Tag: car insurance

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Car Insurance with Telematics (The Complete Guide)

Insurers use a wide variety of factors to determine your insurance rates. The underlying assumption is that all these factors will help them determine how likely are you to file a claim or cause an accident in which someone else will file a claim. Insurance companies have long relied on driving histories and automated reports,…

How Your Children Will Impact Your Car Insurance Policy

Your child may be an excellent driver, and they may have an impeccable and spotless driving record – but you’ll still pay way more for an auto policy once they’re added to it.

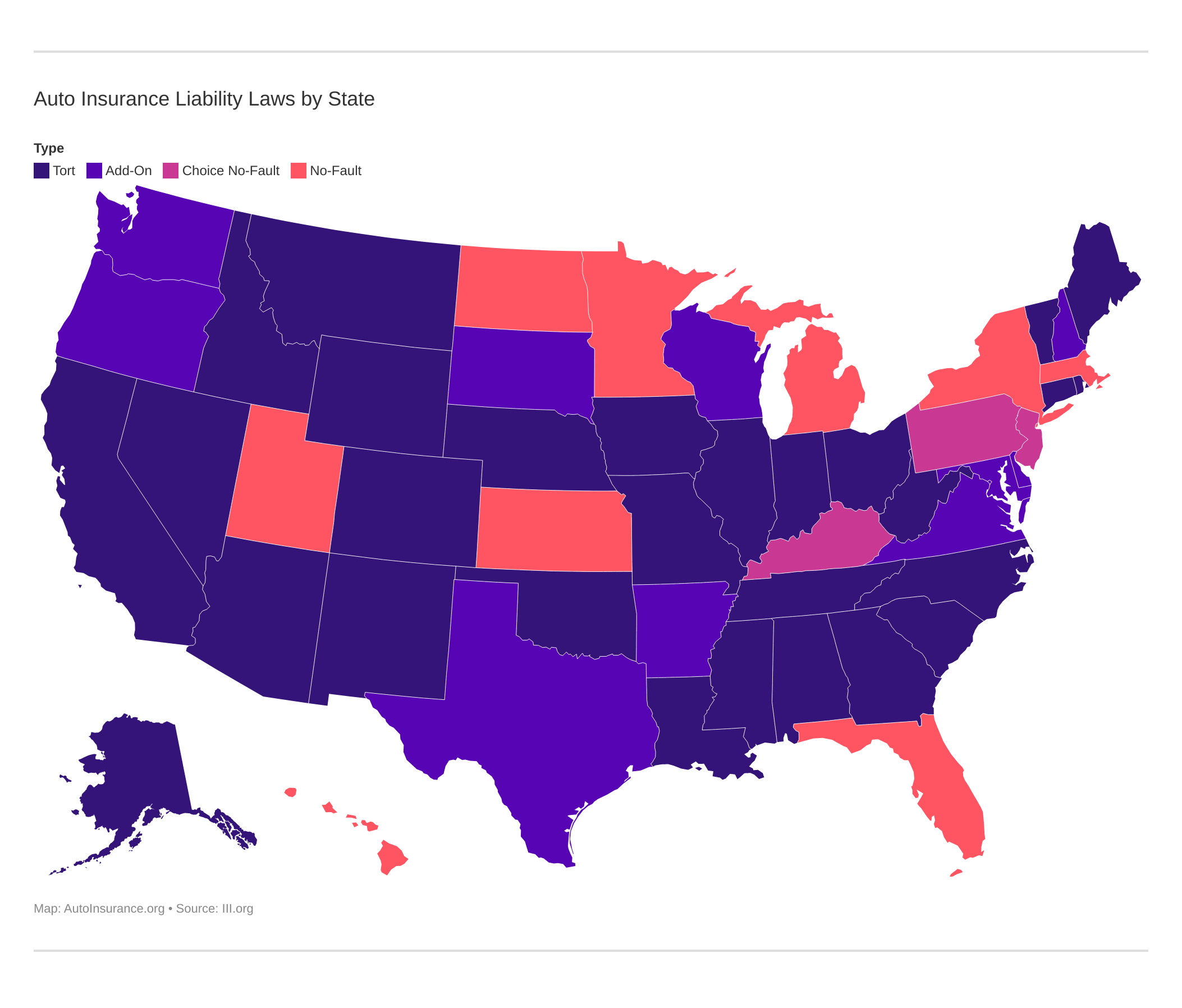

What’s the Difference: No-Fault vs. Tort Car Insurance

There are two basic types of auto insurance systems: “no fault” and “at fault” (this is normally referred to as tort). We’ll be the first to admit that having varying systems, with each state having its own specifics and guidelines, can be quite confusing.

How to Drive Safely, No Matter the Time of Day

At CarInsurance.org, we’d like every driver and passenger to be safe. So here are our tips for safe driving by time of day, with special emphasis on morning commutes, rush hour and driving at night.

Things You Do That Can Raise Your Premiums

Despite myths that persist about auto insurance, we assure you that there is always a reason for pricing. And those reasons apply to both increases and decreases in premiums.

What if you can’t pay your deductible?

In 2009, the typical car crash resulted in an average collision repair cost of $4,245, which is not an insignificant amount of money for the majority of people.

When to Use Your Deductible

Knowing when to file an insurance claim is an important consideration in regards to your auto policy.

How the States Rank on Uninsured Drivers

As many as one in six drivers in the United States may currently be driving without insurance. Here we look at how each state ranks in terms of the percentage of their motorists that may be driving without auto insurance.