Best Car Insurance in Maine for 2025 [Top 10 Companies Ranked]

The best car insurance in Maine comes from Geico, State Farm, and Progressive, with rates starting at $15 a month. Geico leads as number #1 for its efficient claims process. State Farm offers top-notch customer service with its network of local agents, and Progressive help drivers save up to 30% with Snapshot UBI.

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Jimmy McMillan

Licensed Insurance Agent

Jimmy McMillan is an entrepreneur and the founder of HeartLifeInsurance.com, an independent insurance brokerage. His company specializes in insurance for people with heart problems. He knows personally how difficult it is to secure health and life insurance after a heart attack. Jimmy is a licensed insurance agent from coast to coast who has been featured on ValientCEO and the podcast Modern Li...

Licensed Insurance Agent

UPDATED: Mar 13, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident car insurance decisions. Comparison shopping should be easy. We are not affiliated with any one car insurance company and cannot guarantee quotes from any single provider.

Our insurance industry partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about car insurance. Our goal is to be an objective, third-party resource for everything car insurance related. We update our site regularly, and all content is reviewed by car insurance experts.

19,116 reviews

19,116 reviewsCompany Facts

Full Coverage in Maine

A.M. Best Rating

Complaint Level

Pros & Cons

19,116 reviews

19,116 reviews 18,154 reviews

18,154 reviewsCompany Facts

Full Coverage in Maine

A.M. Best Rating

Complaint Level

Pros & Cons

18,154 reviews

18,154 reviews 13,283 reviews

13,283 reviewsCompany Facts

Full Coverage in Maine

A.M. Best Rating

Complaint Level

Pros & Cons

13,283 reviews

13,283 reviewsThe best car insurance in Maine is offered by Geico, State Farm, and Progressive, with rates as low as $15/month.

Geico provides high-rated claims handling and secures financial stability. State Farm offers incredible customer service with its local representatives, while Progressive provides personalized, tailor-fit policy options and coverage to meet your lifestyle needs.

Rest assured that this car insurance guide can help you secure the best car insurance in Maine for your unique and diverse lifestyle.

Our Top 10 Company Picks: Best Car Insurance in Maine

| Company | Rank | Bundling Discount | A.M. Best | Best For | Jump to Pros/Cons |

|---|---|---|---|---|---|

| #1 | 25% | A++ | Affordable Rates | Geico | |

| #2 | 17% | B | Customer Service | State Farm | |

| #3 | 10% | A+ | Customizable Policies | Progressive | |

| #4 | 10% | A++ | Military Families | USAA | |

| #5 | 25% | A+ | Safe Drivers | Allstate | |

| #6 | 25% | A | Flexible Coverage | Liberty Mutual |

| #7 | 13% | A++ | Bundling Policies | Travelers | |

| #8 | 20% | A | Local Agents | Farmers | |

| #9 | 25% | A | Customer Support | American Family | |

| #10 | 20% | A+ | Discount Programs | Nationwide |

Affordable auto insurance quotes in Maine are just a click away. Enter your ZIP code into our free quote tool to find the best policy for you.

- Find the best car insurance in Maine tailored to your budget and lifestyle

- Geico provides affordable coverage, with rates starting at $15 a month

- Compare the best car insurance in Maine for better discount options

#1 – Geico: Top Overall Pick

Pros

- Affordable Premium Rates: Geico offers cheap car insurance in Maine, with premium monthly coverage starting at $15.

- Vast Discounts: Maine drivers can get up to 25% off when bundling policies such as safe-driving and multi-vehicle. Read our Geico car insurance review for the full details.

- Convenient Digital Tools: Geico offers an easy-to-use, feature-friendly mobile app. Drivers in Maine can easily navigate their policies through their cell phones.

Cons

- Limited Customer Service Availability: Its limited local service representatives may not sound appealing to policyholders who prefer in-person assistance.

- Limited Personalized Coverage: Geico may not be the go-to choice for Maine drivers who like to customize and tailor policies to their needs.

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#2 – State Farm: Best for Customer Service

Pros

- Exceptional Customer Service: State Farm offers some of the best car insurance in Maine. Its high-rated customer service ensures motorists get the support they need.

- Vast Network of Agents: The State Farm car insurance review stated that it helps motorists customize policies through its extensive network of local agent representatives.

- Discounts for Safe Drivers: Motorists, especially young drivers, can enjoy State Farm’s various discounts, from safe driving to the Steer Clear program.

Cons

- Expensive Coverage Rates: Factors like a driver’s profile affect the rates State Farm offers, and Maine drivers may find it slightly more expensive than most competitors.

- Limited Digital Services: State Farm’s digital mobile app may not be as easy to use or contain as many features as some competitors’ apps.

#3 – Progressive: Best for Customizable Policies

Pros

- Custom-Made Policies: Unique options like ridesharing are just some of the personalizable options Progressive offers Maine drivers who want better tailor-fit coverage.

- Multiple Discount Options: Progressive offers various discounts, such as for bundling and safe driving. Read our Progressive car insurance review to understand it better.

- Snapshot UBI Program: Progressive’s Snapshot Program offers potential savings based on Maine drivers’ real-time driving routines.

Cons

- Customer Service Could Improve: While generally good, Progressive’s customer service could be more responsive during high-demand times.

- Few Local Agents in Rural Areas: There is a low presence of local agent representatives in some rural areas in Maine. Find details through our

#4 – USAA: Best for Military Affiliated Families

Pros

- Special Benefits for Military Families: USAA provides one of the cheapest car insurance in Maine for persons in the military, veterans, and their families.

- Affordable Rates for Members: USAA offers competitive rates in Maine, especially for military families, and saves money on bundling and safe driving.

- Excellent Customer Service: Provides military family members in Maine with exceptional customer support, assuring they feel valued and heard.

Cons

- Eligibility Limitations: This service is exclusively provided to military personnel, veterans, and their families. Drivers with non-military affiliations in Maine cannot access it.

- Higher Rates for Non-Military Customers: Maine drivers who are non-military affiliated may suffer higher rates. For additional insights, read our USAA car insurance review.

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#5 – Allstate: Best for Safe Drivers

Pros

- Great Discounts for Safe Drivers: Offers Maine drivers generous discounts for safe driving and bundling policies. Get the full details in our Allstate car insurance review.

- Personalized Coverage Options: Allstate offers customizable policies to suit a variety of needs, including for new drivers and those with unique vehicles.

- Local Agents: Allstate does an excellent job of providing personal services through a wide network of local agents and opting for Maine drivers for in-person assistance.

Cons

- Higher Rates: Although Allstate provides excellent coverage, their rates may be higher than some of the competition.

- Mixed Customer Service: Longer waiting times during peak seasons may not sound enticing to the drivers of Maine.

#6 – Liberty Mutual: Best for Flexible Insurance Coverage

Pros

- Broad and Flexible Policies: Maine drivers can customize their policies with add-ons like accident forgiveness and vanishing deductibles.

- Multi-Policy Discounts: Bundling options for auto, home, and renters insurance can save you up to 25%. Read Liberty Mutal’s car insurance review to expand your understanding.

- Claims made easy: File your claims easily through Liberty Mutual’s digital tools, making it convenient for policyholders in Maine.

Cons

- Higher Base Premiums: Drivers in Maine may find Liberty Mutual’s base rates slightly more expensive than most competitors, especially if you have a DUI record.

- Scarce in Local Agents: Limited in-person support compared to other car insurance companies in Maine.

#7 – Travelers: Best for Bundling Policies

Pros

- Bundling Savings + Discounts: Motorists can earn up to 13% discounts for bundling auto and home insurance. Learn more by reading our Travelers car insurance review.

- Rewards Long-Term Policyholder: This program rewards policyholders with discounts of up to 15% for maintaining continuous insurance and no gaps in coverage.

- Unique Coverage Range: In addition to their wide range of coverage options, Traveler’s now offers liability coverage to residents who frequently drive a car but don’t own one.

Cons

- Higher Rates for Young Drivers: Traveler’s basic coverage can be expensive for young and high-risk drivers registered in Maine.

- Limited Local Rural Support: While Travelers has a national reach, it may have limited coverage in rural parts of Maine.

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#8 – Farmers: Best for Local Agents

Pros

- Personalized Service Through Local Agents: Farmers has a large network of agents in Maine who provide personalized service for customers.

- Solid Discount Offers: Farmers offers various discounts, including bundling home and auto insurance and safe driving. For extra details, check our Farmers car insurance review.

- Exceptional Coverage Options: Farmers offers a unique New-Car Replacement Coverage for policyholders whose vehicles were totaled in an accident.

Cons

- Expensive Base Rates: Drivers who are high risk or have a DUI record may particularly find Farmers’ monthly rates higher than competitors.

- Minimal App Features: Farmer’s online digital features are less advanced than other Maine car insurance companies.

#9 – American Family: Best for Discount Opportunities

Pros

- Long List of Discounts: American Family offers discounts such as early quotes and a young-driver discount, helping all Maine drivers lower their car insurance costs.

- Low Average Rates: A clean record or low vehicle mileage can lower rates than the average cost. You can check our American Family car insurance review to learn more.

- Flexible Coverage Options: Maine drivers can customize their policy by putting in add-ons like roadside assistance and gap coverage.

Cons

- Slower Claims Processing: Although known for their list of discounts, few policyholders reported that their claim process takes longer, which may be frustrating in urgent events.

- Higher Rates for High-Risk Drivers: Factors such as lousy driving record or DUI history can affect Maine drivers’ premium rates.

#10 – Nationwide: Best for High-Risk Drivers

Pros

- Lower Rates for High-Risk Motorists: Compared to other providers, coverage rates for families with young drivers and drivers with bad credit histories are affordable.

- Unique Perks and Discounts: It offers peculiar perks and discounts, such as SmartRide and Defense Driving, that could help Maine drivers save 10% to 40%.

- Convenient Mobile Tools: Provides convenience in managing policies and claims filing. For other insights, read our Nationwide car insurance review.

Cons

- Limited Coverage for Specialty Vehicles: High-tech and expensive automobiles may not have as many coverage options as other providers.

- Slightly Higher Premiums: Although drivers in Maine can lower their premium rates with Nationwide’s peculiar discount, their average premium is higher than competitors.

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Monthly Car Insurance Rates in Maine from Top Providers & Coverage Level

Evaluating your needs when looking for the best car insurance in Maine is essential. You should consider several elements, such as your location, driving habits, and different types of car insurance coverage. These factors sharply affect the rates depending on your choice of premium policy.

Maine Car Insurance Monthly Rates by Provider & Coverage Level

| Insurance Company | Minimum Coverage | Full Coverage |

|---|---|---|

| $43 | $108 | |

| $34 | $84 | |

| $47 | $117 | |

| $15 | $37 | |

| $48 | $120 |

| $35 | $87 |

| $38 | $94 | |

| $57 | $59 | |

| $25 | $61 | |

| $16 | $38 |

Knowing these factors highlights the importance of comparing rates in your area to determine what policy is suited for you and your budget.

Understanding your needs in choosing the best car insurance in Maine and selecting the appropriate policy protects you from unexpected financial burdens or, in a worst-case scenario, a moose-related vehicle accident.

In Maine alone, there are between 50,000 and 70,000 moose, making car collisions with them a real risk. Imagine driving on a winding road, seeing a “Moose Crossing” sign, and suddenly encountering a 1,200-pound moose in your path. In 2017 alone, there were 287 car-moose crashes in Maine.

Liability insurance covers the other driver’s costs if you’re at fault, but it won’t pay for your own damages. To protect yourself, add collision and comprehensive coverage.Kristen Gryglik Licensed Insurance Agent

Given this risk, Maine residents should ensure they have the right car insurance, which is readily available with competitive pricing and discounts for safe driving. But what types of insurance protect you in these situations?

Car Insurance Rates by Coverage Type

Maine auto insurance rates vary depending on the coverage level and provider, so it’s always important to compare premium coverage options before deciding. Providers like USAA and American Family offer lower rates for basic coverage, while others like Liberty Mutual and Farmers have constant rates regardless of the coverage type.

Maine Car Insurance Monthly by Coverage Level for Top Providers

| Insurance Company | Low Coverage | Medium Coverage | High Coverage |

|---|---|---|---|

| $96 | $96 | $96 | |

| $59 | $187 | $187 | |

| $139 | $139 | $139 | |

| $102 | $103 | $103 | |

| $166 | $166 | $166 |

| $78 | $120 | $225 |

| $92 | $92 | $92 | |

| $105 | $111 | $111 | |

| $71 | $71 | $71 | |

| $69 | $70 | $70 |

To obtain the best car insurance in Maine, Mainers must balance price and full coverage. Comparing top providers will help them find coverage with the desired protection and accident preparedness without overpaying.

Car Insurance Discounts from the Top Providers in Maine

Residents should choose the best car insurance in Maine with care and caution since it will affect their coverage rates, savings, and satisfaction in the long run. Maine residents should easily find the best car insurance, given their access to high-quality insurance providers that offer competitive prices and practical discounts, like incentives for cautious driving and multiline savings.

Car Insurance Discounts From the Top Providers in Maine

| Insurance Company | Anti-Theft | Bundling | Good Driver | Good Student | UBI |

|---|---|---|---|---|---|

| 10% | 25% | 25% | 20% | 30% | |

| 25% | 25% | 25% | 20% | 30% | |

| 10% | 20% | 30% | 15% | 30% | |

| 25% | 25% | 26% | 15% | 25% | |

| 35% | 25% | 20% | 15% | 30% |

| 5% | 20% | 40% | 15% | 40% |

| 25% | 10% | 30% | 10% | $231/yr | |

| 15% | 17% | 25% | 25% | 30% | |

| 15% | 13% | 10% | 8% | 30% | |

| 15% | 10% | 30% | 10% | 30% |

The tables above show the top providers and their discount ranges, which should help you select the best car insurance for your lifestyle. It’s also essential to compare coverage options, take advantage of all the unique discounts, and determine what coverage best suits your needs, like rideshare insurance for drivers who use their vehicles for business.

Ready to find affordable car insurance? Use our free comparison tool to get started.

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Minimum Insurance Coverage Requirements in Maine

Maine requires drivers to carry liability insurance, uninsured motorist coverage, and medical payments coverage. The minimum required auto insurance in Maine includes liability coverage of $50,000 per person for bodily injury, $100,000 per accident, and $25,000 for damaged property known mostly as 50/100/25, which is significantly higher than most states.

Maine Minimum Auto Insurance Requirements

| Coverage | Limits |

|---|---|

| Bodily Injury Liability | $50,000 / $100,000 |

| Property Damage Liability | $25,000 |

| Uninsured/Underinsured Motorist (UM/UIM) | $50,000 / $100,000 |

| Medical Payments (MedPay) | $2,000 |

If you fail to meet these insurance requirements, you can be fined ($100–$500), have your license and registration suspended, and even be jailed in the event of an accident. Maine allows electronic proof of insurance, and violations can be dismissed if proof of coverage is shown during the incident. However, officers cannot search a phone because a driver presents electronic proof.

But remember, Liability insurance covers damages if you’re at fault in an accident, but if damages exceed coverage limits, you’ll have to pay out of pocket.

Average Monthly Car Insurance Rates in Maine (Liability, Collision, & Comprehensive)

The data below comes from the National Association of Insurance Commissioners (NAIC), a leading source in this subject matter:

Maine Car Insurance Cost by Coverage Type

| Coverage Type | Monthly Cost |

|---|---|

| Full Coverage | $98 |

| Liability | $28 |

| Collision | $22 |

| Comprehensive | $9 |

Your average monthly car insurance rates by coverage may be cheaper than expected for additional coverage like comprehensive. Review rates for car insurance coverage below:

Core coverage is cheaper, significantly, in Maine than the countrywide average. It also protects against damage to your own vehicle from an accident (collision coverage), damage from acts of god (comprehensive coverage), as well as general liability insurance.

Having it is the difference between an inconvenient incident and major financial losses.

The average car insurance cost in Maine for full coverage will typically be higher for drivers who got a citation for a traffic violation, have received a DUI, or have been involved in an at-fault accident. Just one auto insurance accident on your driving record may increase auto insurance rates significantly. DUI can also raise your premiums by 75% on average when compared to standard full-coverage policies.

Aside from the minimum coverage liability the law requires for Maine drivers, Maine also requires them to carry Med Pay and Uninsured/Underinsured Motorist Coverage (UI/UIM) and liability insurance. Med Pay covers medical costs for you and your passengers, while UI/UIM coverage protects you if the at-fault driver lacks adequate insurance.

Monthly Car Insurance Cost for MedPay and UIM

| Coverage Type | Average Monthly Cost |

|---|---|

| Medical Payments (MedPay) Coverage | $20 |

| Uninsured/Underinsured Motorist Coverage (UM/UIM) | $11 |

While Maine law mandates more than just minimum coverage, drivers should ask: “Is it bad to just carry minimum coverage car insurance?” Without additional protection, a serious accident could lead to significant out-of-pocket costs.

Available list of Insurance Add-ons, Endorsements, and Riders

Have you ever had a flat tire and needed help fixing it? Has your engine blown out, and you need a tow? Did you need reimbursement for that rental car while your car was in the shop?

When selecting car insurance, always compare coverage options alongside premiums—higher rates might bring better protection, ensuring you don’t end up paying more out-of-pocket in the long run.Chris Abrams Licensed Insurance Agent

Fortunately, insurance companies have a good amount of add-ons to your insurance plan. They include:

- Gap insurance

- Umbrella policy

- Rental reimbursement

- Roadside assistance

- Mechanical breakdown insurance (MBI)

- Non-owner insuranc

- Modified car insurance>

- Classic car insuranc

- >Usage-based insurance (UBI)

For a more detailed look at add-ons, read this article.

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Windshield Coverage

In Maine, it is illegal to drive with a cracked or broken windshield under the following circumstances:

- If the crack obscures the driver’s view of the road

- If the crack is greater than six inches

It is also illegal to drive with a windshield that has been repaired, and that repair is greater than one inch in height or obstructs the view of the driver. Those repairs can be done with minimal governmental regulation: Essentially, in Maine, you can choose if you want OEM (original equipment manufacturer) parts or aftermarket parts.

You can also choose the shop it gets repaired in. However, the insurance company may only pay for what it thinks is necessary (e.g., certain parts or rates from a preferred shop).

High-Risk Insurance

Sometimes, a person makes a mistake and incurs a high-level infraction on their driving record. The person is labeled as a high-risk driver, and the government often requires them to have an SR-22 (Certificate of Insurance).

Infractions that cause this?

- A DUI conviction for driving with a blood-alcohol level of .08

- Failing to provide proof of insurance during a traffic stop or accident

- Driving with a suspended or revoked license

Among others.

To apply for an SR-22, you need to contact your insurance company and request it.

An insurance company will view those who apply for an SR-22 as high-risk and generally charge higher rates. It’s important to note that an SR-22 in some cases can be avoided:

If the person attends driver safety school and receives a reduction in marks on their driving record.

If you can’t get insurance through the voluntary market, you may be eligible for the Maine Auto Insurance Plan (AIP): It’s a plan for high-risk drivers.

Low-Cost Insurance

Maine does not have any specific low-cost insurance, but there are ways you can lower your rates through your insurance company:

- Good student

- Safety device

- Anti-theft device

- Low mileage

- Multiple vehicles

- Multiple policies (auto and home)

- Driver education

These options can save you hundreds of dollars. Talk to your insurance agent or research before signing up for a plan.

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Maine Car Insurance Costs as a Percentage of Household Income

In Maine, the cost of car insurance as a percentage of household income has remained relatively stable between 2021 and 2023. For example, a full coverage premium of $1,175 represents 1.55% of a median household income of $75,740 in 2021-2023.

Maine Car Insurance Costs as a Percentage of Household Income (2021-2023)

| Year | Full Coverage Premium | Median Household Income | Insurance as % of Income |

|---|---|---|---|

| 2023 | $1,175 | $75,740 | 1.55% |

| 2022 | $1,175 | $69,543 | 1.69% |

| 2021 | $901 | $64,767 | 1.39% |

The percentage rises slightly when the median income decreases, with a premium of $901 making up 1.39% of a $64,767 income.

Comparing this to neighboring states, Massachusetts residents pay $1,108 for full coverage, which is 2.20% of their disposable income of $50,366. In New Hampshire, a premium of $796 makes up 1.65% of disposable income of $48,280. Vermont has the lowest premium ($745), which represents 1.77% of disposable income of $42,267.

Car Insurance Costs as a Percentage of Income in Maine & Surrounding States

| State | Full Coverage Premium | Disposable Income | Insurance as % of Income |

|---|---|---|---|

| Massachusetts | $1,108 | $50,366 | 2.20% |

| New Hampshire | $796 | $48,280 | 1.65% |

| Vermont | $745 | $42,267 | 1.77% |

While Maine has a lower premium cost than its neighbors, the percentage of disposable income spent on car insurance is relatively higher in Maine compared to New Hampshire and Massachusetts.

You might want to refer to this data before making an informed decision to find where to get cheap full coverage insurance in your state.

Major Factors Influencing Car Insurance Rates in Maine

When comparing the best car insurance in Maine, customers should consider several elements, including age and gender.

These factors greatly impact how you can lower your car insurance rates from the best insurers. Below, we have provided a comprehensive analysis of these factors so you can secure the best insurance for your needs and protection.

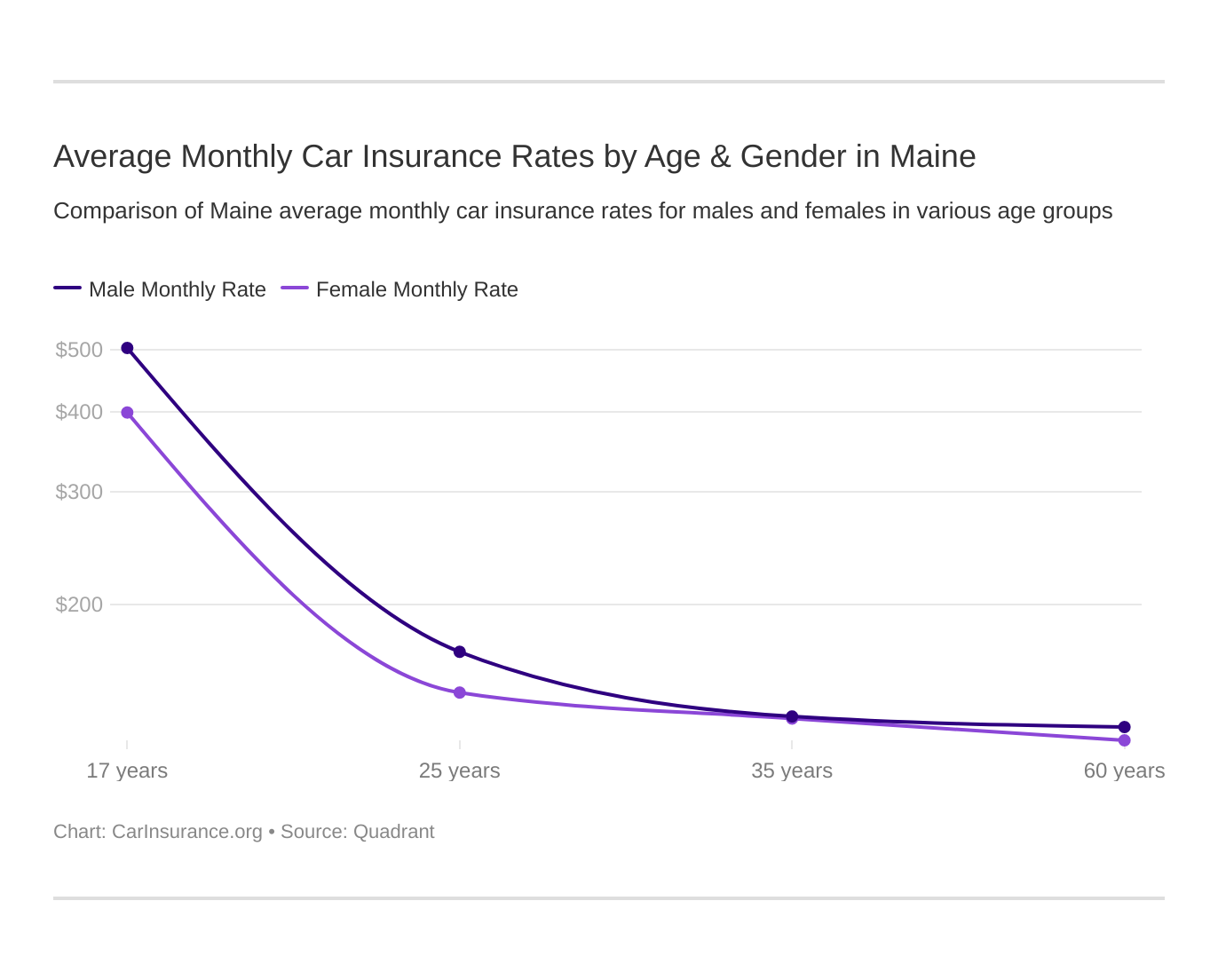

Average Monthly Car Insurance Rates by Age & Gender

Several factors, other than driving habits, zip codes, and vehicle type, affect car insurance rates. In this section, it’s Age and Gender.

While other providers don’t engage in stereotypes, car insurance companies still charge differently for females and males based on their age.

Maine Car Insurance Monthly Rates by Provider

| Insurance Company | Age: 17 Female | Age: 17 Male | Age: 25 Female | Age: 25 Male | Age: 35 Female | Age: 35 Male | Age: 60 Female | Age: 60 Male |

|---|---|---|---|---|---|---|---|---|

| $375 | $502 | $163 | $182 | $150 | $154 | $134 | $146 | |

| $448 | $497 | $167 | $173 | $142 | $144 | $133 | $143 | |

| $206 | $268 | $92 | $99 | $85 | $88 | $85 | $85 | |

| $528 | $790 | $249 | $350 | $249 | $249 | $237 | $237 |

| $662 | $744 | $185 | $209 | $159 | $156 | $159 | $156 | |

| $349 | $435 | $122 | $134 | $109 | $109 | $103 | $103 | |

| $391 | $528 | $96 | $111 | $97 | $101 | $88 | $90 | |

| $237 | $261 | $92 | $97 | $72 | $71 | $72 | $70 |

Here’s a look at the premiums ranked by most expensive first:

Maine Auto Insurance Monthly Rates by Provider, Age Group & Rank

| Insurance Company | Rank | Age: 17 Female | Age: 17 Male | Age: 25 Female | Age: 25 Male | Age: 35 Female | Age: 35 Male | Age: 60 Female | Age: 60 Male |

|---|---|---|---|---|---|---|---|---|---|

| #1 | $706 | $1,107 | $348 | $467 | $348 | $348 | $332 | $332 |

| #2 | $996 | $1,048 | $278 | $293 | $221 | $208 | $221 | $208 | |

| #3 | $541 | $706 | $128 | $148 | $129 | $134 | $117 | $120 | |

| #4 | $519 | $670 | $227 | $254 | $199 | $205 | $185 | $194 | |

| #5 | $614 | $663 | $234 | $239 | $190 | $191 | $177 | $191 | |

| #6 | $466 | $603 | $162 | $183 | $146 | $146 | $138 | $138 | |

| #7 | $288 | $376 | $123 | $131 | $113 | $117 | $113 | $113 | |

| #8 | $245 | $249 | $80 | $85 | $74 | $79 | $53 | $53 |

Although using gender to calculate insurance rates is controversial, California became the seventh state to outlaw this practice.

As you can see from the tables above, age and gender still play a significant role in selecting full coverage insurance premium rates in Maine, with Males having the most expensive rate as they age. Knowing these factors and using this article as a guide may help you decide which provider to secure to get the best car insurance in Maine that fits your needs.

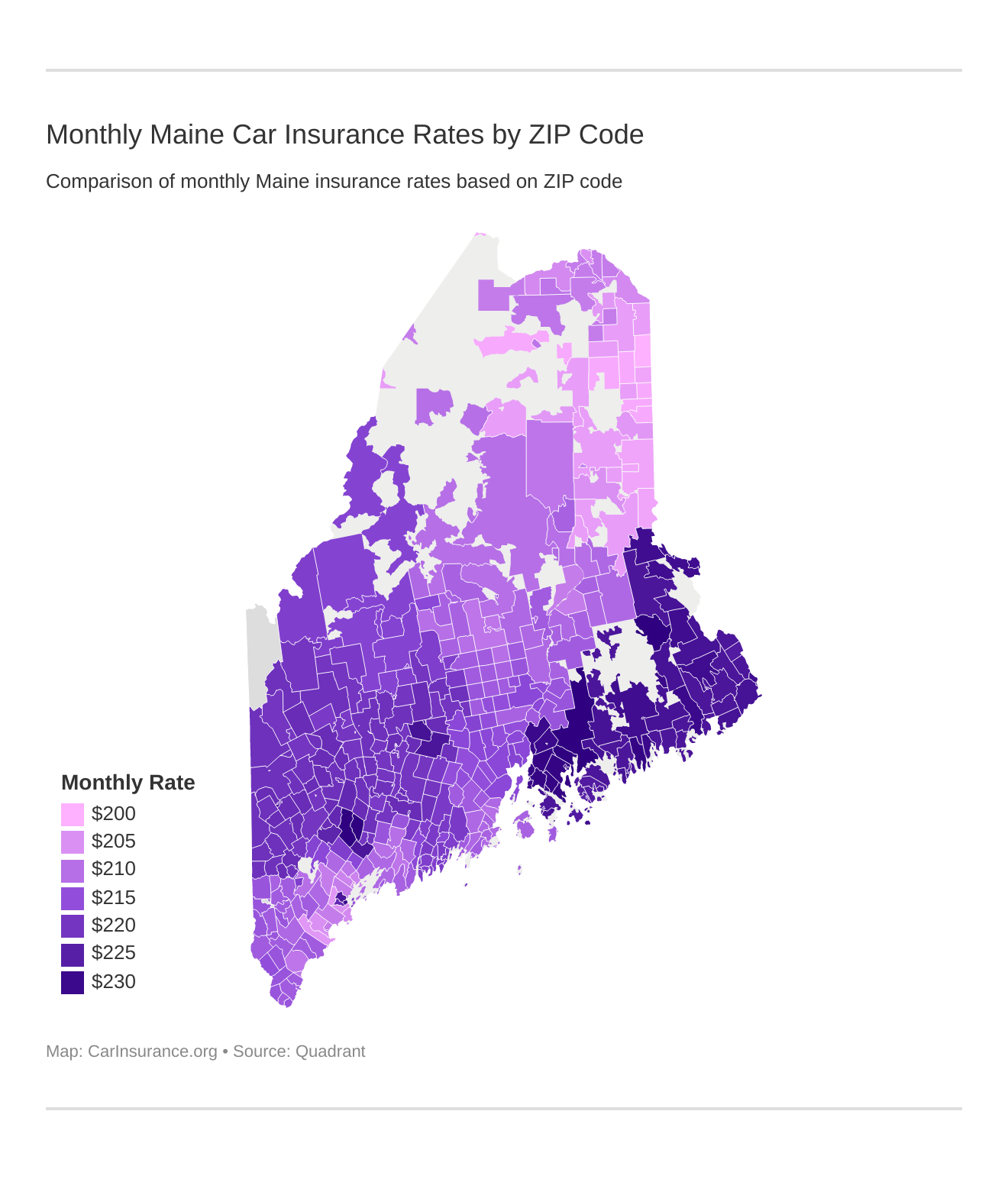

Cheapest Rates by ZIP Code

ZIP code is another factor that can raise your premium. Here, we’ve compiled a list for you where you can search for the average premium in your zip code:

Maine Car Insurance by ZIP Code

| ZIP Code | Rates |

|---|---|

| 04626 | $105 |

| 05073 | $114 |

| 03101 | $122 |

| 83853 | $129 |

| 96783 | $136 |

How does ZIP code affect auto insurance? Factors like traffic, crime, and claim frequency in your area all matter. Find out how your ZIP code compares against other zips in ME.

The chart above shows that ZIP Codes affect the average monthly premium rates, depending on the city you live in. Learn these factors and take advantage of what other elements impact your car insurance coverage prices.

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Cheapest Car Insurance Rates by City

The average cost of minimum car insurance in Maine for full coverage is $15 per month from Geico. However, you can get cheaper rates if you meet certain requirements, such as being an active service member or a veteran.

Cheapest Monthly Car Insurance Rates by City in Maine

| City | Monthly Premium |

|---|---|

| Biddeford | $87 |

| Saco | $88 |

| Bangor | $89 |

| Portland | $94 |

| Augusta | $96 |

| Auburn | $96 |

| Lewiston | $97 |

This table lists the cheapest monthly car insurance rates in various cities across Maine. Biddeford has the lowest rate at $87 per month, followed closely by Saco ($88) and Bangor ($89). Portland’s rate is slightly higher at $94, while Augusta and Auburn both average $96. Lewiston has the highest rate among these cities at $97 per month.

Driving Record Rates by Companies in Maine

In Maine, recorded driving habits heavily influence vehicle insurance premiums, with offenses such as speeding tickets, accidents, and DUIs resulting in significant premium hikes.

Maine Car Insurance Monthly Rates by Provider & Driving Record

| Insurance Company | Clean Record | One Ticket | One Accident | One DUI |

|---|---|---|---|---|

| $96 | $110 | $140 | $190 | |

| $120 | $135 | $160 | $250 | |

| $139 | $155 | $180 | $476 | |

| $102 | $118 | $145 | $159 | |

| $145 | $160 | $200 | $300 |

| $110 | $125 | $150 | $240 |

| $92 | $108 | $135 | $189 | |

| $105 | $120 | $155 | $408 | |

| $71 | $85 | $110 | $128 | |

| $69 | $80 | $95 | $104 |

USAA, Travelers, and Progressive are among the cheapest Maine car insurance companies for drivers with a clean driving record, whereas Liberty Mutual and Farmers apply some of the worst fines for violations.

Having a clean driving record is critical for obtaining Maine’s best car insurance rates because car insurance rates after a single DUI can double your premium.

Credit History Rates by Companies in Maine

Your average Maine car insurance cost is heavily influenced by your credit score, with lower rates for those with good credit and significantly higher premiums for those with bad credit.

While companies like USAA and Travelers offer the most affordable options across all credit levels, others, such as Farmers and State Farm car insurance in Maine, impose steep increases for drivers with poor credit standing.

Maine Car Insurance Monthly Rates by Provider & Credit Score

| Insurance Company | Good Credit | Fair Credit | Bad Credit |

|---|---|---|---|

| $96 | $96 | $190 | |

| $120 | $130 | $250 | |

| $139 | $139 | $476 | |

| $102 | $102 | $159 | |

| $145 | $160 | $300 |

| $110 | $125 | $240 |

| $92 | $92 | $189 | |

| $105 | $105 | $408 | |

| $71 | $71 | $128 | |

| $69 | $69 | $104 |

Credit histories can vary, but generally, they include how much debt you have, the interest rates on that debt, if you’ve missed payments, and so forth. Insurance companies take all this data and—through a process called underwriting—determine your risk for a plan.

Maintaining a good credit history can significantly lower your car insurance premiums, but even with a bad credit history, there are strategies and providers, like Liberty Mutual, that can help you find affordable coverage.Justin Wright Licensed Insurance Agent

For drivers looking for the best auto insurance in Maine, having and keeping a good credit score can result in savings, so it’s important to compare insurance carriers, know what your car insurance covers, and acquire the best premium coverage.

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Commute Rates by Company in Maine

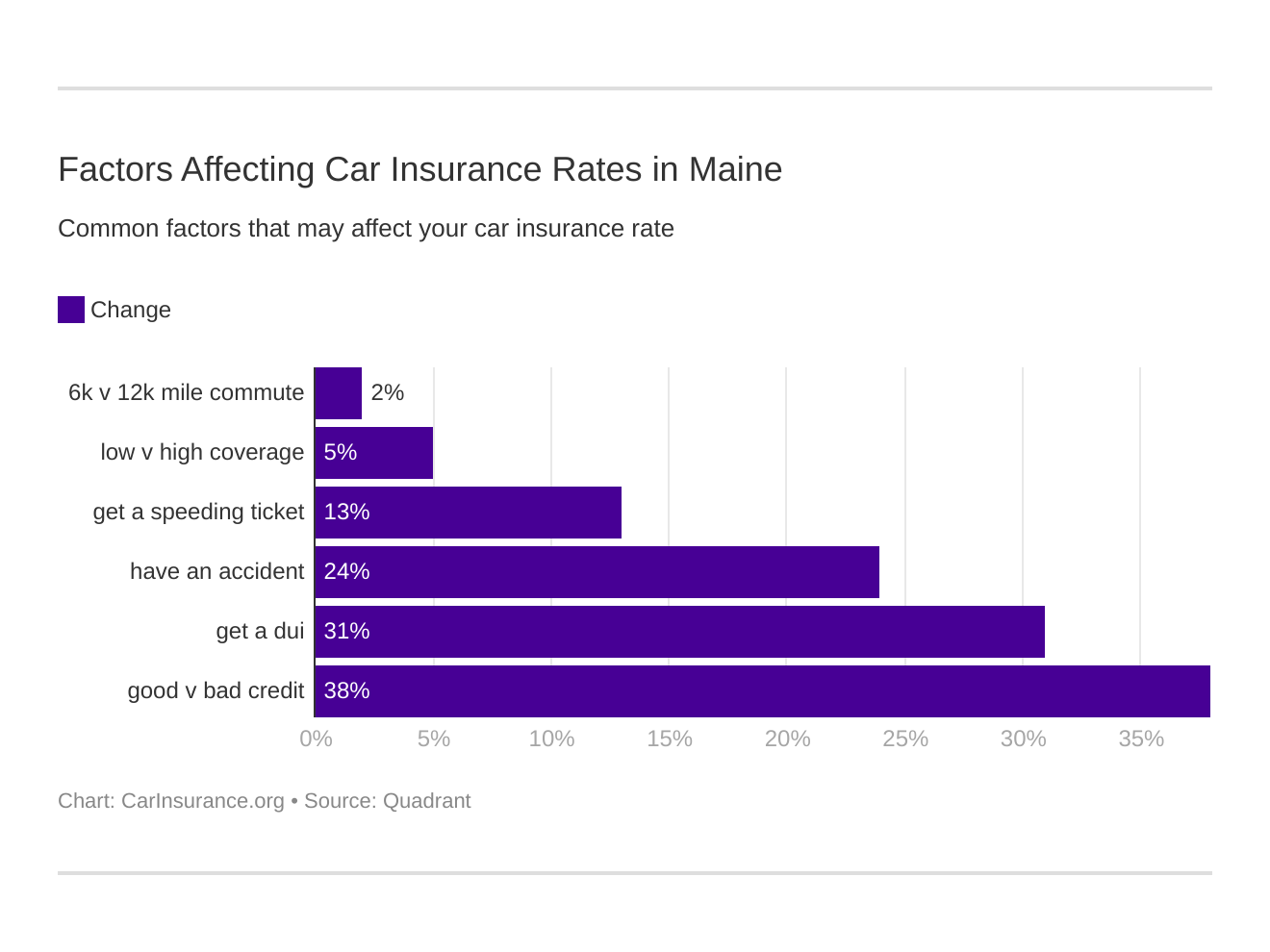

It may be fascinating, but the amount you spend commuting can affect your premium car insurance in Maine. See the table below for other factors that affect premiums by company, and take a look at these 6 major factors affecting auto insurance rates in Maine.

Though many elements, such as DUI, type of coverage, road violations, vehicle accidents, and credit standing, impact auto insurance rates in Maine, we would like to highlight how your annual mileage and commuting can be two of the most significant contributors to your car insurance premium rates.

Maine Car Insurance Monthly Rates by Annual Mileage for Top Providers

| Insurance Company | 6,000 Miles | 12,000 Miles |

|---|---|---|

| $96 | $96 | |

| $142 | $142 | |

| $139 | $139 | |

| $102 | $103 | |

| $166 | $166 |

| $129 | $129 |

| $92 | $92 | |

| $105 | $111 | |

| $71 | $71 | |

| $69 | $70 |

Travelers and USAA have the lowest rates, while Liberty Mutual and American Family have the highest. However, some companies (Progressive, Nationwide, and Allstate) don’t raise or lower rates depending on commute.

Best Car Insurance Tips: Finding the Most Affordable Coverage Rates in ME

Shopping around for car insurance in your area can be very confusing, but this guide will help you get the best car insurance in Maine. You can start by contacting a car insurance agent or broker and telling them your needs. This allows you to compare quotes for the best car insurance in Maine.

Getting to know your factors, such as your age, gender, credit history, and so on, can also help you find the best rates for affordable prices. You may also take advantage of car insurance discounts from providers like USAA, especially if you or a member of your family is in the military. USAA offers insurance in Maine.

The rest of this section provides an in-depth review of major car insurance companies such as Progressive, Geico, and State Farm. It includes information on financial stability, J.D. Power ratings, complaint history, and how their respective rates compare based on driver credit history, commute distance, and coverage level.

This part highlights the importance of reviewing a company’s financial reliability, like how you would assess whether a friend is likely to repay a debt before trusting them with your insurance needs.

Maine10 Largest Insurers AM Best Ratings

| Insurance Company | AM Best |

|---|---|

| A+ | |

| A++ | |

| A++ | |

| A |

| A | |

| A++ | |

| B | |

| A | |

| A++ | |

| A++ |

We are using AM Best, a global firm that assesses companies on everything from credit ratings to overall financial ratings. We have the latter. If you want a guide for their ratings, click here.

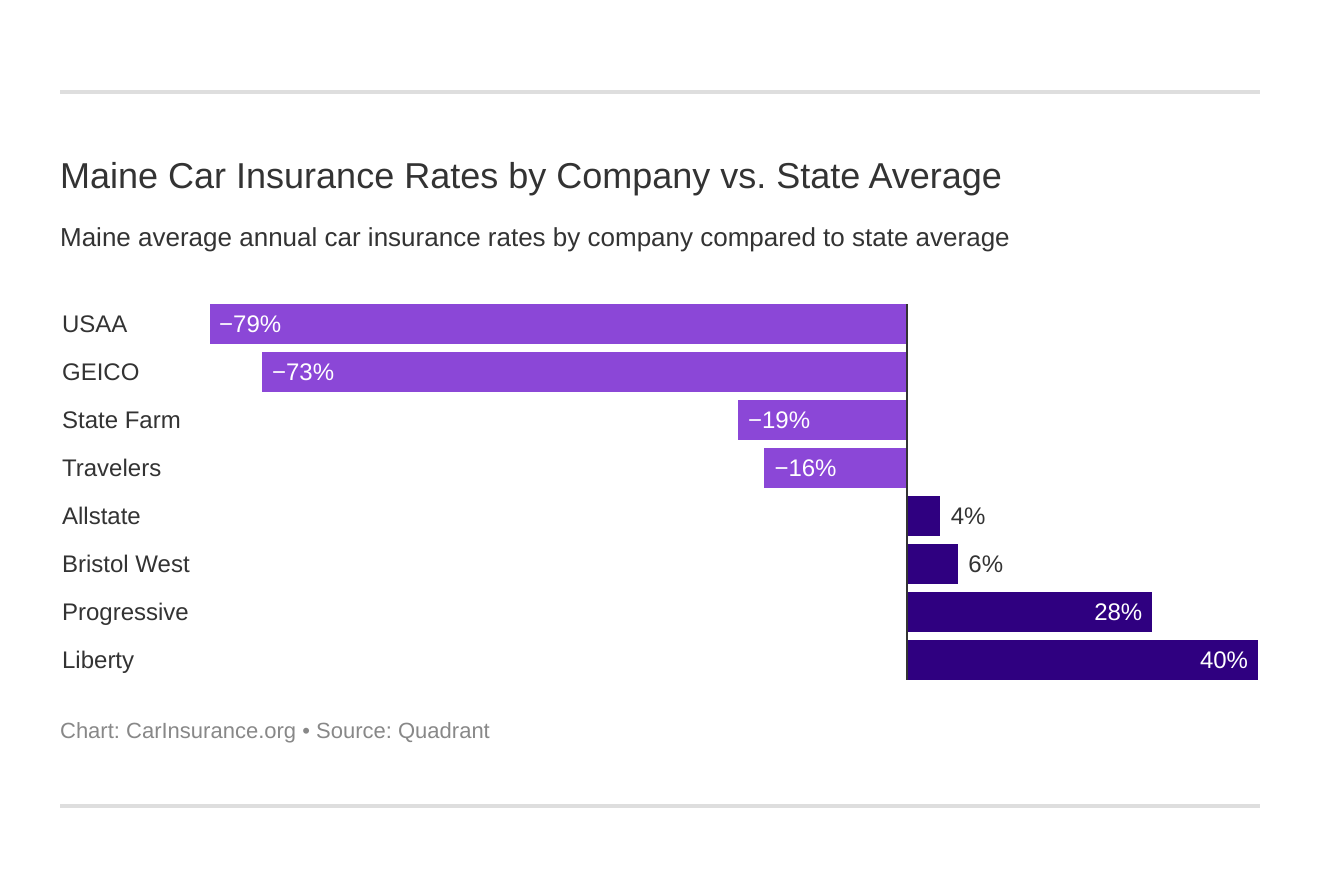

Mainers can access a variety of top insurance providers, so using the chart below to find the cheapest car insurance in Maine shouldn’t be difficult.

Maine's Cheapest Car Insurance Companies

| Company | Monthly Rate | Compared to State Average (Monthly) | Percentage Difference |

|---|---|---|---|

| $96 | -$2 | -2.4% | |

| $59 | -$39 | -39.8% | |

| $139 | +$41 | +41.6% | |

| $102 | +$4 | +4.5% | |

| $122 | +$22 | +24.0% |

| $126 | +$28 | +28.6% |

| $92 | -$6 | -5.9% | |

| $105 | +$7 | +7.4% | |

| $71 | -$27 | -27.4% | |

| $69 | -$29 | -29.6% |

Compare the monthly car insurance rates of various companies in Maine against the state average, know what provider suits you better, and how to lower your car insurance cost.

Best Car Insurance Companies Rating

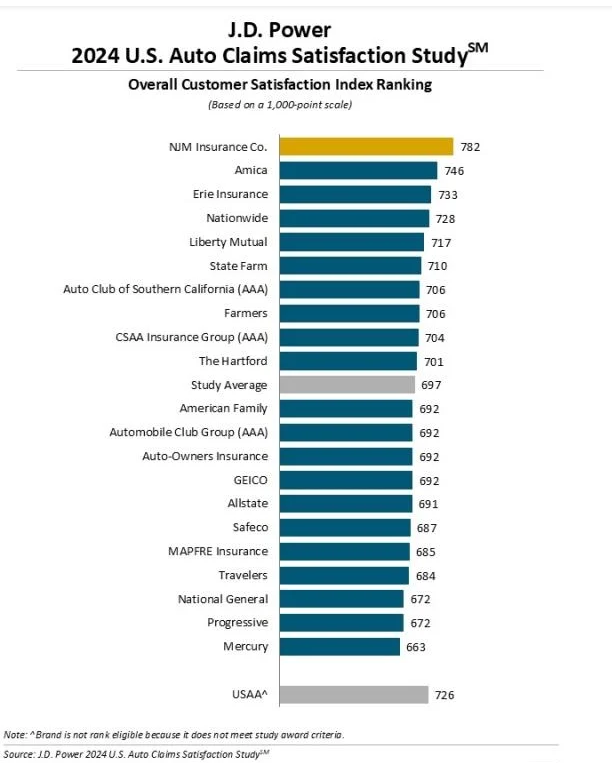

According to reports from J.D. Power, customer satisfaction ratings with car insurance are at their peak, driven mostly by the rise of electronic services trends such as online payments, digital tools and receipts, and convenient access to insurance policies.

J.D. Power’s latest survey on customer satisfaction in the New England Region includes nearly all of the top auto insurance companies in Maine except USAA, which may lack a strong regional presence or high customer satisfaction scores to make the list.

For those searching for the best car insurance in Maine with high-rated reviews, comparing rates and customer feedback is crucial to finding the right policy for you that balances affordability and service.

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Car Insurance Companies with the Most Complaints in Maine

In searching for the best car insurance in Maine, we consider many factors, such as the provider’s complaint index. This chapter discusses that factor, which measures the complaints an insurance provider receives relative to its customer base.

These data show that State Farm and Progressive had the highest total complaints in Maine from 2021-2023. They did not have the highest complaint index, as they serve many customers.

Maine Insurance Companies with the Most Complaints (2021-2023)

| Company | 2021 Complaint Index | 2022 Complaint Index | 2022 Number of Complaints | 2023 Complaint Index | 2023 Number of Complaints |

|---|---|---|---|---|---|

| 0.96 | 1.8 | 18 | 1.3 | 10 | |

| N/A | 0.5 | 1 | 2.4 | 4 | |

| 1.09 | 0.9 | 5 | 1.5 | 6 | |

| 0.70 | 1.1 | 19 | 0.5 | 8 | |

| 2.46 | 1.1 | 14 | 1.1 | 11 |

| 0.34 | N/A | N/A | N/A | N/A |

| 0.83 | 1.4 | 33 | 0.9 | 23 | |

| 0.70 | 0.7 | 12 | 0.8 | 16 | |

| 0.49 | 0.6 | 3 | 1.4 | 6 | |

| 0.85 | 0.6 | 4 | 0.8 | 6 |

As you can see from the breakdown in the table above of complaint indexes for major insurance companies, Liberty Mutual has the highest complaint index in 2021 (2.46), while other companies like USAA and Geico had consistently lower indexes.

A ratio between the number of complaints a company has and the numbers of customers they serve in the state.

This data helps consumers assess insurers based on customer satisfaction and complaint handling.

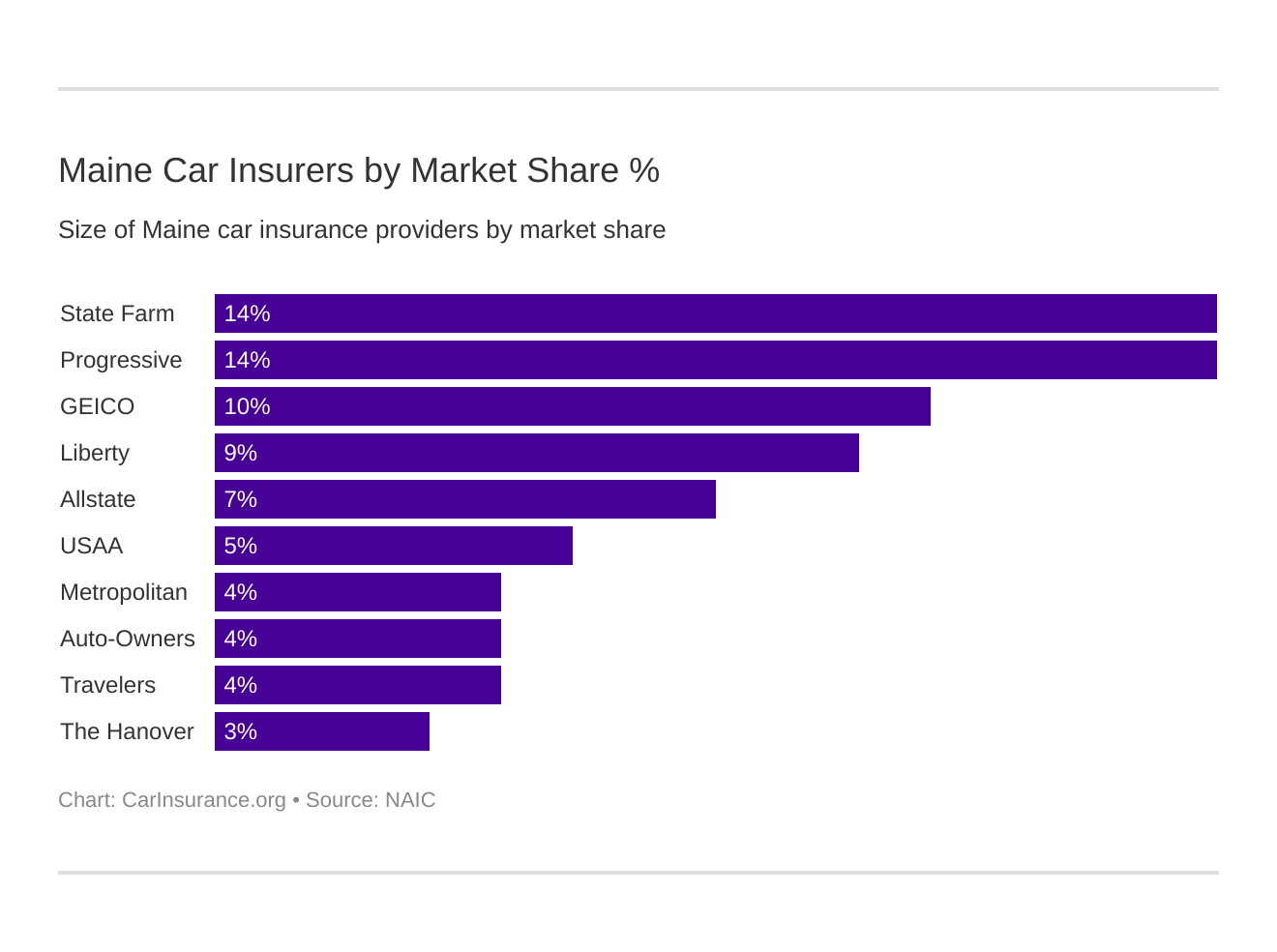

Largest Car Insurance Companies in Maine

Knowing the largest auto insurance companies in ME can help you make an informed decision about which car insurer to get your policy from; knowing their financial strengths can assist you in deciding which company to pick for easier claims and payouts.

The competition is fairly balanced in Maine compared to other states. Here, just three companies—State Farm, Progressive, and Geico—have equal or more than 10 percent of the market.

Maine Car Insurance Market Share by Provider

| Insurance Company | Market Share |

|---|---|

| 8% | |

| 4% | |

| 4% | |

| 13% | |

| 9% |

| 17% | |

| 13% | |

| 3% | |

| 4% | |

| 5% |

The top companies in the J.D. Power satisfaction survey are at the top here, with USAA the lowest in market share.

Number of Insurers in Maine

Maine has 705 insurers, nine domestic and 696 foreign. What is the difference? Domestic and foreign generally apply to national borders; in this case, they apply to state borders.

A domestic insurer is an insurance company formed under Maine’s laws, whereas a foreign insurer has been formed under any other state’s laws. This includes chain insurance companies that do business in multiple states.

For the purposes of the insurance, the designation makes no difference. Just make sure you have the minimum coverage that meets Maine’s car insurance requirement.

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Automobile Insurance Fraud in Maine

While Maine does not have an insurance fraud bureau, they have taken steps to curb insurance fraud by:

- Classifying insurance fraud as a crime

- Granting immunity to whistleblowers who expose fraud

- Requiring insurance companies to have a fraud insurance plan

In Statute 2126, the Maine government outlines what it considers fraud and processes for reporting fraud. One interesting note is that companies/drivers/whistleblowers have until March 1 to report fraud that happened in the previous calendar year.

For rideshare drivers in Maine, relying solely on personal auto insurance may leave dangerous gaps in coverage—consider a rideshare-specific policy for full protection.Michelle Robbins Licensed Insurance Agent

That’s quite some time and for good reason. It is estimated that property/casualty fraud costs insurance companies $30 billion per year. Fraud occurs in different ways. Some of the most common are:

- Padding actual claims to inflate costs

- Misrepresenting facts or the “what happened” on insurance claims

- False claims for damage or services that never occurred

- Staging accidents

- premium avoidance or application fraud

In Maine, deceptive insurance practices (fraud) are classified as Class D crimes, which carry up to 364 days in jail and a $2,000 fine.

Vehicle Licensing Laws in Maine

When you’re planning on getting your first vehicle together with your chosen car insurance provider, first, you must know that there are laws you should know.

For years, driver’s licenses were simple plastic cards with essential information, but security measures tightened after 9/11. In 2005, Congress passed REAL ID, mandating states to enhance identification security.

Maine has been slow to comply, only releasing its new REAL ID in April 2019. While the state progresses, it still holds a “granted extension” status from the DHS. Many Mainers remain skeptical, significantly since a 2007 law initially blocked compliance.

However, by October 1, 2020, anyone flying domestically will need a REAL ID or another approved form of identification. To get one, residents must visit the BMV with the required documents, have their photo taken, and pay the necessary fees.

You’ll need all the documents you’d need for a regular license:

- One document that establishes identity, date of birth, and lawful status

- One document that establishes proof of social security number

- Two documents that establish residency in Maine

Being well-informed about and adhering to the laws evades motorists from fines and violations.

Penalties for Driving Without Insurance

Maine requires all drivers to have insurance. There are stiff penalties for not having it:

A fine between $100 and $500 and a suspension of license and registration until proof of insurance is shown

Remember: the penalty is much more severe if you’ve had an accident and failed to show proof. In addition to the fine and the suspension, you’ll face jail time of up to six months and be forced to get an SR-22 before your license and registration are reinstated.

That’ll force you to have insurance and pay more for it than if you got it in the first place.

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Teen Driver Laws

Maine teenagers can apply for a learner’s license, also known as a learner’s permit, at 15 years old. After teenagers have completed 70 hours of supervised driving (10 at night), they can apply for a driver’s license if they are 16 and have completed the mandatory holding period.

Maine Learner's Permit Restrictions & Requirements

| Requirement | Details |

|---|---|

| Minimum Entry Age | 15 years old. Applicants under 18 must complete an approved driver education course before applying. |

| Mandatory Holding Period | 6 months. Permit holders under 21 must hold the permit for at least 6 months before applying for a road test. |

| Supervised Driving | Minimum of 70 hours, including 10 hours at night, accompanied by a licensed driver who is at least 20 years old and has held a valid license for 2 years. |

| Minimum Age for Driver's License | 16 years old. However, drivers under 18 will receive an intermediate license with certain restrictions. |

When a driver gets a restricted license, these rules are in place:

Maine Intermediate License Restrictions

| Restriction Type | Details | Duration |

|---|---|---|

| Unsupervised Driving | Prohibited between 12 a.m. - 5 a.m. unless accompanied by a licensed driver (age 20+ with 2 years of experience). | 9 months |

| Passenger Limitations | No passengers except immediate family members, unless accompanied by a licensed driver (age 20+ with 2 years of experience). | 9 months |

| Mobile Device Use | Prohibited from using or interacting with a handheld electronic device while driving. | 9 months |

If you’re a parent unsure how to teach your teenager to drive, Maine has The Parents Supervised Teen Driving Program. Its app allows you to log trips, mileage, and duration, and its website has resources for driving in different environments and weather, among other things.

Students who take a driver’s education course and follow these tips could also receive reduced car insurance rates.

Fault vs. No-Fault

Maine is an at-fault state, meaning that the person who caused the accident is responsible for all damages and medical costs.

This concept has to do with a legal term called liability.

Liability is a duty or obligation, a stipulation that you owe something, monetary or otherwise. It means that you’re responsible—in a legal sense—for damage to the other person’s car, their injuries, and any other property damage that might have resulted.

Because legally, you are on the hook; if you can’t pay up, there are consequences.

To prevent these situations, Maine requires minimum insurance. Fortunately, if you don’t have insurance, the other person should have uninsured/underinsured motorist insurance, preventing a complete financial calamity.

Vehicle Theft in Maine

Regardless of the state, vehicle theft is an occurring problem; in 2023 alone, there have been a lot of reports of stolen cars. This can affect how much your car insurance in your state will be too. Ideally, the higher the theft reports are in your area, the higher the increase from top insurers’ quotes will be, and this can also be said for the same as what type of vehicle you use.

In every state, there are more vehicles stolen than others. Although these tables are specifically for the state of Maine only.

Most Stolen Vehicles in Maine

| Make/Model | Thefts in 2023 |

|---|---|

| Hyundai Elantra | 48,445 |

| Hyundai Sonata | 42,813 |

| Kia Optima | 30,204 |

| Chevrolet Silverado 1500 | 23,721 |

| Kia Soul | 21,001 |

| Honda Accord | 20,895 |

| Honda Civic | 19,858 |

| Kia Forte | 16,209 |

| Ford F-150 | 15,852 |

| Kia Sportage | 15,749 |

In Maine alone, there have been many reports of stolen vehicles in different cities since 2023; this can significantly impact your car insurance rates. Although there are not many reports compared to other states, you should still be on the lookout for possible theft in your area.

Maine Vehicle Thefts by City (2023)

| City | Number of Thefts |

|---|---|

| Portland | 125 |

| Augusta | 51 |

| Lewiston | 49 |

| Bangor | 44 |

| Sanford | 31 |

| Auburn | 28 |

| Biddeford | 27 |

| Saco | 27 |

| South Portland | 23 |

| Waterville | 22 |

| Westbrook | 22 |

Both where you live and what you drive play a role. If you’re concerned about someone stealing your vehicle, here are some safety tips:

Along with these tips, we suggest that you get car insurance that covers theft for better protection and to avoid financial burdens. Compare quotes now, especially if you live in the city of Portland, you can compare quotes from car insurance in Portland, Maine, that fit your needs and lifestyle.

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Car Culture in Maine

Maine’s car culture is shaped by key statistics: an average 22-minute commute (one of the shortest in the U.S.), 83% of fatal crashes occurring on rural roads, and strict penalties for texting while driving—$250 in fines and a 90-day license suspension.

Factors beyond your control, like location, accident rates, and uninsured drivers, can impact your insurance rates. This guide explores those factors, starting with Maine’s minimum coverage requirements.

Ready to know what the best car insurance in Maine? Start comparing affordable insurance options in Maine by entering your ZIP code into our free quote comparison tool today.

Frequently Asked Questions

What is the best car insurance in Maine?

Known for its high-rated process of filing a car insurance claim after an accident, affordable rates, and 24/7 customer support, we deem Geico the best car insurance in Maine if you want full coverage at an affordable price.

What is the cheapest car insurance in Maine?

Geico and Progressive are the cheapest car insurance in Maine for their affordable options and full coverage premium to Maine drivers. Enter your ZIP code to compare rates from the top providers near you.

Is Maine the cheapest state to live in?

Maine is not the cheapest state to live in. While it offers lower-than-national-average commute times and lower-than-average car insurance costs, the overall cost of living is higher compared to states in the Southeast or Midwest. Housing costs, particularly in cities like Portland, can be steep.

Does Allstate cover Maine?

Yes, Allstate covers Maine, offers customers a big 25% discount for bundling policies, and rewards safe drivers.

How much is car insurance in Maine?

Car insurance rates in Maine may vary depending on your needs. However, the average cost for full coverage is between $15 and $108 per month. But it’s also important to note how much car insurance you need for a car.

What happens if you drive without insurance in Maine?

Like in all states, driving without insurance in Maine is a serious offense. The law mandates drivers have at least the minimum coverage, and failure to comply could lead to costly legal consequences.

When did car insurance become mandatory in Maine?

Car insurance became mandatory in Maine in 1975. To secure financial responsibility in the event of an accident, the law requires all driving residents to have minimum liability insurance coverage.

Does AAA cover Maine?

Yes, AAA provides coverage in Maine through its regional club, AAA Northern New England. This includes auto insurance, roadside assistance, travel services, and discounts. If you’re a AAA member in another state, your benefits generally extend to Maine as well.

Do you need car insurance in Maine?

If you ask, do you need car insurance in Maine? The answer is yes. Drivers registered in Maine need to carry or have car insurance at any event of time. Failure to adhere to the laws in Maine may subject you to violation. Compare insurance rates today by entering your ZIP code into our free comparison tool.

What is the minimum auto insurance in Maine?

The law requires every driver to carry 50/100/25 liability insurance in Maine. If authorities discover you are uninsured during an at-fault accident, you can be subjected to fines ranging from $100 to $500 or revoked your driving privileges. It’s also best to know what your car insurance covers in Maine.