GoAuto Car Insurance Review for 2025 [See Rates & Discounts Here]

GoAuto car insurance review shows a budget-friendly insurer offering basic coverage for around $75 per month by selling directly and skipping commissioned agents. GoAuto keeps costs down with limited add-ons and custom payment plans, but customer reviews show higher complaints than those of cheaper competitors.

Kristen Gryglik

Licensed Insurance Agent

Kristen is a licensed insurance agent working in the greater Boston area. She has over 20 years of experience counseling individuals and businesses on which insurance policies best fit their needs and budgets. She knows everyone has their own unique needs and circumstances, and she is passionate about counseling others on which policy is right for them. Licensed in Massachusetts, New Hampshire,...

Licensed Insurance Agent

UPDATED: Apr 22, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident car insurance decisions. Comparison shopping should be easy. We are not affiliated with any one car insurance company and cannot guarantee quotes from any single provider.

Our insurance industry partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about car insurance. Our goal is to be an objective, third-party resource for everything car insurance related. We update our site regularly, and all content is reviewed by car insurance experts.

UPDATED: Apr 22, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident car insurance decisions. Comparison shopping should be easy. We are not affiliated with any one car insurance company and cannot guarantee quotes from any single provider.

Our insurance industry partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

GoAuto

Average Monthly Rate For Good Drivers

$75A.M. Best Rating:

B++Complaint Level:

LowPros

- Sells policies directly to customers

- No pressure from commissioned agents

- Offers flexible, custom payment schedules

- Supports in-person and digital services

- Streamlined app for easy access

Cons

- Limited availability in select states

- No coverage beyond auto insurance

- Add-ons not offered statewide

- Above-average volume of complaints

GoAuto car insurance review shows how the company keeps costs low by cutting out commissioned agents and selling policies directly to drivers.

GoAuto Car Insurance Rating

| Rating Criteria | |

|---|---|

| Overall Score | 3.0 |

| Business Reviews | 3.0 |

| Claims Processing | 2.2 |

| Company Reputation | 3.0 |

| Coverage Availability | 1.9 |

| Coverage Value | 2.8 |

| Customer Satisfaction | 3.3 |

| Digital Experience | 3.0 |

| Discounts Available | 4.3 |

| Insurance Cost | 3.6 |

| Plan Personalization | 3.0 |

| Policy Options | 2.5 |

| Savings Potential | 3.9 |

GoAuto offers state-minimum liability, personal injury protection, collision, and comprehensive car insurance coverage, with limited add-ons available only in select states.

The company serves six states and offers flexible payments, including the ability to choose your due date. Although it offers simplicity and accessibility, it also carries more customer complaints than some lower-cost rivals.

- GoAuto car insurance review shows rates start at $75 with payment plans

- Offers basic coverage and direct service without agent commissions

- GoAuto car insurance review is a top pick for budget-focused local drivers

Get the right car insurance at the best price — enter your ZIP code to shop for coverage from the top insurers.

GoAuto Rates by Age & Gender

Looking at GoAuto’s monthly rates by age, gender, and coverage level, you’ll notice a clear trend: younger drivers, especially teens, pay the most, up to $480 per month for full coverage. That’s typical, since insurers see them as higher risk. Female drivers tend to pay a bit less than males at the same age, but the difference evens out over time.

GoAuto Car Insurance Monthly Rates by Coverage Level, Age, & Gender

| Age & Gender | Minimum Coverage | Full Coverage |

|---|---|---|

| 16-Year-Old Female | $250 | $450 |

| 16-Year-Old Male | $270 | $480 |

| 18-Year-Old Female | $220 | $400 |

| 18-Year-Old Male | $240 | $430 |

| 25-Year-Old Female | $115 | $205 |

| 25-Year-Old Male | $125 | $215 |

| 30-Year-Old Female | $105 | $195 |

| 30-Year-Old Male | $110 | $200 |

| 45-Year-Old Female | $90 | $170 |

| 45-Year-Old Male | $95 | $180 |

| 60-Year-Old Female | $80 | $160 |

| 60-Year-Old Male | $85 | $165 |

| 65-Year-Old Female | $75 | $150 |

| 65-Year-Old Male | $80 | $155 |

If you’re wondering where you can get cheap full coverage car insurance, GoAuto offers a straightforward option, though younger drivers will still see higher rates. Once drivers hit their 20s and early 30s, rates start to drop significantly. For example, a 25-year-old female pays about $115 for minimum coverage, while full coverage runs around $205.

By age 65, those rates fall even more, with minimum coverage dipping to $75 and full coverage averaging $150 for women. Car insurance GoAuto rates are based on specific risk factors like your age and gender, and while that’s common across the industry, their pricing stays pretty straightforward. It’s designed for drivers who want simple, no-frills coverage without extra costs or complications.

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

GoAuto Car Insurance Cost Breakdown

Starting with the comparison table, GoAuto’s average monthly rate is $128, which puts it right in the middle of the pack. It’s cheaper than Allstate, Farmers, and Liberty Mutual, but pricier than State Farm, Progressive, and Geico car insurance. So if you’re focused on affordability, GoAuto isn’t the lowest-cost option out there—but it’s competitive, especially considering it doesn’t use agents or upsell unnecessary add-ons.

GoAuto Car Insurance Monthly Rates vs. Top Providers

| Insurance Company | Monthly Rate |

|---|---|

| $135 | |

| $129 | |

| $136 | |

| $109 | |

| $128 | |

| $148 |

| $129 |

| $110 | |

| $91 | |

| $122 |

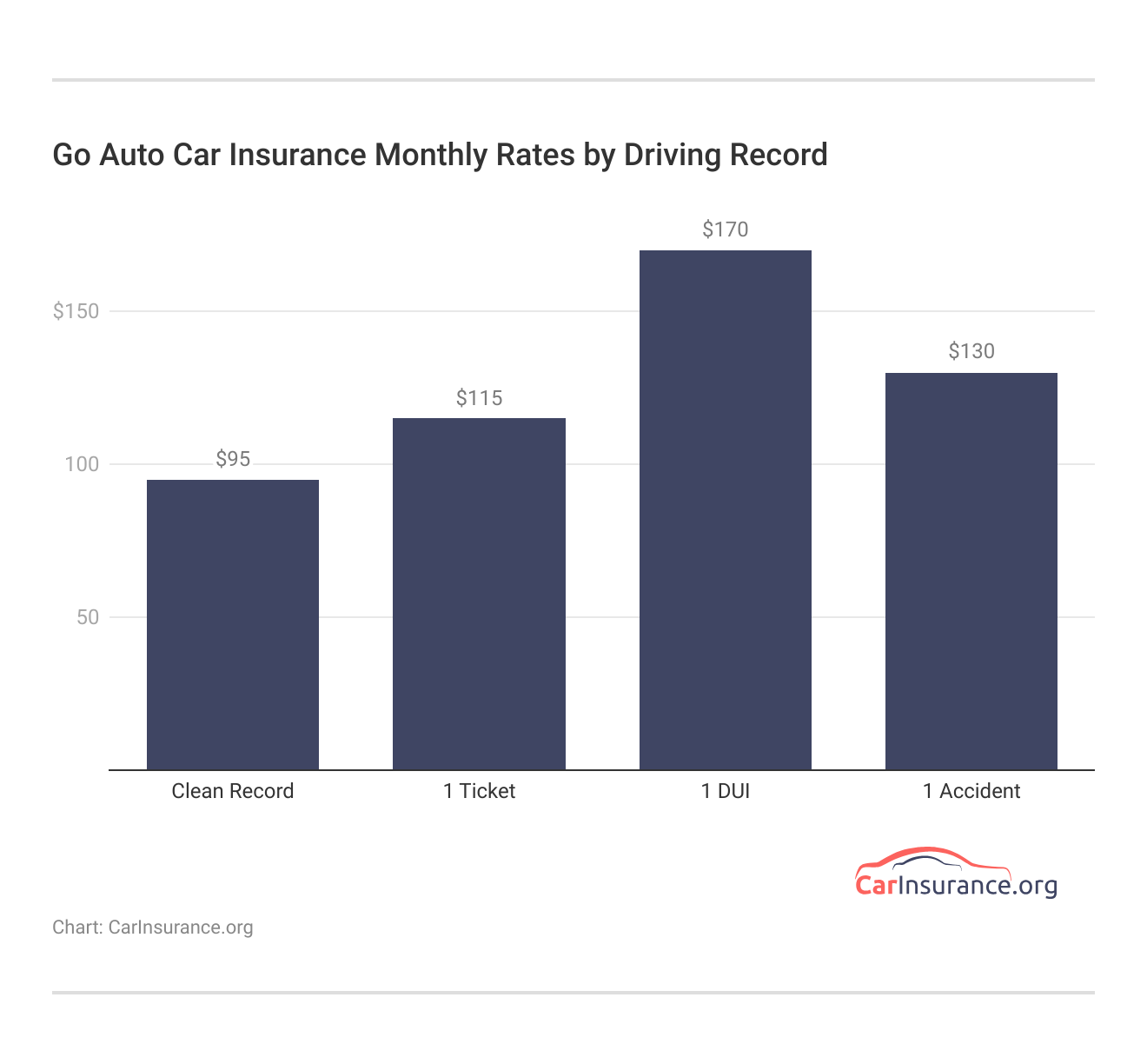

Now, looking at the driving record breakdown, you can really see how much your history affects what you pay. With minimum coverage, someone with a clean record pays about $95 a month, but that jumps to $130 after an accident, and all the way up to $170 if you’ve had a DUI. If you’ve just had a ticket, expect to pay around $115. So even one slip-up can raise your rate by $20 to $75 a month.

For full coverage, the pattern holds—rates start at $180 for drivers with clean records, go up to $200 with a ticket, $240 after an accident, and spike to $320 if there’s a DUI. That’s nearly double the cost for full coverage just based on your record.

Overall, GoAuto car insurance does reward clean driving with better rates, but penalties for violations, especially a DUI, can drive your premium up fast. It’s not the cheapest option out there, but GoAuto car insurance offers a practical middle ground with straightforward coverage and flexible payments.

GoAuto Driver Discounts You Should Know

When you look at GoAuto’s car insurance discounts, there’s a good mix of options that can actually help lower your monthly rate. If you’re insuring more than one vehicle, you can save up to 25%—that’s the highest discount they offer. Safe drivers can get 20% off, and students with good grades may qualify for a 15% discount.

GoAuto Car Insurance Discounts

| Discount Type | |

|---|---|

| Multi-Vehicle | 25% |

| Safe Driver | 20% |

| Good Student | 15% |

| Multi-Policy | 10% |

| Anti-Theft Device | 10% |

| Military | 10% |

| Switching/Transfer | 10% |

| Paid-in-Full | 10% |

| Anti-Lock Brakes | 5% |

| Paperless Billing | 5% |

The rest of GoAuto’s discounts land in the 5–10% range—things like a military service discount, switching from another insurer, or installing anti-theft devices. Even smaller perks like going paperless or having anti-lock brakes can shave down your rate. When buying car insurance, stacking a few of these discounts can lead to noticeable savings without changing your coverage.

Compare GoAuto Insurance by Credit Rating

If you’re wondering how credit affects your GoAuto premium, this chart lays it out clearly. Drivers with good credit pay about $128 per month with GoAuto, which is lower than most major providers like Allstate and Liberty Mutual car insurance. As credit drops to fair, GoAuto’s rate increases to $155, and for bad credit, it climbs to $185.

GoAuto Car Insurance Monthly Rates vs. Top Competitors by Credit Score

| Insurance Company | Good Credit | Fair Credit | Bad Credit |

|---|---|---|---|

| $145 | $165 | $210 | |

| $132 | $155 | $195 | |

| $140 | $165 | $200 | |

| $120 | $140 | $175 | |

| $128 | $155 | $185 | |

| $138 | $160 | $205 |

| $129 | $152 | $190 |

| $125 | $150 | $190 | |

| $105 | $130 | $160 | |

| $122 | $145 | $185 |

While that jump is expected, GoAuto stays competitive, still more affordable than Liberty Mutual or Farmers for drivers with poor credit. So if your credit score isn’t perfect, GoAuto might still be a budget-friendly option worth considering.

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

GoAuto Business Ratings and Financial Strength

GoAuto’s ratings across trusted platforms show a mixed but generally decent reputation. J.D. Power gave it an 864 out of 1,000 for customer satisfaction, and Consumer Reports scored it 75 out of 100. As for GoAuto insurance reviews, BBB-related, the Better Business Bureau gave it an A+ rating, pointing to strong service reliability despite customer complaints found elsewhere.

Go Auto Car Insurance Business Ratings & Consumer Reviews

| Agency | |

|---|---|

| Score: 864/1000 Above Avg. Satisfaction |

|

| Score: A+ Great Rating |

|

| Score: 75/100 Good Customer Feedback |

|

| Score: 3.2 Avg Complaints |

|

| Score: B++ Good Financial Strength |

While the NAIC gave GoAuto a 3.2—indicating it receives a moderate number of complaints—AM Best rated it B++, confirming its financial stability. In one of the GoAuto Insurance reviews Reddit users shared, someone mentioned owning a GoAuto-insured vehicle for nearly six years with no major issues, just routine maintenance.

Comment

byu/delondro from discussion

inEdmonton

They stressed the need to pick a used car that has low mileage and comes with a full-service history and offered practical advice based on real-life experience. Their advice for used-car shoppers: you want the lowest mileage you can get, and you want paperwork for the complete service history.

It’s solid, straightforward advice that holds up no matter where you buy—and it ties back to understanding how car insurance works, especially when evaluating the long-term cost of insuring a higher-risk vehicle.

GoAuto Car Insurance Coverage

GoAuto, founded in 2009, focuses on low-cost auto insurance by selling directly to drivers and cutting out commissioned agents. This approach helps lower rates for customers across the four states where it operates. Instead of pushing expensive extras, GoAuto works with you to choose the right plan based on state laws, budget, and driving habits.

It offers flexible payment options and multiple types of car coverage, including the minimum required by law and basic protection for you, your passengers, and other drivers.

- Liability Coverage: Covers medical bills and repair costs if you’re at fault in an accident; required in all four states GoAuto serves.

- Personal Injury Protection (PIP): Pays for medical expenses, lost income, and funeral costs, no matter who caused the crash.

- Medical Payments (MedPay): Helps pay for medical costs not covered by health insurance or the other driver’s policy.

- Uninsured/Underinsured Motorist: Covers your expenses if the at-fault driver doesn’t have insurance or enough of it.

- Collision and Comprehensive: Collision covers damage to your car from crashes; comprehensive handles non-accident damage like theft, weather, or vandalism.

GoAuto insurance offers limited add-ons, and availability varies by state—extras like rental reimbursement and towing coverage are only offered in places like Louisiana. While GoAuto doesn’t bundle optional features widely, it does provide full coverage insurance, which drivers can customize by adding collision and comprehensive coverage to meet needs beyond state minimums.

How To File a Car Insurance Claim With GoAuto

Filing a claim with GoAuto is straightforward, and you can do it in a way that works best for you—online, over the phone, or through their app. Just make sure you’ve got all the necessary details on hand to help move things along quickly.

- Choose a Method: File your claim by phone at 1-833-700-0000, online, or through the GoAuto mobile app.

- Prepare Your Info: Have details ready, such as your role, policy number, and contact info for everyone involved.

- Include Accident Details: Share the police report number, time, location, and any injury or witness information.

- Initial Contact: A GoAuto agent will reach out within two business days to start the claims process.

- Investigation & Resolution: GoAuto Insurance reviews all details, inspects vehicles, and issues payment if the claim is approved.

When everything is submitted, GoAuto comes in to do the heavy lifting. They will take you from investigating the claim to determining the outcome and make the process as stress-free as possible.

While it helps to be prepared with complete information, especially when filing a car insurance claim after an accident, GoAuto’s support team is available to walk you through each step so nothing gets missed or delayed.

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

GoAuto Car Insurance Pros and Cons

If you’re considering GoAuto, this quick GoAuto car insurance review breaks down what works and what doesn’t. It’s a good fit if you prefer low-frills coverage and want to skip the agent markup—but make sure you’ve thought through how much insurance you need for your car before deciding.

Pros

- Direct-to-Consumer Model: By skipping commissioned agents, GoAuto allows customers to purchase coverage directly, helping to mitigate upselling and keeping it simple.

- Flexible Payment Plans: You can choose your payment schedule and due dates, making it easier to fit your policy into your monthly budget.

- Local Customer Support: With walk-in offices and a strong community presence in the states it serves, GoAuto provides in-person help when needed.

Cons

- Limited Add-On Options: Coverage is barebones, and optional features like roadside assistance or rental reimbursement aren’t available everywhere.

- Higher Complaint Volume: Customer reviews show more complaints than other providers, especially around claims and service response time.

GoAuto works best for drivers who value simplicity and want to avoid the bells and whistles. If your main priority is a no-frills policy with flexible support, it’s a decent option—but it may not suit those looking for robust coverage or nationwide perks. Always weigh those pros and cons against your personal coverage needs before signing up.

Who Benefits Most from GoAuto Insurance

The GoAuto car insurance review shows that the company focuses on affordability by cutting out agents and selling coverage directly to customers. It goes beyond the basics, offering liability, collision, and personal injury protection, with limited add-ons depending on the state.

While it’s not always one of the absolute cheapest car insurance companies, GoAuto does offer value with flexible payment options and walk-in service at local offices. If you’re after straightforward coverage without the upselling, and you like working with a smaller, local provider, GoAuto might be a solid choice.

Enter your ZIP code into our free comparison tool to see how much car insurance costs in your area.

Your Opinion Matters!

Rate your insurance provider and provide share feedback with shoppers just like you.

Frequently Asked Questions

What are the benefits of GoAuto insurance?

GoAuto offers a few key benefits like low down payments, custom payment plans, flexible due dates, and the ability to manage your policy through an app. It’s a good fit for budget-conscious drivers who want to avoid sales commissions and added fees.

Does GoAuto offer SR-22 insurance?

Yes, GoAuto provides SR-22 filings for drivers who need proof of financial responsibility after a serious violation. This service is available in most states where they operate, but you’ll need to request it specifically when starting your policy.

Does GoAuto have full coverage?

Yes, GoAuto offers full coverage, but it’s not a pre-set package. It combines state-required liability with optional add-ons like collision and comprehensive coverage. Since car insurance rates by state can differ widely, you’ll need to talk with a GoAuto agent to tailor a policy that fits your budget and meets local requirements.

What features are included in the GoAuto app?

The GoAuto app allows you to get a quote, pay your bill, manage your policy, view digital ID cards, and file claims. It’s available on both Android and iOS and is designed to make basic account tasks more convenient for policyholders.

How do I get GoAuto car insurance quotes?

You can get a quote directly through the GoAuto website, by calling their customer service line, or by visiting a local office. The quote process typically asks for your ZIP code, vehicle information, and driving history to estimate your rate.

Does GoAuto have roadside assistance?

GoAuto offers limited roadside assistance in certain states, like Louisiana, but it’s not automatically included with your policy. You might get access to towing or emergency help, depending on the location. For better accident preparedness, make sure to ask your local agent exactly what’s covered and if it’s worth adding to your plan.

What is the GoAuto claims phone number?

To file a claim with GoAuto, call 1-833-700-0000. Claims can also be filed online or through their app. Once submitted, an agent usually contacts you within two business days to begin the review process.

What is GoAuto Insurance’s cancellation policy?

GoAuto allows policy cancellations but requires you to notify them directly, either by phone or in person. Refunds for unused premiums may be issued, but cancellation fees or penalties might apply depending on your state’s regulations.

What collision coverage does GoAuto offer?

GoAuto offers basic collision coverage that helps cover repair costs if you’re at fault in an accident. It’s part of their full coverage option and generally available in most areas, but you’ll need to double-check availability with your agent. Alongside choosing the right coverage, GoAuto also encourages safe driving tips to help lower your risk and potentially avoid costly claims altogether.

How is GoAuto’s customer service rated?

GoAuto’s customer service experience varies by platform. While it offers in-person help at local offices and digital support through its app, some customer reviews mention slower response times and difficulty reaching representatives after filing claims.

Find the best comprehensive car insurance quotes by entering your ZIP code into our free comparison tool today.

How can I pay my GoAuto bill online?

You can pay your GoAuto bill online through their official website or mobile app. Options include one-time payments and recurring billing, and you can also choose your payment date for added flexibility.

What is the GoAuto Insurance Company?

GoAuto Insurance is a regional provider that operates in six states and focuses solely on auto coverage. While it’s not typically ranked among the best car insurance companies, it keeps costs down by cutting out agents and selling directly to customers through storefronts and online tools.

How do I report a claim or accident with GoAuto?

To report a claim, call 1-833-700-0000, use the mobile app, or file online. You’ll need to provide policyholder details, vehicle info, incident reports, and any witness or third-party contact information to get the process started quickly.

Kristen Gryglik

Licensed Insurance Agent

Kristen is a licensed insurance agent working in the greater Boston area. She has over 20 years of experience counseling individuals and businesses on which insurance policies best fit their needs and budgets. She knows everyone has their own unique needs and circumstances, and she is passionate about counseling others on which policy is right for them. Licensed in Massachusetts, New Hampshire,...

Licensed Insurance Agent

Editorial Guidelines: We are a free online resource for anyone interested in learning more about car insurance. Our goal is to be an objective, third-party resource for everything car insurance related. We update our site regularly, and all content is reviewed by car insurance experts.

MzKristel

Go Auto Does Not Honor Coverage

Kpal

THE WORST CUSTOMER SERVICE I HAVE EVER EXPERIENCED!

Jamica_Chisley

Go auto with the low ball offers

Kesha_

Beware!!!

Crackcorn58

Bad customer service

Walter_

Dont buy this insurance

walterj

Buyer beware

GoAuto

Don't Use this company.

walterj

GO AUTO BUYERS BEWARE NO GOOD

Twinn83

Frustrated customer