you’re likely to reduce car insurance costs in the process. In fact, some drivers saw decreases in rates during COVID-19, as working from home decreased their mileage (Learn More: Driving During COVID-19).

But how much will you pay? Let’s examine Allstate and Nationwide’s rates based on commute mileage.

Allstate vs. Nationwide Full Coverage Car Insurance Monthly Rates by Commute

| Daily Commute |  |

|

|---|---|---|

| 10 Miles | $403 | $286 |

| 25 Miles | $411 | $289 |

Allstate car insurance costs more than Nationwide. However, it may be more cost-efficient to choose the highest commute mileage, especially if you’re driving your vehicle every day.

Rates by Credit Score

If you have good or exceptional credit, you could receive a significant discount on car insurance. Why? According to Experian, auto insurance companies correlate your credit history to your risk of filing claims. Statistically speaking, the better your credit, is the less likely you are to file a claim.

Read More: Things You Do That Can Raise Your Premiums

What does this mean for customers with fair or poor credit? Let’s find out how Allstate and Nationwide calculate premiums based on credit.

Allstate vs. Nationwide Full Coverage Car Insurance Monthly Rates by Credit

| Credit Score |  |

|

|---|---|---|

| Good Credit | $322 | $244 |

| Fair Credit | $382 | $271 |

| Bad Credit | $541 | $340 |

Policyholders with good credit scores pay the least for car insurance, while customers with fair and poor credit scores pay at least $30 more.

Nationwide is the best option between the two companies if you have fair or poor credit.

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Car Insurance Coverages at Allstate vs. Nationwide

Sometimes you’ll need more than the minimum car insurance requirements. Low auto insurance rates save you money, but will you have enough coverage?

Let’s see which company has more coverage.

Comparing Allstate vs. Nationwide Car Insurance Coverage Options

| Coverage Option |  |

|

|---|---|---|

| Collision Coverage | ✅ | ✅ |

| Comprehensive Coverage | ✅ | ✅ |

| Bodily Injury Liability | ✅ | ✅ |

| Property Damage Liability | ✅ | ✅ |

| Uninsured & Underinsured Motorist | ✅ | ✅ |

| Medical Payments Coverage | ❌ | ✅ |

| Personal Injury Protection (PIP) | ✅ | ✅ |

| Rental Reimbursement Coverage | ✅ | ❌ |

| Gap Coverage | ❌ | ✅ |

| Personal Umbrella Policy | ✅ | ❌ |

| Sound System Insurance | ✅ | ❌ |

| Roadside Assistance | ✅ | ✅ |

| Classic Car Insurance | ✅ | ❌ |

| Travel Car Insurance to Mexico | ✅ | ❌ |

| Rental Car Expense | ❌ | ✅ |

| Accident Forgiveness | ❌ | ✅ |

| Vanishing Deductible | ❌ | ✅ |

| Total Loss Deductible Waiver | ❌ | ✅ |

| Towing and Labor Coverage | ❌ | ✅ |

Nationwide has more options, but Allstate Insurance Company has specialty auto insurance coverage products, such as classic car insurance, sound system insurance, and travel car insurance to Mexico.

Learn More: How can I get Allstate accident forgiveness?

You can also still get regular coverages like rental car coverage. If your car is in the shop after a covered accident, the Allstate rental car reimbursement option can help cover rental car costs.

Both Allstate and Nationwide also offer pay-per-mile insurance programs with Allstate’s Milewise and Nationwide’s SmartMiles.

With these specialty coverage programs, you pay a set monthly premium and then a per-mile rate. These programs are ideal for drivers who rarely drive, such as retired drivers.

Allstate Specialty Coverages

One of the specialties that Allstate offers is umbrella insurance. When evaluating Allstate’s umbrella policy, it’s important to consider how it complements other coverage options. For instance, if you’re looking into Allstate insurance rental car discount, this can provide additional savings on rental coverage while your vehicle is being repaired.

Additionally, comparing this with Nationwide’s gap insurance can help you understand how each policy addresses potential coverage gaps and provides comprehensive protection.

You can protect yourself from financial loss if your car is totaled and you owe more than its current value with Allstate gap insurance.

- Policy Coverage: Review the benefits and coverage provided by Allstate’s umbrella policy, which offers additional liability protection beyond standard auto insurance.

- Customer Feedback: Look into Allstate umbrella policy reviews to gauge customer satisfaction and effectiveness of the coverage.

- Comparisons: Compare Allstate’s umbrella policy with similar offerings from other insurers to determine if it meets your needs.

If you own a classic or antique vehicle, consider opting for collector car Insurance from Allstate. This specialized insurance provides tailored coverage to protect your prized possession. You can easily obtain an online insurance quote from Allstate to compare rates and coverage options, ensuring your collector car receives the best protection at a competitive price.

Read More: Need Roadside Assistance? You’re in Good Hands with Allstate Roadside Assistance

By comparing Allstate Insurance Company with other leading insurance providers and examining specific aspects such as coverage options, rates, discounts, and customer reviews, you can make a more informed decision on the best insurance policy for your needs.

Allstate and Nationwide Car Insurance Discounts

If the factors above give you higher than average car insurance quotes, start searching for discounts to lower your policy costs. The more deals you’re eligible for, the more you’ll save per month.

Let’s compare Allstate vs. Nationwide car insurance discounts to see which company has more deals.

Allstate vs. Nationwide Car Insurance Discounts

| Auto Insurance Discount |  |

|

|---|---|---|

| Adaptive Cruise Control | ❌ | 10% |

| Adaptive Headlights | ❌ | 5% |

| Anti-lock Brakes | 5% | 5% |

| Anti-Theft | 10% | 10% |

| Daytime Running Lights | 3% | 3% |

| Electronic Stability Control | 5% | 5% |

| Utility Vehicle | 8% | ❌ |

| Vehicle Recovery | 6% | 6% |

| VIN Etching | ❌ | 2% |

| Lane Departure Warning | ❌ | 7% |

| Newer Vehicle | 10% | 10% |

| Green Vehicle | 5% | ❌ |

| Forward Collision Warning | ❌ | 8% |

| Claim Free | 15% | 15% |

| Continuous Coverage | 7% | ❌ |

| Defensive Driver | 10% | 10% |

| Distant Student | 8% | 8% |

| Driver's Ed | 6% | ❌ |

| Driving Device/App | 10% | 10% |

| Early Signing | 5% | 5% |

| Emergency Deployment | ❌ | ❌ |

| Engaged Couple | ❌ | ❌ |

| Family Legacy | ❌ | ❌ |

| Family Plan | ❌ | 6% |

| Farm Vehicle | 7% | ❌ |

| Fast 5 | ❌ | ❌ |

| Federal Employee | ❌ | ❌ |

| Full Payment | 9% | ❌ |

| Further Education | ❌ | 4% |

| Garaging/Storing | ❌ | ❌ |

| Good Credit | ❌ | 10% |

| Good Student | 10% | 10% |

| Homeowner | ❌ | 5% |

| Life Insurance | 5% | 5% |

| Low Mileage | 7% | 7% |

| Loyalty | ❌ | 6% |

| Married | ❌ | 5% |

| Membership/Group | ❌ | 5% |

| Military | 5% | ❌ |

| Military Garaging | ❌ | ❌ |

| Multiple Drivers | ❌ | ❌ |

| Multiple Policies | 12% | 12% |

| Multiple Vehicles | ❌ | 10% |

| New Address | ❌ | ❌ |

| New Customer/New Plan | ❌ | ❌ |

| New Graduate | ❌ | ❌ |

| Newly Licensed | ❌ | ❌ |

| Newlyweds | ❌ | ❌ |

| Non-Smoker/Non-Drinker | ❌ | ❌ |

| Occasional Operator | ❌ | ❌ |

| Occupation | 5% | 5% |

| On-Time Payments | 6% | ❌ |

| Online Shopper | ❌ | ❌ |

| Paperless Documents | 3% | 3% |

| Paperless/Auto Billing | 4% | 4% |

| Passive Restraint | 5% | 5% |

| Recent Retirees | ❌ | ❌ |

| Renter | ❌ | ❌ |

| Roadside Assistance | ❌ | ❌ |

| Safe Driver | 15% | 15% |

| Seat Belt Use | ❌ | ❌ |

| Senior Driver | 6% | ❌ |

| Stable Residence | ❌ | 4% |

| Students & Alumni | ❌ | 5% |

| Switching Provider | ❌ | ❌ |

| Volunteer | ❌ | ❌ |

| Young Driver | ❌ | ❌ |

Allstate offers fewer discounts than Nationwide Mutual Insurance Company, but you may not qualify for all the discounts on either company’s list, such as the telematics discounts offered by Both Allstate’s Drivewise and Nationwide’s SmartRide (Read More: Car Insurance with Telematics).

Good driver programs require drivers to demonstrate good driving behaviors before a discount is issued.Dani Best Licensed Insurance Producer

However, one way you can secure a discount is through bundling. If you’re thinking about comparing Allstate vs. Nationwide home insurance, you have a chance to bundle that policy with your car insurance to save on both types of coverage.

Allstate and Nationwide also offer a valuable car insurance student discount to help young drivers save on their premiums.

This discount is designed to reward students who maintain good grades, encouraging responsible behavior both on and off the road. By taking advantage of the Nationwide or Allstate car insurance student discount, students can enjoy more affordable coverage while focusing on their education.

Customer Reviews of Allstate and Nationwide

Now that we’ve reviewed rates, coverages, and discounts at Nationwide vs. Allstate, we want to look into customer reviews of the companies. To start, take a look at the Reddit thread discussing Allstate below.

How is Allstate as an insurance company, are the nightmare stories about them true?

byu/Jcs609 inInsurance

When reading through Allstate warnings, you will find that a common thread of complaints is denied claims and high rates. However, other customers mention having no bad experiences with Allstate.

This mix of reviews is common for an insurance company. When looking through Reddit comments about Nationwide auto insurance, you will see similar contrasting reviews about filing a car insurance claim after an accident.

While some customers recommend Nationwide, saying they had a great claim experience, others warn potential customers away, citing denied claims or being dropped after a claim.

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Business Ratings of Allstate vs. Nationwide

Both Allstate and Nationwide are major competitors in the auto insurance world, with large market shares. Because of this, they have been rated by several businesses, that have evaluated everything from financial strength to customer service.

Price is important, but you also want to know if you can trust your car insurance company to pay a claim and deliver good service in the process. This is why you should always check a company’s financial strength and customer satisfaction ratings.

Financial strength ratings from companies like A.M. Best give you insight into how capable a company is of paying out claims.Daniel Walker Licensed Insurance Agent

Before you commit to a car insurance quote, take a moment to look at the Allstate and Nationwide ratings.

Insurance Business Ratings & Consumer Reviews: Allstate vs. Nationwide

| Agency |  |

|

|---|---|---|

| Score: 691 / 1,000 Avg. Satisfaction | Score: 728 / 1,000 Above Avg. Satisfaction |

|

| Score: A+ Excellent Business Practices | Score: A+ Excellent Business Practices |

|

| Score: 74/100 Good Customer Satisfaction | Score: 75/100 Positive Customer Feedback |

|

| Score: 1.45 Avg. Complaints | Score: 0.78 Fewer Complaints Than Avg. |

|

| Score: A+ Superior Financial Strength | Score: A+ Excellent Financial Strength |

Allstate and Nationwide have identical A.M. Best and J.D. Power scores. Nationwide has a better Moody’s credit score, but Allstate’s S&P credit score is better than Nationwide’s. Allstate’s mobile app reviews are also stronger than Nationwide’s.

To access the insurance apps for either company, you’ll need to create a Nationwide or Allstate insurance account.

Read More: How to Lower Your Car Insurance Cost

You can create a Nationwide or Allstate login online or through a smart device like an iPad or smartphone.

Allstate Car Insurance Pros and Cons

There are multiple pros to Allstate, such as how Allstate has initiated innovative programming such as its Drivewise telematics program, which saves money on premiums for safe and careful drivers. Allstate also has specialty coverages like specialized classic car insurance to protect these valuable vehicles.

Other pros include:

- Coverage Variety: Allstate offers everything from gap to rental car reimbursement.

- Pay-Per-Mile Insurance: Allstate’s Milewise is ideal for low-mileage drivers looking to save with the best dollar-a-day car insurance.

- Good Driver Discount: Customers can join Drivewise to save based on their good driving habits.

Some cons to consider about Allstate include:

- DUI Insurance Rates: If you have a DUI on your record, Allstate DUI insurance rates may be higher. It’s important to compare these rates to find the best deal.

- Customer Complaints: Allstate has more customer complaints than Nationwide, with a 1.45 score from the NAIC.

Considering the pros and cons of Allstate can help you make an informed choice.

Nationwide Car Insurance Pros and Cons

Let’s now look at a few pros and cons of Nationwide Mutual Insurance Company. First, some of the great pros of Nationwide include:

- Cheaper Rates: Nationwide’s rates are cheaper on average than Allstate’s.

- Pay-Per-Mile Insurance: Nationwide’s SmartMiles program is a great option for low-mileage drivers.

- Coverage Variety: Nationwide also boasts a variety of coverages, such as gap insurance.

One of the biggest things to recommend Nationwide over Allstate is its cheaper rates (Read More: Cheap Car Insurance Companies That Only Look Back 3 Years). However, some cons of Nationwide are as follows:

- Availability: Nationwide is not available in Alaska, Hawaii, Louisiana, or Massachusetts.

- Customer Feedback: Not all customers have left positive reviews about Nationwide.

Did you see any advantages and disadvantages based on your personal circumstances as you were reading the guide? Double-check the article to make sure before you decide on a quote.

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

What to Consider With Allstate Car Insurance

The price of Allstate car insurance can vary based on several factors, including your location, driving history, and the type of coverage you choose. Known for its comprehensive coverage options and reliable customer service, Allstate offers competitive rates that cater to a wide range of drivers.

To find the best Allstate car insurance price for your needs, it’s recommended to compare quotes and explore available discounts.

Learn More: Where can I get cheap full coverage car insurance?

When searching for the best car insurance deal, understanding how to leverage various discounts and features like Drivewise can help you save significantly.

When evaluating Allstate car insurance quotes, it’s important to consider various aspects to ensure you’re getting the best deal. For instance, Allstate provides an Allstate insurance rental car discount which can help reduce costs if you need a rental while your vehicle is being repaired.

- Allstate Auto Insurance Quote: Start by obtaining an Allstate auto insurance quote. This will provide you with a baseline estimate for your coverage needs.

- Allstate Car Insurance Estimate: Use the Allstate car insurance estimate tool to get a rough idea of your premium costs based on your personal details and coverage preferences.

- Online Allstate Insurance Quote: For convenience, you can get an Online Allstate insurance quote. This allows you to quickly see potential costs without visiting an office.

Comparing Allstate’s quotes with options like Nationwide’s Gap insurance can help you understand how each provider’s coverage and discounts stack up. This approach will give you a clearer picture of your potential expenses and available savings. You should also consider Allstate discounts like:

- Allstate Bundle Discount: Save money by bundling multiple policies with Allstate, such as combining auto and home insurance.

- Allstate Good Student Discount: For students with good grades, the Allstate insurance good student discount can be a great way to lower rates.

- Allstate Employee Discounts: If you work for a company that partners with Allstate, you might be eligible for Allstate employee discounts.

- Allstate Military Discount: Members of the military can take advantage of the Allstate insurance military discount for additional savings.

When getting your Allstate quotes and applying discounts, make sure you are also checking ratings and reviews. You’ll want to research Allstate car insurance ratings to gauge the company’s reputation and reliability.

You should also read Allstate car insurance reviews from other customers to get insights into their experiences and service quality and check the Allstate insurance company ratings from industry watchdogs to understand its financial strength and customer service performance.

Then, you can compare Allstate insurance prices with other providers to make sure you’re getting the best value for your money.

Make sure to regularly review your Allstate insurance rates and adjust coverage as needed to maintain affordability and revisit your Allstate insurance estimate periodically to see if you qualify for additional discounts or if your circumstances have changed.

By utilizing these strategies and discounts, you can maximize your savings and get the most out of your Allstate car insurance policy.

What to Consider With Nationwide Car Insurance

Nationwide Mutual Insurance Company offers competitive auto insurance with benefits like a good student discount and comprehensive gap insurance. Comparing Nationwide insurance rates and reviews, including those from Consumer Reports, can help you assess its value relative to other providers like Allstate.

For a thorough evaluation, consider how Nationwide’s different types of car insurance coverage and customer feedback stack up against competitors.

- Getting Quotes: Use Nationwide auto insurance quotes to get an estimate of your potential premiums. Compare these quotes with those from Allstate and other providers.

- Discounts: Investigate discounts offered by Nationwide, including the Nationwide good student discount and other savings opportunities.

- Coverage Details: Ensure you understand the coverage details included in Nationwide quotes, such as gap insurance and rental car discounts.

For example, compare the types of coverage offered by Nationwide vs. Allstate, including standard and additional options like gap insurance and umbrella policies.

You should also evaluate Nationwide insurance rates against Allstate insurance rates to determine which provider offers the best value for your coverage needs, and review Nationwide car insurance rating and Nationwide insurance reviews on Consumer Reports to assess customer satisfaction compared to Allstate’s ratings.

Allstate and Nationwide vs. Other Major Car Insurance Providers

When choosing the right car insurance provider, it’s essential to compare different companies to find the best coverage and rates for your needs. Here’s a detailed comparison of Allstate with other major insurance providers, including insights into specific policies and ratings.

Read more: Allstate vs. USAA Car Insurance

When comparing Allstate with Liberty Mutual, Nationwide, and Progressive, focus on coverage options, discounts, and rates. Allstate offers unique benefits like classic car insurance and rental car discounts, while other providers may offer competitive rates and additional savings. Check customer ratings and policy details to choose the best option for your needs.

Allstate vs. American Family

When comparing coverages, compare Allstate’s diverse range of coverage options with those offered by American Family. Consider features such as classic car insurance and umbrella policies.

Read More: American Family Car Insurance Review

You should also evaluate how Allstate insurance rates stack up against American Family’s rates for similar coverage levels and look into Allstate vs. American Family customer reviews to gauge service quality and customer satisfaction.

Allstate and Nationwide vs. Liberty Mutual

When comparing Liberty Mutual vs. Allstate, make sure to review the specific coverage options and features provided by both companies.

Learn More: Liberty Mutual Car Insurance Review

Compare available discounts, including Liberty Mutual vs. Allstate bundle discounts and rental car discounts, and check Liberty Mutual insurance rates and Allstate insurance ratings by J.D. Power to see which provider offers better value and service.

J.D. Power rates customer satisfaction after collecting and analyzing customer surveys.Kristen Gryglik Licensed Insurance Agent

Make sure to also examine Liberty Mutual vs. Nationwide in terms of coverage options, customer service, and pricing. You should also evaluate the Nationwide good student discount compared to similar discounts offered by Liberty Mutual.

Allstate vs. Progressive

You should compare the range of coverage options provided by Progressive vs. Allstate car insurance, including any specialty coverage like rental car reimbursement. Read more about Progressive in our Progressive car insurance review.

Additionally, assess the pricing differences between Allstate and Progressive, including any potential discounts offered, and look into Allstate insurance reviews and Progressive insurance reviews to understand customer experiences with each provider.

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Choosing Between Allstate and Nationwide Car Insurance

When comparing Allstate vs. Nationwide car insurance, both Allstate and Nationwide offer high-quality car insurance coverage and boast strong customer satisfaction ratings.

Read More: Cheapest Car Insurance Companies

While Allstate Insurance Company has a better A.M. Best rating, Nationwide Mutual Insurance Company wins out when it comes to coverage, claims process, and customer reviews. Overall, customers are equally pleased with these insurers’ claims experience.

In addition to the car insurance company you choose, factors like your age, credit score, and discounts can affect quotes, so we recommend getting quotes from multiple companies.

Now that you know more about whether to buy Allstate vs. Nationwide car insurance, you’re ready to compare rates. Use our free online quote tool below to compare multiple companies in your area and secure cheap car insurance.

Your Opinion Matters!

Rate your insurance provider and provide share feedback with shoppers just like you.

Frequently Asked Questions

Is Allstate cheap?

No, Allstate is generally not considered cheap. Compared to Nationwide, which is more affordable, Allstate’s rates are higher when you buy Allstate Vehicle and Property Ins. Co. car insurance.

Is Allstate cheaper than Progressive?

The article does not provide a direct comparison between Allstate and Progressive. To find out which is cheaper, you should compare quotes from both insurers.

Is Allstate cheaper than Geico?

The article does not provide a direct comparison between Allstate and Geico. You may need to compare quotes from both companies to determine which is cheaper for your specific situation. Learn more about Geico in our Geico car insurance review.

Is Allstate insurance expensive?

Yes, Allstate insurance is considered expensive compared to Nationwide. On average, Allstate car insurance costs $120 more per month than Nationwide. To find affordable auto insurance in your area, enter your ZIP in our free quote tool.

How much does Allstate pay for bodily injury per claim?

or details on coverage limits on bodily injury claims, you should check your Allstate policy documents or contact a representative.

How much does Allstate car insurance cost?

Wondering how much does Allstate car insurance cost per month? On average, Allstate car insurance rates start at $87 per month for minimum coverage (Read More: Is it bad to just carry minimum coverage car insurance?).

How much is Allstate car insurance for full coverage?

Allstate full coverage starts at $214 per month.

Why is Allstate so expensive?

Allstate’s higher rates compared to Nationwide can be attributed to factors such as higher premiums for various risk profiles, including age, driving record, and credit score. Additionally, Allstate may have higher operational costs and different pricing strategies. To determine your exact rate at Allstate, you can get Allstate auto insurance quotes online.

Does Allstate car insurance cover rental cars?

Yes, Allstate offers rental car coverage as part of its insurance policies, which can help reduce costs if you need a rental while your vehicle is being repaired (Learn More: If my car breaks down, will insurance cover a rental?).

Does Allstate offer accident forgiveness?

You will have to add accident forgiveness onto your policy to qualify. You may need to contact Allstate directly or check their policy details to confirm if they offer accident forgiveness.

How much is Nationwide car insurance?

Nationwide car insurance starts at an average of $63 per month. You can get a Nationwide car insurance quote to determine your exact rate.

Are Nationwide and Allstate the same company?

No, Nationwide and Allstate Corporation are not the same company. They are separate insurance providers with different coverage options, rates, and policies.

Chris Abrams

Licensed Insurance Agent

Chris is the founder of Abrams Insurance Solutions and Marcan Insurance, which provide personal financial analysis and planning services for families and small businesses across the U.S. His companies represent nearly 100 of the top-rated insurance companies. Chris has been a licensed insurance agent since 2009 and has active insurance licenses in all 50 U.S. states and D.C. Chris works tireles...

Licensed Insurance Agent

Editorial Guidelines: We are a free online resource for anyone interested in learning more about car insurance. Our goal is to be an objective, third-party resource for everything car insurance related. We update our site regularly, and all content is reviewed by car insurance experts.